Ethereum 2.0 is perhaps the single most widely anticipated upcoming release in the cryptocurrency industry right now. In development for nearly half a decade, the upgrade will improve the cryptocurrency’s efficiency, transaction throughput, and security.

While ETH 2.0 is often referred to as an upgrade, it is actually closer to a complete overhaul of the network. This is even more apparent by the fact that its deployment will take place on an entirely separate blockchain network initially. The original chain is expected to be merged with the new network towards the end of the development cycle.

So, what is Ethereum 2.0?

What Is Ethereum Used For?

For the uninitiated, Ethereum is a decentralized blockchain digital currency similar to Bitcoin. However, that’s where the similarities between the two end. Ethereum was never intended to function as digital money. Instead, it pioneered two key concepts—decentralized applications and smart contracts, both of which were unprecedented at the time of Ethereum’s release.

Ethereum’s first major application, decentralized applications, revolutionized the way we think about internet-based services. Instead of entrusting large corporations with our personal lives and data, decentralized apps allow its users to collectively wield control and ownership. In other words, Ethereum democratizes software similar to how Bitcoin upended central banks.

For example, the Ethereum platform enables developers to create decentralized social networks that are functionally similar to Twitter, but without the potential for censorship or interference by authorities.

This is because the decentralized application’s data is stored directly and permanently on the Ethereum blockchain. This blockchain is then relayed and hosted by thousands of individuals around the world. There are no middlemen involved or country-specific servers, so silencing a particular user is also impossible.

Ethereum’s other highlight feature—smart contracts—are essentially digital agreements that have the ability to automatically execute when a certain condition is met. Such contracts are invaluable for industries such as supply chain management, where payments need to be made immediately.

These days, smart contracts have also made their way into the collectibles ecosystem. NFTs—or non-fungible tokens—allow anyone to auction real-world or digital assets in exchange for a traceable record of ownership on the Ethereum blockchain.

The main use case of Ethereum’s token (ETH), meanwhile, is to pay for transactions on the network. Since the network is decentralized, transactions on the blockchain need to be validated by the public at large. ETH is simply used to pay for transactions and incentivize these validators.

Ethereum’s Scalability Woes

The Ethereum network uses the Proof of Work algorithm (PoW) to validate new transactions and add them to the blockchain. When the network was first released in 2014, there was no real alternative to proof of work—at least not one that was sufficiently tested at scale.

It’s important to note that the PoW algorithm is secure, but slow—meaning Ethereum can only process 10 to 20 transactions per second.

For a couple of years after its release, Ethereum’s implementation of PoW served its purpose. Transactions were occasionally slow to finalize due to the nature of the consensus algorithm, but not overwhelmingly so.

However, all of that changed in 2017, when the cryptocurrency market first attained critical mass among mainstream users and investors. Ethereum’s valuation skyrocketed, while its user base also saw exponential growth within months. All of a sudden, ~20 transactions per second were not nearly enough to keep up with the network’s average user activity.

As a result, Ethereum went through extended periods of slowdowns—which was only aggravated by the surging popularity of dApp platforms such as CryptoKitties. This caused fees to spike—stalling the network’s adoption. By this point, it became extremely clear that Ethereum’s developers needed to account for scenarios where thousands of transactions would need to be confirmed within seconds.

Enter ETH 2.0: Scalability

Ethereum 2.0 promises to alleviate the issues of high fees, low transaction throughput, and settlement speed by completely eliminating the Proof of Work consensus mechanism. In its stead, Ethereum’s developers have opted for a Proof of Stake (PoS) implementation—which vastly simplifies the transaction verification process.

Instead of relying on miners to produce new blocks, PoS offers Ethereum holders the opportunity to validate new blocks in exchange for a reward. In this system, users need to stake a minimum of 32 ETH in a deposit contract for the right to verify new transactions. Every so often, they will be randomly assigned the responsibility of voting on a transaction’s validity.

Once a validator has voted on a transaction’s validity, other participants on the network are asked to attest to the accuracy of the vote. If the vote is valid (as it should always be), the validator is awarded a reward for their honesty. However, if a validator is voted against, a portion of their initial staked ETH will be deducted as a penalty.

Since PoS does not involve solving complex cryptographic puzzles, it boasts superior energy efficiency and improved transaction speeds.

