If you're into cryptocurrency or decentralization in general, you've most likely heard of Ethereum. However, this isn't just a popular digital asset. Ethereum's blockchain allows for the development of any number of decentralized projects, be it new tokens, DeFi services, NFTs, or even games.

But, as time goes on, the cracks in Ethereum's ecosystem are starting to show, which has given way to so-called "Ethereum killers."

So, what exactly is an Ethereum killer, and what are some of the most notable examples today?

What Is an Ethereum Killer?

An Ethereum killer is a blockchain that has the ability to one day out-compete Ethereum, hence "killing" its popularity or prevalence in the industry. At the moment, Ethereum takes the cake as the most commonly used blockchain for developers, investors, and traders alike. Furthermore, the growing popularity of decentralized services and applications has given Ethereum a huge boost in terms of usage, with tens of thousands of individuals interacting with the network daily.

Ethereum has reached the peak of the blockchain pyramid by offering smart contract support for traders and developers, allowing quicker and more convenient transactions without the need for a middle man. The sheer diversity of the platform has also fueled its popularity. As more individuals build their projects on Ethereum, more users have a reason to get involved.

However, Ethereum has some glaring issues that have made it something of an annoyance to many users. Above all, Ethereum's gas fees are increasingly frustrating. Gas fees are charged to Ethereum users to compensate for the huge amounts of computing power required to run the network. Validators on the Ethereum network have to use a considerable amount of energy to verify transactions and maintain the blockchain's security, so gas fees are charged to users to pay these validators back.

Depending on network usage, gas fees fluctuate from one minute to the next, but they can become hefty. It's this nasty additional charge that has turned people off using Ethereum altogether. Along with this, Ethereum also struggles with scalability limitations. When more users join a blockchain network, and more transactions need to be verified, a backlog can quickly form, which lengthens the time it takes for any transaction to be processed.

With these frustrating fees and long transaction times, people have started looking for alternatives to Ethereum, which has given way to some prevalent Ethereum killers. So, let's discuss and compare some of the most talked-about Ethereum killers in the industry today.

Top Ethereum Killers

1. Cardano

Launched in 2017 by Ethereum co-founder Charles Hoskinson, Cardano has risen through the ranks to become one of the most popular blockchains on the market. Cardano's native coin, ADA, has become incredibly popular in recent years. And, like Ethereum will in the future, Cardano uses the proof of stake (PoS) consensus mechanism to verify transactions. Cardano uses the Ouroboros PoS protocol, which is thought to be the most energy-efficient protocol available. This speaks to the eco-friendliness of the network.

The Cardano blockchain also underwent a large update in September 2021, known as the "Alonzo" upgrade. This is a hard fork that gave Cardano smart contract capabilities, which is a desirable attribute in the eyes of developers and investors.

Cardano is also waiting on another update, known as the "Hydra" upgrade. This is a layer two scaling solution that will allow the blockchain to lower its transaction times. While a Cardano transaction can take just 20 seconds to process on a good day, this waiting time can rise to as much as ten minutes if network latency is high. So, we'll have to wait and see how the Hydra upgrade will affect this.

2. Algorand

Algorand is another top contender in the Ethereum killer race. Launched in 2019 by renowned computer scientist and cryptographer Silvio Micali, Algorand is the first open-source, permissionless pure proof of stake (PPoS) blockchain and has a range of great features that make it a great alternative to Ethereum.

Firstly, the Algorand blockchain is carbon-neutral due to its PPoS consensus protocol, which uses fewer validators per transaction, allowing for a much lower power requirement per block. On top of this, Algorand's transaction speeds are drastically lower than Ethereum. One Algorand transaction can be verified in just five seconds, whereas Ethereum's current transaction time can range from anywhere between 15 seconds and five minutes.

What's more, Algorand does not charge gas fees, and its transaction fees are very low (just 0.01 ALGO per transaction, which equates to around $0.0004). This makes the Algorand blockchain a much more affordable choice than Ethereum.

