Bitcoin currently stands as the world's most popular and valuable cryptocurrency, and it's not looking like this will change any time soon. But there are flaws within Bitcoin's network that are frustrating for users, one of the most prevalent being transaction times. Bitcoin's transaction times can be incredibly high, but why is this the case? What factors drive up Bitcoin transaction times?

Bitcoin Transaction and Confirmation Times

Before we get into the factors affecting Bitcoin's speeds, let's make sure we understand the difference between transaction and confirmation times.

The confirmation time of any given transaction refers to how long it takes to be recorded by the network after it is submitted. A single Bitcoin transaction has to go through a number of confirmation phases in the process of its verification to avoid transaction reversals or cancellations. It takes a minimum of six confirmations for a single Bitcoin transaction to be processed fully, with larger transactions generally requiring more confirmations, therefore taking more time.

After all the confirmation phases are passed, the transaction can be fully finalized. This is the transaction time. Bitcoin's confirmation and transaction times vary largely from day to day. One day, your transaction will process in ten minutes, but this time can shoot up to over an hour. So, why exactly is this the case?

What Affects the Speed of Bitcoin Transactions?

Scalability Issues

A very important thing to note about the Bitcoin network is that it suffers from scalability limitations. Scalability refers to the network's ability to accommodate a larger user base and, therefore, a larger transaction load. A single Bitcoin block has a theoretical capacity of up to 4MB. However, most Bitcoin blocks are around 1MB-1.5MB in size (the original limit before its 2017 alteration) and cannot store nearly as many transactions as the blocks used by other popular cryptocurrencies.

