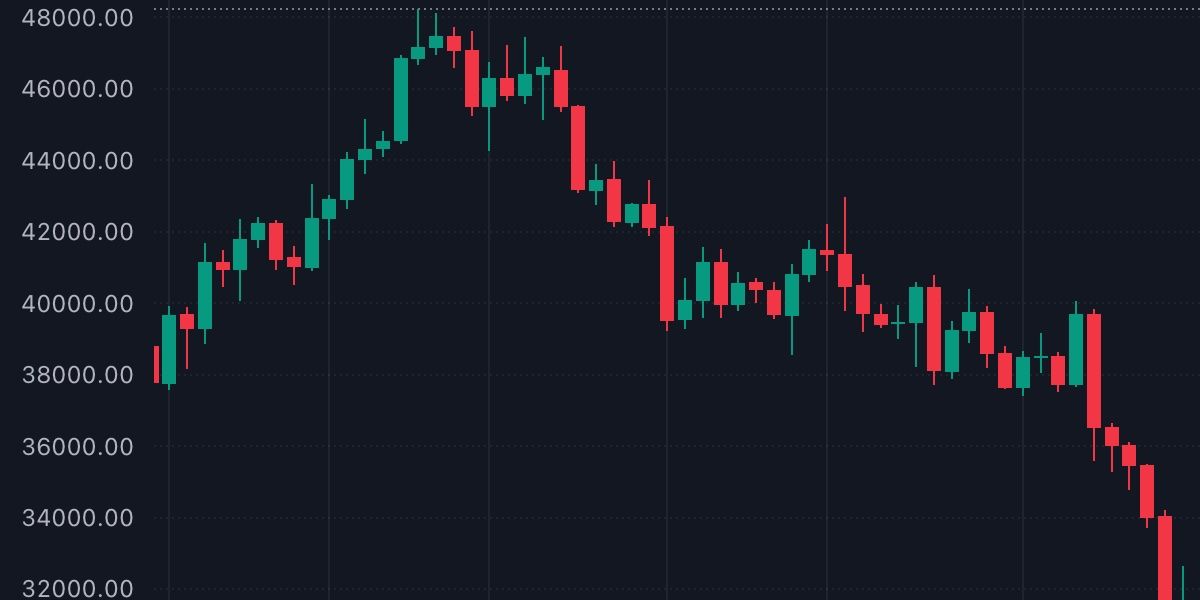

The volatile crypto market makes for wild market swings, causing the price to rise and fall quickly. Price can also move in one direction for a long time, especially during bull and bear runs. When a buying market starts to reverse due to a minor price decline or a trend change, uninformed and inexperienced investors sell their positions for fear of losses.

For this, we will be looking at what causes a panic sell-off, how you can avoid it, and also how you can spot possible points of price reversals early before a significant price decline.

What Is Crypto Panic Selling?

During panic selling, traders are forced to sell their positions for fear of a major price decline. The situation can be caused by a decrease in the value of a cryptocurrency due to negative sentiment, a minor price correction, a sudden change in market conditions, and other similar issues.

This situation can affect investors in various ways. For some, it could be that their positions are already in the red, and they are afraid of further losses. For others, it could be that their positions have not made any reasonable or desired profit, but they are forced to sell for fear of not having any profit. Whichever way it is, panic selling prevents traders from making the most of any trading decisions and, most times puts them in a worse position than before they opened the position.

Panic selling can cause a significant and sharp price decline in the crypto market. The price declines rapidly when many people exit their positions. This phenomenon is often triggered by some negative signals, which are often spread by widespread rumor, fear, and overreaction. As panic selling occurs, the price starts to go down and down and can trigger a crypto bear market. At this point, many investors do not make or forget to make reasoned analyses but rather get out of their positions for fear of making more losses.

6 Ways to Avoid Panic Selling

Panic selling is never useful. You'll often lose money, so it's best to avoid panic selling altogether. With that in mind, here are six ways to avoid panic selling your crypto.

1. Only Invest What You Can Afford to Lose

One of the best ways to invest is to use an amount you can afford to lose or one you won't need for an immediate need. This can help remove your emotional attachment to the money invested. In addition, investing money you don't need immediately will help you remain unmoved by short-term volatility since you believe the price will recover.

2. Always Think Long Term

The crypto market is volatile and constantly has major price swings. A more long-term perspective is usually safer, as you won't get so bothered by daily price swings and seasonal bear markets. Even though the market is volatile, those with a long-term perspective can still summarize what is going on in the market in simple words. It is usually clear if a market is a bull market, a bear market, or simply consolidating.

3. Dollar Cost Averaging

With dollar cost averaging, you won't invest all your capital in one position. Rather, you invest a little at specific intervals over time. This way, a fall in price may not affect all your positions since you didn't invest at the same price.

Dollar-cost averaging can protect you from the adverse effects of the bear market. However, it can reduce your general profit in the long run.

4. Diversify Your Portfolio

Another way to avoid panic selling is to diversify your portfolio. Investing in assets other than crypto can help you stay calm since it is less likely that your whole investment will be down at the same time.

One of the best ways to diversify is to invest in non-correlated assets, that is, assets whose price movements are not caused by the same factors that move the cryptos you invested in. That way, your other assets may still be in good condition when crypto prices are down.

5. Always Do Your Own Research

Always do your research before investing in any crypto. In your research, you need to analyze technical, fundamental, and sentimental aspects. Taking your time to analyze and research before entering positions can give you some form of confidence in your positions. In addition, knowing why you entered the trade can help you stay in it even during adverse conditions.

6. Accept the Market Fluctuations and Stick to Your Trading Plan

You are expected to have a trading or investment plan before putting your money into any assets. As much as many investors find it hard to stick to their plan, doing so can help you to

How to Identify Crypto Market Sell Offs

Traders employ different types of analyses to identify points of possible sell-offs in the market. We will look at how you can do this with technical and sentiment analysis.

Using Technical Analysis

Traders can use candlestick patterns to identify critical points in the market when a bullish trend is likely to experience a possible reversal. For example, the hammer and the shooting star can help you know that a buy trend might end, especially when you combine them with other price action and technical tools.

Technical indicators like the relative strength index, stochastic oscillator, and others can also help you know when a buying move is weakening. Combining such knowledge with other analysis methods can help you get out safely before any major price drop.

Using Sentiment Analysis

The general market sentiment about crypto or a particular crypto market can influence direction. For example, when the general mood around the market is optimistic, the price will likely continue to rise; if there is fear or general skepticism, the price might start to fall very fast.

Keeping up with general news about the market you're interested in or the crypto market, in general, can help you stay informed about market conditions. In addition, being informed about the general sentiment that surrounds the crypto market can help you make early decisions about any of your open positions.

If you find it hard to follow the news or want extra support for your decisions, then the Bitcoin greed and fear indicator can help you know the market mood at any given time.

Panic Selling Opens Up New Buying Opportunities

Massive sell-offs should not put you completely off, as they open up new opportunities for those who can take advantage of them. For example, when crypto prices fall massively, investors who desire to buy at a lower price can get their entries. These investors employ various analytical tools to know when the price is at its bottom and likely to reverse.

Following your trading plan and other measures we have explained in this article will help you not to panic sell and reduce the rate at which you end your trades prematurely.