Whenever tax season rolls around, two things usually happen. First, you start thinking about your refund amount (or if you'll even receive one). Second, you start worrying about filing your taxes and what it entails.

Whether you're a first-time tax filer or a long-time payer, there are always questions that need answering. These tax questions might seem daunting, but you don't have to handle them alone. By using H&R Block, you can get all your IRS tax questions answered for free.

Test Your Financial Awareness

Before directly addressing any specific tax questions, H&R Block offers two helpful tests. Both tests check areas that can help you prepare for better financial decisions for your upcoming tax year. Neither are long and aim to improve your self-awareness and be better informed.

The financial literary quiz examines your experience across different financial scenarios. The second quiz checks whether you're at risk for tax identity theft and then advises on ways to improve.

These are great free options to examine at the start of your fiscal year.

Get Familiar with H&R Block's Tax Information Center

If you're ready to get your tax questions answered for free by H&R Block, it all begins with visiting their tax information center. At the top of the page, you'll notice H&R Block's three article tags: Featured, News, and Popular. They're a good indicator of the site's biggest offerings.

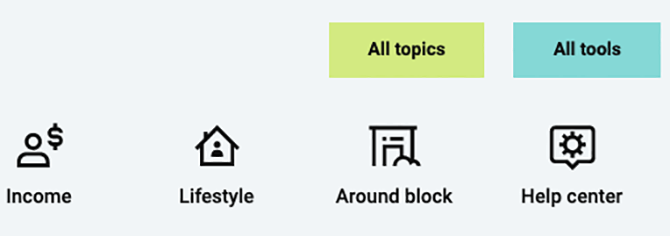

But if you're searching for anything specific, you can scroll down a little more. The online tax center offers two major divisions: Topics and Tools. You can check everything available by clicking on the buttons for either All topics or All tools.

You can also use the icons located below these two buttons. These serve as quick access points to the most popular topics and tools. If you continue down further, you'll see H&R Block's filing options.

If you're curious, take a look at how H&R Block's free tax filing plan provides the most value.

Check Out H&R Block's Topics

If you selected the topic button, you'll see the posts split up into these categories:

- Around Block (general H&R Block information)

- Filing

- Income

- IRS

- Lifestyle

- Small Business

- Healthcare

While mostly self-explanatory, H&R Block offers a quick explanation of each of its topics. To help you get to your questions, it divides each of these large topics into several subsections. Each subsection comes with a description as well to help make searching a little easier.

So if you know roughly where your tax question falls, H&R Block can help you quickly find it.

As another option, you can always view all the topics under the main categories. Browse through them if you're uncertain about what to look for so that you don't miss any critical information.

Let H&R Block Guide You to All the Answers

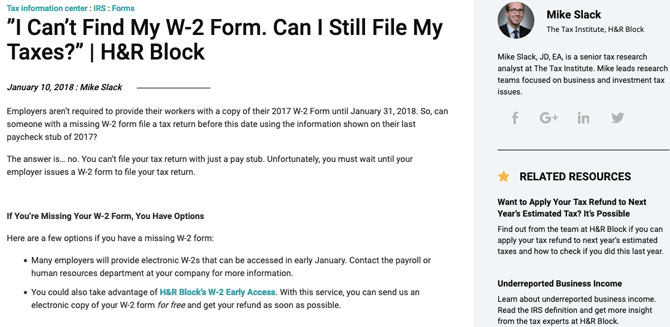

Once you've decided to click on an article, H&R Block answers the questions very succinctly. Additionally, depending on the article type, you'll see the writer and their professional experience noted. The articles themselves make it easy to find related information.

If you're investigating anything and you need more information, there are two ways to quickly move forward. You can either click the sidebar's related resources or look at related topics at the bottom of each article.

Check Out H&R Block's Tools

If directly asking your questions and researching doesn't help, H&R Block offers a variety of free tools to get a handle on your tax situation. By using either the website's resources or their mobile app, you can take an active look at your tax situation.

Make Your Tax Prep Checklist Before Filing Tax

When looking for ways to help get your information together, the classic checklist remains a useful tool. H&R Block offers the option to create your own tax checklist or print the full list. If you choose to create your own, you'll answer a short quiz to help generate your list.

Regardless of which option you choose, you'll end up with a checklist of your personal information, your dependent(s) information (if any), sources of income, and the types of deductions. If you're looking to self-file for the upcoming tax year, this provides a great organizational method.

Estimate Your Tax Refund

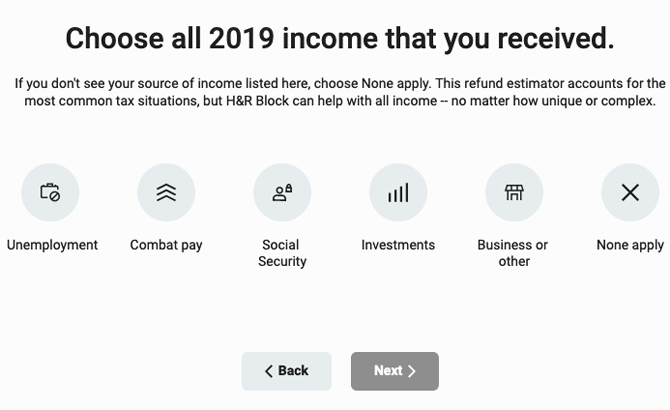

One of the most stressful points of the tax experience can be whether or not you'll receive a refund. Using H&R Block's free refund estimator, you can quickly get a read on your situation. Simply answer a few questions about yourself, your income, and your expenses to get your results.

In the end, you'll get an estimate based on your taxable income, taxes owed, tax credits, and taxes paid. You can then choose to log-in and save your information, go to the tax prep checklist, or begin filing.

Use the Mobile App to Answer Your Questions While Filing

If you need help on the go, H&R Block Tap Prep and File offers an easy-to-use help tab. At any point during the filing process, you can swap over to this tab and look up your questions. As you type in the search bar, you'll also receive suggestions to speed up your search.

All results show up in the app itself. As such, don't worry about having to go between H&R Block Tax Prep and File and a browser app.

Can't find what you need? Click the magnifying glass icon to search again. You can also select the answer wasn't helpful to bring the search bar back up.

Download: H&R Block Tax Prep and File for Android | iOS (Free)

Get Your H&R Block's Tax Questions Answered for Free

Whether you're utilizing H&R Block's tax center or app, you won't have to pay a dime. H&R Block's detailed articles already answer all of your tax questions for free. With the added knowledge, you can file with confidence.

If you're looking for another filing option, you can apply your new knowledge and learn how to file taxes online with TurboTax.

Also, see why FreeTaxUSA is worth using to file instead of TurboTax or H&R Block. Regardless of the company you choose, just remember H&R Block will still always offer free resources.