You may have heard a lot about initial coin offerings (ICOs) if you follow the cryptocurrency space; it’s popular among people who look for high-tech investment opportunities.

Nowadays, it has become a common way of fundraising by startups. But what does the term actually mean, and what are its pros and cons? Let's find out.

What Are ICOs?

ICOs are the fundraising vehicle for cryptocurrency or blockchain-based service startups. If an individual owns tokens or coins through an ICO, they can either own a stake in the project or use the service when the project is complete.

Mostly, the investment in ICO goes through Bitcoin or Ethereum. In return, you receive an equivalent amount of a new cryptocurrency that the project is offering. However, the tokens or coins that you get may not yet yield much of a return.

When the project successfully delivers the promised results, the value of the tokens increases. If you wish, you can sell your tokens in the cryptocurrency exchange to exit with your profits. The project owner will let you know which cryptocurrency exchange will list the tokens during the ICO campaign.

The ICO could either be public or private. In the two sections below, you'll find out a little more about each of these.

1. Public ICO

If the fundraising campaign is open to everyone, it’s a public ICO. As anyone can participate in this program, you can also call it a democratized ICO.

You’ll know about public ICOs on popular technology websites, cryptocurrency exchanges, and social media platforms. Due to varying regulatory concerns globally, however, you might not find that many public ICOs.

2. Private ICO

When an ICO issuing project opens up the campaign to a handful of investors, it's a private ICO. The project owner has the right to set up some rules for the investors—such as determining that only accredited investors or high-net-worth investors can participate.

These days, issuers prefer private ICOs as regulatory concerns are minimal. The issuing company can tailor the ICO campaign based on its selected investors and their country of origin.

How Do ICOs Work?

When startups come up with an idea for technology-based projects, they issue ICOs. ICO connects the investor to the company. There are no intermediaries, so the fees for investment or scrutiny by regulatory authorities are next to none.

ICOs start with a white paper. You need to thoroughly go through the contents of this document to get a good idea about the offering. The document will clarify the following things, among others:

- Which technology will the project utilize?

- How will the project convert this technology into a popular service?

- How much money does the project require?

- How many tokens will the project owners keep?

- What will be the payment method for ICO tokens or coins?

- How long will the ICO stay available for investment?

The more the supporters, the better the chance an ICO has of achieving success. If the project’s owner can't raise enough funds by the end of the ICO campaign, you’ll get back what you have invested.

To understand ICOs function better, let's run through the following scenario.

Consider that a company wants to utilize the Ethereum blockchain to address issues in the home delivery services. Their technology will resolve issues like transparent delivery tracking, transaction security, delivery driver management, and customer privacy.

The company will come up with an ICO based on the Ethereum blockchain. They’ll name their coins and invite investors. If you participate in this campaign, you’ll get some crypto coins. You’ll earn profits by selling these coins in cryptocurrency exchanges when the project is successful.

Tokens issued during an ICO campaign will grow in value, depending on the number of early investors, the success of the project, and interest among potential investors on cryptocurrency exchanges.

