One of the things that separate a good trader from a bad one is risk management. Without proper risk management, you can lose money. One of the ways to ensure you maintain your desired risk level is to always size your positions before trading. Position sizing helps you control your risk since you can determine how much you wish to risk per trade and how much you desire to earn on every trade. Therefore, it's necessary for futures and perpetual futures traders to always size their positions to maintain control over their accounts.

What Is Position Sizing?

Position sizing involves setting an actual percentage or portion of your crypto asset that you intend to risk when trading. When sizing your position, you determine what percentage of your total account value you are willing to let go of in a trade in relation to the reward you intend to receive. Traders size their positions to mitigate risk and determine how much they will earn and lose from a potential price move.

How to Calculate Your Position Size

To size your position for any trade, you must consider the following:

Your Risk Per Trade

You must determine the amount you are willing to risk on every trade. This can be based on your desire, trading style, or appetite for risk. It is more common to advise traders to stick to risking 1–3% of their trading balance on every trade they execute. Day traders try to risk less since they enter positions more often, while those that wait a long time to get their setups risk a little more.

Let's assume that you have a trading balance of $5,000, and you choose to risk 2% of the initial balance on every trade. This means that you will only lose $100 if a trade goes completely against your prediction. In this case, you would need to lose 50 consecutive trades to lose your trading balance.

Your Stop-Loss Level

After deciding the amount or percentage you wish to risk per trade, you must know how to set your stop-loss to fit into the plan. You must set your stop loss in a way that you won't lose more than you have predetermined before the trade.

Your stop-loss is the predetermined position or level at which you will exit a trade if the market moves against you. The tool assists you in reducing your losses; a properly sized stop-loss keeps your losses under control.

If you decide to risk 1% per trade, regardless of how far your stop loss is from the entry price, you should always keep the 1% target in mind. The position size is smaller when the distance of the stop loss from the entry is wide and higher when the gap is tight. With proper position sizing, it makes no difference whether you use a large or small amount; if the trade hits your stop loss, you will only lose 1% of your capital.

Sizing Your Position

After determining the amount you are willing to risk per trade and the stop loss, you can use the information to calculate your position size.

You need to use the following formula to calculate your position size:

Position size = Risk amount/Distance to stop loss.

We will assume you have an account size of $1,000, and you choose to risk 1% per trade; it means that if the trade goes against your prediction, you will lose $10. Let's say you buy ETHUSD with an entry price of $1,570 and a stop loss of $1,550. Using the price range measuring tool on TradingView, the distance between the two values is 1.27%, which, converted to decimal, is 0.0127.

To calculate position size, we will multiply the account size by the risk percentage, in this case, 1% (0.01), and then divide the result by the distance to stop 0.0127.

Therefore, we have 1,000 x 0.01 / 0.0127: then, the position size would be: $787

You don't always have to carry out the calculations yourself. Some platforms have tools you can use to calculate your position size, and we will list some of them in the following section.

5 Crypto Position Size Calculators

There are automated tools that can help you size your positions. With them, you won't have to carry out the calculations manually. Let's quickly look at five position sizing calculators you can use when trading.

1. Bybit Risk: Reward Calculator

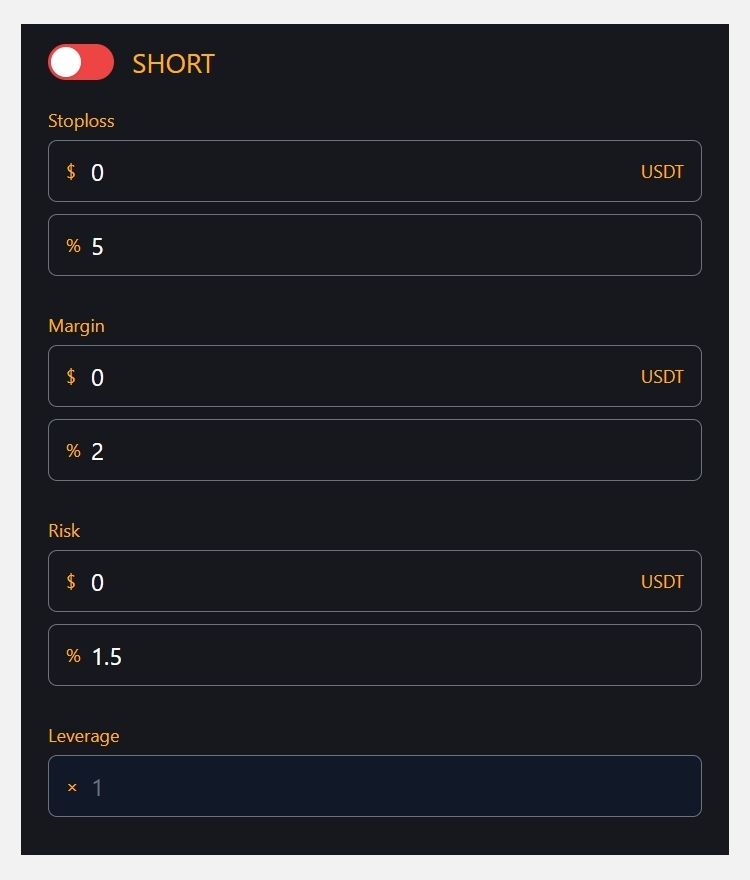

The Bybit risk-reward calculator comes in the form of an extension. You can integrate it into your browser for easy access whenever you need it. You must enter your stop-loss level, margin, risk, and leverage into the tool to get the desired value.

