The Internal Revenue Service and Treasury Department in the United States have sought feedback on plans to treat NFTs in the same way as traditional collectibles like artworks for taxation purposes.

Should new rules be imposed, they could see non-fungible token holders paying as much as 28% in tax on their holdings.

The IRS Wants to Tax NFTs

For collectors of NFTs, this would mean that they should consider their tokens similar to their more tangible counterparts, such as art, collectibles, stamps, gems, and vintage wines.

In addition, the IRS' statement also signaled its intention to define non-fungible tokens as collectibles prior to gaining further guidance on the matter.

To complicate matters further, NFTs that certify ownership of a physical item or property would be taxed accordingly after a "look-through" analysis has been conducted on the token. This may mean that the IRS would identify the non-fungible token as an analog for the asset it represents. However, this also means that the NFT would be liable for similar taxation measures if its underlying asset is also regarded as a collectible.

Although these prospective new rules and regulations can be difficult for investors to keep up with, what do they actually mean for NFT holders?

How Does Collectibles Taxation Work?

So, how does taxation on traditional collectibles work in the first place? When it comes to capital assets that have been held for over one year, they can be subject to relatively lenient tax rates depending on the holder's tax profile. Generally speaking, these could amount to 0%, 15%, or 20%.

Despite this, if the capital gain relates to a collectible item, the maximum long-term capital gains rate can be as high as 28%. In the eyes of the IRS, a collectible item can be any artwork, antiques, gems, stamps, metals, musical instruments, or just about any other physical property that's deemed to be collectible in nature to the IRS.

How Will Collectibles Taxation Apply to NFTs?

