With the increase in the use of cryptocurrencies, many investors with large funds are also increasingly getting involved and looking for ways to trade crypto safely. Institutional investors often trade large amounts that are better not traded on public crypto platforms. These trades are regarded as block trades and are traded in dark pools.

Read on to learn how block trades work and find reputable platforms that offer this service.

What Is a Block Trade?

Block trades are high-volume trades or transactions that are privately negotiated. The transaction amount must meet a certain quantity threshold to be negotiated and traded outside the general crypto market.

Exchanges provide block trading services to institutional investors, businesses, and individuals with huge capital. The market negotiation can also take place between two market participants or through a broker.

How Does a Block Trade Work?

Block trades are not carried out on regular trading platforms; thus, they do not reflect in the general order book. These trades are usually carried out in dark pools or over the counter (OTC). A cryptocurrency dark pool is a privately organized forum, platform, or exchange for crypto trading activities.

The trades are arranged for two main reasons: to ensure the privacy of buyers and sellers and to manage the negative effect of large transactions in the general public market.

Block trades are preferred by the crypto market whales trying to trade a large sum of crypto assets. If they trade such a large amount of crypto in the regular trading market, their trades would be affected by slippages, putting them in a bad market position. These slippages occur because it is often hard to get matching orders to fill large trade requests at the desired price.

The second issue is that if such trades appear in the public order book, it will affect market sentiment as many traders might prefer to execute trades in the direction of the large order or close their ongoing trades.

When institutions or individuals with significant capital want to trade, they typically submit a request for a quote to the block trading platform. The broker often breaks the trade into smaller blocks while the market makers provide an execution price quote. If the trader accepts the quote, then the trade will get executed. Some trading platforms also carry out block trades using complex strategies that involve multiple instruments in a single trade volume.

Since the trades are not going through the order book, the investor is always sure that the price will be executed at the agreed price, meaning that the trades are not open to any form of slippage.

5 Popular Crypto Platforms for Block Trading Services

The following are popular and reputable platforms where you can trade large orders securely.

1. Binance OTC

Binance is one of the crypto platforms that offers a personalized way of trading for large fund investors. The minimum amount to qualify for a private negotiation is 10 BTC. The platform allows you to discuss trades over chat on WhatsApp or Telegram, where its team interact through the trading process.

The platform supports block trades on most coins on the exchange and even some that are not listed. The asset you intend to trade must remain in your account while you chat with the company to process the transaction without delay. The whole process, from start to finish, can be completed within two minutes. To access block trading, you can reach the team at tradedesk1@binance.com.

