Cryptocurrency is rapidly becoming a legitimate type of financial asset, one that's increasingly hard to ignore.

Popular publications like the Financial Times and the Wall Street Journal cover the crypto market extensively. Public figures such as Warren Buffet and Elon Musk hold strong views on the subject. Central banks, prominent software companies, and governments around the world are thoroughly researching the technology, and some are even considering launching their own coins.

But beyond this noise, the overwhelming majority of people still have a limited understanding of cryptocurrencies. Many do not understand the basic concepts behind crypto.

So, let’s cut through the complexity and explain all about cryptocurrency.

What Is Cryptocurrency?

Cryptocurrency is digital cash. It doesn't have a physical presence like notes and coins but exists purely as digital entries in an online database. This database is just a collection of numbers and letters secured by cryptography, hence the name cryptocurrency.

Cryptography is the method of encoding and decoding information so that only members participating in a transaction, with the right public and private keys, can read and process the information.

In this context, cryptography eliminates the possibilities of counterfeiting and double-spending, which reinforces the security of cryptocurrency. However, this doesn’t mean that cryptocurrencies are immune from all hacks. In fact, several cryptocurrency startups and exchanges have fallen prey to some of the worst cyberattacks in the last few years.

Unlike traditional money, cryptocurrency is decentralized, meaning that it’s created, stored, and processed outside the sphere of a central bank or government.

As a result, cryptocurrencies avoid any interference from government agencies or financial institutions. The conventional financial model often controls individuals’ access to their own funds.

The lack of a central authority allows crypto transactions to be processed anonymously, which many people tout as a major benefit of cryptocurrencies.

How Does Cryptocurrency Work?

Very few people realize that Bitcoin, the first and most valuable cryptocurrency, emerged as a byproduct of another invention. The unknown inventor of Bitcoin, who goes by the pseudonym Satoshi Nakamoto, never intended to create a digital currency.

Instead, Nakamoto wanted to develop a new electronic cash system that he proposed in his late-2008 paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Nakamoto proposed a payment system based on cryptographic proof instead of trust. This cryptographic proof comes in the form of cryptocurrency transactions that are recorded on a distributed ledger called a blockchain.

What Is a Blockchain?

Blockchain is a distributed ledger technology that permanently records all transactions. The transactions are stored in the form of blocks in the database and are linked together to form a chain, hence the name blockchain.

Think of it as a book where you write down all the transactions you make every day. Each page in the book is a block and the entire book constitutes the blockchain.

Every time you buy or sell a cryptocurrency, all the users on the blockchain network add and verify the transaction. They validate each transaction using one of two methods: proof of stake and proof of work.

The digital validation process and the nature of blockchain make it virtually impossible to modify or delete records on the ledger. Any change in data on one block will alter the data on all the other blocks on the blockchain.

How Many Cryptocurrencies Are There?

There was a time when anyone could easily keep track of all the virtual currencies in use. But that’s not the case today. The crypto market has grown by leaps and bounds since the 2010s.

Bitcoin, Ether, Dogecoin, and Litecoin are a few popular coins that everyone is aware of, but there’s an extensive list of digital currencies that don’t make it into the mainstream discourse. As of July 2021, there are nearly 6,000 virtual currencies listed on Coin Market Cap, a market research company.

The total value of the crypto market is more than $1.35 trillion as of July 2021, according to the same company. However, nearly 60 percent of this comes from Bitcoin and Ethereum alone.

What Are the Different Types of Cryptocurrencies?

There are several ways to define and separate digital currencies. The simplest of these is to divide cryptocurrencies into the following three categories:

- Bitcoin: The self-explanatory category, Bitcoin is the first and most popular currency that highly influences the nature of the crypto market.

- Altcoin: These are the alternative currencies that launched after the success of Bitcoin. Some Altcoins work in exactly the same way as Bitcoin. However, others target the perceived drawbacks of Bitcoin and project themselves as better alternatives. They use different algorithms, showcase themselves as more environmentally friendly coins, and claim to have a competitive advantage over Bitcoin.

- Tokens: These are cryptocurrencies that don’t have their own blockchains. Tokens build upon existing blockchains like the Ethereum platform or the Chiliz Blockchain.

What Drives the Value of Cryptocurrency?

As cryptocurrency rises in popularity, questions about the value of digital coins have also entered public discourse. Although the crypto market is now worth over a trillion dollars, many people still question the intrinsic value of cryptocurrency.

These questions, however, stem from the misunderstanding associated with the definition of currency. Put simply, a currency is anything that is being accepted as a medium of exchange between buyers and sellers. It earns its value by the price that people are willing to pay to obtain the currency.

