Trading cryptocurrencies can be challenging for different reasons, including not having a working trading strategy and fear of losing money. What if we told you that there is a way to trade without having to risk money? This is a way to practice your trading skills and gain confidence through paper trading before trading on a real account. Traders who take their time to paper trade before trading on live accounts are likely to make fewer trading mistakes than those who start trading on real accounts immediately.

What, then, is crypto paper trading, and how does it work?

What Is Crypto Paper Trading?

Crypto paper trading is a process that lets you buy and sell cryptocurrency as you would on a proper trading account without risking your money. This practice is carried out on simulated trading accounts using virtual money. In the old times, before the internet and the demo platforms became popular, traders tested their trades by drawing them out on paper; hence, the term paper trading.

Paper trading, also known as demo trading or mock trading, allows prospective clients of an exchange to experiment and test how the platform works. It is also useful for active traders to try new ways of trading before using their real money.

How Does Crypto Paper Trading Work?

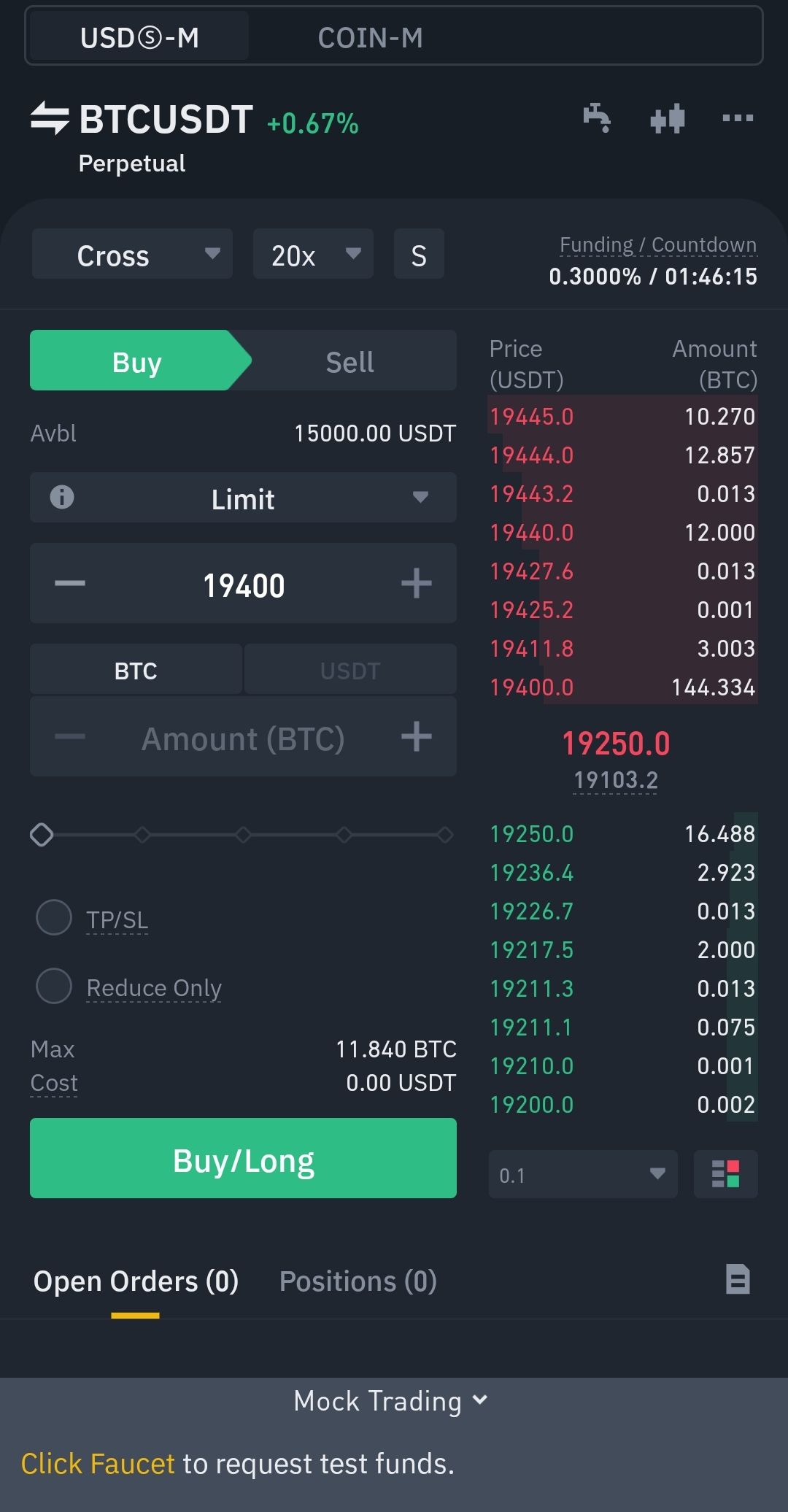

To engage in paper trading, you must create an account on a trading platform that offers it. After opening an account, you will have to find your way to the simulated version of the crypto exchange and create a simulated account. This version also works like the actual version of the platform.

You will have access to some virtual money after creating the account. You will also have access to real-time prices, technical tools, indicators, and almost everything in the live trading account.

After setting up your account, you can start trading as you would on a live account. This way, you will be able to see the results you would have had if you had executed the trades on a live account.

Trading on a demo account does not have any risk. You can reset your account and access more virtual money if you blow up the trading balance. Paper trading is free on many crypto platforms, although some sites charge a subscription fee to access this feature.

