Even when transaction volume drops, blockchain platforms like Ethereum struggle with transaction speeds and gas fees. To solve this problem, Ethereum supports Layer 2 solutions to swap some transactions off-chain temporarily.

Still, the transactions must come back to the Ethereum blockchain at some point, and the method these solutions link back to Ethereum is known as a cryptocurrency bridge.

So, what is a cryptocurrency bridge, and how does it work?

What Is a Cryptocurrency Bridge?

A cryptocurrency bridge is an application that lets someone transfer their crypto between blockchain platforms.

One concern about blockchain tech is its ability to communicate with other blockchains. This communication, called interoperability, allows developers to build on multiple blockchains and fill demands for users regardless of which blockchain they want to use.

The problem impeding interoperability is that each blockchain has a native coin, token creation rules, potentially unique coding language, and smart contract executables. Basically, each blockchain speaks a different language, and there aren't any interpreters.

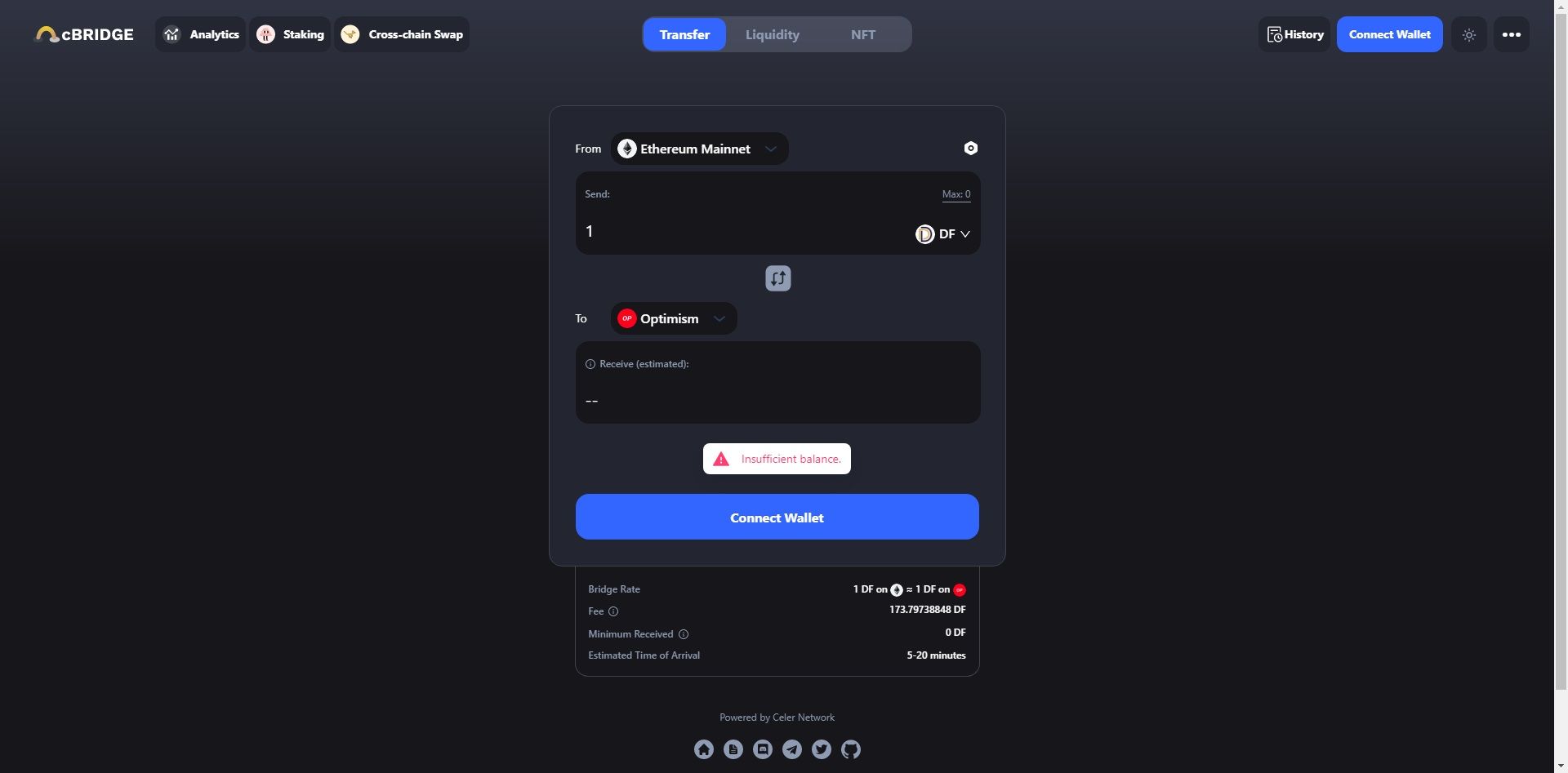

To solve that problem, bridges allow users to send their crypto to other blockchains by creating tokens representing that crypto, minting that token on the other blockchain, and holding the previous tokens. Then, if a user decides to go back, they turn in their minted tokens and receive the native crypto on the first chain.