Besides the move to PoS, Ethereum 2.0 will also introduce another scalability technique—sharding. In short, sharding enables the Ethereum blockchain to be split into several tiny ‘shard’ chains running in parallel. To ensure compatibility and coordination between shards, Ethereum uses an overarching beacon chain. This way, users in two separate shards will still be able to transact with each other.

When Will ETH 2.0 Launch?

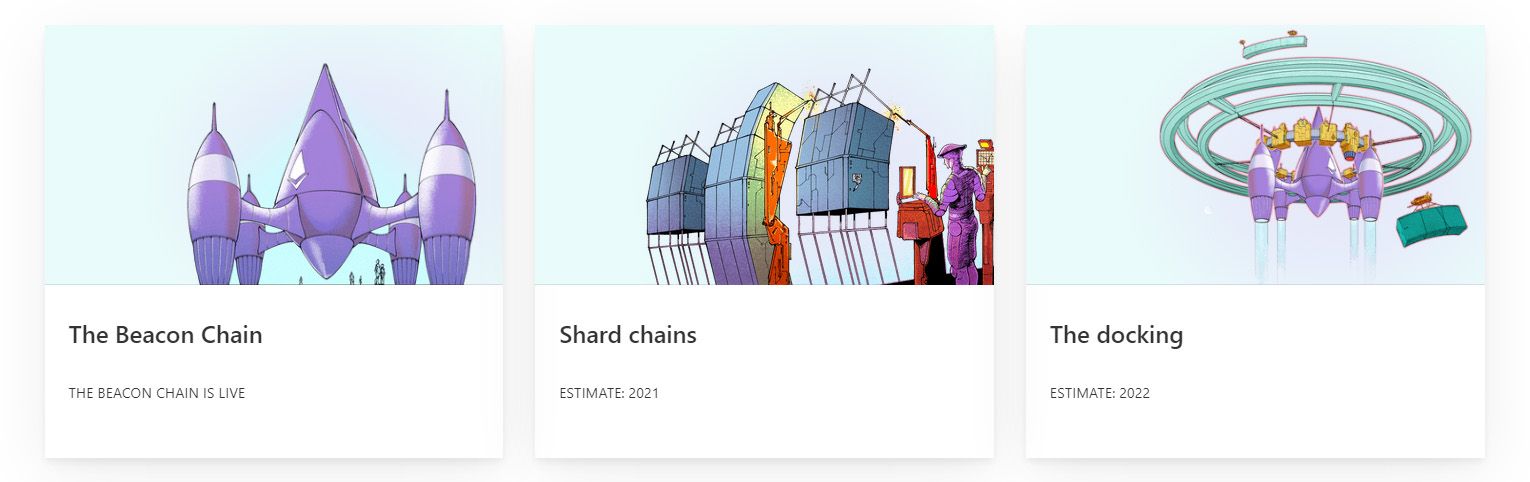

As mentioned previously, ETH 2.0 has been in development for several years now. However, the good news is that its release is already in progress as of mid-2021. More specifically, ETH 2.0’s rollout has been divided into three distinct phases, as outlined below:

- Phase 0: Implementation of the beacon chain, along with an initial deployment of the Proof of Stake consensus mechanism. Interested validators may deposit a minimum of 32 ETH to begin staking on the network. Phase 0 operates as a separate blockchain and co-exists alongside ETH 1.0, which continues functioning as it always did.

- Phase 1: Expected to integrate the first set of shard chains. This phase will split the Ethereum blockchain into 64 shards, enabling 64 times better transaction throughput as compared to ETH 1.0.

- Phase 2: Expected to enable smart contract functionality within shards and completely merge ETH 1.0—paving the way for the original PoW-based Ethereum mainnet to be safely abandoned.

Phase 0 of ETH 2.0 already launched successfully on December 1, 2020, officially setting the upgrade into motion. As of April 2021, more than 124,000 validators have added 32 ETH or more to the deposit contract and are actively staking on the beacon chain.

Development on merging the original Ethereum mainnet with ETH 2.0 is underway. Phase 1 of the project is expected to arrive sometime in 2021. However, given the complexity involved, the Ethereum Foundation has refrained from offering concrete timelines. Nevertheless, the developers hope to complete a full migration (Phase 2) by the end of 2022.

With the eventual adoption of sharding and proof of stake, decentralized applications and smart contracts will finally become accessible and affordable to the masses. Needless to say, a lot is riding on ETH 2.0’s success.

Image Credit: Nick Chong/Unsplash, Ethereum/official website