2. TradeCrypto Bitcoin Trading Position Size Calculator

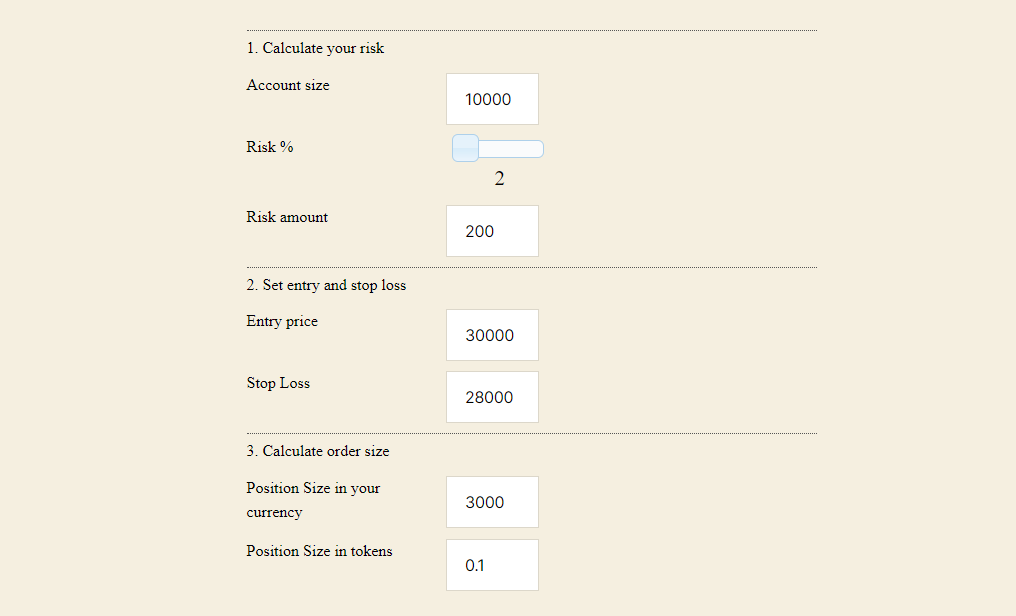

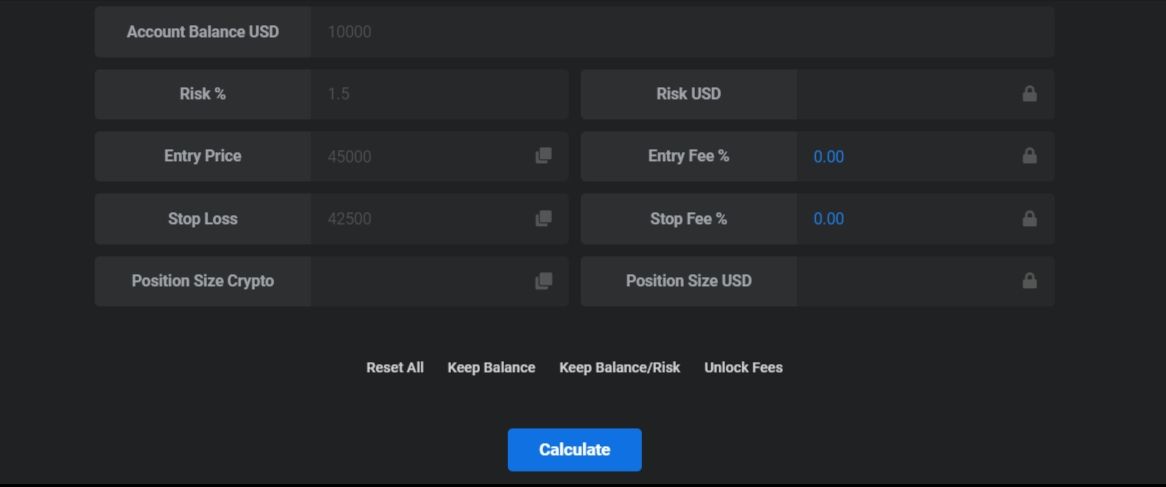

TradeCrypto is a website that offers resources on how to trade, and it also includes a position sizing calculator on its webpage. All you have to do is input the figures on the available boxes to get your position size. This calculator not only shows you the amount to risk; it also gives the size in crypto value, which helps if you are trading on a platform that requires inputting crypto lot sizes instead of the USD values.

