Finances can be a worrisome topic for freelancers. Unlike employees whose salary and benefits are clearly defined each month, your income is more variable. You're also responsible for paying your own benefits, such as health insurance.

How can you be more assured of your future finances? Just like everybody else, you can plan wisely. Here are some tips to help you achieve your financial goals.

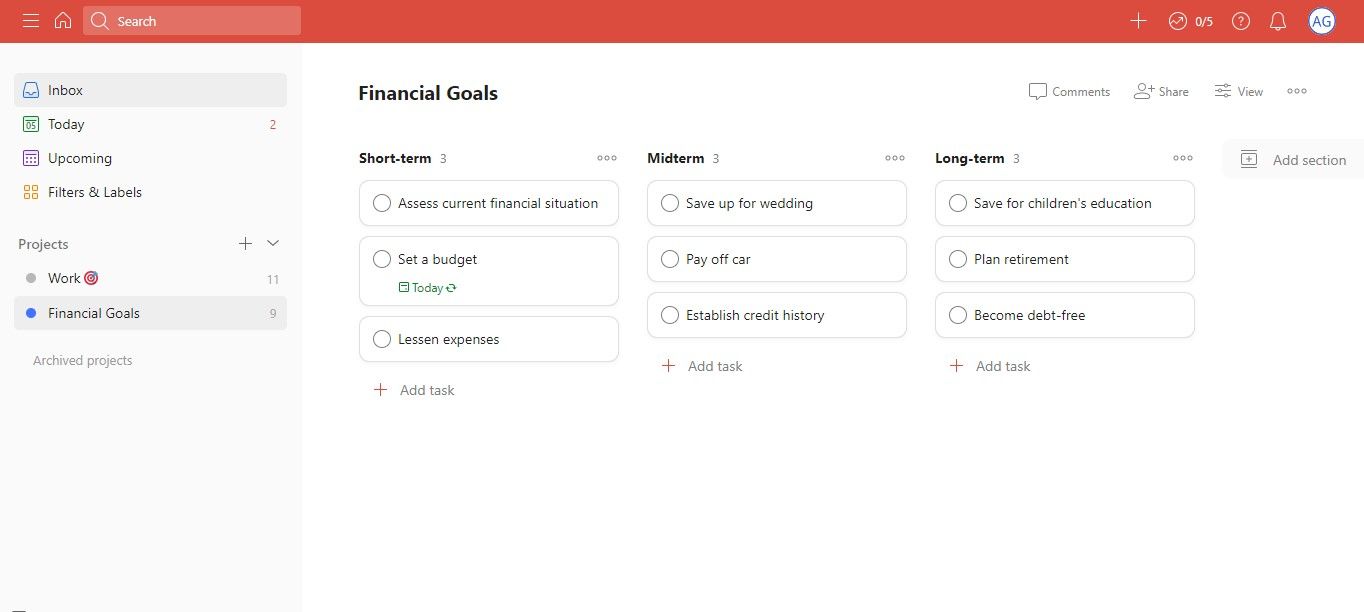

1. Track Your Financial Goals

If you don't have much money, the more that you need to plan for your finances. Use a personal goal-tracking app like Todoist to set, edit, and keep tabs on your financial goals. Without a clear goal, the tendency is to feel overwhelmed and to continue unhealthy spending habits. Writing down your financial goals will help you take measurable steps to manage your expenses, pay off your debts, and invest wisely.

Financial goals can be long-term (achievable in more than five years), mid-term (achievable in one-five years), or short-term (achievable in a year). Thus, goals vary from person to person, depending on your income. Here's a sample list of goals:

Short-term goals:

- Assess the current financial situation.

- Set a budget for each month.

- Lessen expenses.

Mid-term goals:

- Save up for a wedding.

- Pay off the car.

- Establish a credit history.

Long-term goals:

- Save for your children's education.

- Plan for retirement.

- Become debt-free.

2. Diversify Your Income Streams

Creating multiple income streams helps you gain financial stability. The reality is, you can unexpectedly lose your income if you suddenly fall ill or become disabled, a client ends your contract, or another pandemic happens.

While it takes time to create another source of income, you will benefit from it in the long run. Here are some ideas to diversify your income:

- Sell products on an e-commerce site like Shopify.

- Try these apps to help you discover great stocks to invest in.

