When a cryptocurrency begins amassing hype, many want to know how and why. Recently, The Graph has seen major price hikes along with other AI-focused cryptos. So, what exactly is The Graph, how does it work, and why is it becoming so popular?

What Is The Graph?

The Graph is an open-sourced software built on the Ethereum blockchain. The purpose of The Graph is to collect, process, and store different kinds of data for blockchain-based platforms. The Graph calls itself an "indexing protocol" for "querying networks like Ethereum and IPFS." Overall, The Graph aims to make blockchain data more easily accessible.

The Graph was founded in 2018 by Brandon Ramirez, Yaniv Tal, and Jannis Pohlmann. It wasn't until late 2020 that the project's token was released in the mainnet launch, which we'll discuss later. Today, The Graph helps 31 Ethereum-based DApps in data retrieval, including Uniswap, Decentraland, AAVE, and Balancer. DApps designed to work with The Graph are written in GraphQL, a programming language originally developed by Facebook.

But how does The Graph work?

Complicated smart contracts can make projects' data difficult to read, which presents an issue for many blockchain platforms. Only being able to read data on a basic level complicates processing and retrieval, and this is where The Graph steps in.

Indexing blockchain data is by no means a quick task. However, The Graph protocol solves this problem by providing efficient data querying for blockchain platforms. In short, The Graph uses artificial intelligence (AI) to learn how to index data, organizing this information into "Subgraphs" for querying efficiency.

Within The Graph's ecosystem are different contributors that play a role in the retrieval, processing, and provision of data.

Curators evaluate new subgraphs before adding them to the network, while Indexers are responsible for collecting the data for the Subgraphs. Then there are Delegators who provide GRT as payment to Indexers as part of The Graph's reward system. Next are Fishermen, who verify query responses, and Arbitrators, whose role is to identify and remove malicious Indexers from the system.

The Graph protocol is entirely decentralized, meaning data and power across the project are spread among nodes.

Because of its decentralized nature, The Graph also has a governance mechanism. The project uses The Graph Platform, a group of individuals that oversee network upgrades and the governance process. These users must follow the decentralized governance protocol when voting on network changes, which keeps the system fair.

On top of this, The Graph has a governing community known as the Graph AdvocatesDAO, which focuses on community-based initiatives and furthering decentralization. Anyone can apply to become an advocate within the Graph Advocated DAO, though you must provide certain personal information to do so.

The Graph's native token, GRT, has been experiencing some healthy price hikes in recent weeks, fueling discussion around the project. But what is the purpose of this token, and why is it amassing so much hype?

What Is The Graph's AI GRT Token?

The Graph's AI GRT token was first launched in late 2020, along with the mainnet. The native token of The Graph protocol uses the ERC-20 token standard due to its origin on the Ethereum blockchain.

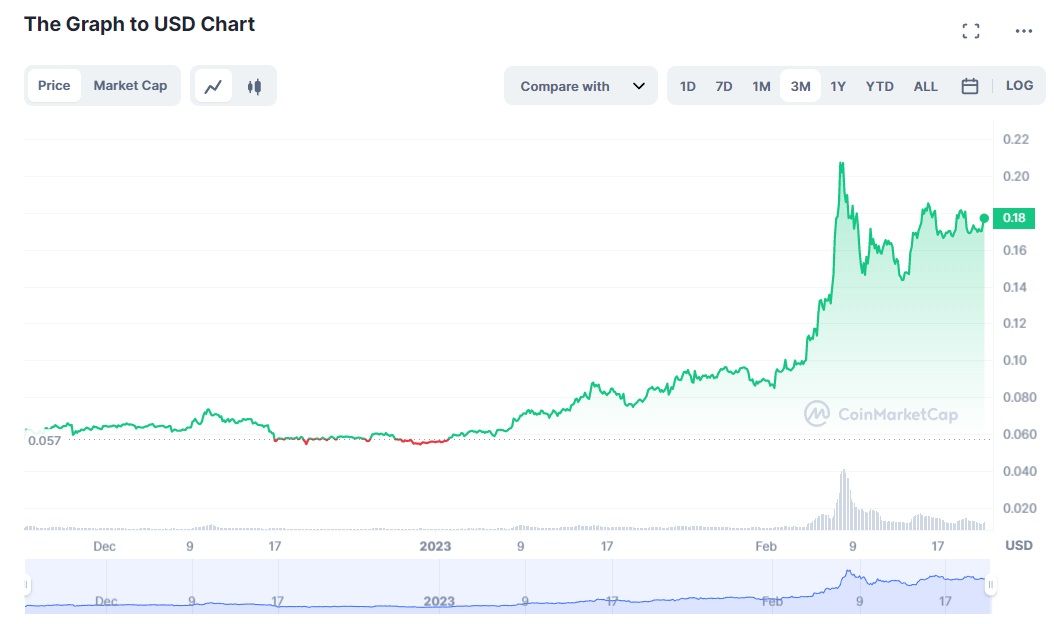

As you can see in the price chart below, the GRT token experienced major growth at the beginning of 2023.

On January 20, 2022, one GRT token held a value of $0.0841. A month later, on February 20, it held a value of $0.1737, meaning GRT's price more than doubled in this 31-day window. At one point, GRT even reached a price of $0.228, but this peak was short-lived. There are currently 8.8 billion GRT in circulation. GRT has a total supply of ten billion, but this figure is also set to rise by around three percent annually.

What Does The Graph's GRT Token Do?

But why are people investing in GRT? Does this token have a specific utility, or is this a buy-low-sell-high scenario?

GRT has utility within The Graph's ecosystem, mainly in fee payments. Within decentralized projects, cryptocurrency is always used to pay fees, and it is often the project's native coin that provides this function. Within The Graph's ecosystem, fees are charged for queries.

The Graph currently charges $15 monthly to its users for a low volume of queries, with all other services totally free (so long as the service doesn't exceed 30,000 monthly queries). The middle volume tier costs $750 a month, and the highest tier costs $4,500 a month (though you'll only need this if your platform needs to process over 30 million queries monthly).

Why Is GRT's Price Increasing?

But GRT's growth isn't all down to its utility. Investors have noticed that GRT is experiencing an uptick in value, so there's no doubt that some are choosing to buy this token in the hopes that its price will continue to increase, which will make for a profitable sale down the line.

GRT is available to buy and trade on a number of popular exchanges, including Binance, Kraken, eToro, and KuCoin.

GRT has experienced this price growth mainly due to the increasing amount of data The Graph is aggregating and providing to consumers. As The Graph continues to support more networks and work with more DApps, the use of GRT will likely continue to proliferate. People are also increasingly leaning towards decentralized platforms, as they offer transparency over centralized services.

The Graph's AI Blockchain Data Processing Has Potential

There's no doubt that The Graph can provide DApps with an easier way to retrieve and access data while also increasing overall efficiency. The GRT token's price hike may continue due to The Graph's increasing prevalence, but nothing is ever certain when it comes to cryptocurrency. Time will tell how GRT goes on to perform in the long run.