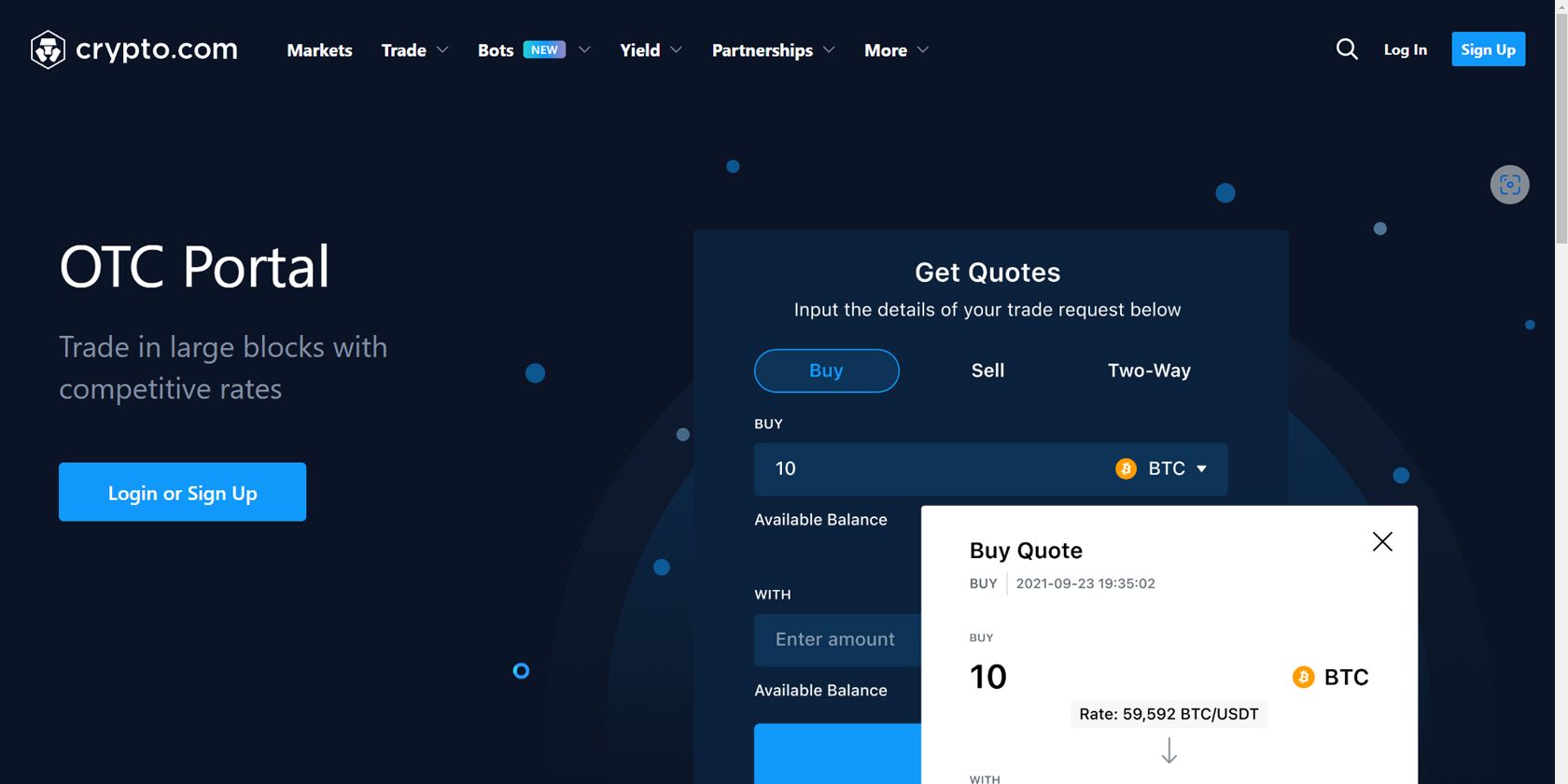

2. Crypto.com OTC Portal

You need at least 50,000 USDT, or its equivalent, to carry out block trades on crypto.com. This form of trading is only available to its selected institutional and VIP users who are registered as companies.

The platform largely supports USDT pairs for its block trades. The pairs you can trade include BTCUSDT, ADAUSDT, DOGEUSDT, XRPUSDT, ETHUSDT, SHIBUSDT, DOTUSDT, LINKUSDT, and some others. You can also contact the company if you are interested in trading assets other than the listed pairs.

The custom quotes provided are always competitive to help you trade at the best possible price. Quoting and execution are carried out by its team, and you can reach them at otc@crypto.com.

3. Kraken OTC Desk

Kraken also offers superior execution and competitive quotes. The platform recently launched an automated request-for-quote (AutoRFQ) tool that allows clients with considerable funds to execute orders of more than $100k. The AutoFRQ enables institutions and individuals with large funds to request automated quotes.

Its OTC trades currently support 20 assets and five quote currencies, including USD, EUR, GBP, USDT, and USDC. To start trading, log in to the Kraken OTC portal, request quotes, and trade instantly.