5 Pros and Cons of Crypto Paper Trading

The following are some benefits of using crypto-paper trading.

1. Pro: Risk-Free Crypto Trading

Paper trading is risk-free. Therefore, any wrong or poor decision you make has no vital implications. The process helps those new to trading to get their hands on real-time prices and professional trading tools more comfortably.

2. Pro: Freedom to Attempt Diverse Trading Strategies

Another advantage of crypto paper trading is that it allows you to execute diverse trading strategies. This way, you can measure each strategy's results in different market conditions. You can also open multiple accounts to attempt high-risk and low-risk strategies and choose the best of them.

3. Pro: Pro: Useful for Testing Strategies

Since paper trading works like a real crypto market, new traders can use the platform to put into practice what they are learning and get used to a trading platform. Active crypto traders can also use demo trading platforms to test new trading strategies and tools, gain more experience, and get acquainted with new ways of trading.

4. Con: It Does Not Reveal True Trading Fees

Slippage and commission are two costs that some users don't know about when they use paper trading. For example, on a paper trade, a crypto purchase can be $1, while on an actual trade, it is $1.05. This difference is because trades executed on a simulated account on many trading platforms are not always subjected to slippage and dividend adjustment.

5. Con: It Gives Users False Emotions

In crypto paper trading, the funds are not real, so traders and investors tend not to bother about the outcome of trades. However, when users start using the live account, reality sets in, and if they are not careful enough, they can get overwhelmed by the emotion attached to a live trading account.

Some experts advise that new traders should not use the demo account for too long because it does not train them to master their trading psychology, which is a vital part of trading.

