The earliest cryptocurrencies have performed well in the past few years, making many investors who bought them early and held on to them very rich. This has inspired more people to invest in new crypto projects, hoping to get lucky to invest in a project that will become the next big thing. In addition, many investors are also searching for new projects to invest in for diversification purposes.

Whatever category you fall into, here's how you find new cryptocurrencies to invest in.

4 Ways to Find New Cryptos to Invest In

Now let's look at some ways you can employ to find new crypto projects for investment.

1. Check Out Crypto Exchanges

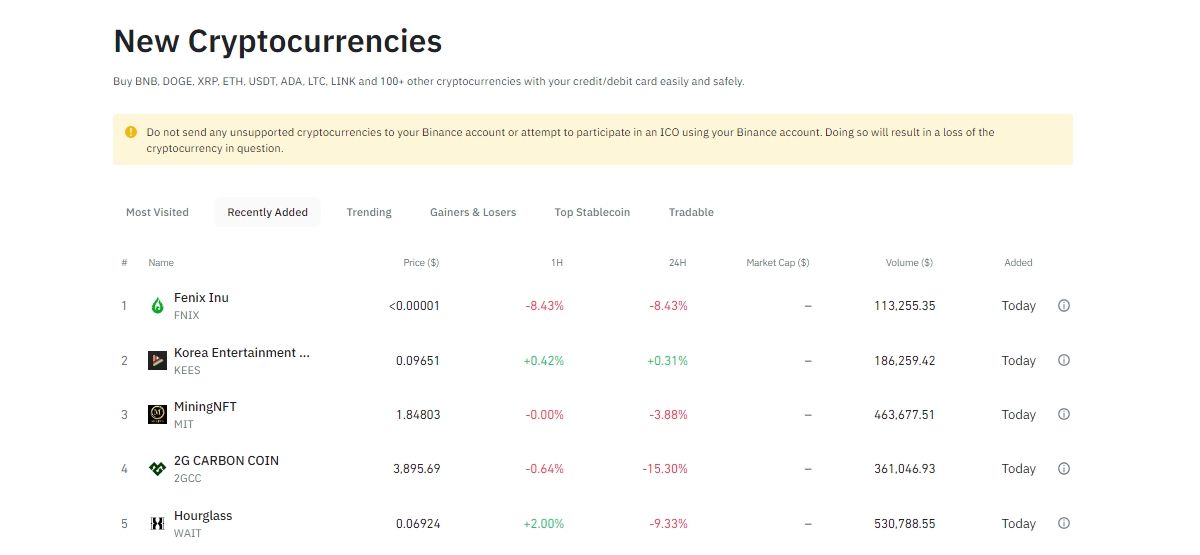

Where else should you search for new cryptos to invest in, if not the platform you wish to invest on? Exchanges have sections where they list new cryptos available for investment. You will need to visit the exchanges and check for them. Examples of these exchanges include Binance, Coinbase, Crypto.com, etc.

2. Social Media Channels

Developers use social media channels to create more awareness about their coin or communicate changes. For example, there are many Telegram channels, Twitter pages, and Discord groups for disseminating information about ongoing and upcoming projects.

You can also get information about trending cryptos to invest in through these channels. Some are not necessarily new; they may only be currently experiencing a bullish move or have a strong potential to do well in the future.

You should also follow the social media pages of exchanges; they usually update their followers about upcoming projects and new releases. Exchanges usually put the links to their official channels on their websites. If you don't find any helpful links, you should chat with support for help.

