<firstimage="https://www.makeuseof.com/wp-content/uploads/2010/11/square-3d-logo.jpg" />

Square is a growing mobile credit card provider that makes it "easy" to accept credit card payments from anywhere you have a phone (iPhone or Android) and an internet connection. Who might use a service like Square? Any time you might want to accept payment for a product or service - maybe you sell crafts at a craft fair, want to have a garage sale or offer a service for which it would be helpful to offer credit card processing. Square can be used in many of these situations where only cash or check have been viable options previously.

Currently limited to the United States, Square requires a U.S. bank account, social security (or tax ID number if you are a business) and a U.S. address to sign up for an account.

Anyone, even individuals not associated with a business, can sign up. If approved, you do not need any hardware to begin taking credit cards. If you do not have the Square reader, you will have to type the credit card number into the app - and you also pay a higher transaction rate. The reason the rate is higher is because these are considered 'card not present' transactions since you do not have the information on the magnetic stripe to prove you actually had the card.

The drawbacks to traditional wireless credit card machines, pictured at the right, are:

- Big, bulky

- Expensive, a few hundred dollars to purchase

- Monthly Wireless Maintenance Fees

Square aims to eliminate all of these drawbacks while also adding a very slick interface. Let's run through a sample transaction through the Square interface.

The Square reader plugs into the headphone jack of an iPhone, iPad or Android device. These are the only three devices that support the Square platform at the present time.

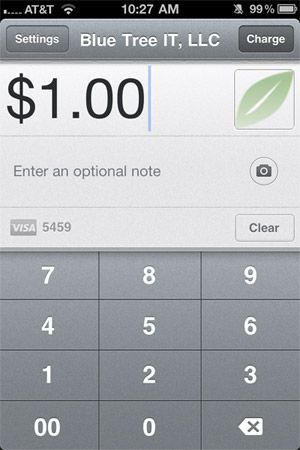

You have 3 options for payment. The first is to take a cash transaction, in this case Square acts as the "receipt" and will list in your control panel as well as optionally email a receipt to the payee. Square does not charge for this service. The second two are both credit card transactions. The difference is whether you swipe the card via the square reader (provided by square for free) or if you type it in manually.

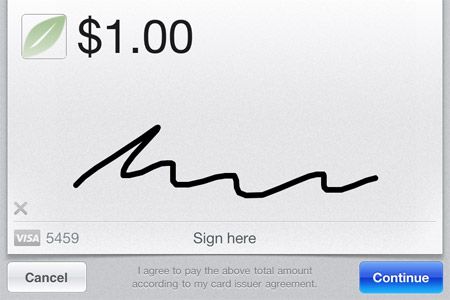

Once you plug in the square reader you simply swipe the card, type in the amount and optionally a description of what the transaction is for, and press 'Charge.' It will then approve or decline the transaction and move to the next screen where your payer will sign their signature with their finger.

Finally on the next screen, you have the option to have a receipt emailed to the payee. This email receipt includes the details of the transaction as well as the merchant's (your) address.

Compared to traditional mobile credit card processing machines, the process from the perspective of both a merchant and a client is a true breath of fresh air. Square makes the process easy and is extremely transparent with their fees, which is also a break from my experiences with traditional credit card merchant accounts.

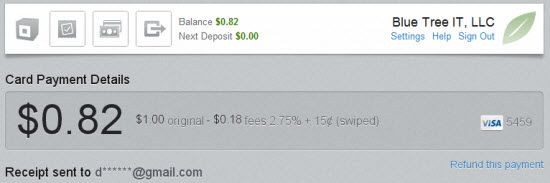

As you can see on the online receipt below, Square breaks down each transaction and clearly states how much money will be deposited to your account, and how much in fees were deducted from your transaction. Their fees, as of this article's publishing date, are 2.75% + 15¢ for card-present transactions (swiped via the Square reader), and 3.5% + 15¢ for typed in transactions (see their features page for current rates).

As you can tell from my experiences so far, I am very impressed by Square. But who would benefit from using Square? Essentially, it opens up the world of credit card acceptance to 'normal people' and not just businesses, although businesses who already accept credit cards can also benefit from their low rates and minimums.

If you are an individual, you can now offer credit card processing to anyone whom you would typically only take cash or a check from. Of course, you are paying a percentage of the transaction to Square, but in some cases it is worth the fee to get 'immediate' payment rather than a future promise of payment.

For businesses, it gives you an easy portable solution for accepting credit cards. However it does lack a few features that many normal merchants have. An API to accept payments via a website is notably lacking. Also, I suspect if you are a heavy volume credit card processor, the long term reliability of the reader + headphone jack solution may be less than optimal.

That all being said, Square has the possibility of absolutely revolutionizing the credit card processing industry. The ease of use and transparency of fees are something that is refreshing in the sea of other credit card merchants.

Let us know if you have used Square and what you think of their services. Everything seems to be positive from my testing but please share your experiences with our other readers!