How much are you earning as a freelancer? Since your freelance income may vary per month, you'll want to know if you're making and charging enough. If this sounds intimidating, browse these free and useful tools and templates to help you calculate your income easily.

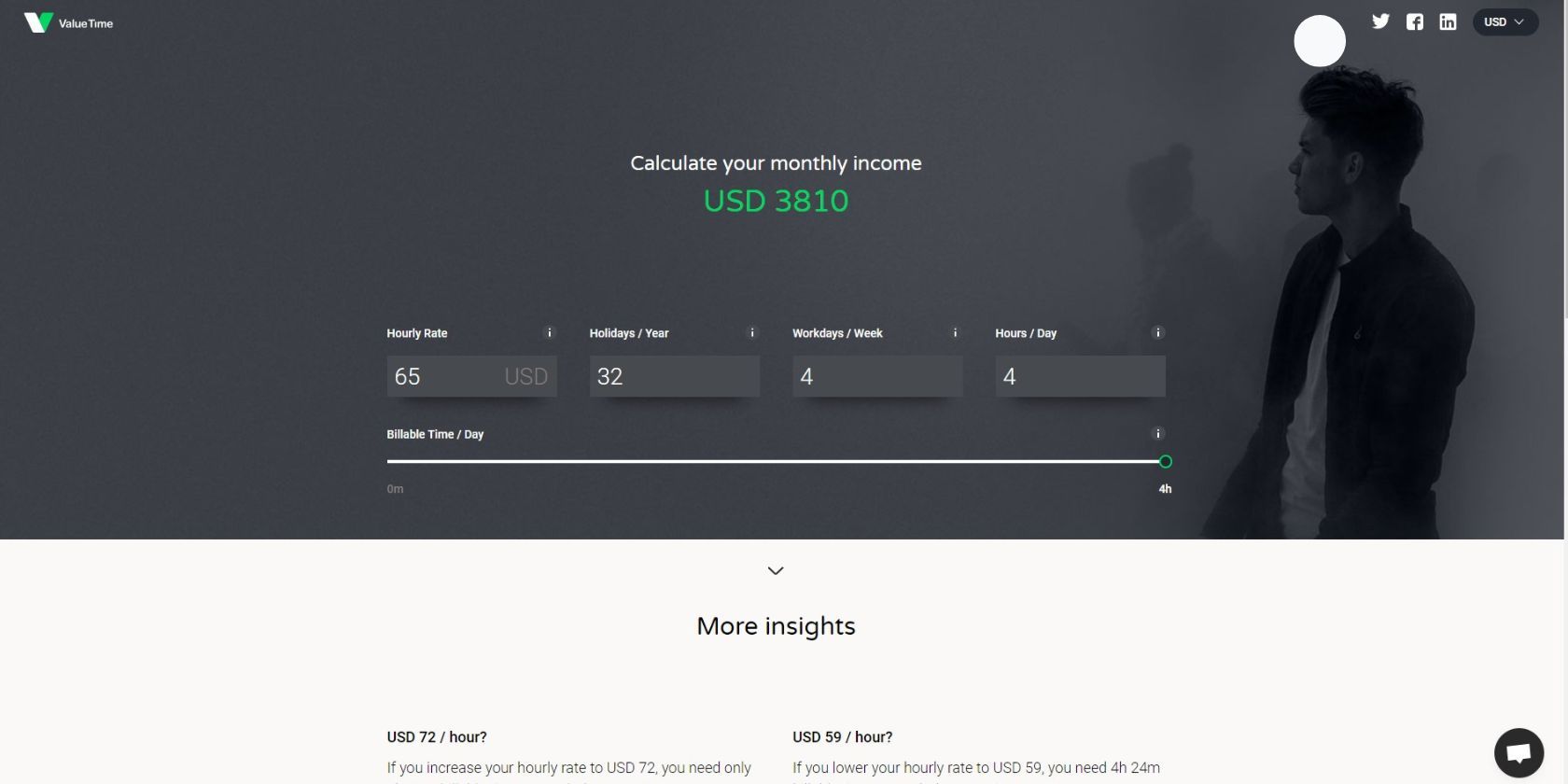

1. ValueTime Income Calculator for Freelancers

If you're paid by the hour, try this simple income calculator. To compute your monthly income, choose the correct currency in the dropdown menu in the upper-right-hand corner. Then input your hourly rate, number of holidays per year, workdays per week, hours per day, and billable time per day to get the results.

Aside from computing your monthly income, the tool provides insights to help you decide on your ideal hourly rate. It shows you the rate you need to charge if you want to shorten your working hours. You'll also know how many additional hours you need to work to reach the same monthly income at a lower hourly rate.

