Getting a technical indicator that works for you requires a lot of study and practice, a process that can be quite overwhelming, especially for new traders. Beginner traders typically try out different indicators to see how they work, as they may find it hard to know which ones to use for specific market situations and needs. For this reason, we have listed four categories of indicators that you can use based on your specific needs. After reading, you will be able to know which indicator to use for what.

Using Technical Indicators

In technical analysis, crypto traders try to determine the current trend and price movement and want to get the right market entries and exits. To achieve these, they often use different indicators to check for market trends, volume, volatility, and momentum. They then use the result of their analysis to determine their next action.

One of the challenges you may face in trying to do these is getting the right indicator for whatever purpose you want. For example, knowing the right indicator to weigh trading volume during a breakout to know if the trend is strong. Knowing the right indicator to use for specific purposes and at the correct time can help you get more accurate market information.

4 Categories of Indicators Used in Crypto Technical Analysis

Let’s take a quick look at four popular categories of technical indicators and some examples for each.

1. Trend Indicators

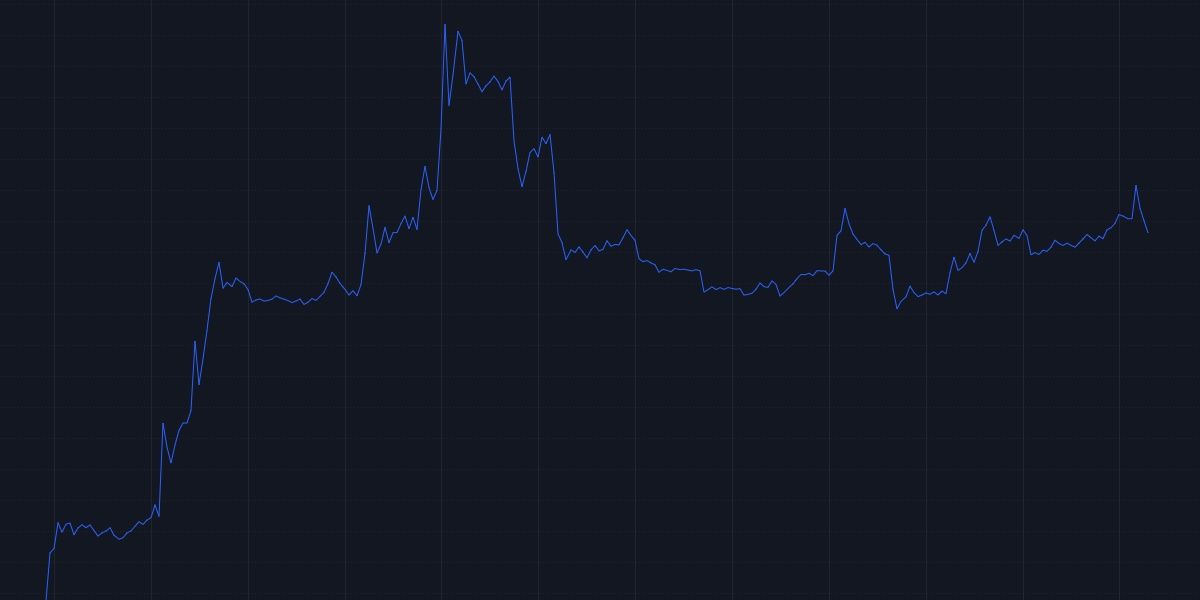

Traders use trend indicators to determine if the market is bullish, bearish, or consolidating. A market is bullish if the price keeps going up for a long time, and if it is bearish, it keeps going down. A market that is consolidating has a sideways movement, meaning that the price is neither bullish nor bearish.

Below are some popular indicators that traders use to determine market trends:

Moving Averages

Moving averages can be used to determine long-term and short-term market trends. To determine short-term market trends, you can use the 50-day moving average and below, while to carry out long-term trading analysis, you need to use the 50-day moving average and above. The price is usually above the moving average in a buyer’s market (bullish trend) and below the moving average in a seller’s market (bearish trend).

