In crypto trading, trends and patterns say it all. Many avid traders closely monitor graphs and other statistics to determine how the market will change or how it's currently changing.

Trends begin, end, and even reverse. Crypto trend reversals aren't uncommon, but what causes them, what do they look like, and what warning signs should you look out for?

Crypto Trends Explained

Crypto prices massively depend on trends. When a certain coin or token amasses popularity, a wave of investors may move to buy it. This bumps demand for the token, driving up its value. On the other hand, if many crypto holders dump it, its supply will exceed demand, causing its price to dip.

In general, you either have a bearish or bullish crypto market. A bearish market occurs when the demand for crypto falls below the supply, whereas a bullish market occurs when the demand exceeds the supply. Bear markets lead to price drops, whereas bull markets lead to price hikes.

This is the most well-known trend pattern you'll see in crypto graphs, though many kinds of trends exist. You must know how to identify primary, secondary, and tertiary crypto trends to help you trade more effectively. And there are times when these trends reverse unexpectedly.

Reversals can technically be big or small but usually involve more significant price shifts. Smaller reversals are more commonly referred to as pullbacks. A crypto trend can last days, weeks, months, or even longer, depending on how investors and platforms receive the asset in question.

But what exactly is a crypto trend reversal, and how does it affect the market?

What Is a Crypto Trend Reversal?

Crypto trend reversals (not to be confused with reversal trading) occur when a consistent rise or fall in an asset's price reverses. Such shifts in price can be quick and short-lived or may span months or years. Longer trend reversals can be harder to spot, as they happen gradually and discretely, not suddenly.