We recommend using a time-tracking tool so you can input your accurate working hours on ValueTime's calculator. You can try some free time-tracking apps to maximize your deep work.

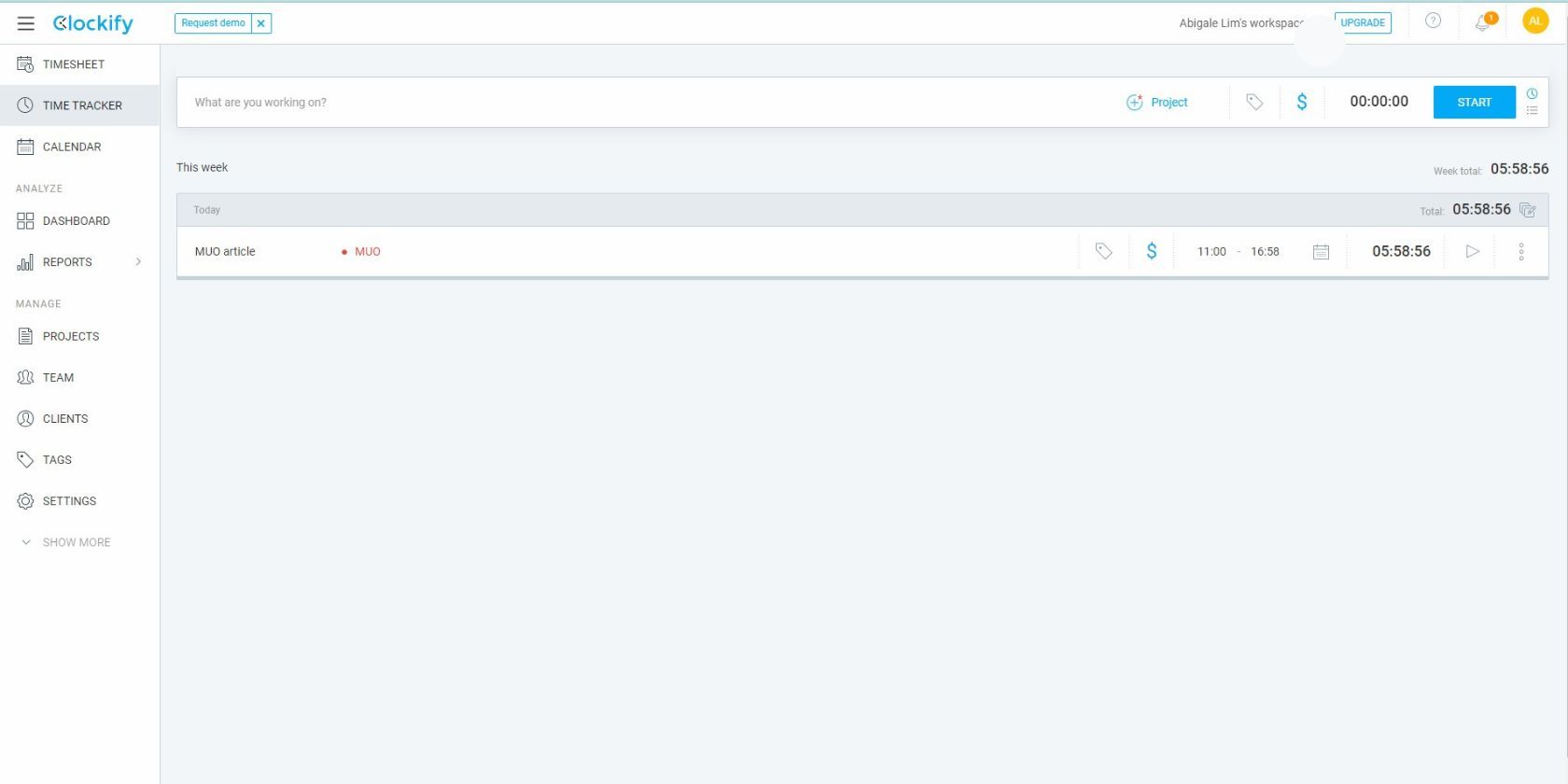

2. Clockify Time and Expense Tracking App

Clockify is one of the most popular time-tracking apps for freelancers. Use this tool to know your income per hour and learn if your project is profitable. Even if you charge a flat rate, you can track the time to check if you're losing money or asking for a fair rate.

For instance, a client might give you $300 for a one-time project. If it takes 30 hours to complete it, you only earn $10 per hour. If you consistently track time, you can better estimate your income for a project and negotiate better rates.