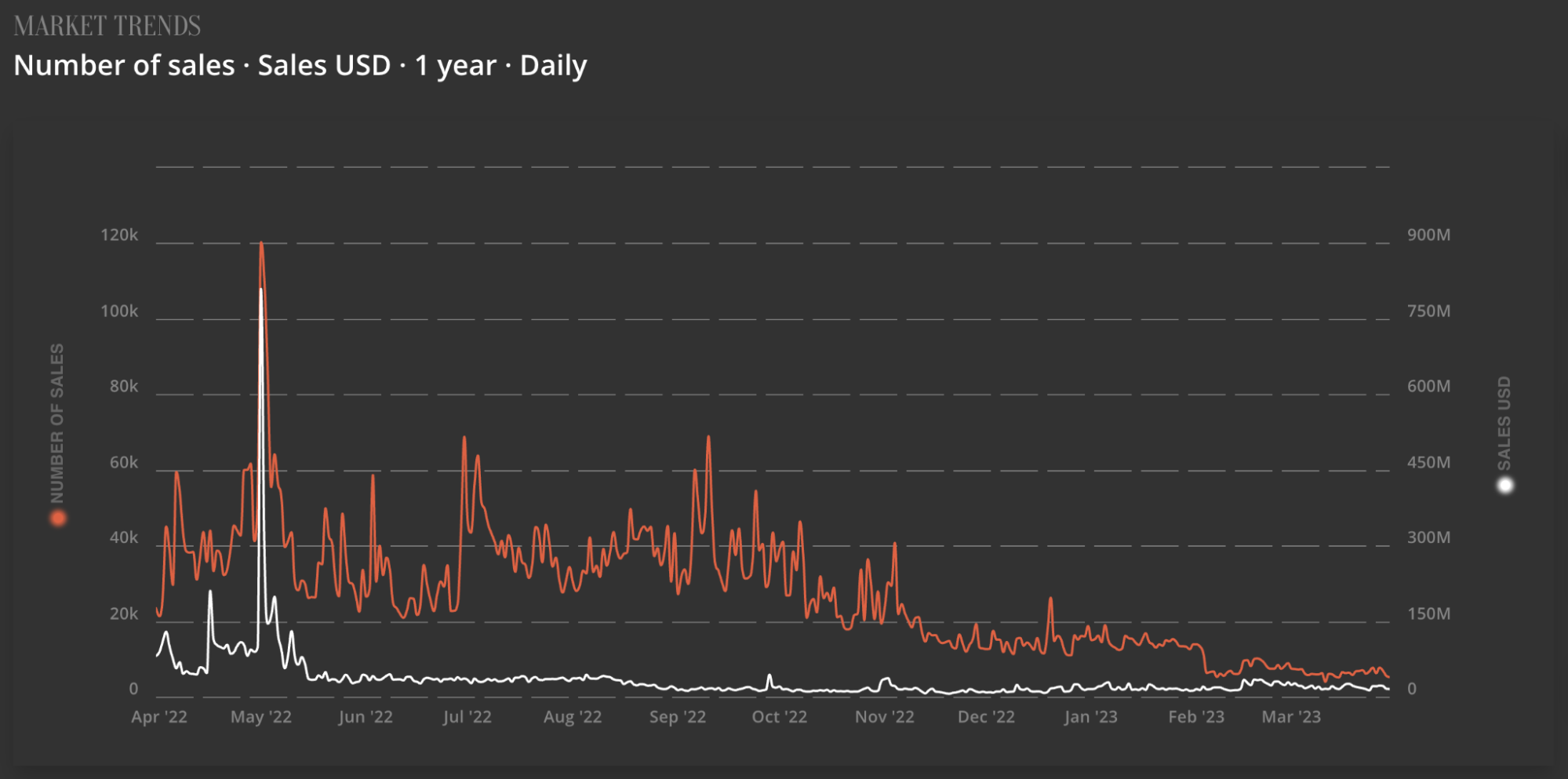

The NFT marketplace experienced a drop-off in volume following blistering trading volumes recorded in 2021 and early 2022.

Due to falling market sentiment, NFT trading volume sank 77% to $1.7 billion in Q3 2022 as opposed to Q2 2022, which was valued at $7.4 billion. As the chart below shows, these volumes have continued to slow in 2023, with NFT sales volume falling below 6,000 in March 2023 despite a brief 2022 peak reaching 120,000 in volume.

Although such a drop-off is concerning for collectors, it can help holders bypass capital gains tax when selling their NFTs through processes like crypto tax loss harvesting.

However, for investors who remain bullish about the long-term prospects of NFTs, buying at this time could incur higher tax charges on the profits made from buying the bottom of the market to sell on at a profit. Although, at the same time, these charges may boil down to how we, and the IRS, define our NFTs.

The imposition of a "look-through analysis" to work out whether an NFT is a collectible could also open the door for new interpretations for the purpose of NFTs.

According to section 408(m) of the federal tax code, a collectible is a tangible personal property like a work of art, rug, antique, metal or gem, stamp or coin, or alcoholic beverage. This means that if a look-through analysis for an NFT certifies the ownership of a physical asset like a gem, it would be regarded as a collectible. However, if the NFT certifies the right to land, this wouldn't be considered a collectible.

To clarify (or convolute) this further, virtual land, such as metaverse property, isn't regarded as a collectible, according to the IRS. This means that some utility tokens could be immune from scrutiny. Which begs the question, what do you own when you buy an NFT?

First Look at the Future of NFT Taxation

Although the plans of the IRS are still subject to feedback, these new plans represent an important step in providing NFT owners an insight into what the future of taxation may look like for their assets.

Individuals who buy and trade cryptocurrency and NFTs should be aware of the tax implications, and crypto and NFT exchanges need to begin promoting tax literacy learning programs to help collectors to avoid issues further down the line.

With the prospect of a 28% capital gains tax replacing the old 15% capital gains tax rate that applies to many other forms of assets, the news is likely to pose more challenges for an NFT ecosystem struggling to maintain trading volumes over the past year. Still, these plans for more comprehensive taxation measures will help alleviate the uncertainty hanging over the market.

While calls for a court challenge to contest these measures have been fielded, it's worth reiterating that these are preliminary guidance measures and can be subject to change many times in the future. With major NFT market ramifications hanging on the whims of the IRS, the eventual decision on these plans will carry significant weight.