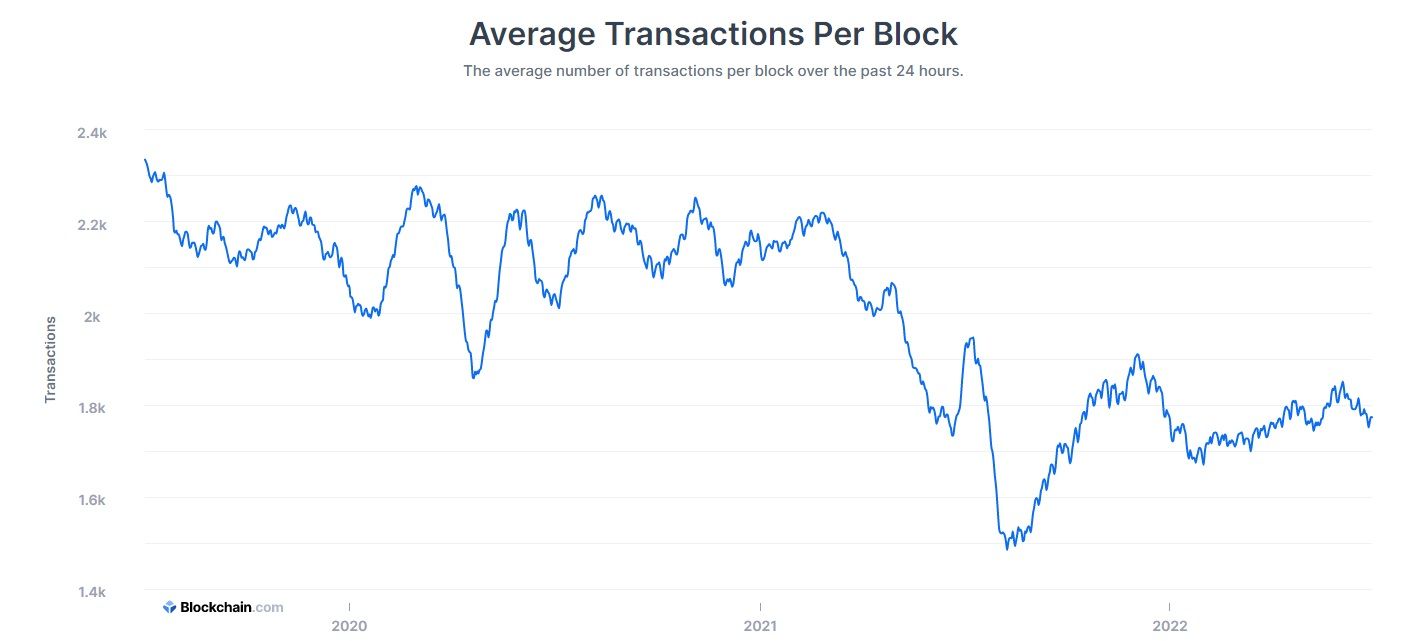

Currently, the average Bitcoin block houses between 1,500 to 2,500 transactions, but it still isn't enough relative to the mammoth user demand. To put this into perspective, Bitcoin Cash, a hard fork of Bitcoin, has a block size of 32MB, meaning it can hold vastly more transactions than Bitcoin and therefore has a significantly lower transaction time and fee.

This means that huge swathes of Bitcoin transactions are getting stuck in what is known as the mempool. You can think of the mempool as a sort of waiting room for pending transactions. If a transaction is valid, it is sent to the mempool where it waits to be included in a block and finalized. But because the transaction demand placed upon the Bitcoin network is now so high, the mempool is typically congested with transactional traffic, causing even longer delays.

The issue is so prevalent that Bitcoin is well-known for its scalability restrictions. Many Bitcoin owners see the network's scalability as something that must be tackled (which we'll discuss later on).

Network Load

If Bitcoin was a relatively small crypto, scalability wouldn't be nearly as much of a concern. But, because Bitcoin is vastly popular, the network processes hundreds of thousands of transactions daily and tens of millions of transactions yearly. Because the transactional load is so high, the miners working to verify them are beginning to struggle. Unfortunately, this has also led to an increase in Bitcoin transaction fees, which simply adds to the frustration felt by BTC holders.

Bitcoin has employed a layer two solution known as the Lightning Network to reduce transaction times and fees. Individuals can use the Lightning Network to dodge fees by conducting off-chain transactions directly between their wallets via digital payment channels. This also takes a little heat off the Bitcoin blockchain in terms of the transaction load.

While the Lightning Network is scalable and can be of use to network members, it is not an all-encompassing solution to mitigating Bitcoin's long transaction times. Not only is it susceptible to cyberattacks via payment channel manipulation, it costs users money to open and close payment channels.

Transaction Fees

On top of network load and scalability limitations, fees also play an integral role in Bitcoin's transaction periods. When you conduct a Bitcoin transaction, you have the option of choosing the lowest fee possible. While cutting costs this way may make sense on paper, choosing the lowest fee will make you a low priority for miners.

Bitcoin miners, who are responsible for creating and verifying new blocks, get paid for their work in the transaction fees of users. Miners aren't forced to verify whatever transaction they come across next. Rather, if a miner sees a transaction with a rock bottom fee, they're not going to be very keen on processing it because there's not much in it for them financially.

This is why some Bitcoin users end up paying very high fees. Sometimes a trader may need a transaction to go through as quickly as possible and doesn't have time to wait for a verification that may take over an hour. So, those who can pay a higher fee often do because it incentivizes miners to process their transactions in less time.

It may seem somewhat unfair, but there is an acknowledgment in the Bitcoin community that miners do have to expend a considerable amount of computing power to verify blocks and keep the network safe and decentralized. Bitcoin miners (or nodes) operate their equipment on a 24/7 basis, so it's safe to say they invest a good amount in electricity to operate. On top of this, note that your transaction will not be left in the mempool forever if you've chosen the lowest fee. It will simply take longer to be finalized.

If you're frustrated with Bitcoin transaction times, you can use an accelerator to attempt to speed up the time it takes for your transaction to be processed. These allow you to re-broadcast your transaction to essentially remind miners that it is pending, and typically charge a fee to do so. But accelerators do not guarantee a lower transaction time, and many accelerator websites are scams, so it's something of a risky venture.

Will Bitcoin's Transaction Times Continue to Rise?

While Bitcoin's developers are working to bring down the network's high transaction times and fees, ever-increasing demand on the Bitcoin blockchain could result in even higher fees and waiting periods in the future.