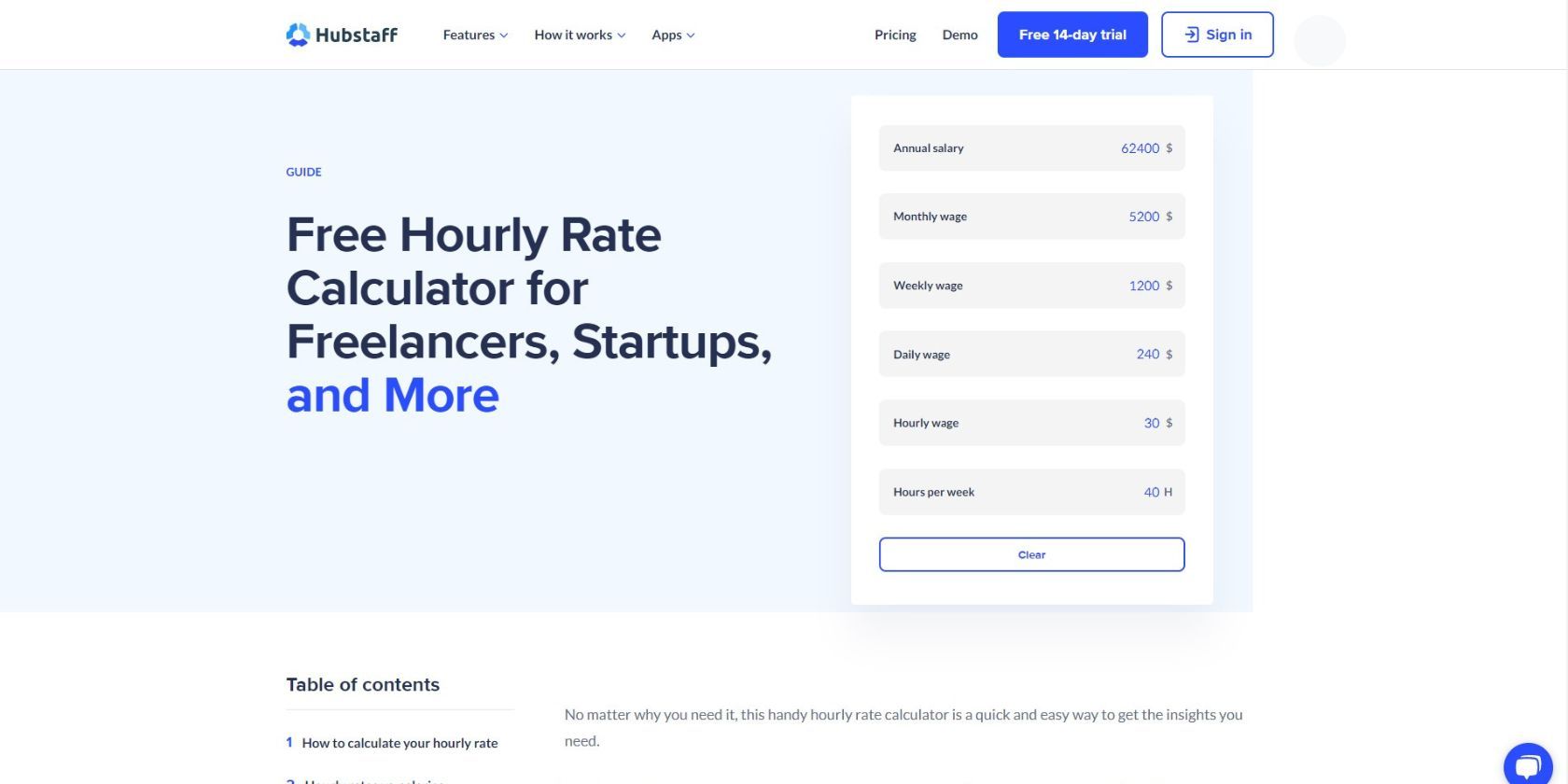

3. Hubstaff Free Hourly Rate Calculator

Hubstaff makes it quick and easy to calculate income with this handy tool. Input your hourly rate and weekly hours; the calculator converts them to your annual, weekly, and daily income. Before you even pay the bills, you'll know if you're earning enough.

If you don't know how much you earn per hour, provide your hours per week and weekly or monthly income, then let the tool do the math. Use this data to decide on and negotiate your rates on freelancing platforms.