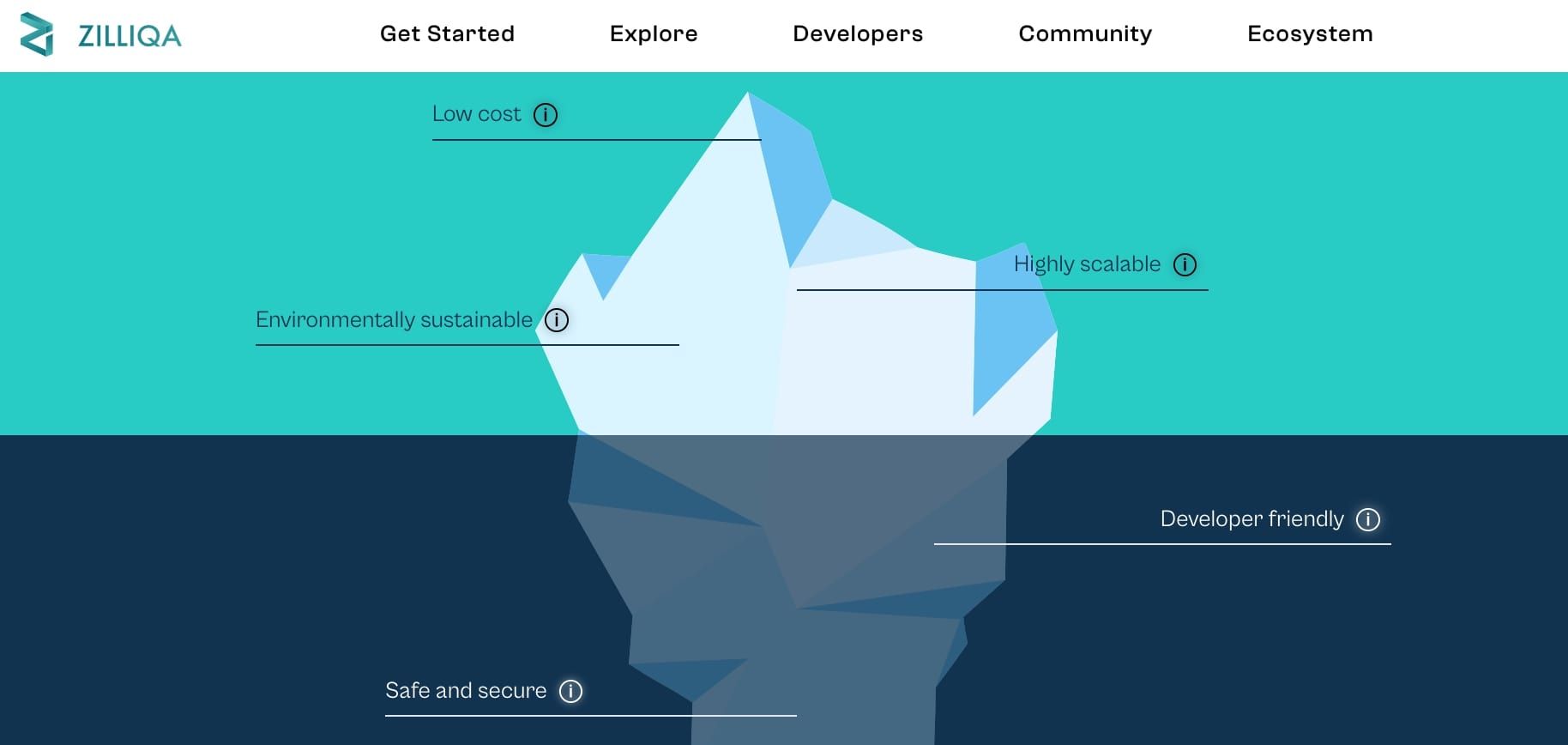

3. Zilliqa

There's one thing about the Zilliqa blockchain that makes it a challenge to Ethereum, and that's sharding. The process of sharding involves splitting one blockchain into many, which distributes the network load more evenly and therefore mitigates scalability limitations. This allows the Zilliqa network to process 2,500 transactions every second! Talk about speedy. Though Ethereum is working on sharding its original blockchain, this process won't begin for another year or so.

Zilliqa also boasts a transaction fee of just 0.01 ZIL, which equates to just a small fraction of a dollar. Even at their absolute lowest, Ethereum's transaction fees still amount to a few dollars, so it's safe to say that Zilliqa is a much more cost-effective option.

Additionally, Zilliqa has its own marketplace, wherein you can find both digital and physical artworks. So, if you're an artist or art enthusiast, you may find this part of the network particularly useful.

4. Avalanche

The Avalanche network has fast become an Ethereum killer for a range of different reasons. Firstly, Avalanche offers an incredibly high transaction speed of 4,500 transactions per second. While Avalanche does charge gas fees, these are sensible in comparison to those charged to Ethereum users. Like Ethereum, Avalanche gas fees vary from minute to minute depending on the state of the network.

In terms of transaction fees, Avalanche's certainly aren't the lowest on this list. While these generally stay below a dollar or two, previous spikes have taken a single Avalanche transaction fee beyond five dollars. Though these still sit below Ethereum's usual transaction fees, they're not the lowest out there, and there are many great blockchains that charge fees below a dollar.

Avalanche is also a pretty eco-friendly platform. It uses the energy-efficient p[oof of stake mechanism, doesn't require validators to use high-end hardware to verify blocks, and also doesn't require validators to keep their hardware active on a 24/7 basis. The network also uses three separate blockchains to distribute the transactional workload and tackle scalability limitations.

5. Polkadot

Polkadot is relatively new to the crypto game, having only been launched in 2020. But this hasn't stopped it from becoming one of the industry's most popular blockchains and coins. A key element that makes Polkadot a competitor to Ethereum is its use of parachains. These are parallel blockchains that all have their own purpose for a given decentralized project. Using multiple chains in this way gives the Polkadot network a great deal of scalability.

Because of this increased scalability, the Polkadot network can process an impressive 1,000 transactions every second. The platform also uses the nominated proof of stake (NPoS) protocol, which involves selecting a smaller number of validators to verify a block, therefore bringing down the energy requirements for the validation process.

What's more, Polkadot uses a weight-based fee model rather than the gas-metering model used by Ethereum. This model involves an equation that factors in a number of elements, which we don't dive deeply into today. The difference in fee calculations here makes it harder to draw a solid comparison between Polkadot and Ethereum in terms of cost. But despite this, it's worth noting that Polkadot's transaction fees are lower than Ethereum, though they fluctuate daily.

Will Any Blockchain Really "Kill" Ethereum?

Though there are many blockchains out there that have the potential to outshine Ethereum, it would take a lot to do so.

Ethereum is currently the far superior blockchain for building decentralized projects, and it is not known whether any alternative blockchain really has the ability to knock it off the top spot. But the decentralized world is anything but predictable, so we'll have to wait and see whether Ethereum ever has to give up its crown.