Founded in China and based in the Seychelles, Huobi has grown to become one of the largest cryptocurrency exchanges based on trade volume. Initially marketed to Chinese investors, the company has grown to cater to over 130 countries.

Having been launched in 2013, Huobi is also one of the oldest names in crypto and has built teams in Hong Kong, Japan, South Korea, the United Kingdom, Australia, Canada, and Brazil.

Huobi also has its own token, the Huobi Token (HT), which was issued in early 2018 and sits well within the world’s top 100 cryptocurrencies based on market capitalization.

Analyzing Huobi as a Company

Founded by former-Oracle computer engineer Leon Li, Huobi built its presence in Beijing as a cryptocurrency trading platform in China and overseas, quickly becoming one of the three largest exchanges domestically by providing relatively easy access to liquidity for Bitcoin traders.

However, following a ramping up of Chinese regulatory measures in the cryptocurrency landscape, Huobi was forced to set up a base in the Seychelles in 2017, with a new headquarters established in Singapore to help retain focus on Asian markets.

In the years that followed, Huobi has managed to become one of the world’s most liquid cryptocurrency exchanges and successfully grew its active users way beyond China.

However, Huobi’s journey to prominence hasn’t been entirely free of controversy. In 2019, Bitwise Asset Management accused the platform of wash trading as a means of artificially inflating its reported trading volume statistics. Although the accusation was denied, Huobi announced that it was creating new measures to discourage wash trading within the platform, and trading volumes dropped as a result.

Due to regulatory headwinds, Huobi Global’s US arm, HBUS, was forced to close in late 2019 and added Singapore to its restricted jurisdictions in 2021. In addition, China’s battle to regulate cryptocurrency also heavily impacted Huobi, and the company announced that it had to close the accounts of its Chinese customers in 2021.

In October 2022, Huobi was bought by About Capital, which has helped the company to continue its operations as a leading crypto-asset ecosystem. At the core of Huobi’s operations is the company’s very own blockchain, dubbed the Huobi Eco Chain, and a core following of tens of millions of customers across over 100 countries worldwide.

What Makes Huobi so Popular?

One of the best assets of Huobi’s platform is its tailored user experience, which is split between Huobi OTC and Huobi Pro.