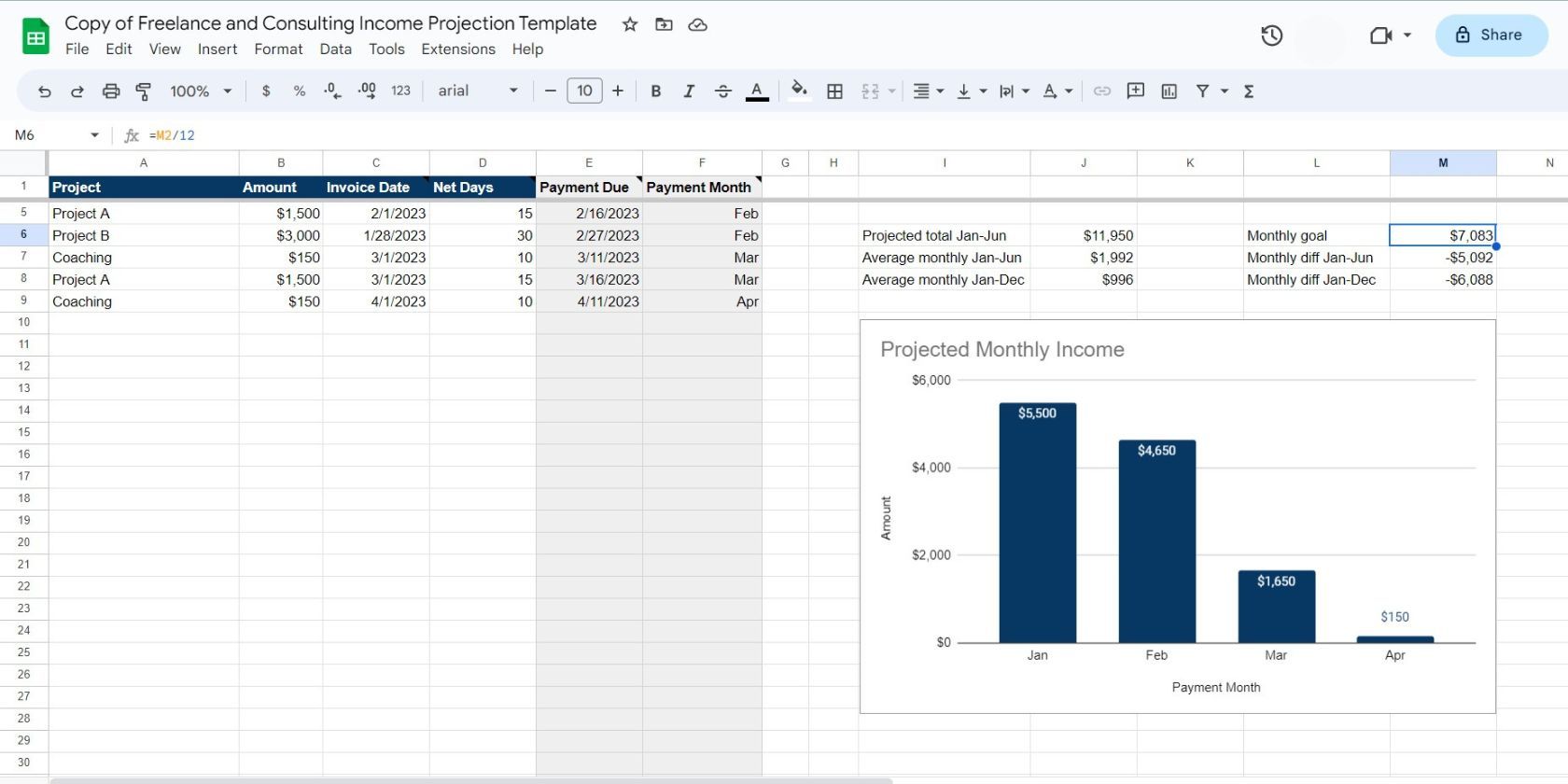

4. Christy Tucker's Income Projection Template

This Google Sheets template from freelance consultant Christy Tucker helps you project your income for the year, motivating you to achieve your ideal income. You can input the amount you received from current projects, invoice date, payment due, payment month, and income goal.

With this data, the template calculates your projected total income, monthly average income, and the difference between your income goals. The template also includes a bar graph of your projected monthly income.

As Christy says, a freelancer's income can fluctuate every month. Using this template helps you assess your financial situation. If you're not hitting your goal, you can start looking for more clients or invest more in marketing your business.

