Are you spending more money than you have? These apps and sites will help you set a budget, reduce spendings, and save money.

Being wealthy isn't about making more money, it's about keeping an eye on what you make right now, and figuring out what you should spend it on. Saving money is one of the most common new year's resolutions, and you can figure out how to do just that with a few choice apps.

Currently, Mint and You Need A Budget are the two heavyweights in the budget-making apps. But before you move on to these paid apps, try a few baby steps to understand the basics of personal finance and how to manage it.

To Make Or Not To Make (Web): Calculate Your Monthly Savings Goal

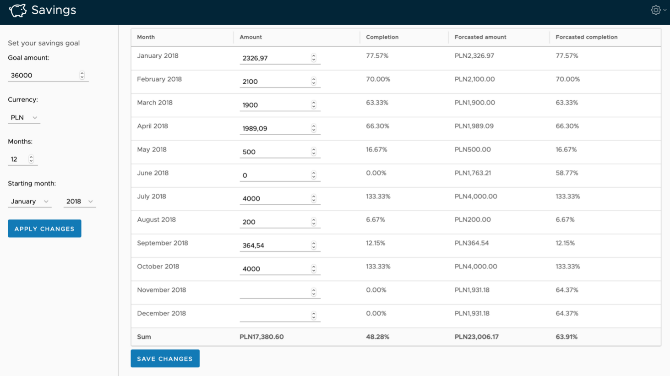

To Make Or Not To Make is the simplest version of a savings plan. It is a barebones calculator that tells you how much you need to make every month to meet your annual savings goal.

Here's how it works. To start with, set an amount that you want to save by the end of the year. To Make Or Not To Make will turn it into a monthly target, divided equally. But when you miss the January target or overshoot it, the app will adjust the remaining months accordingly. Each month, you can add how much money you have saved, so you can see how close you are to your target.

You're always free to change your annual goal and get a new calculation too. The budget is made on a link that is private for you, so don't share the URL with anyone else. Bookmark it, and set a reminder for yourself to enter details in it at the first of every month.

Track My Subs (Web): How Much Do You Pay for Subscription Services?

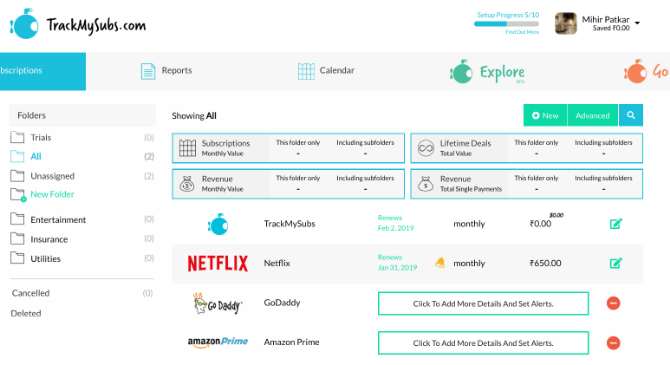

Most of the things you "buy" these days are subscriptions, whether it's your monthly cell phone bill, Netflix or Spotify, and so on. All of these add up to a big total. You can manage all these subscriptions in one place at Track My Subs.

The app doesn't let you change or stop any subscription. Instead, it's a dashboard to figure out these "invisible transactions" where your credit card is charged every month or year. For each subscription, you can set a category, its cost, expiry date, payment method, add tags and notes, and even set up alerts.

Once you set up all your subscriptions, you might be shocked to realize just how much you are spending on non-essential items like entertainment. Track My Subs is a good reality check for those who have plenty of subscriptions.

Trimm (Web): Simple Expenses Tracker

Every money manager recommends that you keep track of all your expenses, no matter how small. There are loads of apps for that, but if you want a free and simple one to start, try Trimm.

It's a desktop-based app, so ideally, fill it out at the end of each day or the start of the next day when you are at your computer. Keep a regular schedule to add all your expenses to Trimm and you'll soon get an idea of where your money is going, and what changes you need to make.

There are only four things you need to add to each entry: how much you spent, a description, a date, and a category. Default categories include Transport, Entertainment, Shopping, Bills, and Personal Care, but you can add custom categories too.

The important thing here is to stick to a ritual of filling out your expenses. After that, you might be able to shift to any of the better budget tracking apps or free spreadsheet templates to manage finances.

Financial Toolbelt (Web): Calculators for Every Financial Need

Financial Toolbelt doles out plenty of good advice on its blog about how an individual should manage their own money, but go there for its free calculators. Through seven different calculators, you'll feel more in control of your financial future than ever before.

The calculators figure out the expenses of different aspects. One tracks how much you need to save for a good retirement (including a good FIRE calculator), another talks about how to do a side-job, others track savings goals or credit card debts. You can pick the one that matters the most to you right now, but I'd recommend giving all of them a shot.

Apart from the calculators, do check out the resources and the interviews to understand basic personal finance topics, and get some good tips on how to manage your money.

HoneyDue (Android, iOS): Money Tracking for Couples

If you're a couple, you need an app that works on both your phones to track all your expenditures and finances. HoneyDue is an easy and free app to set a budget together and review your spendings.

The app's features include almost everything you can think of as a couple. You can see your joint accounts as well as personal accounts (US only), set bills and payments, add monthly budgets and limits, split costs when you manage finances separately, and so on. It's the dashboard that both of you can check at the same time, and decide what you want to do with your money.

These features are also available in some of the other, more robust budget and finance apps, but none of them are fully free, which sets HoneyDue apart from the rest.

Download: HoneyDue for Android | iOS (Free)

Take Control of Your Finances

Each person has a different financial need at a time. You might be looking to save more money, or reduce your debt, or control your spendings. No matter what you're looking for, one of the above apps should be able to get something out of the tools above.

In case you still haven't found the type of app, website, or guidance you need, don't worry. Try these other apps and free ebooks to save money and set budgets.