- Rent out the property.

- Write an ebook you can sell.

- Learn how to make money on YouTube.

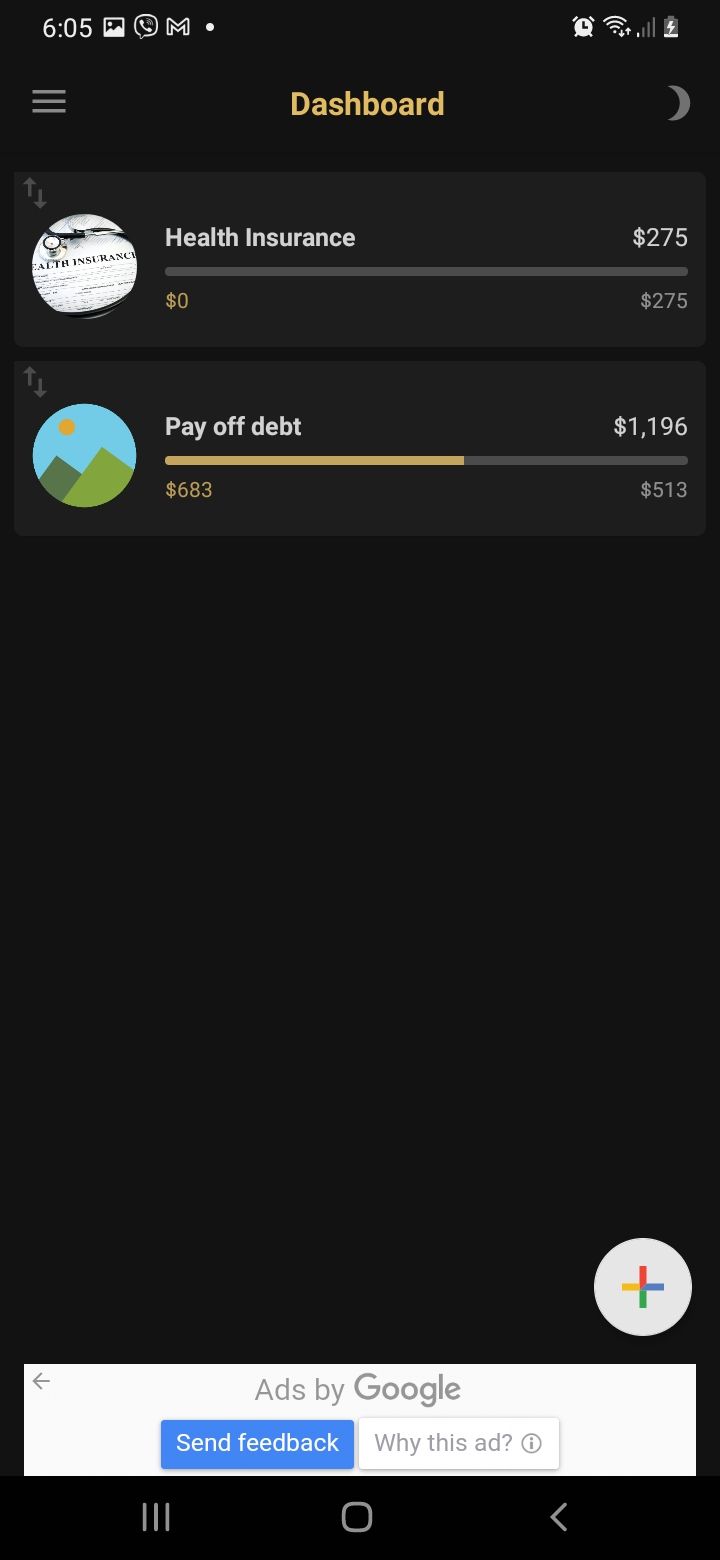

3. Keep Track of Your Expenses

Are you far from achieving your financial goals? Maybe it's time to check if you're overspending. Goal setting is an important step to gaining financial freedom as a freelancer. But you'd have to follow through and track where your money goes. Cut off what you can cut off, and save what you can save.