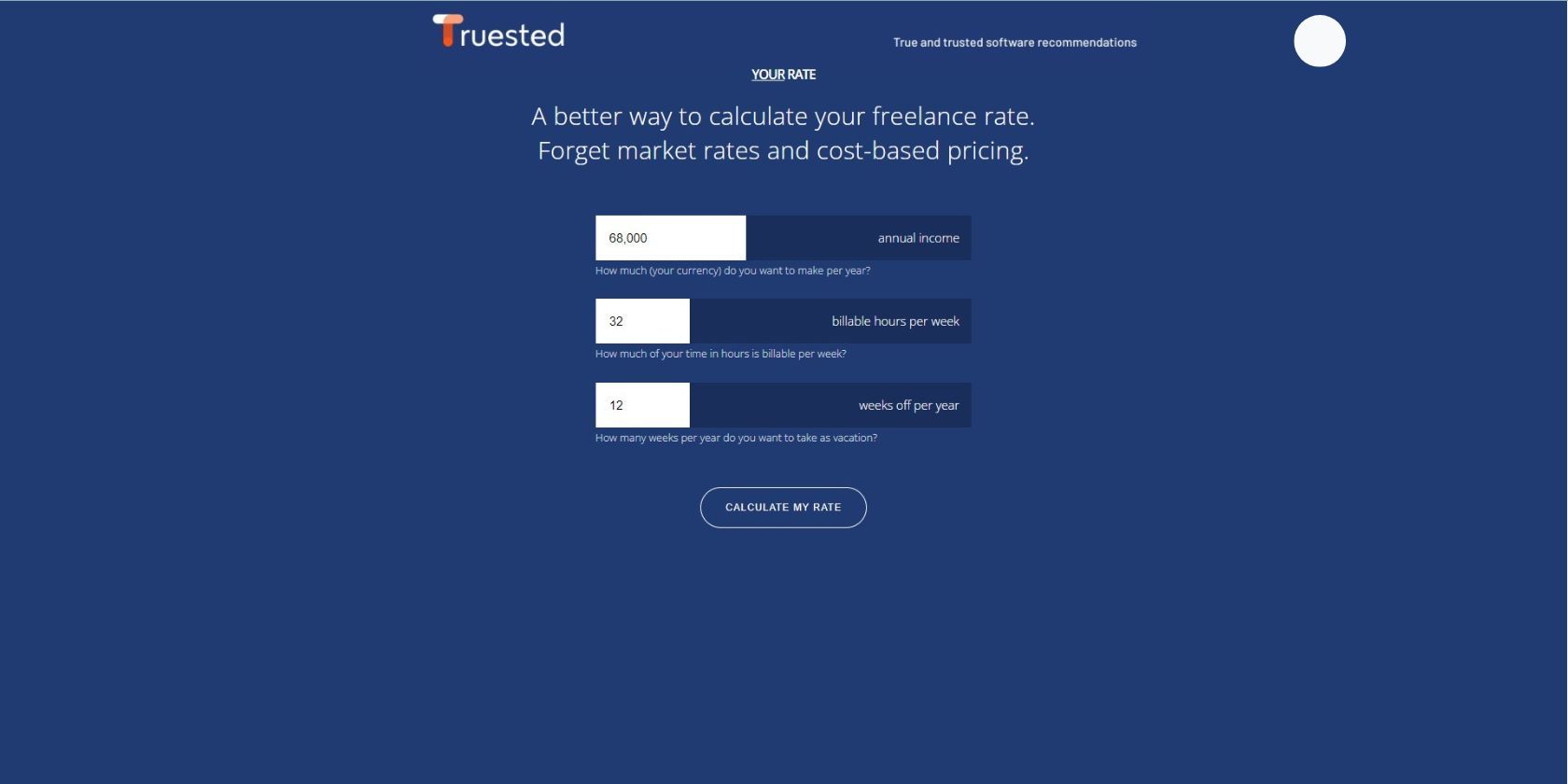

5. Truested Your Rate

Truested Your Rate is a straightforward freelance income calculator that works in any currency. You only need to provide your ideal annual income, billable hours per week, and the number of weeks off you want.

After giving the required information, the tool provides a snapshot of your ideal weekly, daily, and hourly rates. Note that the rates are multiplied by two to account for taxes and savings.

Use this calculator if you don't need a detailed breakdown of your finances. With the results, you can decide whether you're earning enough. Learn how to negotiate a higher freelance rate if your income falls short of your expectations.