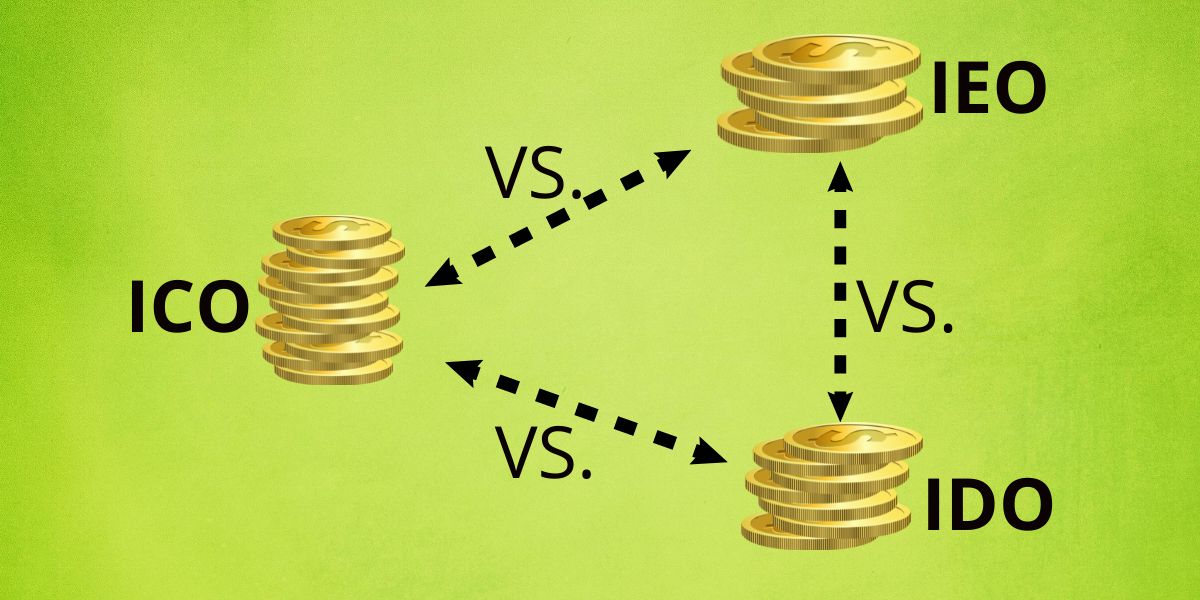

How ICOs, IEOs, and IDOs Differ

Since the success of the Ethereum ICO in 2014, a variety of token offerings have come into existence. Besides ICO, you'll also find initial exchange offerings (IEOs) and initial dex offerings (IDOs).

For an ICO:

- Utility tokens or coins of the ICO campaign become available on any blockchain platform.

- The ICO issue will manage the advertising and marketing.

- After the token generation event (TGE), the project owner will credit the coins in your crypto wallet.

- You’ll have to purchase ICO coins from the project owner’s platform.

- You only pay a nominal exchange fee, and there is no trading fee for the crypto coins.

Meanwhile, for an IEO:

- You’ll participate in crowdfunding through a centralized exchange (CEX).

- You’ll get the tokens immediately. However, there is a specific limit for trading on the same day.

- You’ll transact through the CEX.

- You don’t have to pay a fee as the IEO issuer pays all fees to the CEX.

As for an IDO:

- To participate in the fundraising, you’ll have to purchase crypto tokens from decentralized liquidity exchange (DEX).

- The token transfer is immediate, and you can sell all the tokens on the same day if you wish.

- The transaction is anonymous and utilizes crypto wallets along with blockchain to offer the best security.

- The IDO issuer and investors only need to pay for the gas or smart contract execution fee on an Ethereum blockchain.

The Pros and Cons of ICOs

Being an individual investor or enthusiast of cryptocurrencies, you need to keep in mind the pros and cons of using ICOs.

The first benefit of ICO participation is that anyone can invest in a public ICO. Since the number of participants can increase, so can the chances of success.

Cryptocurrency token trading also benefits from not needing to adhere to complex regulations—nor does it need to go through a middleman.

However, participating in ICOs isn't all sunshine and rainbows. Because regulation doesn't exist, you need to beware of fraudulent ICO events. If your gut feeling is bad, steer clear.

Secondly, you still have an element of risk when participating in these offerings. Just because you invested in something, it doesn't mean that it'll pay off—nor will your exchange necessarily have any base value.

Research Before Participating in an ICO

Having read this article, you should understand the basics of ICOs and how they work.

If the ICO campaign owners follow the good practices, it will benefit both an individual investor and the project. And as blockchain supports these exchanges, it's relatively secure from hacks and other external malicious activity.

At the same time, you must do your research before participating in an ICO. Scams are an unfortunate reality in the cryptocurrency space, and you need to do what you can to ensure that the risk will eventually reap rewards.