One of the biggest threats to any crypto trader is getting burned by so-called nested exchanges, which can quickly drain your funds when you try to cash them out into another currency. These exchanges are unsafe, and it is best to avoid them.

What Is a Nested Crypto Exchange?

A nested cryptocurrency exchange provides its customers with crypto services through an account on another platform. It acts as a bridge between its customers and the services on a chosen crypto exchange.

Nested exchanges do not have exchange machinery of their own but depend on other regulated exchanges. The platform is like a bank; when customers deposit money, the bank takes that and deposits it again in a regulated bank.

How Does a Nested Crypto Exchange Work?

Nested exchanges have accounts on popular crypto platforms and allow their customers to trade using these nested accounts. What nested exchanges gain from their operations is intermediary commissions. They mirror the activities of their customers on the official platform, known as the host, and keep the commission accrued from the transactions. All this is done without the knowledge and consent of the customer.

Many prefer nested accounts because of the speed of transactions and the absence of a strict authentication process. The customer base of these exchanges usually comprises ignorant users, scammers, fraudsters, and even some terrorist organizations.

When completing a crypto transaction on a secure trading platform, you must go through anti-money laundering (AML) and know-your-customer (KYC) checks. These checks are in place to verify your identity and confirm that the funds you're trying to deposit are not the proceeds of illegal activities.

However, these verification checks could take up to 30 days. This may cause some users to opt for nested exchanges, whose other attraction is their criminal anonymity. In addition, TAML and KYC checks are lax or are lacking completely, allowing crypto trading operations to be completed faster than usual and without oversight.

When you use nested exchanges, your funds have little to no safety guarantees. You may also be indirectly funding illegal operations like arms dealing and terrorism. And that's not all.

Opening an account with a nested exchange means your account doesn't technically exist, as it now belongs to the exchange. It can be closed for several reasons, and your deposit would be gone instantly without any chance of recovery.

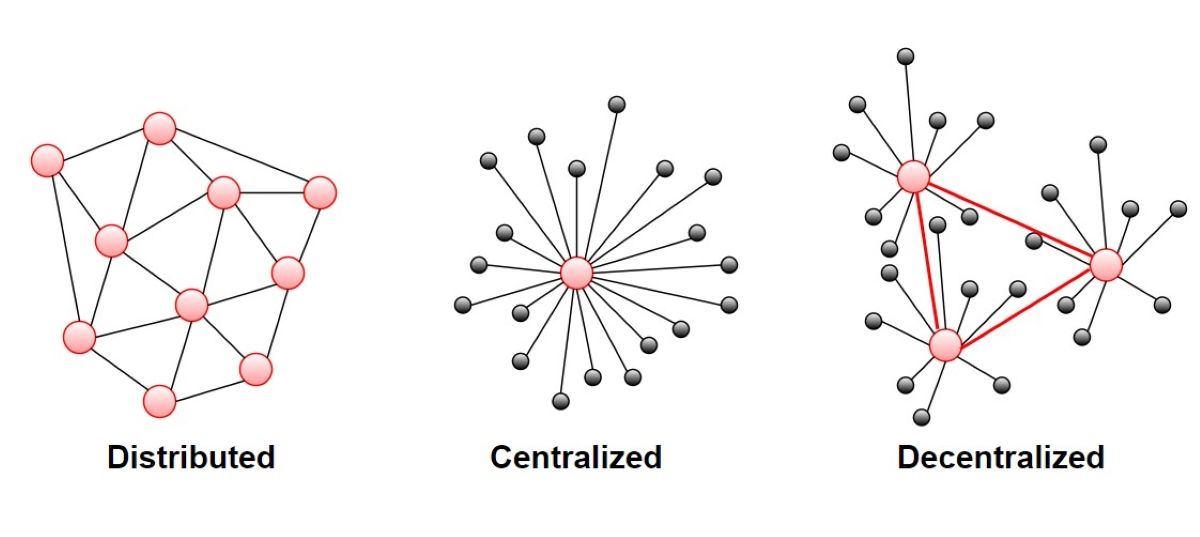

Nested Crypto Exchange vs. Decentralized Crypto Exchange: What's the Difference?

At first glance, decentralized crypto exchanges (DEXs) might look similar to nested platforms due to the absence of KYC checks. But there are notable differences between both.

Unlike nested exchanges, DEXs connect buyers directly to the sellers without holding the cryptocurrency on the exchange. Decentralized exchanges are fully automated with smart contracts, computations, and complex algorithms. But a nested exchange will take control of your crypto while engaging the services of another platform.

You can trace transactions made on a decentralized platform back to the source account. But with nested exchanges, you can't, as they usually use underhanded methods, such as exchanging crypto for handheld cash.