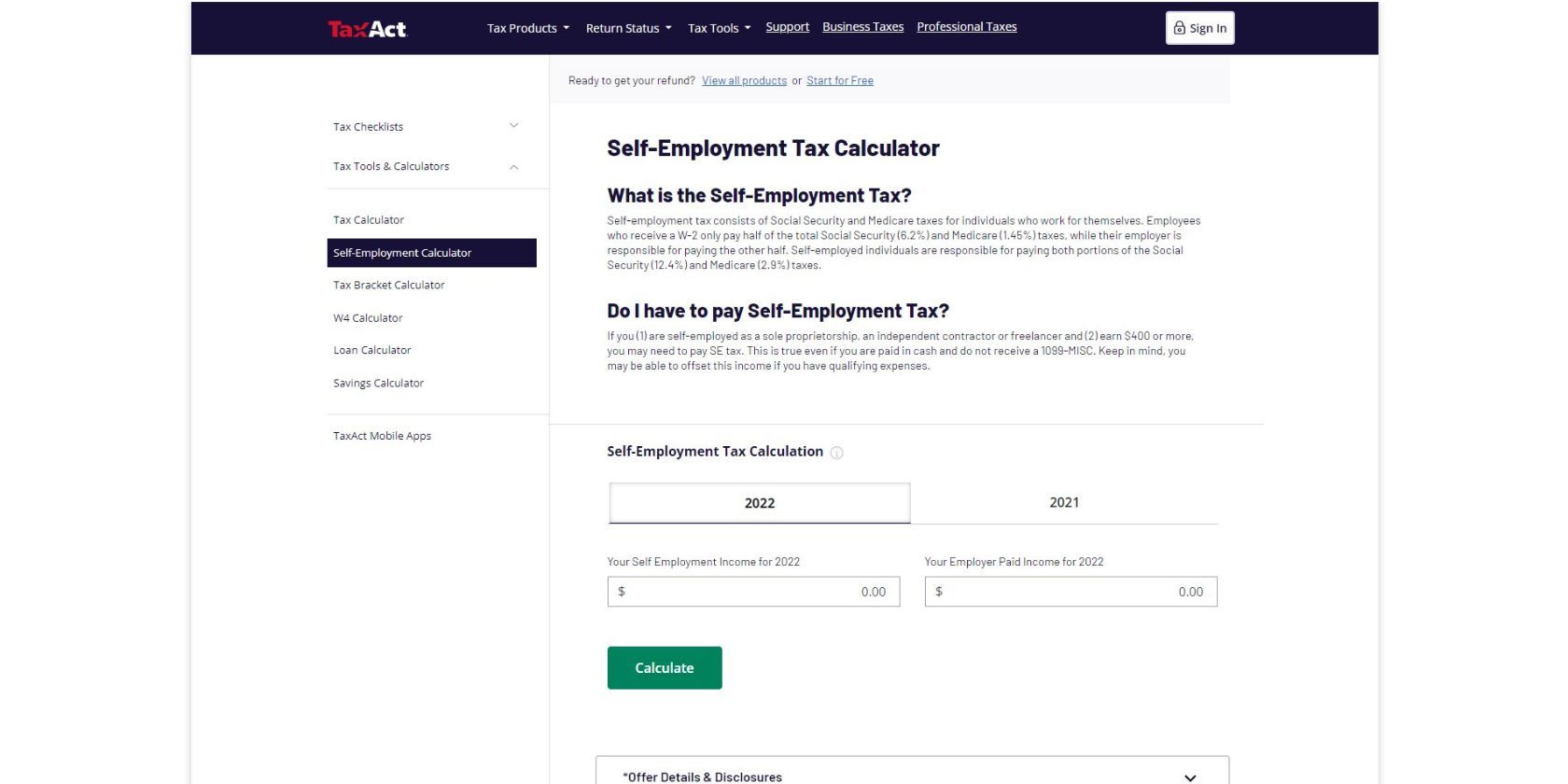

6. TaxAct Self-Employment Tax Calculator

If you want to know your take-home pay, consider how much your taxes cost. Self-Employment Tax refers to the Medicare and Social Security tax rate for freelancers. Use this calculator to know how much you need to pay for the said tax.

Employers automatically deduct your self-employment tax and pay for half of it if you're employed. However, you'll have to calculate and fully pay your taxes yourself if you own a freelance business.

Freelancers and independent contractors with a net income of at least $400 must file a self-employment tax. To avoid tax evasion charges, use this Self-Employment Calculator and the top bookkeeping software for small businesses and freelancers.

