Economies of Scale are based on a paradoxical idea that has so far held itself up. That idea is that there has to be a lot of something for it to be inexpensive, but something also has to have a minimum value to be worth buying or selling.

This has made sense because of how we relate to money, largely as a physical artifact. But, as our money increasingly becomes digital, can the way that we think about transactions change?

Here's an explanation of what microtransactions are and why we need them.

What Are Microtransactions?

"Microtransaction" refers to buying and selling items at a low cost. The definition of "low" depends on the payment medium; some payments have transaction fees that make different minimum values inefficient.

For example, you can still buy items with cash that cost fractions of a dollar or fractions of a pound. That's because the cost of cash transactions is virtually non-existent for the seller. As a result, what is considered a "microtransaction" for cash might be fractions of a penny.

Many retailers enforce minimum transactions of $5 on credit card purchases. That's because credit card purchases come with fees paid by the retailer. If a credit card purchase is below a certain threshold, it is no longer worth it for the retailer to carry out the transaction. So, a "microtransaction" for a credit card is much larger than for cash.

This has posed a problem as credit card transactions become more common, especially with online purchases.

Current Solutions for Microtransactions

Fortunately, we've found a few ways to work around these problems and allow microtransactions. More solutions may also be on the way thanks to financial technologies changing how we think about and use money.

1. Batch Microtransactions in Apps and Games

If you spend a lot of time on mobile apps and games, you might already regularly make microtransactions via in-game currencies.

Most mobile apps and games make most of their revenue through in-app purchases. To get around credit card fees, any mobile games use in-app currencies.

A user makes a relatively small credit card purchase to buy hundreds of in-game tokens. However, each one of these in-game tokens might only be worth a penny or so. The player then uses these to buy items within the game without additional transaction fees for the app.

Steam has a similar approach. Users add money to their Steam Wallets, with a minimum deposit of $5 allowed. Then, when you buy games and features on Steam—in some cases for less than a dollar at a time—the company takes that money from your account for free avoiding external transactions.

This approach allows the player to buy inexpensive items without requiring app owners to process a new transaction each time.

2. (Delayed) Peer-to-Peer Transactions

Credit cards aren't the only way to make paperless transactions. Payment services like PayPal and Venmo allow these to take place between an individual and an organization or between individuals.

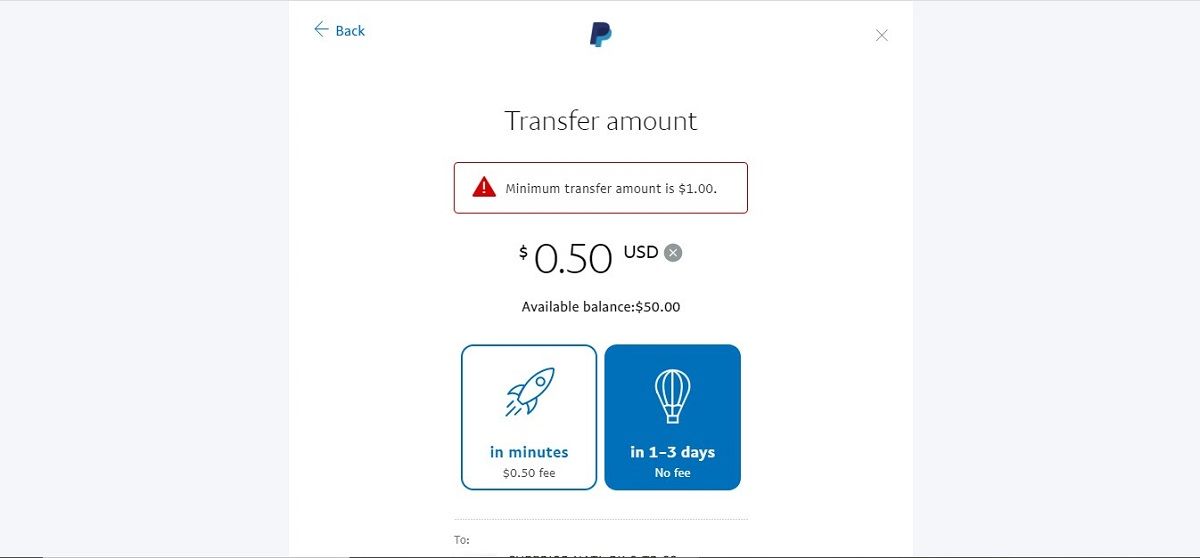

PayPal allows users to transfer amounts as small as $1 for free, provided you can wait as long as three days. You can speed up the process for a $0.50 fee.

Platforms like this do a lot to reduce the smallest feasible online transactions. They also help us understand transaction fees and the importance of microtransaction solutions by imposing on users the fees that retailers normally need to burden.

Can You Use Cryptocurrencies for Microtransactions?

Cryptocurrencies potentially combine all of the best elements of peer-to-peer payment systems. Bitcoin, for example, is usually talked about in terms of whole Bitcoins—which can be worth tens of thousands of dollars. However, a Bitcoin can also be broken down into very small units worth fractions of a penny.

This can allow very small transactions (like in-game currencies do) while working around bank fees (like peer-to-peer payment services do). However, cryptocurrencies can come with their own fees.

The people running the software behind most cryptocurrencies are incentivized to do that work through transaction fees, some of which are quite steep but vary between networks.

The current belief among crypto proponents is that combining long-term factors, including large-scale adoption, will eventually make these fees less significant for users. There are no guarantees, though.

Are Microtransactions Necessary?

You might wonder why anyone would care so much about transactions that are so small. By applying your imagination to the existing use cases for microtransactions, there's a lot of potential in making these tiny payments more convenient.

1. Microtransactions Can Enable More Customer-Friendly Credit Card Purchases

Making microtransactions between users and organizations easier can make it easier to buy inexpensive items, whether in-person, online, or in-app.

While some organizations and retailers have a stake in making this happen, benefits depend on the business model. After all, who hasn't bought more than they wanted to because it was inconvenient or impossible to use a credit card to buy only what you needed?

As microtransactions become more feasible, organizations that don't see the monetary benefit in supporting them will probably be forced by markets to support them anyway. Though, they will probably do so with a delayed model like PayPal's.

2. Microtransactions Can Impact Virtual Worlds and Economies

As exciting as microtransactions between individuals and organizations may be, peer-to-peer microtransactions may be more interesting. This is particularly the case within virtual environments.

As more people become user-creators, item and experience markets are becoming increasingly popular in the virtual communities that develop around games. Fostering these developer communities incentivizes users to create more rich virtual worlds, in some cases including complete in-game economies built around digital items and experiences.

These in-game economies can and do already exist, but they are still limited by the logistics of microtransactions. However, many believe that developing technologies like cryptocurrencies and NFTs will revolutionize these virtual worlds and virtual economies.

The Big Benefits of Small Payments

On their own, microtransactions are pretty small. However, as our payments become increasingly digital, microtransactions promise to vitalize new kinds of economies in our shared virtual spaces.