How to Access Paper Trading on Binance Futures

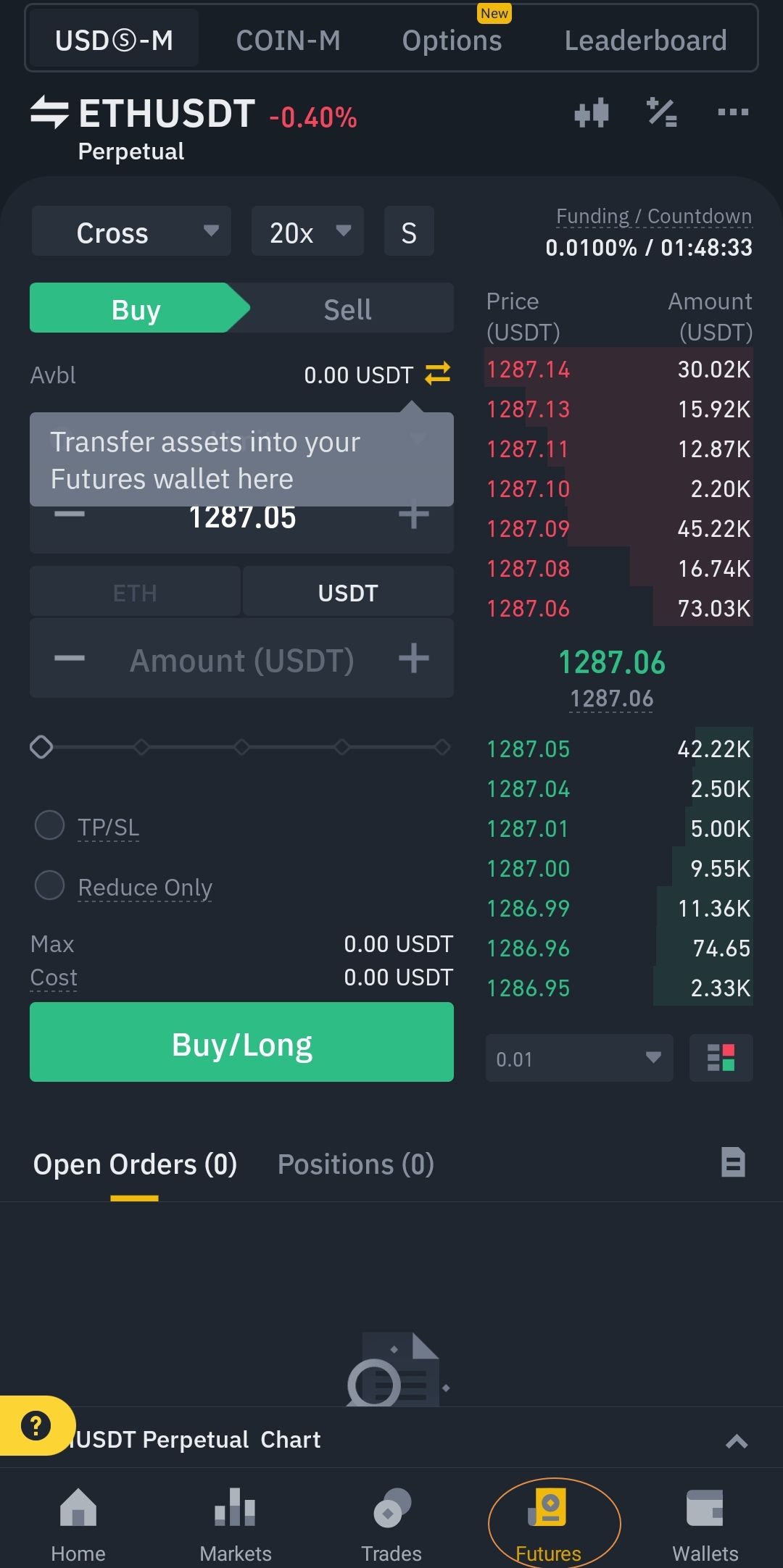

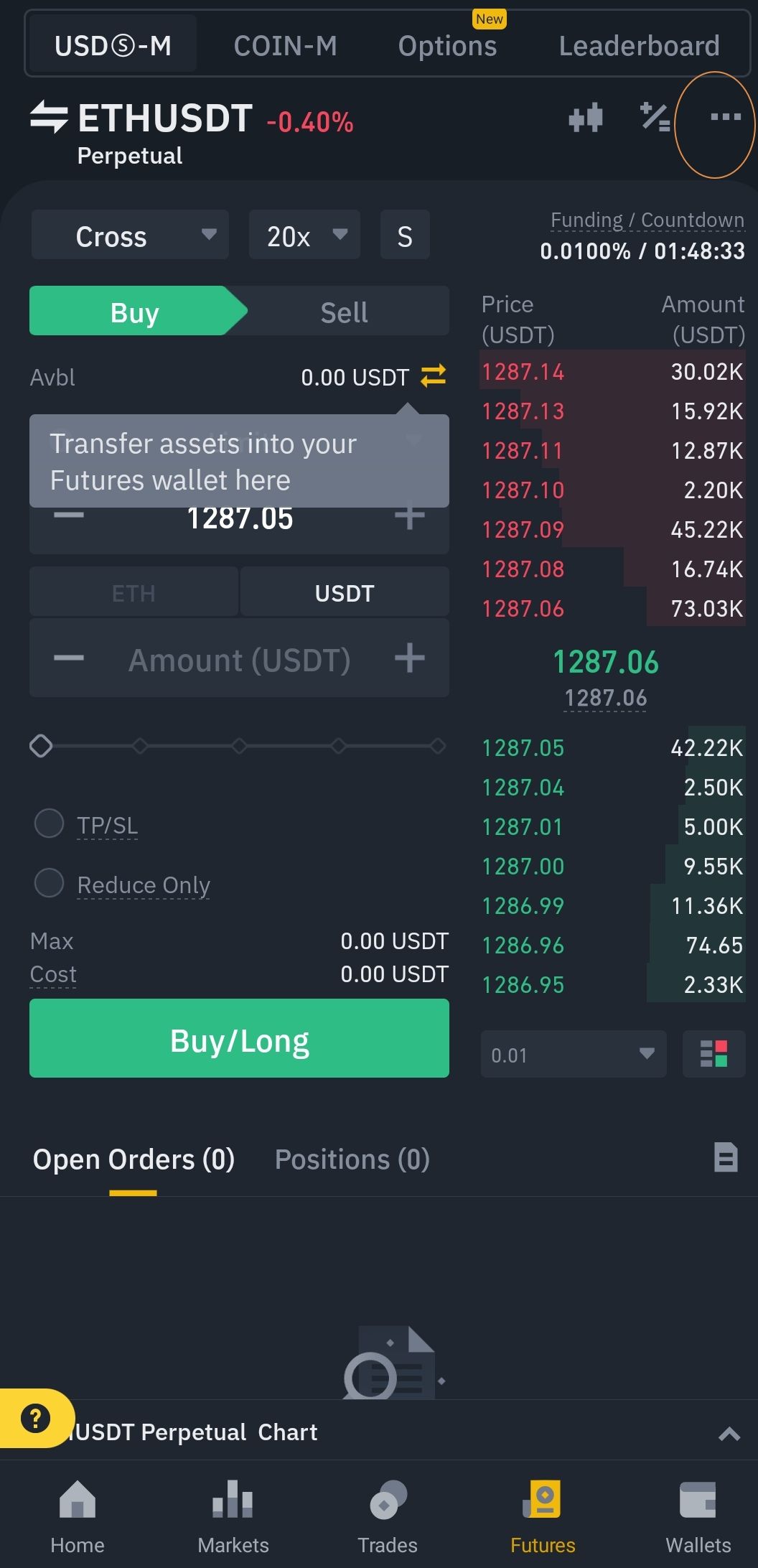

To use the mock trading feature on the Binance app, you first have to open the app on your mobile device. At this point, we expect that you have opened a Binance account; if you haven't, kindly do so and complete all necessary verification. The verification process doesn't take long.