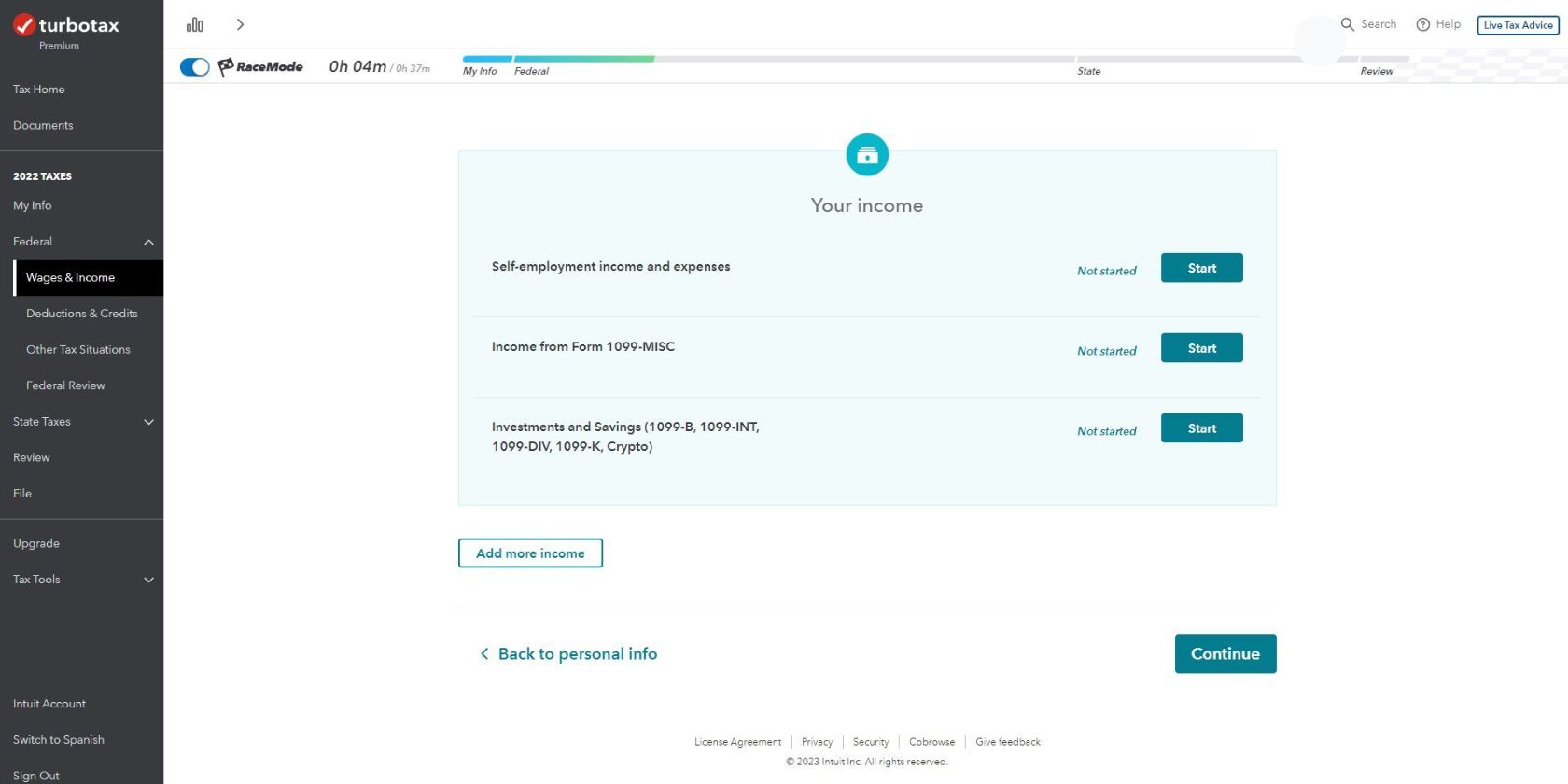

7. TurboTax

According to the IRS, self-employment tax is just one of the taxes freelancers have to pay. You'll have to consider other factors that could affect your net income, like state taxes and tax credits. Considering these factors will give you a more accurate view of your freelance income.

TurboTax helps you calculate your net income and guides you through the whole tax filing process. If you only want to know the total cost of your federal taxes and if you qualify for tax deductions, you can use TurboTax for free. However, filing a return or getting expert advice would require a subscription.