3. Watch Out for Initial Coin Offerings (ICOs)

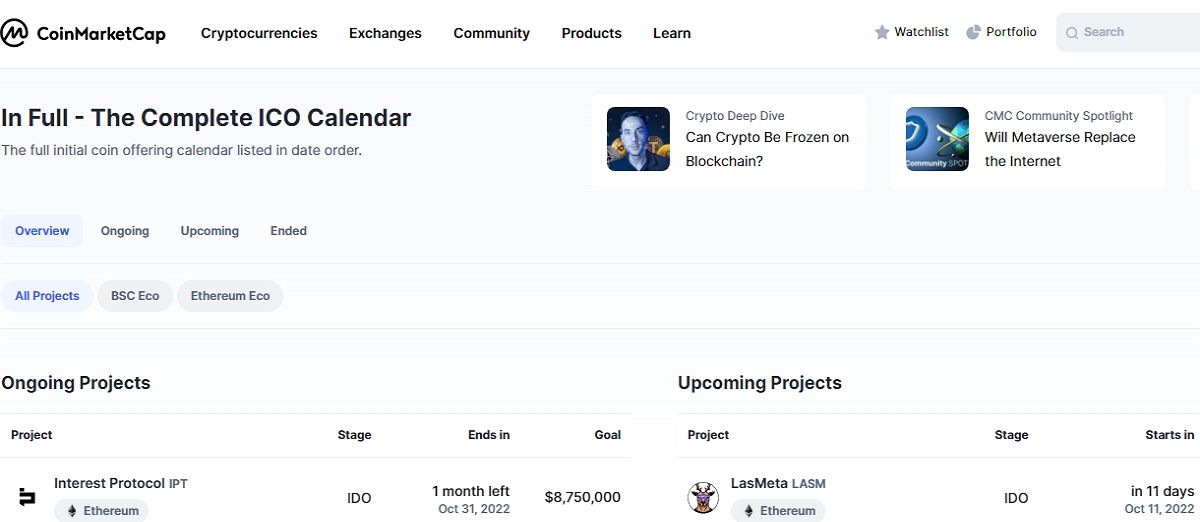

An Initial Coin Offering operates like an Initial Public Offering. It is a way to raise funds for cryptocurrency-related projects and services. ICOs also give investors opportunities to invest early in a crypto project.

Platforms like Icodrops and the CoinMarketCap ICO Calendar can help you stay abreast of upcoming ICOs. They provide helpful information like the token price, fundraising goal, whitepaper, team profile, soft cap, and so on.

