Every Bitcoin transaction comes with a Bitcoin transaction fee. The fee pays the miners that maintain the network and process transactions, and keep the network flowing and, most importantly, safe. However, at times, Bitcoin fees can become extortionate. In late 2020, Bitcoin transaction fees rose as high as $25 per transaction, and while they can remain stable for long periods, intense periods of network activity can cause them to spike.

What Are Bitcoin Transaction Fees?

The transfer of value is made through transactions recorded on the Bitcoin blockchain's public ledger. Every transaction made on the Bitcoin blockchain incurs a transaction fee. Bitcoin miners collect Bitcoin transaction fees when they successfully mine a Bitcoin block, where they also receive the Bitcoin block reward (a set amount that changes roughly every four years).

Payment of network fees helps incentivize Bitcoin miners to process transactions on the network. If miners are not paid for the number of resources they spend, they may not operate in the long term due to the increasingly high costs of mining. Also, many miners process transactions to make a profit. If no fees are paid, they have fewer reasons to mine Bitcoin.

With the right amount of miner fees, you can ensure that your transaction will be confirmed over a short period of time. However, if the fees paid are too low, your transaction could take longer to confirm. In certain cases, the network may return funds to the wallet.

How Does Bitcoin Blocksize Affect Transaction Fees?

If you're new to Bitcoin, the concept of a public ledger may seem confusing. However, it is quite simple. A blockchain is essentially a list of records. The list of records, also known as blocks, is linked together using cryptography. Each block contains verified details of the transaction, including a timestamp, transaction data, and a cryptographic hash of the previous block.

The larger the size of a block on the blockchain, the higher the transaction fees and block rewards tend to be. It tends to take longer to reach a consensus on larger-size blocks. This is because of how much more difficult it can be for a miner to mine larger blocks.

The process of mining adds new Bitcoins to the circulating supply and secures the network against fraudulent transactions. It is like a money-printing operation with pre-defined rules for the supply and security of transactions.

Miners solve computational puzzles to create blocks for the network. For new blocks to be created, the nodes have to reach a consensus on the transactions that have taken place.

To be included in a block, transactions must be chosen by miners from the mempool and verified by nodes in the network. Users of the blockchain must pay fees for their transactions to be included in a block. The larger the transaction, the more data it takes up in a block, and the more the sender will have to pay. In short, the more you send, the more you pay.

Fees are paid as the method used to process transactions on the blockchain costs money. Miners on blockchains have to spend resources such as computing power or electricity. Transaction fees are generally calculated based on the transaction size in bytes and the current network congestion. Users can choose to pay a higher fee to prioritize their transactions, increasing the likelihood of faster confirmation.

What Is the Bitcoin Blocksize?