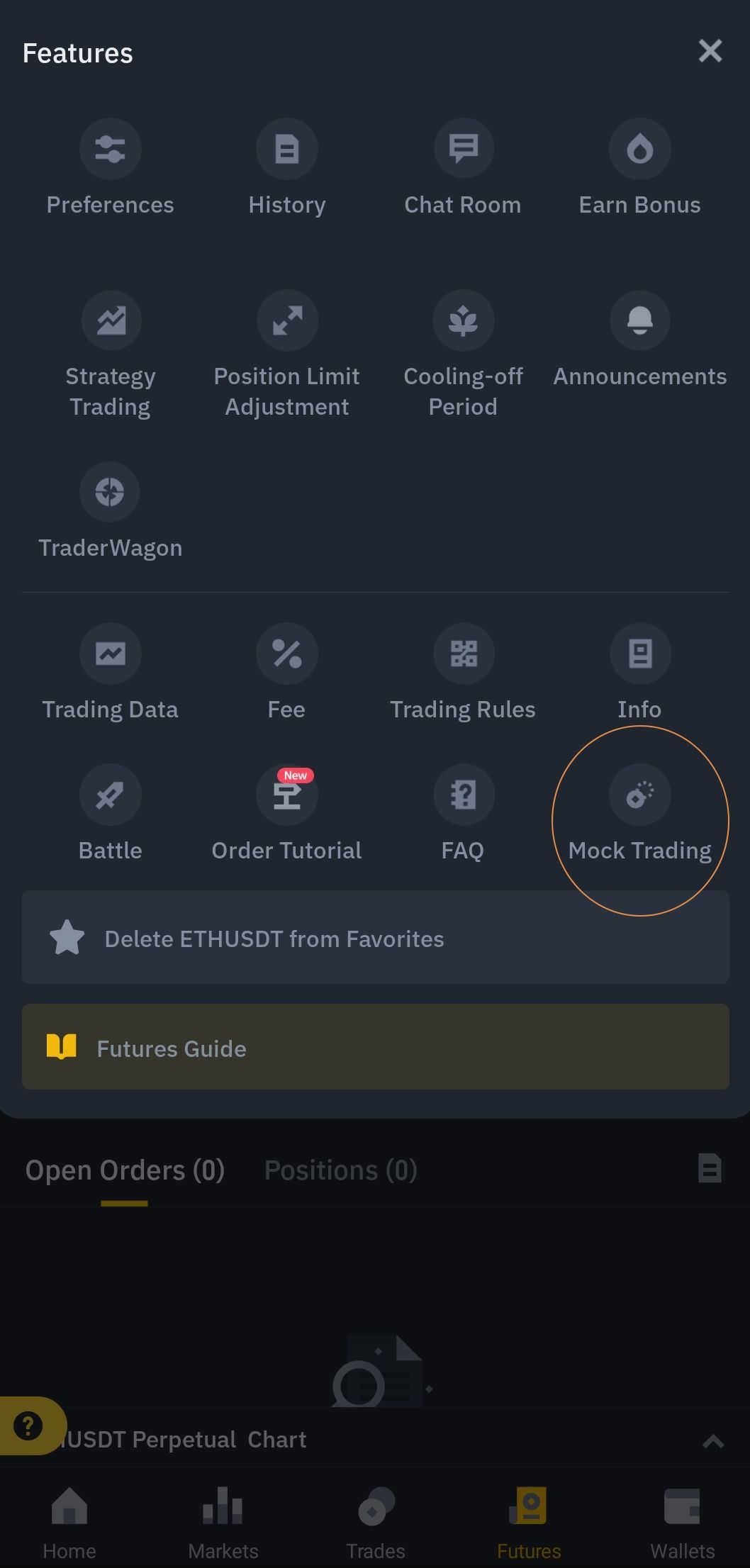

After opening an account and opening the app, click on Futures, and then click on the three dots at the top-right menu to access the Mock Trading option.