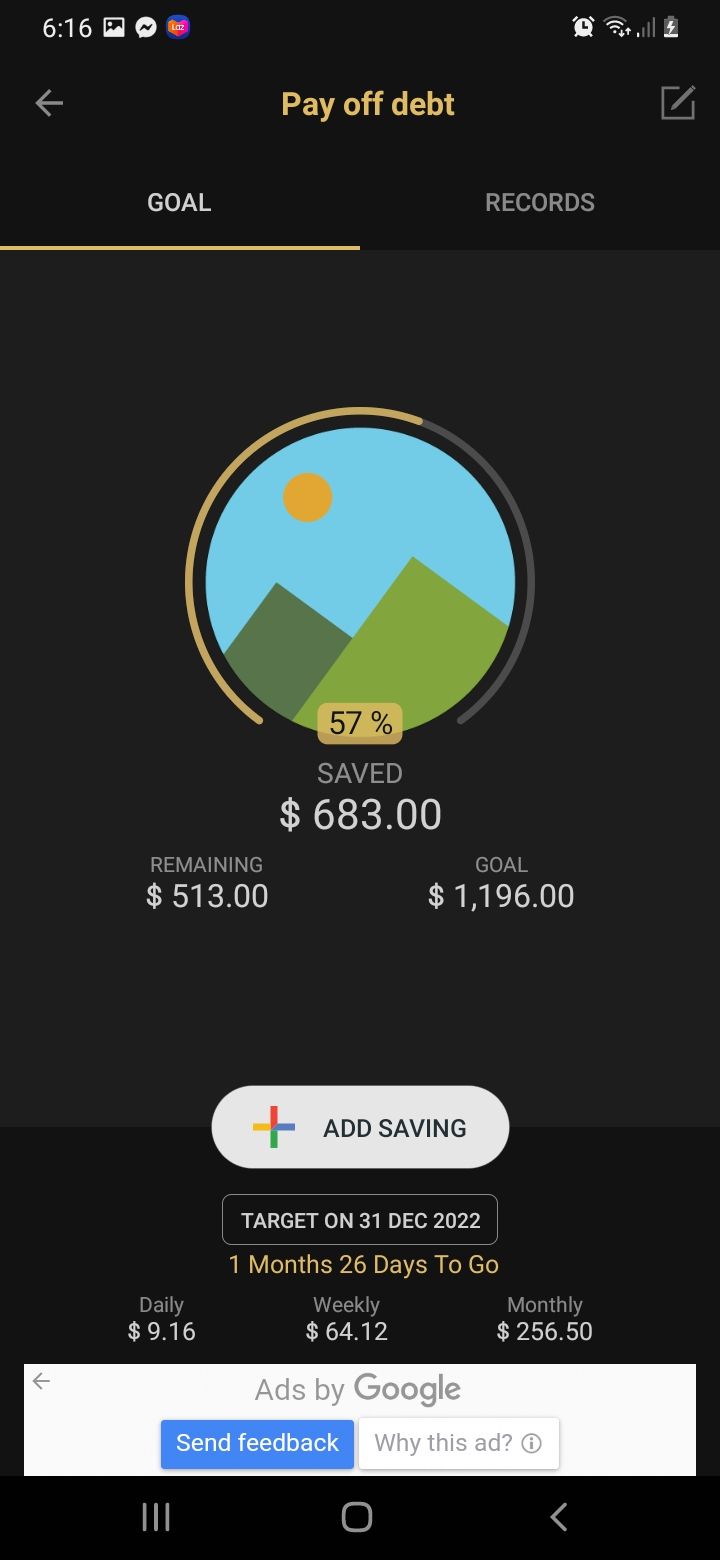

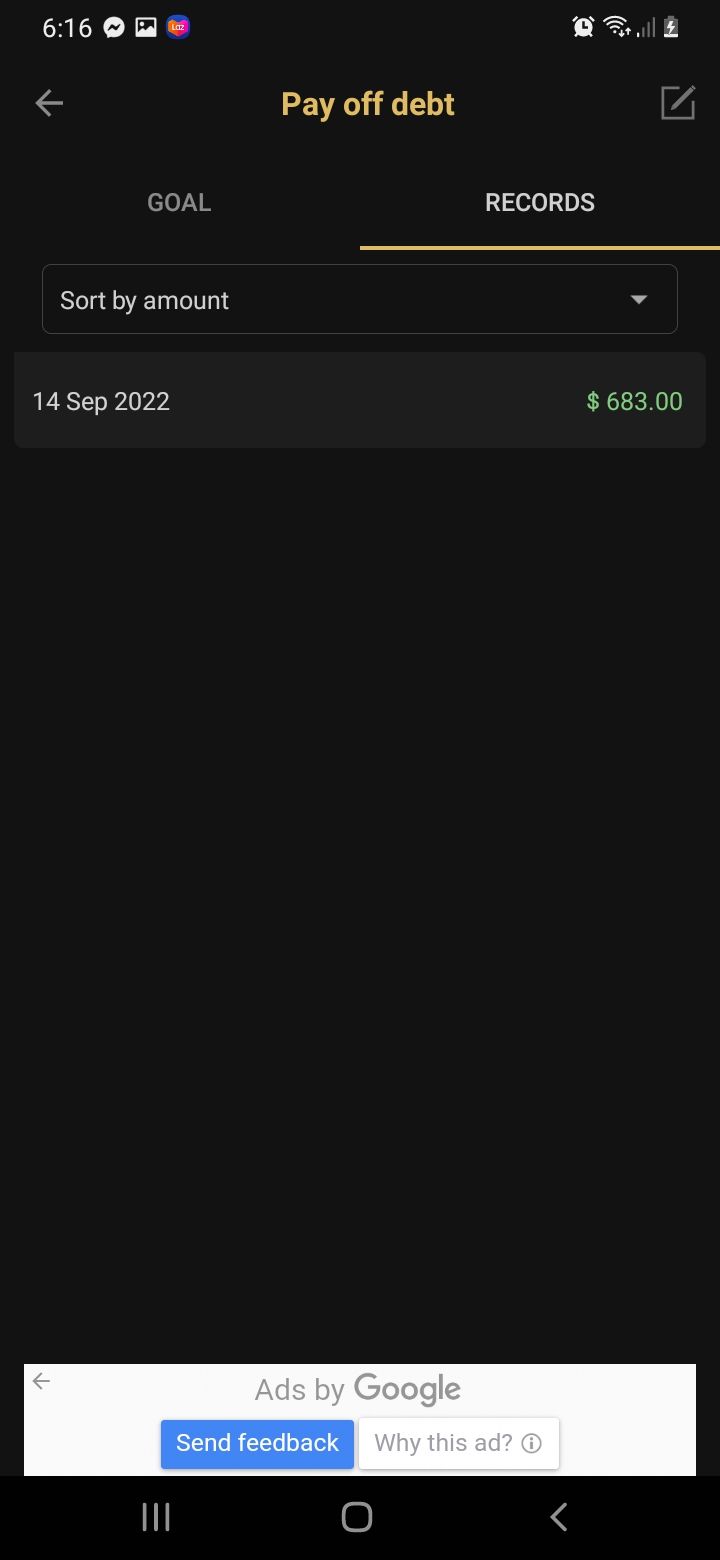

Download budget-tracking apps like Mint or money-saving apps like Savings Goal. If most of your budget goes to expensive coffee or debt repayment, maybe it's time to rethink your finances and think of ways to increase your earning potential.

Download: Mint for iOS | Android (Free, in-app purchases available)

Download: Savings Goal for iOS | Android (Free, in-app purchases available)

4. Learn From Financial Experts

If you feel lost and don't know where to start when it comes to your financial goals, it's best to learn from those who have gone ahead of you. Check out the best free ebook download sites to get financial planning sources that you can read during your spare time. Or you can take a cue from these money-saving blogs and podcasts to learn personal financial planning.