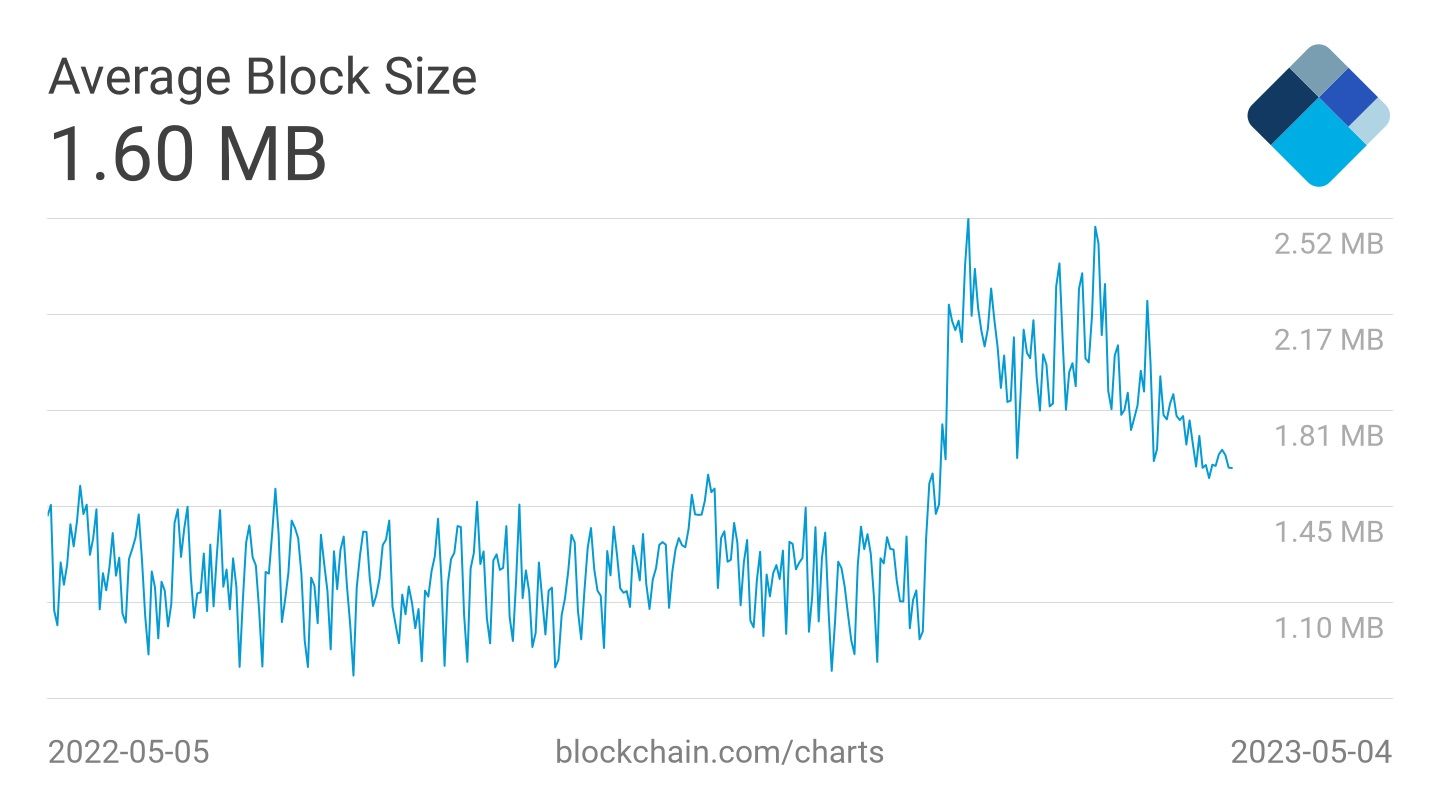

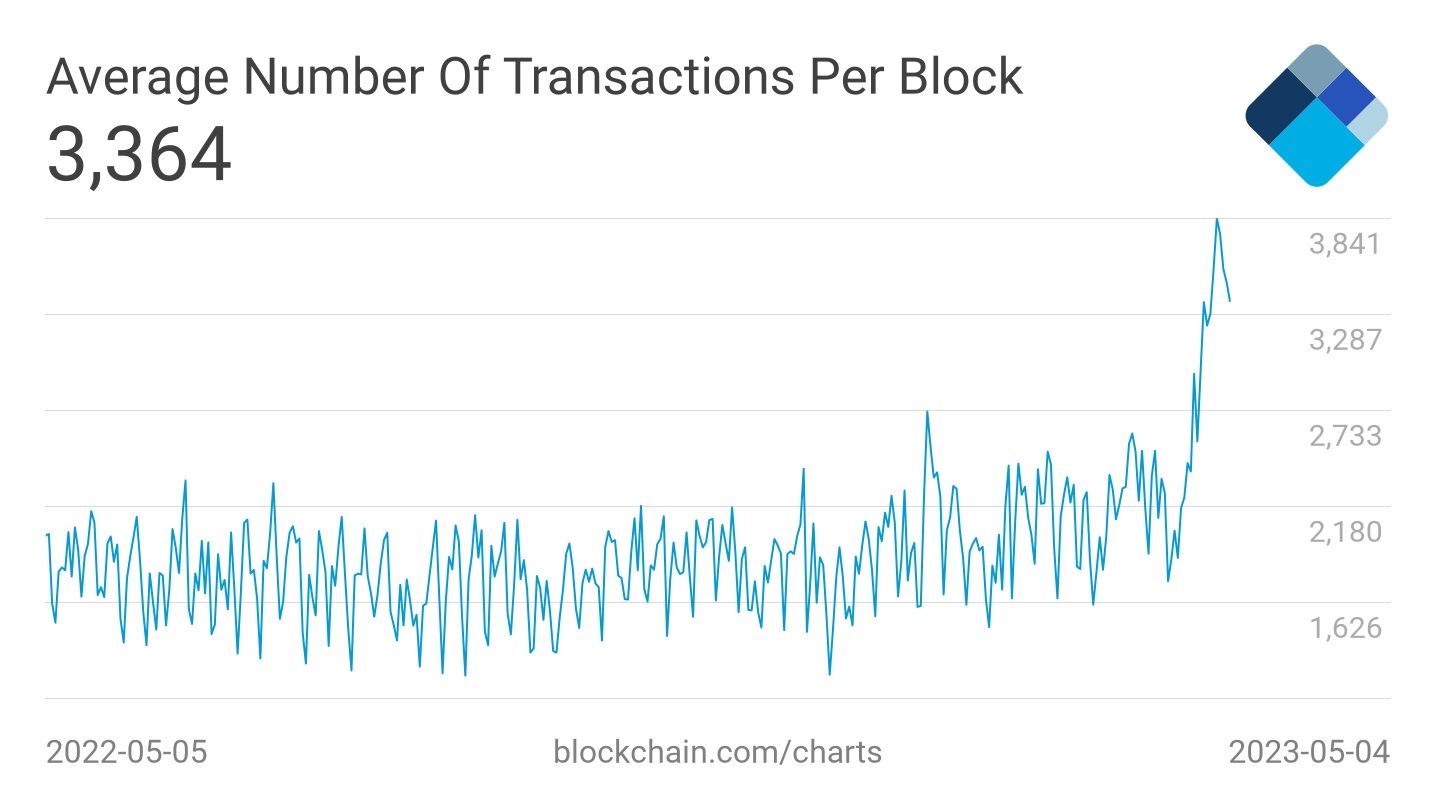

When Bitcoin first launched, the blocksize was set a 1MB per block. Currently, the Bitcoin blocksize has a "soft" limit of around 4MB due to the implementation of Segregated Witness (SegWit) in 2017, which provides more capacity within each block. However, it is rare for any block to reach this maximum size, and the current average blocksize is around 1.6MB.

However, increasing the Bitcoin blocksize isn't guaranteed to make transaction fees cheaper. For a long period, even though the blocksize has increased and transaction fees haven't rocketed to previously seen levels, blocks weren't "full" either, with some extra capacity available. That situation changed in 2023, after the Bitcoin Ordinals protocol launched, effectively bringing NFTs to the Bitcoin blockchain for the first time.

Why Are Bitcoin Transaction Fees High?

Bitcoin transaction fees can fluctuate, but when lots of people use the network, transaction fees increase. Here are several reasons Bitcoin transaction fees are high.

Bitcoin Bull Run

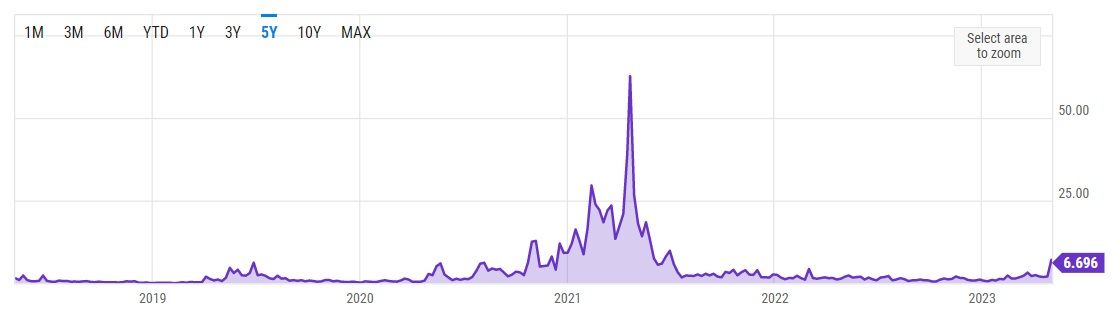

It may shock you to know that in 2021, the Bitcoin transaction fee rose by 362 percent just under a month. From March 26, 2021 to April 21, 2021, the Bitcoin transaction fee rose from around $13.57 per transaction to over $62.

Higher Bitcoin transaction fees during Bitcoin bull runs are nothing new, yet those figures are unprecedented, and have never been repeated. The limited number of miners on the network contrasts with the significantly high demand for transaction processing. As a result, Bitcoin traders are more willing to accept higher fees proposed by miners during higher activity times.