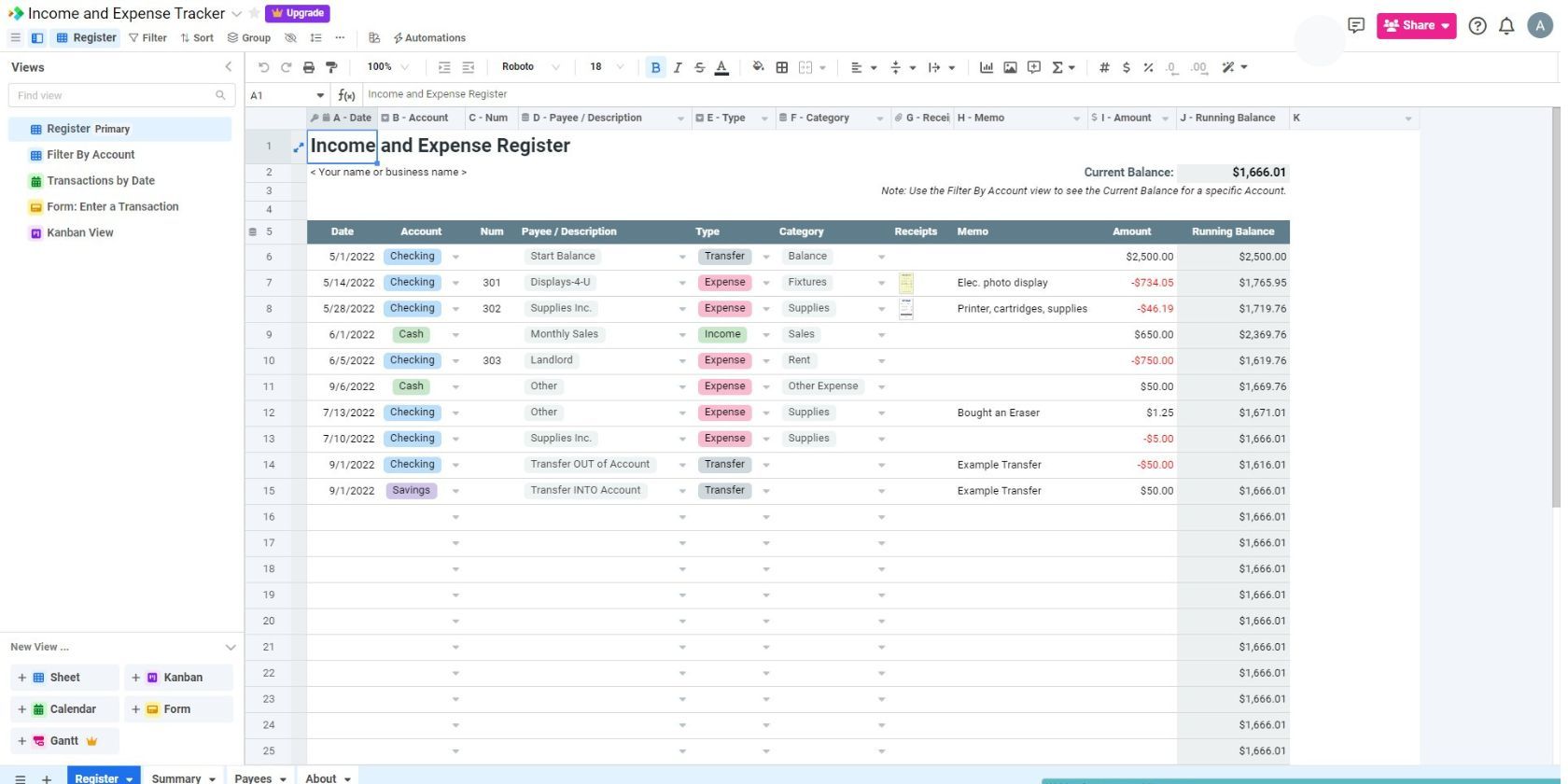

8. Spreadsheet Income and Expense Template

This tracker keeps a detailed record of your income and expenses. It comes in a familiar spreadsheet format but with added project management capabilities. You can use standard formulas, edit details, and share your workbook as you would on Excel or Google Sheets.

This template divides the columns into ten categories:

- Date - shows the date of the transaction

- Account - choose if the transaction was made in cash or using your savings or checking account.

- Num - input the transaction number.

- Payee/Description - choose from a list of your payees or add a description for how the transaction was made, e.g., Transfer OUT of Account.

- Type - choose if the transaction is an Expense, Transfer, or Income.

- Category - choose the transaction category, e.g., expense, rent, and supplies.

- Receipts - upload an image of the transaction receipt.

- Memo - add any comments or details about the transaction.

- Amount - input the amount of the transaction.

- Running Balance - automatically computes your balance.

You'll see a Views column on the left-hand side. You can view the income and expense template in different formats from here.

Register is the primary spreadsheet view. Filter by Account lets you view transactions made through a specific account (Cash, Savings, or Checking). View by Date shows in the calendar view, so you can check your transactions by date. To easily add a new transaction to the spreadsheet, click Form: Enter a Transaction.

Compute Your Freelance Income Easily With Online Tools

Computing your income as a freelancer can be much simpler if you use online tools and templates. You can choose from spreadsheets, apps, or online calculators to estimate your income accurately and negotiate better rates.

Financial management is a challenging task for freelancers. You can always hire an accountant to lessen the burden. However, sharpening your financial skills is also a worthy investment. If you want to succeed as a freelancer, take time to boost your financial literacy.