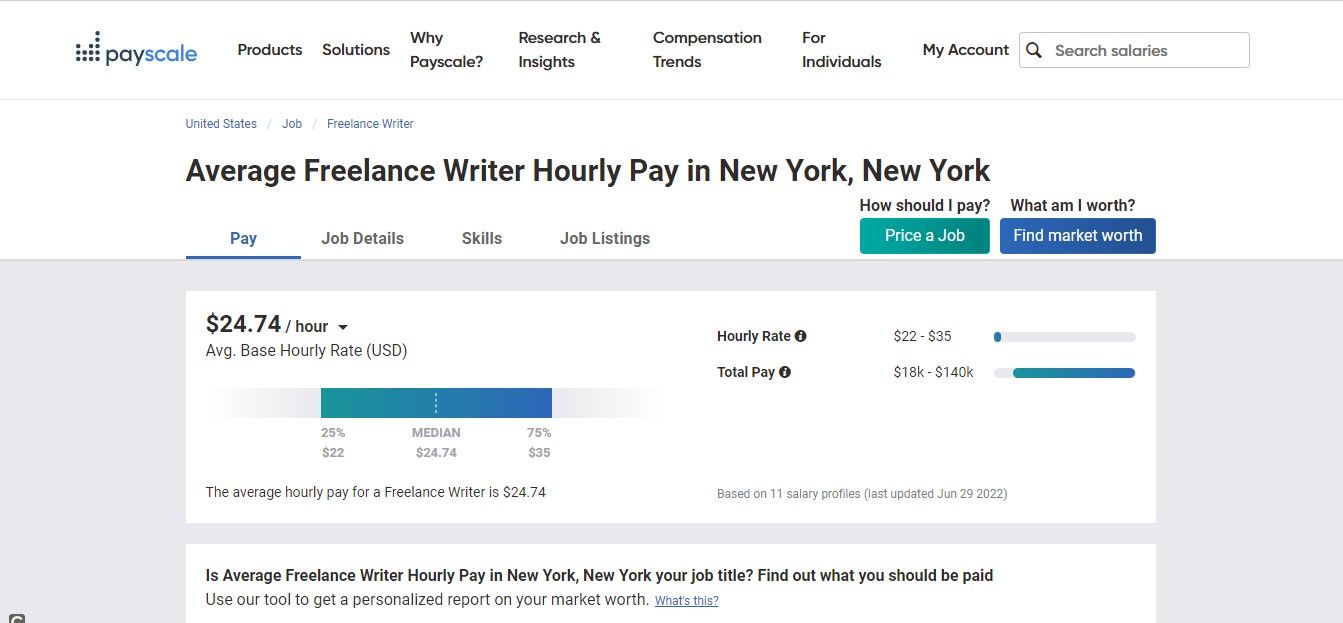

5. Set the Right Rates

One of the common difficulties for new freelancers is not knowing how to set the right rates. Setting your rates too low leads to frustration, feeling shortchanged, burnout, and money problems. If you know that you're offering value to a client, don't be afraid to ask for a fair rate.

Unsure of what the right rate is? Learn how to calculate freelance projects hours accurately. If you don't know if you should get paid hourly or per project, check out by project or by the hour: how should you charge as a freelancer? To know your market worth, you can also use a compensation management platform such as Payscale, which lets you search for the average pay of freelancers in your location.

6. Focus on Serving Your Ideal Client

Your ideal clients are those you're excited to help, promote, and establish a long-lasting professional relationship with. Working with these clients gives your job meaning and purpose. And if you're happy at work, earning won't become a chore.

While the perfect client seems like a myth, it's possible to land more projects that you're motivated to work on. Avoid being impossibly specific (e.g., they should be in their 20s, billionaire rich, and love Elon Musk). But strive to have a clear picture of who you want to serve. Some questions you can ask:

- What are your skills? (e.g., web development)

- What are your values? (e.g., you're mission-focused)

- What are your deal-breakers? (e.g., illegal businesses, non-eco-friendly)

- What usual problems do clients have that you know you can help solve?

7. Upgrade Your Entrepreneurial Skills

One way to increase your earning potential is to upskill. Entrepreneurial skills help you market yourself better as a freelancer. You may be the best in your field, but if no one knows about it, you won't get clients. If you want to learn how to market yourself better, invest in an online digital marketing or entrepreneurship course.

You might also want to start thinking like an entrepreneur. Instead of thinking like a flexible-time remote worker who's still an employee, you might want to start a scalable freelancing business. Study and experiment with ways you can scale your freelance business, so you can maximize your earning potential.

8. Invest in High-Value Clients

While you should continue marketing and getting new clients, one strategy to hit your financial goals is to invest in your high-value clients. High-value clients are repeat customers. They help build your credibility, give you good references and attract new customers for you. Be intentional about building solid professional relationships from the get-go.

Start with the initial discovery call, where you can identify your client's pain points to come up with the best project proposal. If you've never written a project proposal before, you can use these free project proposal templates that grab attention. Once you win the contract, make sure to be responsive on all messaging channels and follow through with excellent, honest work to build client trust.