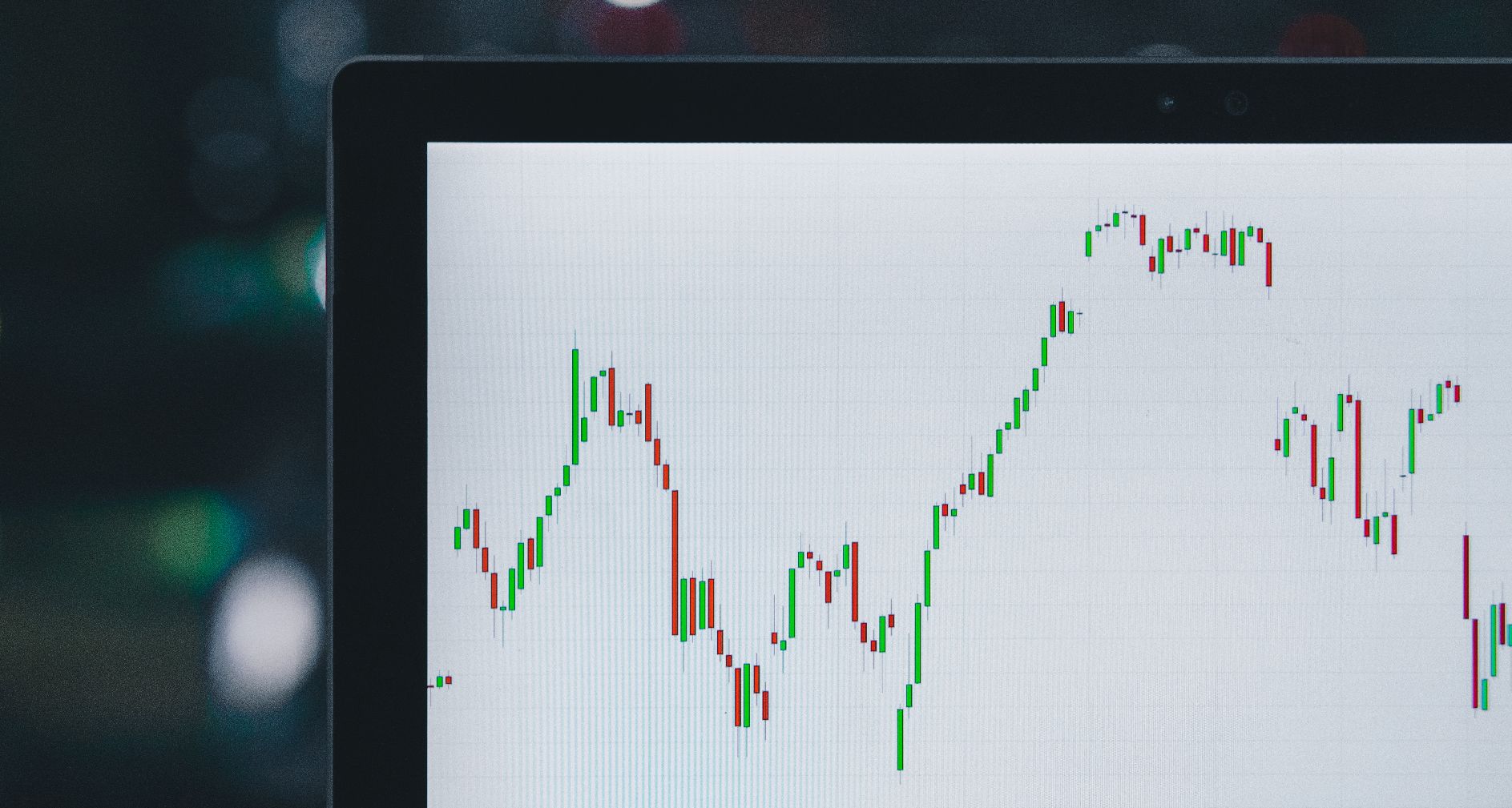

Crypto trend reversals display themselves most clearly on candlestick pattern graphs, a common style of pricing chart used for crypto assets. A candlestick graph consists of thick vertical lines attached to thinner lines. Because of their appearance, they are known as candlesticks.

In a candlestick graph, the bars can be either green or red. Green bars indicate price increases, while red bars indicate price decreases. The stick's main body marks an asset's opening and closing price on a given day, week, month, etc., while the thinner lines at the end show the highest and lowest prices reached by the asset in that period.

So, how do trend reversals display themselves in candlestick graphs?

Below is a basic diagram of a Bitcoin price trend reversal, clearly showing where the trend begins to turn.

As you can see, Bitcoin's price was heading up for some weeks, but a point was reached where this began to change. As labeled on the graph, this point is where the trend reverses.

Trend reversals don't need to be uniform on either side of the reversal point but need to show an overall change in price direction. What's needed is a set of lower lows and lower highs, followed by higher lows and higher highs, followed once again by lower lows and lower highs.

A typical model of crypto trend reversal is known as the Head & Shoulders pattern. Below is an example of a Head & Shoulders price shift experienced by Ethereum.

On the left of this pattern, you've got the left shoulder, followed by a slight dip. Then, the biggest increase forms the head of the pattern. After this, another dip occurs, followed by a slight rise and dip, known as the right shoulder. Both the left and right shoulders do not reach the high of the head in this pattern type.

This is a less apparent trend reversal, as it doesn't involve a steep incline followed by a steep decline (or vice versa). But regardless of its more gradual occurrence, it does indeed display a trend reversal.

You can also get an inverse Head & Shoulders pattern, which essentially looks like the opposite of the pattern shown above. In this case, you get a slight price drop, followed by a slight increase (forming the left shoulder), and then a significant price drop. After this, the price recovers slightly (forming the head), drops less severely than previously, then recovers again (forming the right shoulder). The Head & Shoulders model can be either bearish or bullish.

A Sushi Roll is another common type of trend reversal—a sideways movement of candlestick bars (showing no significant changes) is followed by a large uptick or downtick (i.e., a series of red or green bars). Like the Head & Shoulders model, a Sushi Roll can be either bearish or bullish.

So, crypto trend reversals can come in various forms, but can you spot them before they occur?

Can You Spot a Trend Reversal Before It Happens?

Sometimes, no one sees a price hike or price drop coming. So, you can't see any warning signs of a trend reversal, right?

Not exactly. Before a trend reversal gets underway, there is a short window indicating the oncoming change. You must know how to read crypto price charts, particularly candlestick graphs, to spot an impending trend reversal.

Various factors, including moving averages and volume indicators, may indicate an oncoming trend reversal.

Moving averages represent the recent closing prices of a cryptocurrency. Crypto traders often use one of two moving averages, one spanning over 50 days and the other over 200 days. A shift in an asset's moving averages can suggest that a trend reversal is in the midst.

On top of this, volume indicators can also come in handy. These refer to an asset's trading volume, representing how much of it has been traded in the past day, week, month, etc. 24-hour trading volumes are the most commonly used and could indicate oncoming trend reversals. If an asset's trading volume sees a steep incline or decline, a trend reversal could be on the way for that asset's price.

Crypto Trend Reversals Can Cause Huge Market Ripples

Crypto trend reversals can be minor but have also historically caused significant changes throughout the market. Such reversals can be good or bad news for investors, so if you have a crypto holding or are looking to buy, make sure you know how trend reversals work and what to look for to identify their approach.