3. CBFX Bitcoin Lot Size Calculator

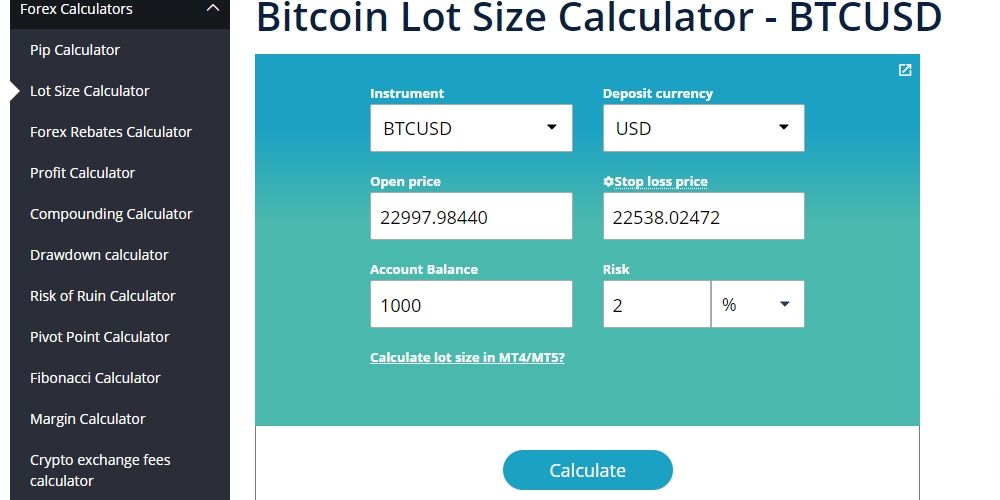

CBFX provides users with calculators for calculating position sizes in various financial markets, including cryptocurrencies. Like other calculators, you only need to input the basic information. The calculator can be embedded into your website, and you can also configure it in any color you wish.

4. Binance Futures Position Calculator

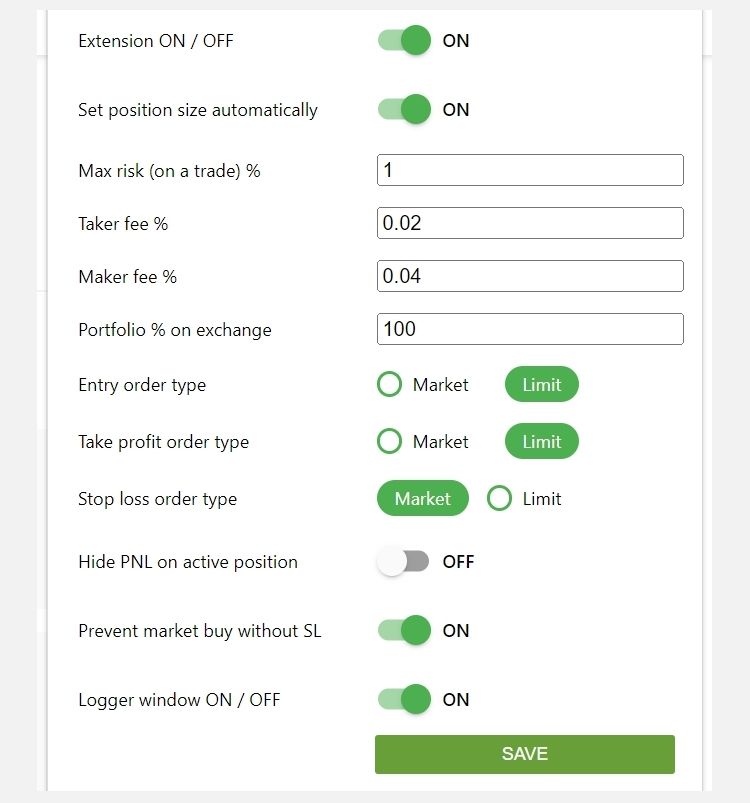

The Binance position size calculator is another automated tool that can help you calculate your position size. The tool is in the form of an extension that you can connect to your browser for easy access whenever you need it.

5. Crypto Position Size (CPS) Calculator

Like the other tools described, you must input your account balance, entry price, stop loss, and risk percentage to get your position size. The CPS calculator offers additional functionality as it lets you input your trading fees and calculate the position for a more accurate value.

Always Size Your Positions Before Trading

Calculating your position size is simple, and the automated tools simplify the whole process. You are only putting your account at risk if you do not size your positions before executing trades, as you will not be able to determine how much you will lose if you lose a trade. That way, it will also be hard to get a consistent profit. Before trading with a large account, practice with a simulated account or a very small amount to ensure you understand how to calculate position size.