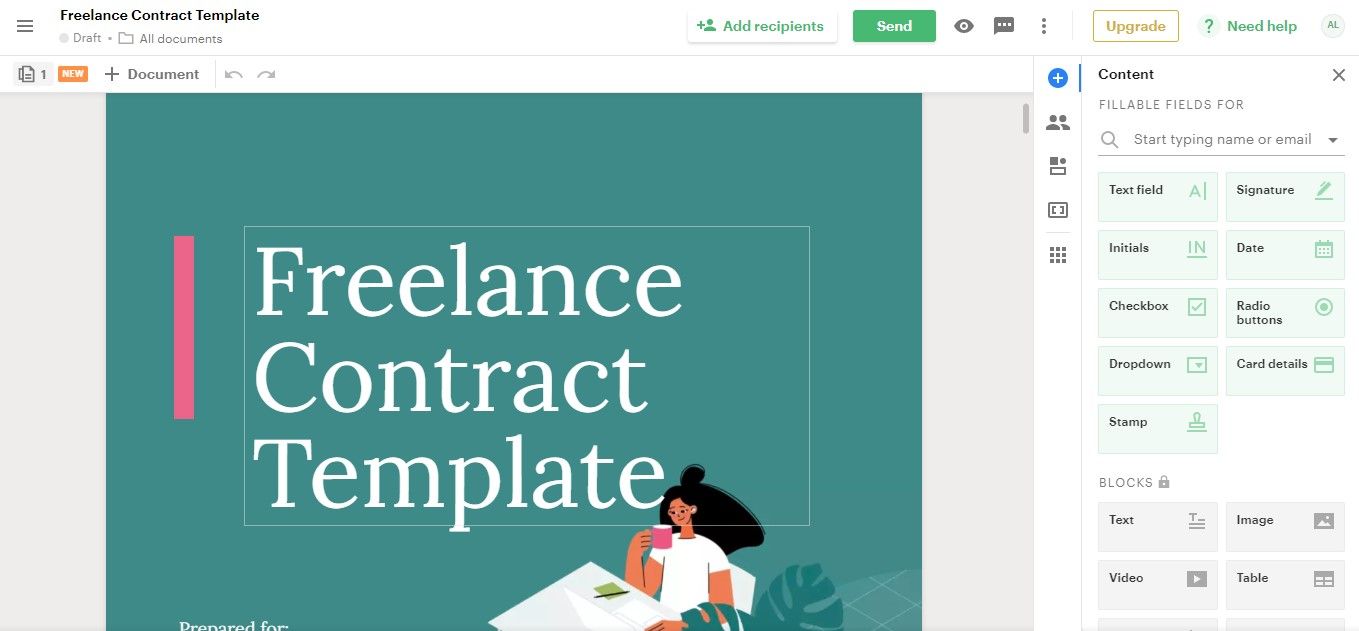

9. Create a Contract With Clients

Another common problem freelancers encounter is job creep. You lose valuable time and money when a client contacts you beyond your paid hours and asks you to do work beyond your job scope. To spare yourself from having a difficult conversation with a client, make sure you create a job contract that specifically outlines how much you're going to get paid, what your consultation fee is, what your deliverables are, and other fees that your freelance work might require (e.g., if you need to pay for an app).

A contract helps you stick to your job scope. It also avoids any misunderstandings with your client. If you don't have experience creating a contract, you can download a contract template from a site like PandaDoc.

10. Immerse Yourself in Your Niche

Freelancing is skill-based. While your college certificate will help, you cannot bank solely on a diploma or years of experience in a totally unrelated field. You have to constantly upgrade yourself and immerse yourself in your niche, so clients will continue to do business with you.

To master your niche:

- Be passionate about continuous learning and identify mentors in your field.

- Use LinkedIn to your advantage, taking note of influencers and career coaches who might help you move forward in your career and give you tips for hitting your financial goals.

- Try reaching out and, if you can, connect with a coach to help you stay motivated on your career path.

Reaching Your Financial Goals Is Attainable

As a freelancer, it's tempting to just go about your daily routine, especially if you're earning enough to sustain your daily needs. But regardless of how much you earn, it's always better to take control of your finances and be ready for the unexpected.

Make an effort to plan your finances, connect with people who can help you, and take intentional steps toward achieving your financial goals.