4. Crypto Data Aggregators

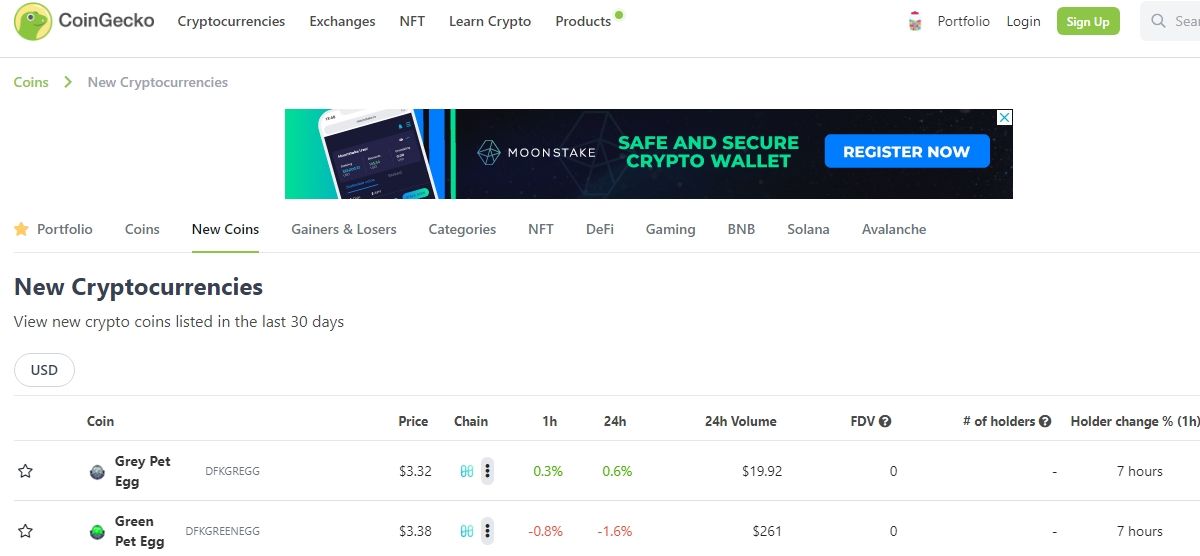

Crypto data aggregators help you combine crypto-related data from the biggest exchanges into a single real-time price field. These aggregators also usually have a list of new coins and more information you can use to analyze your crypto. Examples of crypto data aggregators include Coinlib, CoinMarketCap, CoinGecko, CoinStats, and Kraken.

4 Precautions to Take When Trying to Invest in New Coins

Investing is risky, and being involved in new crypto projects is even riskier, which is why there are certain precautions to take before parting with your money.

1. Don't Believe All You See on Social Media

Social media can help you learn more about crypto and discover new cryptos to invest in. However, if you are not careful, you'll end up with bad results from social media suggestions.

Some cryptocurrencies you see on social media are pushed through sponsored ads. Often, even the marketer or influencer promoting them does not know about them; they are only paid to promote them. As a result, such coins do not have credibility.

There are many scammers on social media, and you will need to take your time to filter them out and look closely at every detail. Someone can easily replicate an account or a message on social media and spread fake news. Therefore, we advise that you only follow reputable accounts and websites, as it could reduce the chance of falling for scams.

2. Don't Follow the Herd

Discussing crypto projects can help you get ideas that you may not think of if you keep them to yourself. However, you should be able to draw the line between following what everyone is doing and discussing crypto investment ideas with people.

The herd instinct is characterized by a lack of decision-making and a willingness to behave like or follow others. As much as this could be a good thing to do in some cases, following the crowd usually has some consequences when investing, and they're not often good.

Make sure you have specific reasons for investing in a cryptocurrency—you should not invest in crypto because others are doing so.

3. Beware of Suspicious Projects

In searching for new cryptocurrencies to invest in, you will also be faced with the trouble of verifying if some projects are genuine or if they are only bothered about stealing your money.

You will see many so-called investment managers promising consistent profits and even many crypto tokens you have never heard of. In all of these, you should be wary of suspicious projects.

4. Understand Your Risk Appetite

Some issues associated with cryptocurrency include the market's price volatility, issues with hackers and cybercriminals, and regulatory uncertainties related to crypto. These issues require you to consider how much risk you are interested in taking when investing. Consider how much money you can afford to lose before buying a token. Never invest more than you can afford to lose.

Some crypto trading strategies can help you reduce risk when trading. One of them is arbitrage trading, a scalping strategy that requires you to buy a token at a low price on an exchange or market and sell it on another almost immediately.

Always Invest Carefully

As much as investing in new cryptocurrencies is not a bad idea, it can be a regretful decision if you are not careful. We expect that many more cryptocurrencies will be introduced in the coming days. Needless to say, there will also be a lot of fraudulent projects, necessitating you to take extra care when trying to invest.

Before you invest in any crypto project, you must check important information like who the developers are, important contact details, the date the domain was created, and the country it is registered in. You should also check the project community on social media to see how active they are, what they are talking about, and the number of people involved. You can also check how long the cryptocurrency has been around, as you may prefer to invest in crypto projects that are months and years old rather than going for ones that are days or weeks old.

Don't forget that new cryptocurrencies are only projects with profit potential; there is no guarantee that they will amount to anything significant in the future. Many new crypto projects have seen a rapid increase in price due to the hype around them. However, they usually don't last long and end up being failed projects. Therefore, do not invest all you have in a project because you have faith in it, and never invest more than you can afford to lose.

The information on this website does not constitute financial advice, investment advice, or trading advice, and should not be considered as such. MakeUseOf does not advise on any trading or investing matters and does not advise that any particular cryptocurrency should be bought or sold. Always conduct your own due diligence and consult a licensed financial adviser for investment advice.