Here in the 21st century, banking has never been easier. Remember when we actually had to get out of our pajamas and drive to the local bank just to deposit a check? Now, we can almost do every transaction on-the-go with our phone or at home on our desktop.

While online banking is convenient, it doesn't come without its fair share of risks. Your identity and bank account information can be compromised if you're not careful. The next time you decide to log in to your online bank account, keep these tips in mind.

1. Frequently Change Your Passwords

I get it, it's really irritating to change your passwords over and over again. You're probably thinking that it's bad enough that you have to incorporate a series of numbers, capital letters, and symbols in your password, and now you have to change it all the time? But seriously, having a complex and frequently-changed password will help protect your account from hackers.

If you're worried about forgetting your password, then you should consider using a password manager to securely store all of your passwords. With password managers, you won't have to go through the hassle of resetting your password ever again.

2. Never Use Public Wi-Fi

Public Wi-Fi has a ton of disadvantages. Not only is it usually slow, but it sometimes doesn't provide a secure internet connection. When a hacker taps into public Wi-Fi, they can see everything, including your bank account login.

However, encrypted webpages can save you from the prying eyes of hackers. Make sure to check if your bank's URL starts with "https://" not "http://" The "s" tells you that the page is safe to use.

Even if a page has encryption, it's still better to avoid public Wi-Fi altogether. Using a virtual private network (our top recommendation is ExpressVPN, which is discounted if you sign up using this link), or using your cellular network to access the internet is far more ideal when dealing with online banking. If you really want to play it safe, just access your account from your own home's Wi-Fi.

3. Enable Two-Factor Authentication

Most banks will give you the option to enable two-factor authentication (2FA). While 2FA has its strengths and weaknesses, it still gives you extra protection for your sensitive account information.

When you sign up for 2FA, you'll typically receive a text message with a one-time password every time you log in to your account. It might seem like an inconvenience to go the extra step, but it's worth it.

If a hacker tries logging into your account, you'll get a text with a code. Once you realize that you didn't make this request, you can intercept the hacker right away.

4. Don't Open Any Suspicious Emails

Emails that ask for your personal information are called phishing emails. These emails try to trick you into divulging your bank and credit card information. The emails may look like they come from a legitimate source, but the person on the other end of that message is almost always a hacker.

Just remember that your bank will never ask you for personal information through email or text message. If you ever receive an email or text from a "financial institution" that seems a bit too nosey, make sure to report it to your bank.

5. Avoid Using Automatic Login

With automatic login, your browser saves your username and password, allowing you to access your bank account without remembering any of your login information. While that's convenient and all, it's not the safest thing to do.

You should avoid automatic login at all costs, especially if you use your phone for online banking. What if someone happens to swipe your phone? They won't even need your username or password to get into your bank account.

If you haven't already, disable this feature on your phone and on your desktop right away!

6. Use the Mobile Banking App

Download your bank's mobile app, and use that instead of accessing it from your desktop. Unfortunately, computers get hit with the most malicious attacks.

While every single device has the potential to get hacked, it's just not as common for mobile devices. Accessing your cellular network and logging into your bank account will give you the most protection.

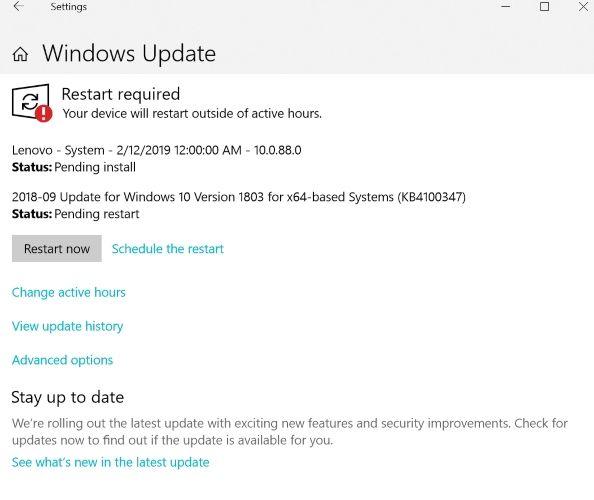

7. Update Your Computer and Mobile Device

Updates can sometimes take several minutes or hours, so I understand why you'd put them off. However, if your computer or phone is months or years behind in terms of updates, you won't have the latest protection against security breaches and malware.

8. Secure Your Mobile Device

Don't forget to utilize all of your smartphone's security measures, especially if you're a fan of mobile banking. Make sure you can lock your phone with a pin, facial recognition, a pattern, or a fingerprint. If your phone ever gets stolen, it's more difficult for the culprit to get into your phone.

9. Sign Up for Text Alerts

If your bank gives you the option to get text alerts about your account, don't hesitate to sign up. Every time a large sum of money is drawn from your account, you'll get a text. Hopefully, you'll only get texts when you're the one taking out cash.

Text notifications allow you to pounce on any suspicious activity in your bank account. If you receive a text that your balance has suddenly dropped, and you haven't made any transactions, you can contact your bank and quickly put a stop to any fraudsters.

10. Keep an Eye on Your Statements

Finally, you should take a closer look at all of your monthly bank statements. Your bank might overlook fraudulent activity on your card, and fail to alert you. By going over your statements, you can scan for any strange transactions. If you do happen to find any, you must contact your bank as soon as possible.

Smarter and Safer Online Banking

Although online banking can potentially lead to hacking and fraudulent charges, using these above practices will help you avoid any problems with your bank account. For safe online banking, you just need to use your common sense. If an email seems sketchy, or a network doesn't seem that secure, go with your gut and avoid it.

For more information about the security of your bank account, check out the potential risks of online banking.