Due to the significant risks associated with crypto trading, taking the necessary measures to mitigate potential losses is important. That's why calculating your risk-to-reward ratio is an integral part of risk management, as it helps you control your losses in relation to your gains.

Understanding this concept, including how to carry it out and its downsides, is vital for most individuals trading cryptocurrencies. So, let's delve into these areas in detail.

What Is a Risk-to-Reward Ratio?

Experienced traders consider the risks involved in a trade and how they relate to the potential profit, which is what the risk-to-reward ratio is about. For example, a ratio of 1:2 means that the potential reward for a trade is double the risk taken.

To illustrate, let's say you are about to execute a trade and are willing to risk $50. If the trade doesn't go as planned and triggers your stop-loss order, you will lose $50. However, if the trade goes in your favor and hits your take-profit order, you will earn $100 in profit.

4 Reasons Why You Always Need to Have a Risk-to-Reward Ratio

It is crucial to have a risk-to-reward ratio for the reasons listed below:

1. Control Your Losses

Setting a risk-to-reward ratio is the core of every crypto risk management practice. Incorporating it into your trading strategy means you won't execute any trade until you have determined how much you will risk and lose if the trade goes wrong. Setting a consistent risk-to-reward ratio allows you to control your losses for each trade and prevent significant losses.

2. You Have a Basis for Trade Evaluation

A risk-to-reward ratio is valuable in assessing your trades. It lets you determine if executing a trade is worth it by comparing the amount you risk with the potential gain.

By having a risk-to-reward ratio, you can also evaluate your trading outcomes. You can then use the evaluation result to identify the ratio that best complements your strategy.

3. Trade With Less Emotional Involvement

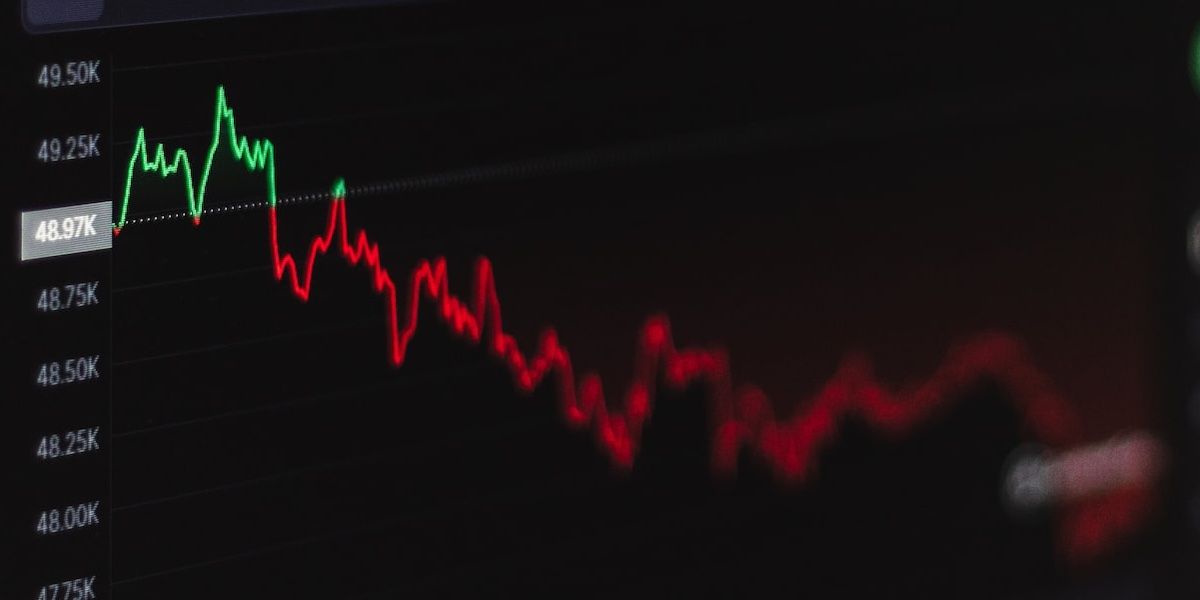

It can be tough to predict price changes, and if you don't have any guidelines to follow, you may make trading decisions based on your emotions.

However, if you have a clear risk-to-reward plan, you will only take trades that meet your criteria. This means you will avoid executing trades that don't offer a safe price to set your stop loss or won't help you achieve your desired profit.

4. Helps You to Stay Consistent

Traders must have consistent results. After all, having many successful trades and losing all your profits with just one bad trade doesn't make sense.

The risk-to-reward ratio helps determine how much you can lose on a losing trade. This way, you can keep trading for a long without losing your entire account to one loss.

How to Calculate Your Risk-to-Reward Ratio Before Any Trade

The first step in calculating your risk-to-reward ratio is identifying your entry price. Your entry price is the price at which you plan to buy or sell an asset.