The 2017-2018 Bitcoin bull run illustrates how network activity affects transaction fees, where the average transaction fee was in the region of $50. Now there is a higher supply of miners, which may be one of the main reasons why transaction fees on the network have not been as painful to deal with.

Exchange Fees

It is no secret that some exchanges charge an arm and a leg for transactions. Users of exchanges may find themselves losing huge proportions of their holdings to fees because of how the exchange chooses to cover the costs of network fees associated with cryptocurrencies.

Withdrawal fees typically depend on the average number of transactions being made on the network or a fixed number set by the exchange to cover transaction fees. Trading fees may also be added to cover the general expenses of running servers and running a team.

Some exchanges may add fees on coins that do not usually have transaction fees. This is a business practice that many find unfair as it pushes avoidable costs to users, to no fault of their own.

Bitcoin Transaction Fees of the Future

Until 2140, the block reward will continue to reduce approximately every four years after every 210,000 blocks are mined. The potential result of this is that Bitcoin transaction fees will become much more important. As the reward gets smaller, the transaction fee may become the main form of compensation for nodes.

It is hoped that more people could use Layer 2 solutions, such as the Lightning Network, in the future to reduce transaction costs significantly. Layer 2 solutions simplify the transaction process by taking transactions away from the main chain. So far, many people have been able to execute transactions for fractions of a cent with solutions such as the Lightning Network.

Still, Bitcoin transaction fees will remain tied to network capacity, and unfortunately, that remains a victim of supply and demand.