Saving for retirement is one of the most important things you can do to improve your financial future—but how do you know if you've saved enough? If you started late, how much will you need to save each month? These 9 tools will help you set goals, put away money in a timely manner and, ultimately, retire on time.

Retirement Calculators

There's no one-size-fits-all retirement calculator, as everyone has different goals, means, and strategies. However, there are a lot of calculators out there that will help you get a better idea of your current status when it comes to retirement savings.

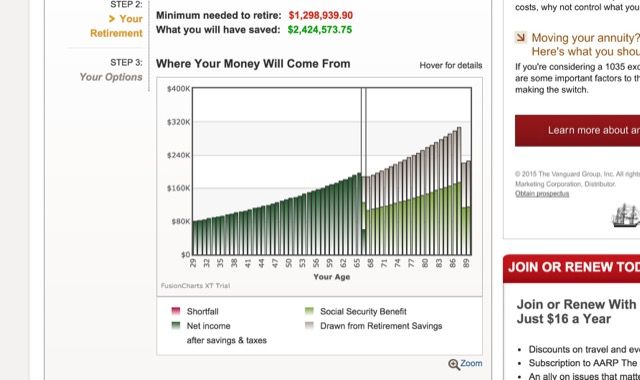

AARP Retirement Calculator

The American Association of Retired Persons is a great resource for information on retirement, and their savings calculator is no exception. After entering information about you and your spouse if you have one—like age, salary, planned retirement age, and current savings—the calculator will let you know if you're on track.

At the end of the process, the calculator also lets you make adjustments to see how you'll have to change your saving strategy to account for differences in retirement age or planned spending.

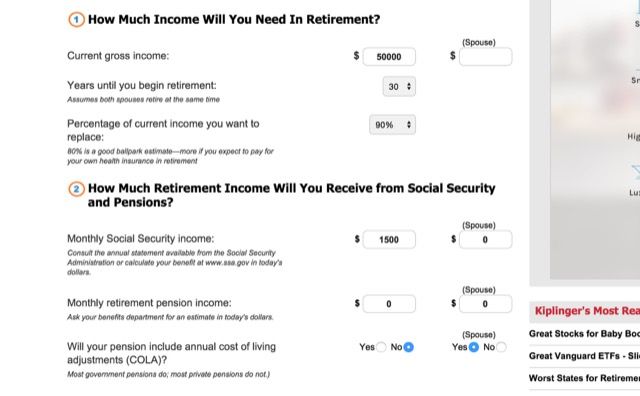

Kiplinger Retirement Calculator

In addition to providing information about yourself, the Kiplinger calculator also asks about your mortgage, your home equity, and your planned investment portfolio during retirement.

Once you've entered all of this information, the calculator will tell you how much you should be saving each month to make it to your goal.

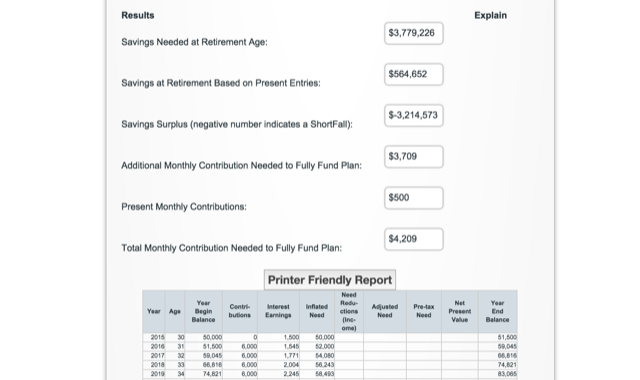

Financial Mentor Ultimate Retirement Calculator

If you think you may have a complicated financial retirement situation, this is a great calculator for you to use. It lets you input things like decreased spending throughout retirement, one-time benefits, and other forms of income.

In addition to figures like projected savings at retirement and savings surplus, you'll also get a printable report with contributions, earned interest, and year-end balances.

Retirement Savings Apps

There are a number of great apps that will help you save for retirement—some of them help you make a plan, and others will help you keep track of your savings. Choose the ones that best fit your needs.