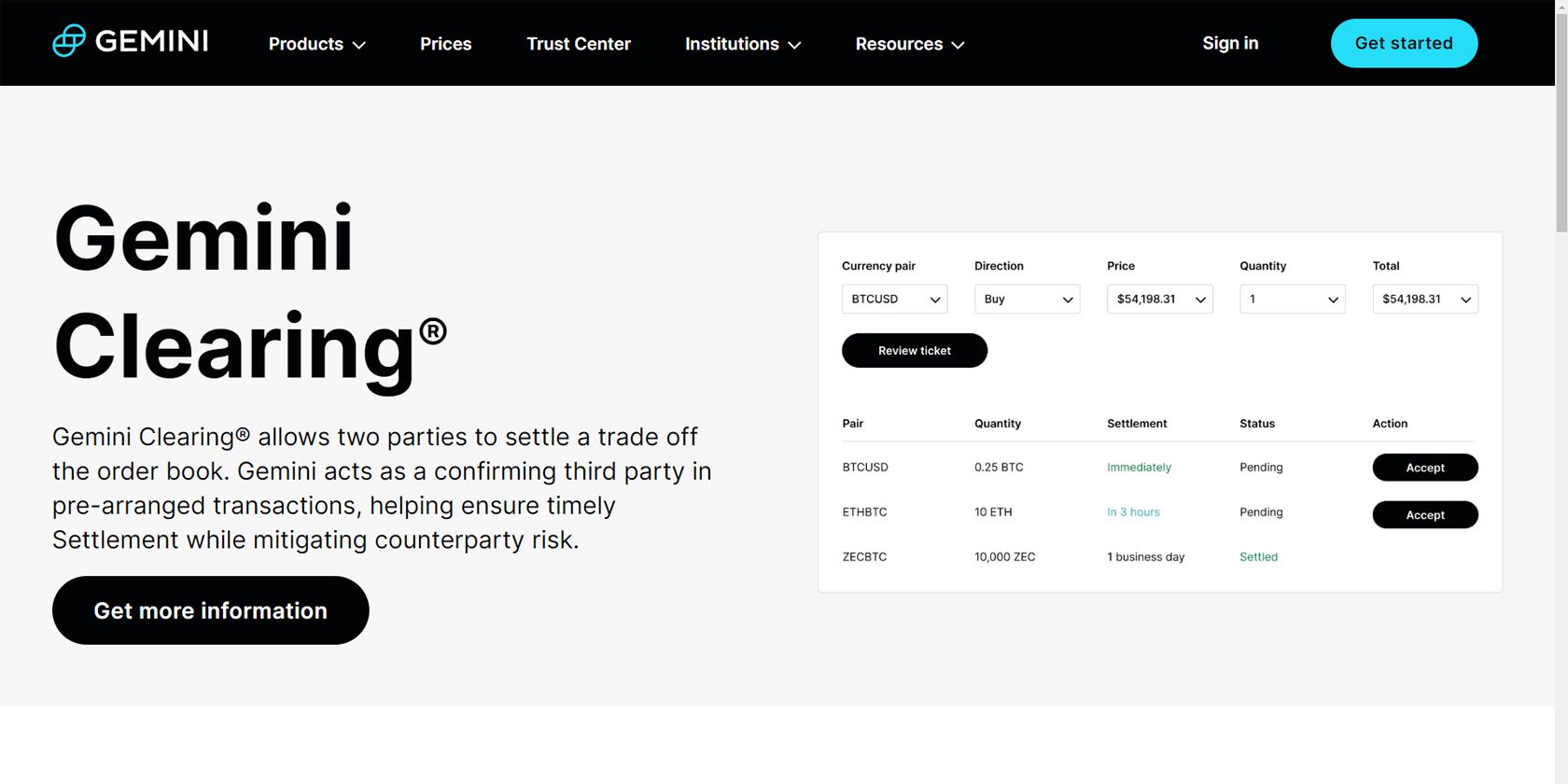

4. Gemini Clearing

The Gemini block trading service is fully digital. It allows you to create a block order that specifies if you want to buy or sell, the quantity you want to trade, your minimum required fill quantity, and your desired price limit.

To maintain transparency, the platform broadcasts block orders to participating market makers simultaneously to ensure that the trader gets the best price. Like other block trades, the orders are not seen on the order book, but the trade information is usually passed through the market feeds minutes after executing a block trade.

5. Coinbase Prime

Coinbase provides institutional-level trading through its Coinbase Prime program. It provides a secure and advanced trading platform to also help you manage your assets in one place.

It also provides smart routing, which allows traders to access the larger crypto marketplaces rather than relying on the price quote on Coinbase.

Benefits and Limitations of Block Trades

Block trading is the best solution for institutional traders to trade large quantities of crypto without adversely affecting the market price. Without this solution, it will be hard for investors with considerable funds to trade without affecting the market price every time they do.

Selling on the public exchange exposes the trader with large funds to slippage because it is hard to find trades that match large investors' orders. In trying to find the best price to trade, the exchange starts to look for the best price to fill the order; the final price could be far less favorable to the investor.

However, since it is conducted over the counter, it is not as regulated as trading on public exchange platforms. Therefore, it is easy to manipulate prices and carry out unethical activities, necessitating that you trade only on exchanges with a good reputation.

Block Trading Is Not Effective for Retail Traders

From all we have explained, it is evident that block trades aren't suited for retail traders. First, exchanges have a minimum account requirement for you to qualify for OTC trades. Some even accept only companies and businesses.

Another reason retail traders don't need block trades is that their trades are not heavy enough to affect the market price. Trading on a public exchange also helps retail traders be in a more regulated trading environment with minimal trade manipulations and unethical practices.

Please note that the investment information delivered in this article does not constitute investment advice. Please do your own research before investing (in any form), and never invest more than you can afford to lose.