Checking our mail is so routine, we typically don't consider it as a security hazard. But if you send and receive checks in your mailbox, you're opening yourself up to an old school type of fraud known as check washing. But what actually is it? How can you protect your identity from this dangerously simple scam?

What Is Check Washing Fraud?

Check washing fraud is the act of removing important information from a check and forging new information onto it. The information is removed using an acetone solution such as nail polish remover. The check is then rewritten in the same type of ink used initially in the check. If it looks close enough to the original handwriting, it normally clears. The criminal gets the money, and the victim is left on the hook—usually for a considerable amount.

Someone with even basic skills can create a passable counterfeit check, making this fraud much more dangerous and widespread. Your check in the wrong hands can result in your checking account getting cleaned out.

How to Protect Against Check Washing Fraud

Fortunately, there are things you can do to ensure you never become a victim of check washing.

Pay Online When Possible

The easiest way to fight against check washing fraud is to pay online. Most services and utilities have an app, website, or even an automated payment option you can set up to automatically deduct funds from your account when payment is due.

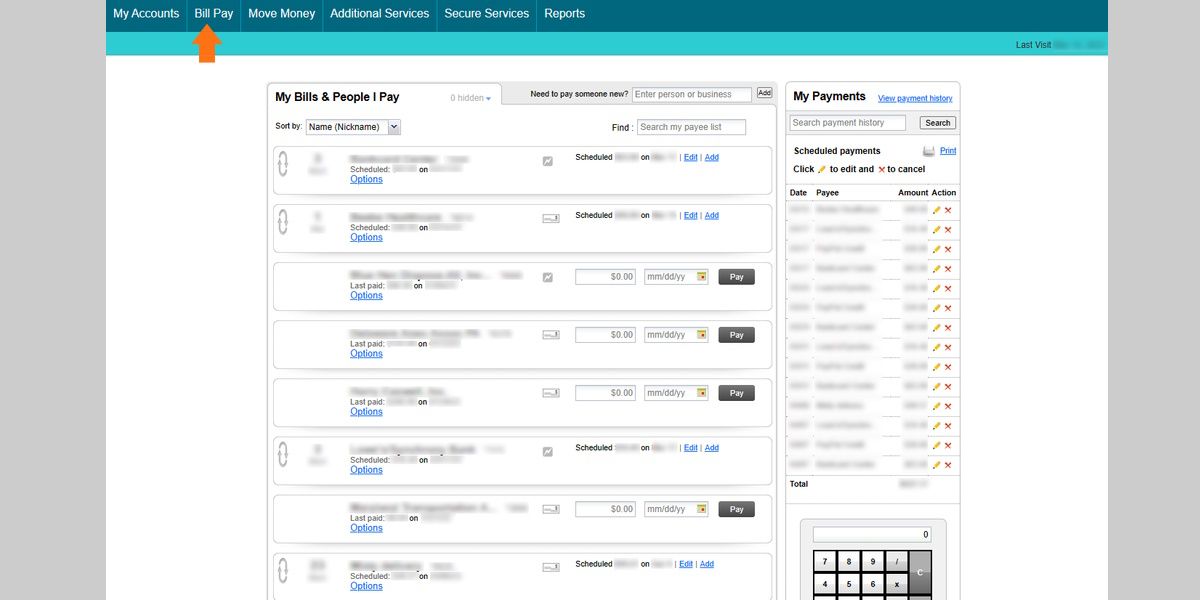

Alternatively, use your bank’s “bill pay” option if you have to pay via check. Your payment may still be sent as a check, but the information will be printed on it, making check washing utterly useless. NerdWallet has a great rundown on how bill pay works.

If You Write a Check, Use a Black Gel Pen

Sometimes, writing a check is the only option. You probably trust your payee, but do you trust them to keep the check secure before they cash it at their local bank branch? User error is a real problem, especially with checks. That’s why this fraud has become so prevalent in the first place.

But there is a unique way to make your checks less attractive to criminals. NBC 5 Chicago reported in September 2022 that the Better Business Bureau (BBB) issued an alert the same month urging consumers to fill out and sign checks using only black gel ink.

The reason? Gel ink pens are “indelible." Criminals have to put serious elbow grease in to remove gel ink from checks. JetPens compared the best and worse pens for writing checks resistant to check washing and found that gel pens are among the best for check writing.

Mailing a Check? Use Extra Layers of Security to Avoid Check Washing Fraud

Use these extra layers of protection to fight back against check washing fraud and identity theft:

- Mail checks from inside your local post office.

- Look at your check images via online banking and ensure they clear for the proper amount.

- Never leave mail overnight!

What to Do if You Expect a Check in the Mail When You’re Away From Home

Expecting a check when you won't be home? If you live in the United States, arrange for your mail to be held via the USPS Mobile app. Outside the US? Call your local post office for a similar option. Once held, you can arrange to have it either delivered the next business day after you’ve returned home or pick it up at your local post office.

Download: USPS Mobile (Free) for Android | iOS

When you get the check, know how you'll deposit: either in-person or via your bank’s mobile app. Both are secure, so it's up to you.

Keep in mind that if you choose your bank's mobile deposit option, you need to use a paper shredder to destroy sensitive documents, including your check. Use it to shred other sensitive trash like bank statements, bills, old tax documents, insurance policies, and other identity-sensitive documents.

Subscribe to an Identity Theft Protection Service

You should look into the best identity theft protection services that monitor every facet of your identity and how it is used. You'll be glad you have it if you’re ever victim to check washing fraud or your identity is stolen in another way.

These services commonly offer a sizeable amount of monetary protection. This applies to check washing fraud. If someone uses one of your checks to wipe out your checking account, an identity theft protection service will reimburse you and, often, fund a lawyer to represent you in court if needed.

Check Washing Fraud Vies for Your Identity

When you know how check washing fraud works, it’s fairly simple to alter your behavior and avoid becoming a victim. But it’s one part of a much larger issue: identity theft. Protect your identity and use security best practices to avoid becoming a victim of check washing fraud altogether.