Think of cryptocurrency as digital gold. Gold has value because most people agree that it does. The same principle governs the value of cryptocurrency. And the same kinds of factors drive the price of cryptocurrency:

- Utility of the coin: The use cases for, or utility of, the currency determines its price. What problems does it solve? How much energy or effort does the currency use for mining or updating its protocols?

- Supply and Demand: Much like fiat (government-issued) money, the value of cryptocurrency is heavily influenced by supply and demand. If enough traders invest in cryptocurrency, prices go up since more people see it as an attractive form of currency. This also means the market must limit the amount of cryptocurrency available to preserve its value.

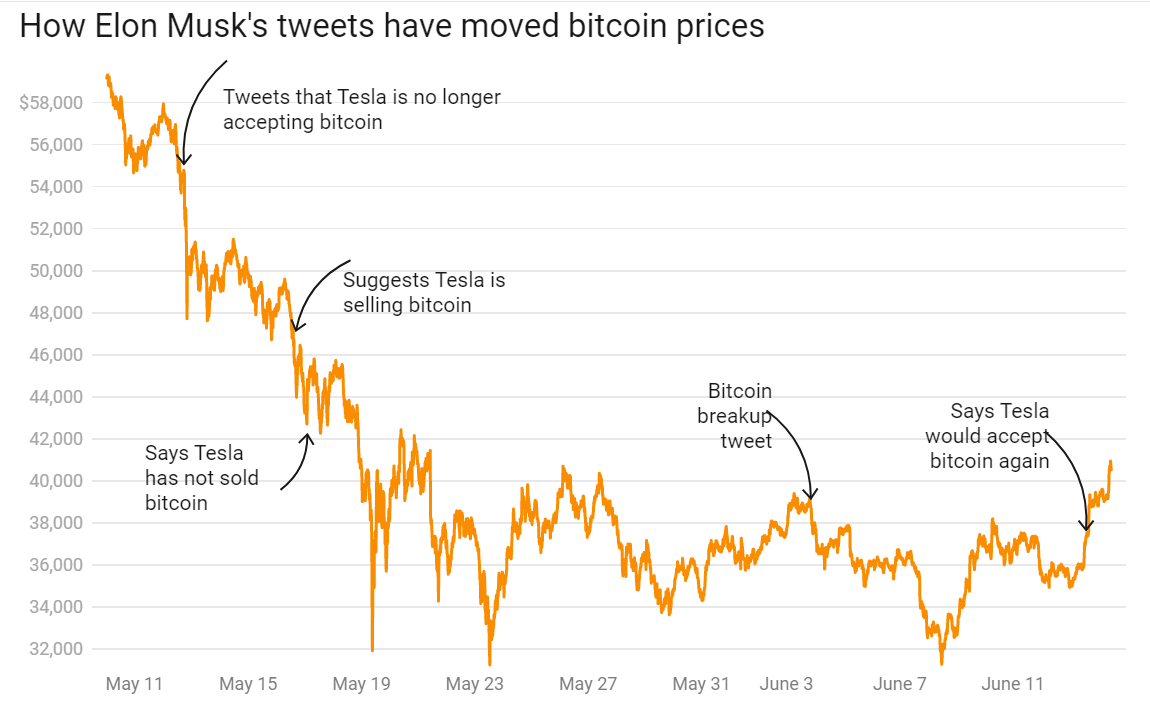

- External Drivers: External factors such as government regulations and tweets of high-profile figures can also sway the value of a currency. Elon Musk, for instance, sent the Dogecoin price up by 30 percent in May 2021 when he tweeted about working with Dogecoin developers. Similarly, his tweets about Bitcoin heavily influenced the price of that cryptocurrency.

Where Are Cryptocurrencies Stored?

The distributed ledger stores proof of how much cryptocurrency you own. It updates every few minutes when someone mines new coins or moves their digital currency.

To access your cryptocurrency, you need a private key (a 256-bit password) that creates a unique signature and enables you to use your cryptocurrency.

The private key correlates to a public key and an address (a string of characters), similar to a bank account address. You can store such private keys in a digital wallet which can be online, on your computer, or on an external storage device.

You can also print out your keys and store them in a safe place. But if something happens to your passwords and keys, you will likely be unable to access your funds.

What Does the Future Hold for Cryptocurrency?

Cryptocurrency, along with the distributed ledger technology at its heart, is still in a nascent stage of development. And just like any new technology, it won't suddenly go from rare to ubiquitous.

Despite the roadblocks, cryptocurrency is emerging as a legitimate financial asset. As Blythe Masters, the former executive at JP Morgan Chase puts it, “You should be taking this technology as seriously as you should have been taking the development of the internet in the early 1990s.” And, while currencies such as Bitcoin have a significant impact on the environment, more efficient alternatives are becoming available.