How Do Cryptocurrency Bridges Work?

When a user sends their crypto to another blockchain via a crypto bridge, they technically don't receive the same cryptocurrency or token they sent. Instead, the user receives a token representing the amount of crypto they put into the bridge that the new blockchain pegs to the value of the transferred tokens.

Say you want to bridge your Ethereum from the native Ethereum blockchain over to the Avalanche blockchain. Once you wrap your ETH, you'd send the new WETH coins into a crypto bridge connecting Ethereum to Avalanche.

The bridge takes the WETH, mints the Avalanche equivalent called WETH.e, and deposits the tokens into the target wallet address. These bridges convert everything one-to-one, meaning you should get an equal amount of WETH.e tokens to what you had in WETH.

Tokens created through bridges have their value pegged to the original crypto, much like how stablecoins have their values set. As the market value for the base token changes, so will the value of tokens created via bridges on new blockchains.

Once you're on the new blockchain, the tokens operate like any other token would on the blockchain. You can use these tokens on decentralized exchanges, buy goods or services, and otherwise participate on the blockchain.

Trust-Based vs. Trustless Bridges

Not all crypto bridges work the same way. Overall, cryptocurrency bridges fall into two categories: trust-based and trustless bridges.

Trust-Based Bridges

Also called federated bridges, trust-based bridges get their name because you have to trust an individual or organization to bridge your crypto for you.

Trust-based bridges run like a private service where individuals have to get permission to bridge their crypto over to the other blockchain. Trust-based bridges often connect a larger blockchain platform like Ethereum to a private blockchain project for a business or organization.

If the bridge approves the transactions, then your submitted tokens are locked up, and new tokens are minted on the smaller private chain. Unfortunately, it also takes permission to leave the private chain, leading to these bridges working slower than their trustless cousins.

Trustless Bridges

On the other end of the spectrum, trustless bridges allow anyone to become a user of the crypto bridge. These bridges use smart contracts and similar automation to exchange submitted crypto into tokens on the connected blockchain.

To encourage users to run the bridge, many projects offer rewards to folks providing crypto used to verify transactions on the bridge. Offering rewards to users encourages loads of different users to confirm transactions, improving the decentralization of the bridge.

Trustless bridges are the most common form of crypto bridges connecting large public blockchains. However, most users on these blockchains prefer the decentralized system, meaning that trustless bridges see more traffic than trust-based ones.

Why Cryptocurrency Bridges Are Important

The biggest draw to cryptocurrency bridges is the interoperability solutions they offer. Anyone using cryptocurrency is familiar with the scalability issues big projects like Bitcoin and Ethereum face. As these projects have grown, their processing speed has dropped while gas fees have soared, especially so for Ethereum.

While these projects have different solutions in testing to scale up (like Bitcoin's Lightning Network or Ethereum's Layer 2 solutions), cryptocurrency bridges offer a way to migrate some of a dApp's traffic to less congested blockchains. For example, developers on Ethereum can use a bridge to offload some of their transactions to a faster chain, improving their speed and lightening the load on Ethereum's ledger.

Developers on smaller blockchains stand to benefit, as well. As more Ethereum users come over to their ecosystem, devs on the smaller chain are incentivized to make their DApps work with these bridges since they can draw a larger userbase by integrating a bridge. This adoption gives them a link back to the talent available in the Ethereum ecosystem, too.

However, cryptocurrency bridges can suffer from the same flaws any DApp based on smart contracts can have. Smart contract exploits have resulted in the theft of huge sums of money, killing confidence and funding goals. Bridging to a blockchain with weaker smart contract security can cause problems for an otherwise safe project.

Cryptocurrency Bridges Improve Interoperability Across Platforms

Despite their flaws, cryptocurrency bridges are the first step blockchain platforms have to create a seamless ecosystem across all of cryptocurrency. While many blockchains operate independently of the others, some folks believe we are heading towards a massive web of blockchains that can operate between each other.

It's hard to say how far off that future is or if it will even happen. But, for now, cryptocurrency bridges will help projects off-chain their transactions and provide a broader range of options.