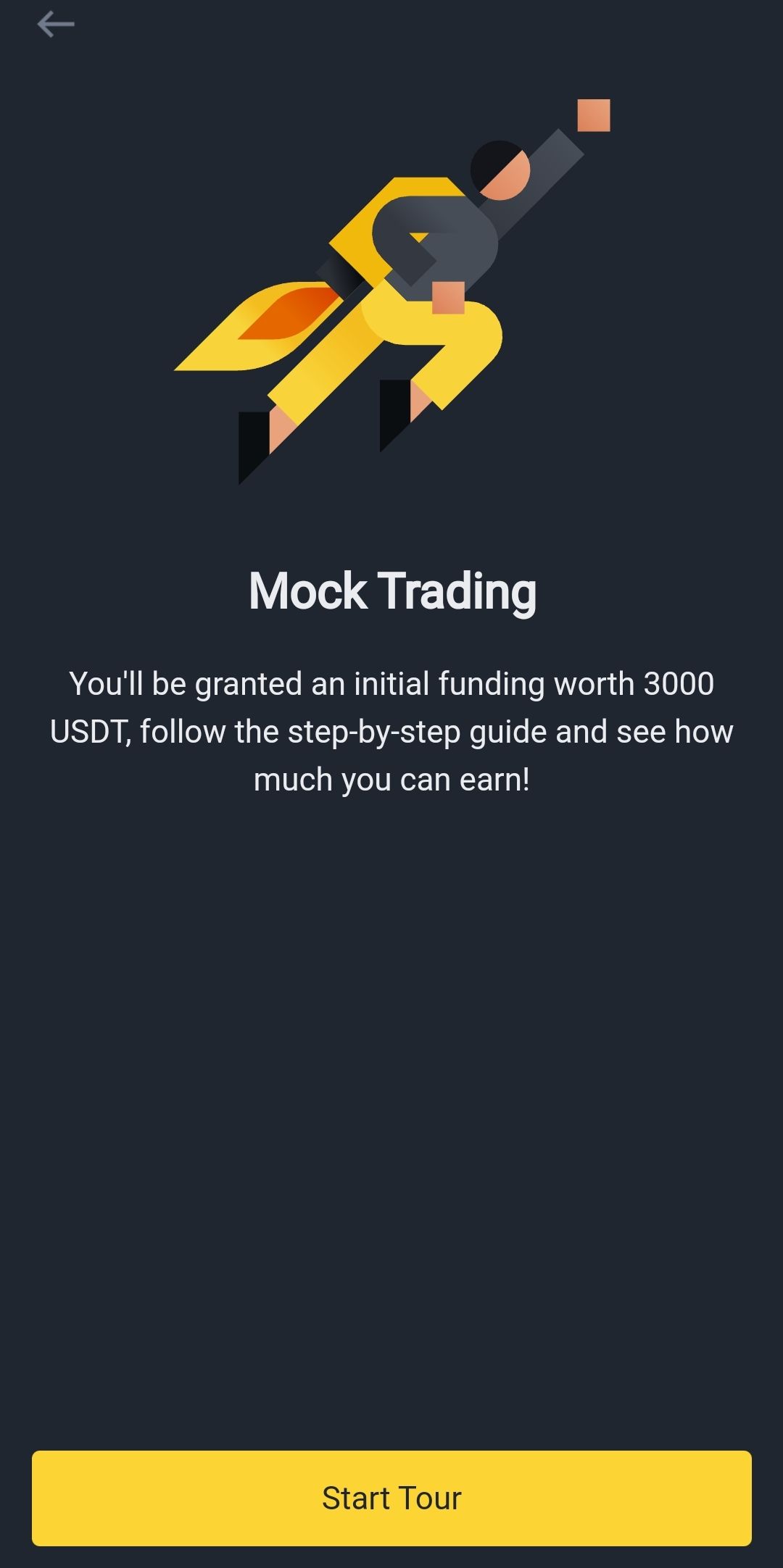

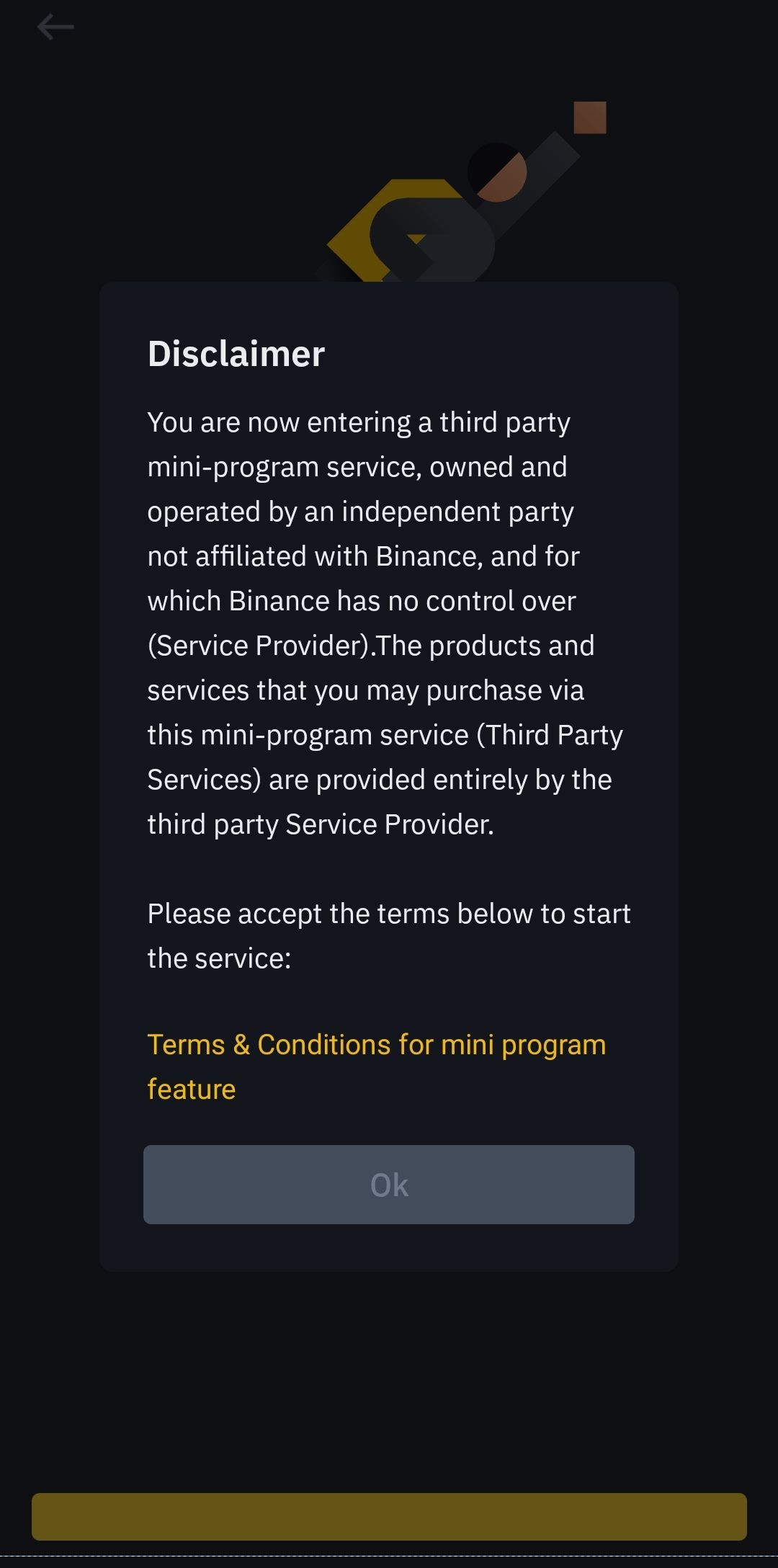

After clicking Mock Trading, you will be given the option to continue to use your email address associated with the Binance account because the mock trading option is a third-party mini-program. It is operated by an independent part that is not affiliated with Binance.

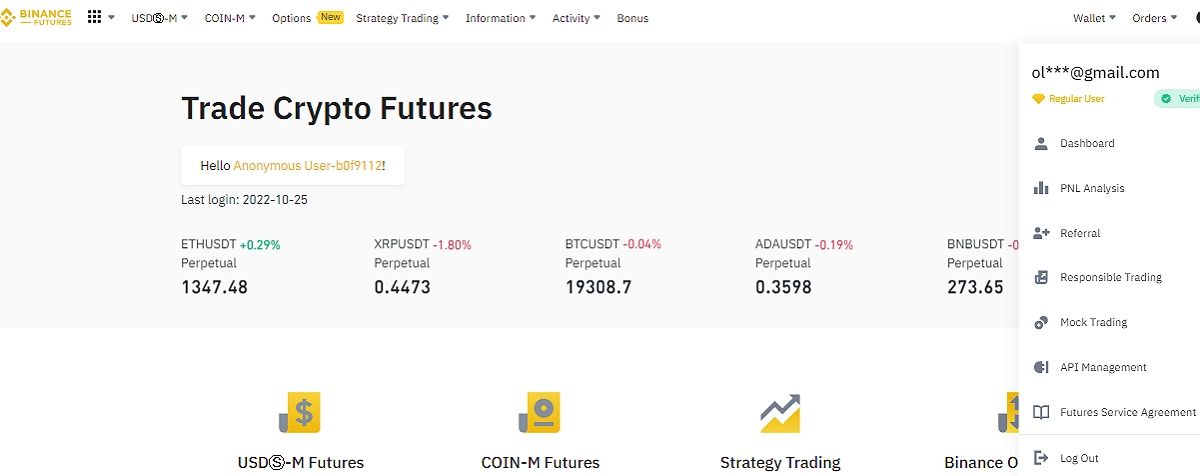

To access Binance mock trading on the Binance website, simply go to Binance Futures through your web browser and then grant Testnet access to the email attached to your Binance account as you did for the app. Doing this will give you access to the mock trading on the Binance website.

When you believe you are good enough to go live, you can click on the Back to Live option to trade on your real account.

Paper Trading Is for New and Experienced Traders

Crypto paper trading is a valuable way to gain knowledge and experience in crypto trading without taking risks. Mock trading platforms give beginners the necessary preparation to start their live trading experience. The platform also helps experienced traders get better with their strategies and improve their skills.

The possibility of affecting your emotion is the biggest downside to paper trading. A simulated account lets you trade without any emotion attached to the money. Therefore, getting used to trading on a demo account can affect your effectiveness when trading with real money.

.jpg)