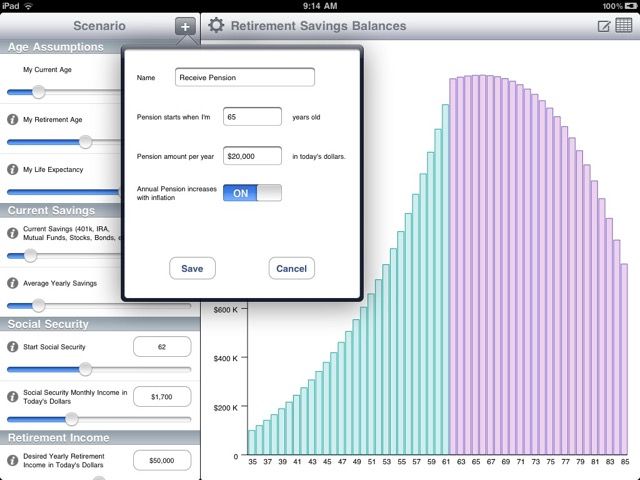

RetirePlan (iOS, $4.99)

This iPad app serves much the same function as the calculators listed above; you can put in a large amount of data, like your current savings, estimated retirement age, pension, and even life events like sending a child to college.

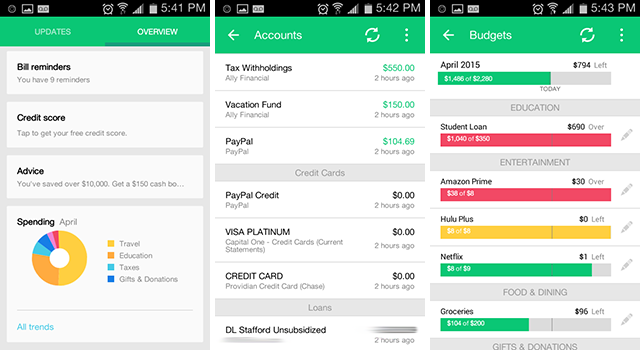

Mint (iOS, Android, web, free)

We've talked about plenty of personal finance apps, but Mint stands above the rest as one of the most comprehensive. Being able to view your investments, savings accounts, bills, and budgets all from your phone or computer makes it easy to get a good idea of where you stand when it comes to saving.

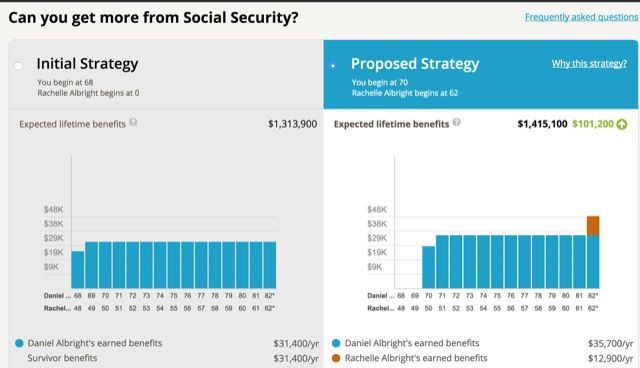

Financial Engines Social Security Planner (web, free)

Using the right strategy in claiming social security can make a huge difference in how much you can receive in benefits over the course of your retirement. Using this planner will help you (and your spouse, if you have one) make the best decision on when to start claiming benefits to maximize your earnings.

Retirement Financial Resources

In addition to setting goals, making plans, and keeping a close eye on your finances, it can also be helpful to make a point to regularly consult some useful resources when it comes to retirement finances. Check out these financial blogs on a regular basis to get inspiration, news, and advice.

Can I Retire Yet?

This site's slogan is "Save More - Invest Smarter - Retire Sooner," and it will help you do all of those things. With recent articles like "Why You Need Multiple Sources of Retirement Income," The 6 Crucial Questions to Answer Before You Retire," and "Roth IRAs and Roth Conversions: Who Needs Them?", this site will give you all the information you need to support your retirement.

If the vast amount of information on this site is overwhelming, work through the Roadmap section, which will walk you through everything you need to get started.

Scott Burns at AssetBuilder

AssetBuilder is a great site for financial advice, and Scott Burns's blog is one of the best places to get into the site. As one of the five most widely read read personal finance writers in the United States, you can be confident that he's giving you good information.

If you want more like this, be sure to check out Andrew Hallam's posts, too.

Planning to Retire from US News and World Report

This blog is written with pre-retirees in mind, so you'll get all sorts of info on things like Social Security payments, retirement savings accounts, benefits, retirement ages, and other useful things.

US News also writes a blog on retirement, so be sure to check that out as well.

Plan, Save, Retire

Retirement is one of the most important financial goals you can save for . . . but it's not easy. It takes a good amount of planning, self-discipline, and patience. But by arming yourself with the best information and tools available, you'll be able to start—or continue—saving money for your retirement. Who knows? Maybe you'll even be able to retire early!

Are you saving for retirement? What are your favorite tools to plan or track your savings? Which financial blogs do you find the most helpful? Share your thoughts below!

Image Credits: senior people with digital tablet by Gyorgy Barna via Shutterstock