We all love to gain an advantage when it comes to trading cryptocurrency, which is why the Average Directional Index (ADX) has become a valuable tool for investors. But what exactly does it do, and how effective is it?

What Is ADX?

The Average Directional Index is a movement indicator developed by Welles Wilder. Although this indicator was originally created to track commodities, it is an effective tool for stocks and cryptocurrencies.

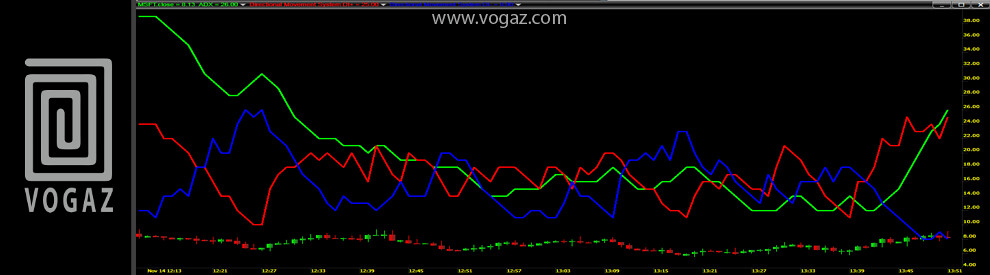

This type of chart is built on the assets' positive and negative directional movements. ADX is a metric based on the smoothed averages of both Plus Directional Indicators and Minus Directional Indicators (+DI and -DI, respectively) over a predetermined period.

To support the ADV, +DI and -DI is calculated by assessing the smoothed averages of positive and negative directional trends over time and are sometimes collectively referred to as the Directional Movement Indicator (DMI).

These Directional Movement Indicators help to support an Average Directional Index in working out the direction and strength of trends, and investors have been finding success utilizing these methods in the world of cryptocurrency,

How Does an Average Directional Index Work?

Calculating an Average Directional Index can be straightforward in concept. To work out the ADX of a cryptocurrency, traders need to discover the mean, or average, of the values of the Directional Index over a specific period.

In a volatile market like cryptocurrency, ADX can be an important tool for investors. We can see from exploring the Average Directional Index of Bitcoin that, despite the asset's historically erratic nature, its ADX can produce some significant trends for investors to follow.

Using Crypto-Indicators data, let's explore how we can read Bitcoin's Average Directional Index while learning about how ADX works on a more general level.

When forming the chart, Welles Wilder suggested that a strong trend can be found when ADX reaches a level beyond 25 with no trends present below 20. As we can see from the Bitcoin ADX, -DI, represented in red, spent much of early 2023 falling below this mark, and the asset's overall ADX, represented in black, has spent much of the year performing well above 25. This shows that BTC has experienced a strong trend throughout 2023 despite evidence of weakening strength in February and March.

We can also see that Bitcoin's ADX has turned downwards from an exceptional high towards the end of January 2023. This indicates that an existing trend may be ending and that investors should conduct more research to ascertain the cause of this trend fading and whether it's worth reassessing their position in the asset.

When the Average Directional Index line begins to decline, it generally means that the market is becoming less directional and that it could be worth avoiding the risks associated with trading trend systems as the trend changes.

Likewise, if our Bitcoin ADX chart shows a sharp rise of five-or-so unity after a period of relatively low strength, it may be a strong signal that a new trend is set to emerge.

Should a change in momentum cause Bitcoin or any other cryptocurrency's trend line to strengthen and rise, the ADX value will consider the slope of the trend. This means that it will be proportionate to the pace of the price movement. With this in mind, if the trend represents a consistent rise, then the ADV value will begin to flatten out.

When exploring smaller-cap or meme-based cryptocurrencies like Dogecoin, we see that ADX can be more erratic. This is because market sentiment is a significant factor in determining the value of the asset, and crowds can be more prone to vulnerabilities like FOMO, which sees trends gathering more momentum.

In the case of Dogecoin, swings in ADX can help determine the strength of price movements, and values can accelerate and decelerate in a more volatile manner, providing more insights for users looking to make trades.

Can Investors Rely on ADX?

Although ADX can be an excellent metric for identifying emerging trends in crypto, it's incapable of signifying when a buy or sell opportunity occurs.

Rather, it indicates whether it's worth investing in an ongoing trend or not by the scale of the strength of the trend lines.

This means that investors could seek to buy or sell a trend if it falls below 50 on the index due to the indication that it could be set to reverse. Although this can be a useful metric, it can be difficult to maximize the potential for profits in the largely sentiment-based crypto landscape prone to rapid investor appetite changes.

ADX Is a Valuable Trading Tool

The Average Directional Index can be a great tool to help inform purchasing or selling positions for investors, and many of those who adopt the approach can use an instance of the Plus Directional Indicator crossing above the Minus Directional Indicator to set up a long position or create a short position should -DI pass beyond the +DI.

Overall, the ADX makes for a great and reliable indicator of emerging trends and is best used to keep investors in touch with the strength of ongoing trends. It can also help to alert investors to possible changes in the investing landscape earlier.