Do your friends and family seem to have more money than you do, even though you work as hard? A lot of it comes down to their ability to save money and manage their finances. And with the right guidance and apps, you can master your money too.

Money is something we never seem to have enough of. Saving money and spending within your budget is a common new year's resolution or life goal. Online communities always argue between two of the most popular services, Mint vs. You Need A Budget (YNAB).

You will read about philosophies like the debt snowball method. While these are the top tools and methods, that doesn't mean they're the best. If you're new to financial management, use something that you feel comfortable with. Here are a few options.

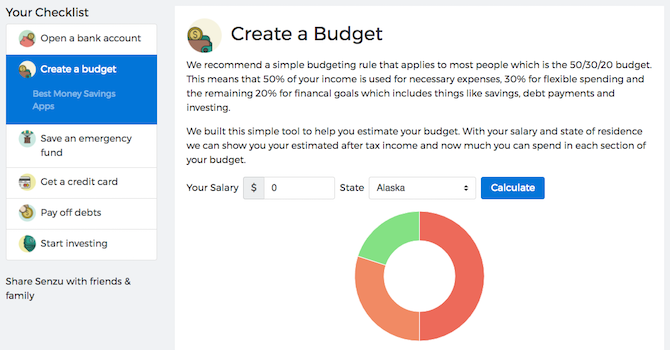

1. Senzu (Web): The Financial Checklist for Beginners

If you're new to money management, it can seem daunting and overwhelming. Senzu has a helpful checklist to get you started with the basics of what you should and shouldn't do.

The checklist has six major steps, from opening a bank account to investing. Each step comes with a beginner's guide. For example, the "Start a Budget" step talks about budget calculators like the 50/30/20 rule. It also includes a simple tool to calculate your expenses, and promotes some useful apps as well.

Senzu's checklist is currently aimed at Americans, but the advice in it is largely universal. It is a financially sound money-managing guide to start with.

2. Half Dollar (Web): No-Install Budgeting on the Web

At its core, setting a budget is simplicity itself. There is a clear mantra: "Don't spend more than you earn." Where things get confusing is in tracking how much you earn and how much you spend. Half Dollar is an easy app to get you started.

It has only three parameters: Monthly Money In, Monthly Money Out, and Monthly Money Leftover. Add all your income sources in the first one. Adding more than one source is especially useful for households with multiple workers, as well as those who have more than one job. In Monthly Money Out, add all the expenses you will incur as well as anything you spend daily. Set aside 15 minutes at the end of each day to update this -- that's all it takes, 15 minutes.

Half Dollar automatically calculates how much you have in Monthly Money Leftover, so you can figure out savings and splurges accordingly. The app works perfectly on mobile browsers too, so you could easily turn it into a mobile app as well.

3. Budgeting 101 (Web, Excel): Insights and Tools to Get Started

Everyone needs one place to start; a guide that will explain what you need to do, why you need to do it, and how you should do it. Redditor TheJMoore made this for the everyman.

The original post on Reddit explains everything you need to know, and is worth reading for inspiration alone. TheJMoore divides money into three "buckets" (expenses, savings, and flex) and explains why this matters. It's a simple and appealing philosophy, so check it out.

The accompanying spreadsheet shows you how to put TheJMoore's philosophy into action. It's a free downloadable Excel sheet, with instructions on how to use it. Put it into action and you'll start saving money like never before.

If you like this, then you might want to check out other free finance templates for Google Sheets and Microsoft Excel.

Download -- Budgeting 101 (Excel Spreadsheet)

4. 202 Ways to Save Money (Ebook): The Web's Best Money-Saving Tips

The Simple Dollar is one of the best personal finance and money websites. Creator Trent Hamm wiped off his own large debt and now shares his insights with others on his blog. Over the years, he has written about several tips and tricks to help you save money, and they are now all collected in this free ebook.

You will need to visit The Simple Dollar and sign up for the newsletter to get the free ebook. It's broken into two parts. The first is "100 of the best tips to start saving today" and the second is "102 things to do for free on the weekend."

The ebook contains some popular money-saving techniques, like the 30-day-rule for impulse purchases. As for the weekend part, Hamm estimates that's where our budgets go for a toss, since we have free time. Even if you want to kill two hours at the movies, that's going to set you back a fair deal once the family wants popcorn and soda. Finding free activities to fill up that free time is the smartest way to save money.

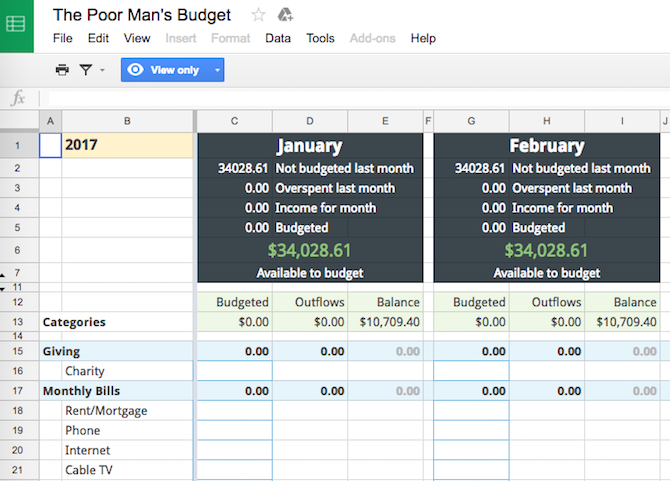

5. The Poor Man's Budget [No Longer Available]: Free YNAB Template

Here at MakeUseOf, we are big fans of YNAB. It is our recommended tool if you want to make a budget and stick to it. But it costs a few bucks, and if you're already pinching pennies, that can hurt your wallet. An enterprising Redditor made a free spreadsheet on the same principles.

The Poor Man's Budget is almost exactly like YNAB. The first column has all the expenses that you incur. Add the estimated expense under "Budgeted", and later update it with how much you actually paid under "Outflows". The sheet will automatically calculate how much you overspent or didn't budget for last month, and figure out your next month's expenses accordingly. Read the last "Instructions" tab to get a clear idea of how to use the Sheet.

You can't edit the Sheet directly, so go to File > Make A Copy, and save the copy on your own Google Drive. You will be able to edit this and use it for your budget. And remember, there are some great money management tools inside Google Drive.

How Did You Start Budgeting?

There are several techniques to setting a budget and saving money. Not everyone follows the same method, especially when you're a beginner.

What about you? How did you first start budgeting your finances? What got you on the path to successful money management?