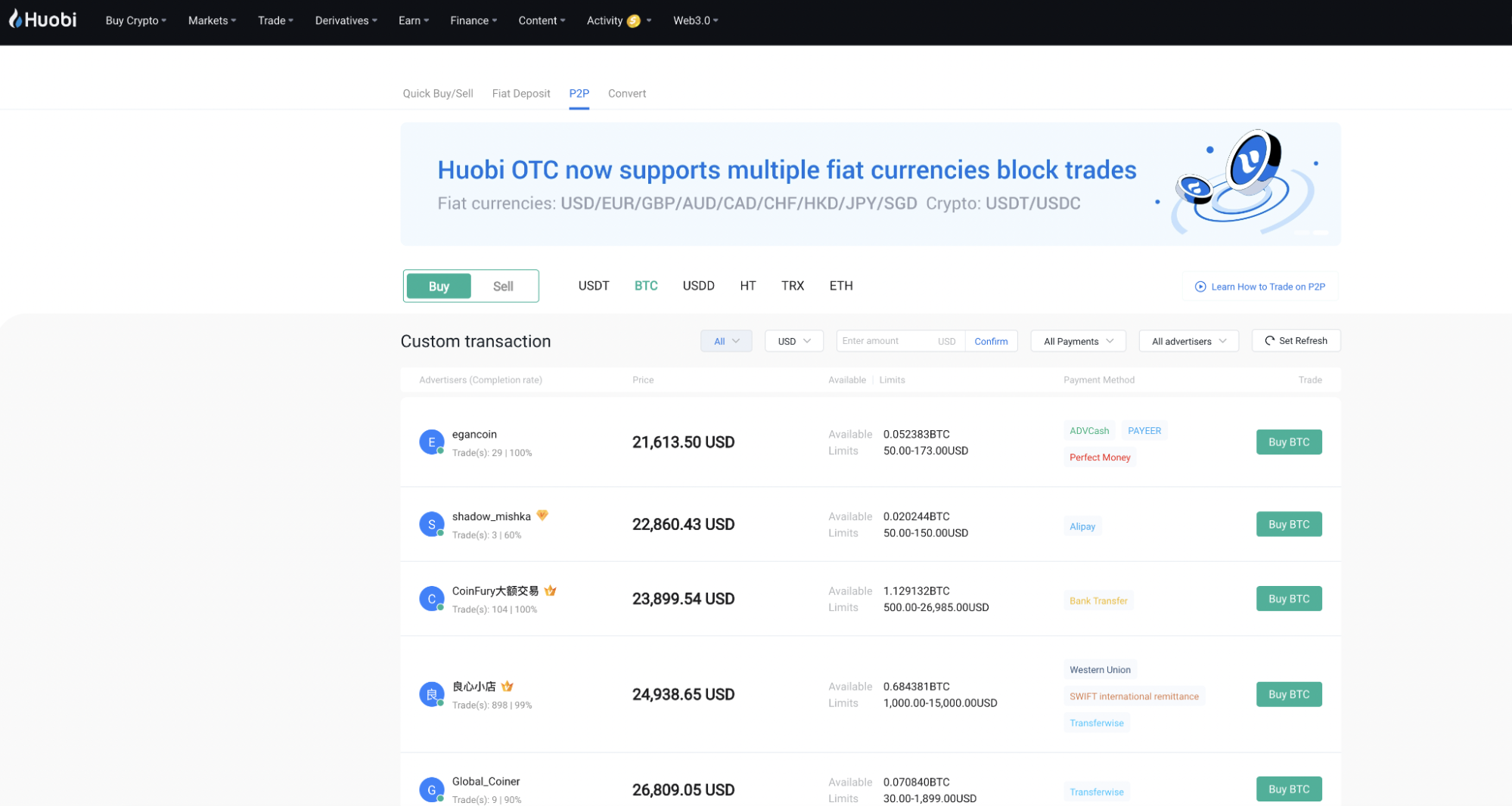

To cater to customers of all competencies, Huobi OTC offers a simplified experience that allows users to trade one of 25 fiat currencies for one of six listed cryptocurrencies. Furthermore, trades in BTC, ETH, and USDT don’t come with transaction fees.

On the flip side, Huobi Pro offers trading pairs for over 100 cryptocurrencies and features a more richly detailed display for users to get to grips with. Trades also come with a 0.2% transaction fee in most cases.

Huobi’s tailored user experience is not dissimilar to that used by Binance, and the platform’s user interface also closely resembles Binance, with simple drop-down menus that offer a range of more intricate options for traders.

What Is Huobi Token?

However, the real perk of Huobi comes in the form of its native cryptocurrency, Huobi Token (HT). Utilizing the token can come with many benefits for investors using Huobi’s platform, and purchases made using HT can bring significant savings in discounted transaction fees for users.

Furthermore, Huobi buys back 20% of its token, which is then placed in a user protection fund that can be redistributed to holders as insurance against prospective hacks.

Huobi’s token forms a key part of the Huobi Eco Chain, which hosts DeFi apps that have the power to undertake decentralized lending and borrowing functions, offering more financial options to users.

The coin’s favorable position within the cryptocurrency ecosystem has meant that HT has been known to perform relatively well during bull runs. For example, in the crypto rally of 2021, HT climbed from a year-opening value of around $5 to a brief peak of $39.66.

Although the market has retraced since, bringing the value of Huobi Token crashing back down to earth, the asset’s market capitalization of over $800m illustrates the strength of the token.

How Does Huobi Work?