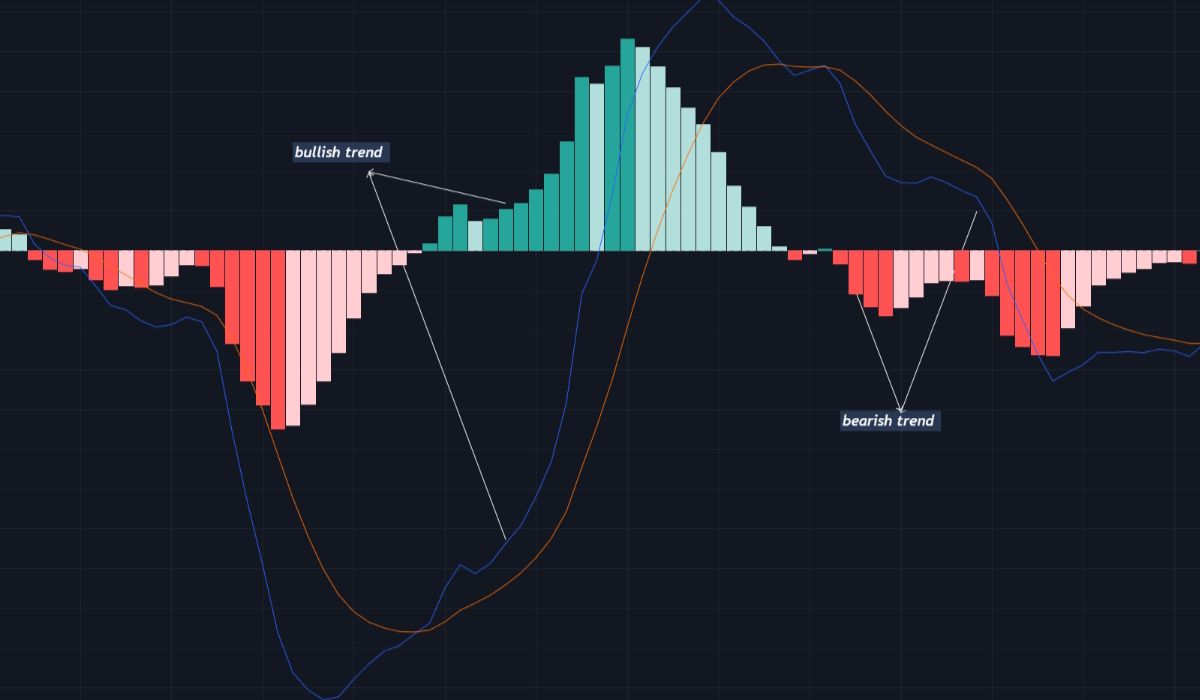

Once you have determined your entry price, the next step is to set your stop-loss and take-profit levels. You should set your stop-loss level at a point you believe the price won't reach as long as the trade you want to execute is valid. On the other hand, your take-profit order should be at a price that you anticipate the price will reach before it starts to reverse.

It's crucial to position your stop-loss and take-profit levels on your price analysis rather than arbitrarily setting them. Additionally, your stop-loss level should be a smaller percentage decrease from your entry price than your take-profit level. This is the best way to ensure that you risk less than the potential profit you may earn.

Suppose your stop-loss level is 10% below the entry price; your take-profit level should be more than 10% above entry. If your take-profit level is lower than 10%, then avoiding executing the trade is best.

However, if your take-profit level is 20% away from the entry price, the risk-to-reward ratio for the trade is 1:2, which means that for every risk you take, you will earn double as profit if it hits your take-profit order.

Consider Your Strategy Win Rate

You can determine your strategy's profitability by considering your win rate. The win rate compares the number of successful trades to the total number of trades you executed. So, if out of 50 executed trades, you win 30 trades; you have a 60% win rate.

Even if your win rate is less than 50%, making a profit is still possible. In this case, you have lost more trades than you have won but are still profitable overall. For instance, suppose your risk-to-reward ratio is 1:3, and your win rate is 40%, meaning that out of 10 trades, you have only four successful trades.

Suppose you invest $50 on each trade; you will receive $150 for every successful trade. After executing ten trades, you would have experienced a loss of $300 and a gain of $600, resulting in a net profit of $300. Therefore, a low win rate may not be significant if your crypto trading strategy is based on a high risk-to-reward ratio.

Drawbacks of Having a Risk-to-Reward Ratio

Adopting a risk-to-reward ratio may lead you to prioritize having a consistent ratio for all trades, even when your analysis suggests otherwise.

Also, it's common to become fixated on achieving your desired reward even when the market signals indicate it's best to exit an ongoing trade. This could cause you to miss out on potential profits you could have earned if you had acted on those signals instead of waiting for the price to trigger your take-profit order.

Improve on Your Risk to Reward When Necessary

Maintaining a consistent profit target can be difficult because the market doesn't always move in a way that allows you to achieve that target. Additionally, market conditions are subject to change, and a risk-to-reward ratio that has previously been effective may not be as effective.

While adhering to your risk-to-reward ratio is essential, it's also crucial to continuously improve it to achieve optimal results. To refine your risk-to-reward ratio and find the best fit for your trading strategy, it's essential to maintain a journal of your trades.

Accurately documenting your trades will record your trading outcomes and any significant events during the trades. This record will enable you to adjust your risk-to-reward ratio to improve your future trades.

Being able to distinguish between improving your risk-to-reward ratio by analyzing your journal entries and switching from one trading strategy to another is crucial. Focusing on the former can enhance your trading performance, whereas the latter can result in inconsistent outcomes.