You can use a shorter and longer period MA in the same chart. When the shorter-period moving average crosses above the longer-period moving average, the bulls have taken control. On the other hand, if the shorter MA moves below the longer MA, the market has turned bearish.

MACD (Moving Average Convergence/Divergence)

The MACD shows the strength of the stronger trend along with signals of the changing trend. The indicator comprises the MACD line and the signal line. The MACD line is derived from the difference between two exponential moving averages (EMA): the 12 EMA and the 26 EMA. While the signal line is 9 EMA.

The MACD line moves as the price moves and oscillates around and below zero, the baseline. When the MACD line is below the baseline, it represents a bearish trend, while it is a bullish trend when it is above the baseline. In addition, when the MACD line crosses above the signal line, it is taken as a bullish signal, and when it crosses below the signal line, it is taken as a bearish signal.

The MACD indicator can be presented in a histogram, with each bar representing the distance between the MACD line and the signal line. The bigger the bars, the stronger the trend. When the MACD line is above the signal line, green bars are formed, and red bars are formed when it is below the signal line.

2. Volume Indicators

Traders use volume indicators to detect the strength of a market trend. To check for a crypto asset volume, you can use the following indicators:

On Balance Volume (OBV)

When the price is making higher highs, and the OBV is also doing the same, then traders can say that the uptrend is strong and likely to continue. If the price and the OBV keep making lower lows, then the downtrend is expected to continue.

In a range-bound market, if the OBV is rising, it could be a sign of accumulation, and there is a likelihood of a bullish breakout. On the other hand, if the OBV is falling in a ranging market, a bearish breakout could happen.

If the price continues to move higher, but the OBV is not making higher highs, it could be a sign that the volume is getting lower, and the uptrend may start to reverse. On the other hand, if the price is making lower lows and the OBV is not, it could be that the price is about to reverse since the volume is getting lower.

Volume

The volume chart is usually displayed at the bottom of the chart as a histogram. Each histogram bar shows the total volume traded over a given time period. Using the daily timeframe as an example, each bar of the histogram indicates the total volume traded in a day.

Investors calculate the average trading volume over a given period. Comparing the current price volume with the average price over a specific time can help you determine the validity of a move. Moves that have higher than average trading volume are usually seen as more valid than moves that have lower than average trading volume.

3. Volatility Indicator

Crypto traders use volatility indicators to spot trading opportunities presented by the frequent price change of crypto assets. The following are indicators you can use to check for crypto market volatility:

Bollinger Bands

The Bollinger bands indicator is made up of three bands: the upper, middle, and lower bands. The middle band is a 20-day moving average, while the upper and lower bands are separated from the middle band by two standard deviations each. When the bands expand, that is, move away from the middle band, it indicates high market volatility; however, when they contract and move closer to the middle band, it indicates low price volatility. Keltner Channel

Like Bollinger bands, the Keltner channel contains three bands: the upper, middle, and lower. The upper and lower bands are set at two ATRs (average true range) from the middle band. The middle band is a 20-day exponential moving average. If the upper and lower bands expand from the middle band, it means the market has high volatility. In contrast, their contraction signals low market volatility.

4. Momentum Indicators

Momentum indicators are used to determine the strength of a trend and whether the price trend will continue or reverse. Some indicators used to find out the market's momentum include the relative strength index (RSI), moving average convergence divergence (MACD), and average directional index (ADI).

Relative Strength Index (RSI)

RSIs are typically used by traders to measure crypto price change and momentum. The indicator measures price change over a default 14-day period, which can be adjusted according to your strategy. The RSI reads from 0-100, with a reading above 70 regarded as an overbought market position and below 30 as an oversold position. When a trend becomes overbought or oversold, it is likely to reverse, or at least have a minor correction.

Stochastic Oscillator

The stochastic indicator is used to identify overbought and oversold points in the market. It also reads from 0 to 100, with a reading of 80 and above regarded as overbought and 20 and below as oversold. Overbought and oversold levels show that the price is likely to reverse.

Paper Trade or Backtest Your Strategy

Some indicators can fit into more than one category because you can use them for multiple functions. You must understand any indicator you want to use and how it fits into your strategy. Paper trading or backtesting an indicator for a while is always a good idea.