Your iPhone may some day be the only device you need to purchase products and services, but first you need to start using Apple Pay.

Over three years ago, I replaced my wallet with my iPhone and a case, which holds up to three debit cards. Now I look forward to the day when I don't have to carry physical cards at all. Apple Pay and other similar services may ultimately make that happen. Here's how to set up the service on your supporting Apple device.

What Is Apple Pay

Apple Pay is an iOS 8 service supported only on the iPhone 6, 6 Plus and the forthcoming Apple Watch that allows customers to pay for merchandise and services using their qualifying and installed debit and credit cards. iPad Air 2 and iPad mini 3 owners can use Apple Pay to pay for goods within apps, but not in bricks and mortar stores.

At this time, only the following banks and credit card networks (including Visa, MasterCard, and American Express) support Apple Pay:

Apple Pay is not supported by PayPal, and it only currently works with U.S. banks. Also, at this time, Apple Pay can be used in about 50 national store chains, including McDonald's, Apple Store, Wallgreens, and Macy's. No supermarket chains, besides Whole Foods Market, have signed up, nor is Walmart supporting Apple Pay.

Setting Up Apple Pay

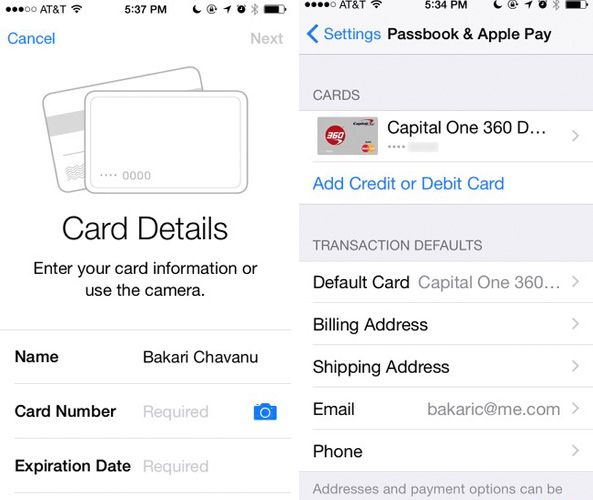

Setting up Apple Pay is a straight forward process. If have you have a supported credit/debit card, add it to your device by opening the Settings app, and tapping on Passbook & Apple Pay > Add Credit or Debit Card. You can either scan the card, or if that doesn't work, input the transaction data yourself.

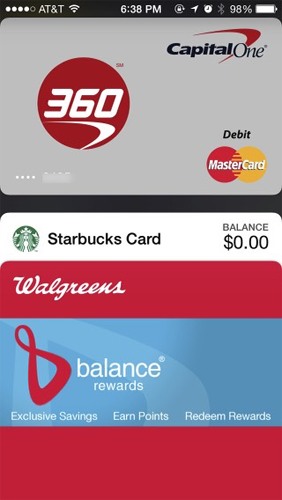

After your cards are added, they will show up in the default Passbook app, which can also include other iOS Passbook supported apps, such as Starbucks, United Airlines, Target, and the event finder app, Eventbrite.

Using Apple Pay

Apple Pay works within supporting retail stores that have a near-field communication (NFC) device installed. The NFC terminal works similar to a credit card scanner, but customers don't have to swipe their cards. To use the remote transaction, look for an Apple Pay icon on the payment system at the cash register.

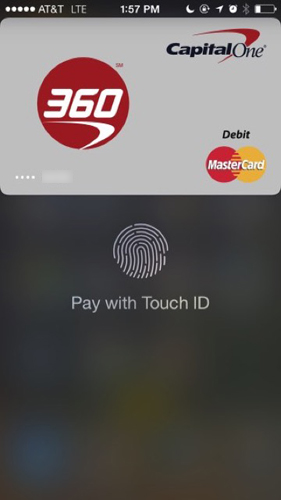

Point your iPhone or other supporting device toward the machine to pay for the merchandise. Apple Pay will pop up and request your touch ID for okaying the transaction. You don't need to open Passbook, and your device doesn't even need to be awake when it integrates with the NFC terminal. After the transaction is complete, you'll feel a little vibration on your device to indicate the completion of the process.

In the three instances I’ve used it so far, there was one occasion when the transaction still required me to punch my passcode numbers in on the machine, instead wirelessly taking care of the entire process remotely.

A Word About Security

Not only is the Apple Pay process convenient for not having to pull out your card to pay for items, it also provides extra security measures that shields your card number and PIN from other merchants and scanning machines. Your credit card numbers are not even stored on Apple's server. Instead, the process involves assigning a unique, encrypted Device Account Number in a dedicated chip within your device.

Touch ID also brings added security, because it prevents a thief from accessing your device, unless he or she knows your passcode number. If you want, you can disable access to Apple Pay and Passbook when your device is in locked position.

Wallet Free?

So does Apple Pay mean you won't need to carry your credit or debit cards? Unfortunately not at this point. The payment process is not yet supported by many of the stores and services you use on a regular basis, including most supermarkets, gas stations, local shops, and so on.

I still keep my cards with my iPhone using the DistilUnion wallet case, and I have a photo of my driver's license on my phone. My physical driver's license, which I rarely have to use, is tucked securely away secure in my car.

Apple Pay also doesn't keep track of your spending, so you might want to make use of a personal finance service like Mint.com.

Have you tried Apple Pay yet?