Standard Features of a Nested Crypto Exchange

Law enforcement agencies and regulated exchanges have been trying to get rid of nested accounts, but their mode of operations has made detection tricky. This is because these platforms constantly masquerade as regulated exchanges. Nonetheless, look out for the following signs to avoid transacting with nested crypto exchanges and keep your funds secure.

Different Exchange Rates

Before using any exchange platform, check the exchange rates, usually displayed on their landing page. You may be dealing with a nested crypto exchange if there are several variations. Nested platforms have different accounts on various regulated platforms. And with each regulated platform having a specific exchange rate, this will lead to varying rates on the nested crypto exchange.

KYC/AML Verification

As mentioned earlier, nested exchanges use the absence of verification processes as an attraction. KYC and AML verifications usually take hours or several days to complete. Therefore, any platform allowing you to transact a substantial amount with little or no authentication process is most likely nested.

Another telltale sign would be the absence of a transaction cap, even with advanced trading features.

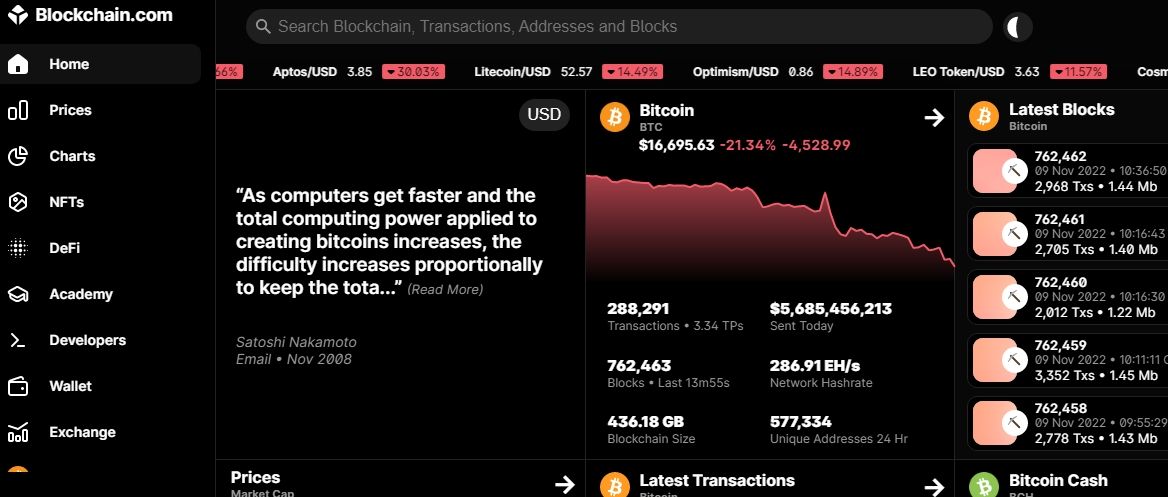

Blockchain Explorer Check

You can check the location of the transactions and the source of your crypto when you want to withdraw to confirm if a platform is nested. You can do this using a blockchain explorer. For example, if there is an unknown external address or your crypto is sent to the wallet of another exchange, you may be working with a nested crypto exchange.

3 Reasons Why You Shouldn't Use a Nested Crypto Exchange

Although crypto transactions may be faster on nested exchange platforms with negligent verification, you should avoid these platforms for several reasons.

1. No Guarantees

Unlike regulated, safe crypto exchanges, nested platforms offer no guarantees for the safety of your funds. Furthermore, since they are always on the run from law enforcement and finance regulatory bodies, there is a chance these nested exchanges will pull the rug on all their operations and disappear with your crypto.

In addition, the host platforms eventually fish out the nested accounts and close them permanently.

2. Law Enforcement Crackdown

Nested exchanges are a haven for ransomers, scammers, and many others with illegal funds, looking for a way to clean their money by converting it to cryptocurrency. Law enforcement agencies are always on the lookout for nested accounts, shutting them down as soon as they are detected, meaning your funds would be frozen too.

Also, you could face legal consequences if it is discovered that you knowingly consort with nested exchanges.

3. Supporting Criminal Activities

You may indirectly support illegal activities like cyber crime and terrorism by using a nested exchange. Continually depositing your crypto on nested exchanges keeps them afloat and allows those involved in illicit activities to clean their funds conveniently.

Avoid Nested Exchanges, Trade with Regulated Exchanges

Don't use nested exchanges. Your crypto could disappear without warning, and there would be no way for you to seek recourse.

Always trade with regulated exchanges. They give guarantees that your crypto is safe. Their KYC and AML verifications may take some time to be completed, but there is no substitute for the security of your funds.