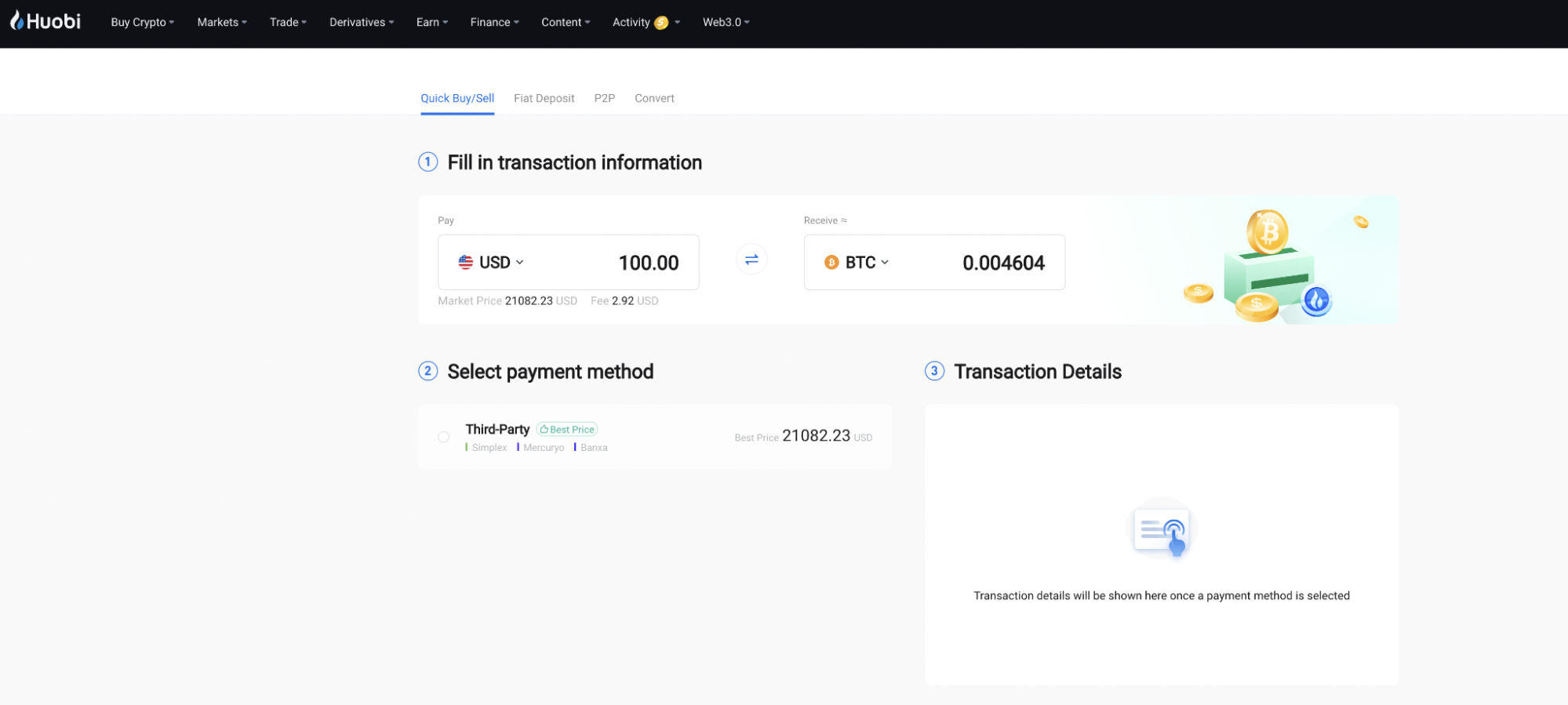

Huobi operates similarly to many of the world’s leading cryptocurrency exchanges. Users are free to buy, sell, and transfer crypto, while the platform earns a small cut from its transaction and trading fees.

The platform’s process for purchasing cryptocurrency is highly transparent, and the website designates when third-party market makers can facilitate transactions from fiat into a designated coin.

Furthermore, Huobi also supports P2P trading within its platform, meaning that users can tap into a significant pool of users to buy and sell their chosen cryptocurrency at transparent rates. For added safety, users can see feedback ratings and the number of trades each individual has completed.

In the recent past, Huobi developed and implemented a dedicated stablecoin, HUSD, which was backed by the value of the US dollar. However, the asset was delisted by the exchange in 2022. It’s currently unclear whether there are plans to reintroduce a stablecoin attached to the platform.

Depositing and Withdrawing Crypto on Huobi

Impressively, Huobi features over 90 deposit and withdrawal methods, including bank transfers and credit card payments. The platform’s quick buy feature allows users to access their assets faster.

At present, deposits and withdrawals are available on Huobi via the following methods:

- Faster Payments

- Visa/Mastercard

- SWIFT International Transfer

- USD Balance

- US ABA Transfer

- SEN

- Fees

When it comes to managing fees, the minimum deposit for Huobi is $100, and users can expect a fee of 1% should this deposit be completed via international wire transfer.

If you’ve added your KYC credentials, you can withdraw as much as 200 BTC plus withdrawal fees, which currently stand at 1% for international wire transfers. For cryptocurrency withdrawals, this figure stands at 0.0001 BTC and 0.001 LTC, respectively.

Building on Experience

Huobi’s decade of cryptocurrency experience has shone through in the development of its platform. Although regulatory pressures have caused the platform to take on significant challenges in recent years, Huobi has adapted and grown.

For investors looking for a change from Binance, Huobi’s framework clearly shares a similar user experience and level of comprehensiveness that will interest users of all experience levels.

Backed by its own blockchain and impressive native currency, we can expect to see Huobi’s past continue to shape a safe and innovative future in the industry.