From actual experts and professionals to everyday folks like you and me, Reddit is full of people sharing their financial wisdom. That's what makes it so useful for getting advice on money issues. Whether it's saving, spending, investing, or just simple tricks to help you live better, you can find it on Reddit.

In an effort to find the most useful personal finance advice out there, we went through some of the best financial subreddits to hunt for gems of wisdom about money matters. From fighting impulse buys to negotiating a raise, here's the best of what Reddit has to offer.

ELI18, ELI22, ELI30, ELI40: The Personal Finance Guides

Four recent Reddit guides perfectly summarize personal finance advice for four different age groups. It uses a popular Reddit acronym -- ELI5 -- to explain who it's for. ELI5 is a trendy internet acronym you should know, which means "Explain Like I'm Five (years old)". Basically, it tells people to dumb down a complex subject for beginners.

With that in mind, one Redditor wrote guides on the basics of personal finance for four major life stages:

- ELI18 -- How to take control of your finances as soon as you are an adult and can legally control your money.

- ELI22 -- After graduation, you're independent and self-reliant. Here's how to manage money from your first full-time job, and pay off debt and taxes.

- ELI30 -- Married/single taxes, children, buying your own house, 401K and retirement plans, and other related issues.

- ELI40 -- It's all about managing wealth at this stage of your life, so here's how to get ready to make the right moves.

Two Methods to Fight Impulse Buys

When someone asked for a simple way to save money, the top two upvoted comments were all about fighting the worst money-wasting culprit: impulse buys.

The first idea is to imagine someone holding your desired object and the money it costs in two hands. Imagine that you have to pick one of those two things. It turns the concept of "buying" into "choosing," which is enough to re-evaluate impulse purchases.

The second idea is just to delay. If you think of buying something that's not urgent, put it aside right now and buy it next week. That's the only rule. Again, if it's not urgent, you buy it next week. You'll be surprised how much money this saves you.

Two Bank Accounts to Find What's Worth Buying

This is again about impulse purchases, but it's a little bit more involved. The idea is simple. Open two bank accounts. One is for saving, the other is for spending. The saving account is always full, the spending account is always empty.

Every time you need to buy something that requires more than petty cash, you need to transfer money from saving to spending. That little bit of friction and inconvenience will have you second-guessing purchases and saving money.

Can You Buy a Car?

Wisdom comes from experience. One Redditor's father gave him sound advice about what he can and can't afford when it comes to a car. Here's how it went:

Best advice my Dad has ever given to me: (1) If you can't afford the monthly payments to pay off your car in 3 years, you can't afford that car. (2) After the car is paid off, continue paying your car payment into a savings account.

The idea is that any loan payment is accounted into your expenses, so don't give yourself the option to skip that once the loan is paid off. Instead, keep putting that money into a savings account. Your lifestyle remains constant, while your wealth grows for emergencies and retirement.

How to Negotiate a Salary Raise

The top-rated post of all time on r/PersonalFinance is a small guide on how to raise your salary. It's not a simple one-line tactic, though. It's a personal story of how one Redditor got a raise, and a step-by-step guide on how to get your own.

Basically, the Redditor used a combination of several tips shared by the community over the years, like comparing your salary with others. Those tips were actually employed to good effect, getting a 45% salary raise in the process. And each step was documented with the dos and don'ts. It's a fine guide to negotiate a pay bump.

Starting With Stock Market Investments

If you hear people talk about their stock market investments and gains, you'll want a piece of the pie too. But playing the stock market is tricky and complicated. You can lose a lot of money if you don't know what you're doing.

When a teenager asked how he should invest, he got one of the best replies possible on stock market investing. Redditor Romanticon explained the dos and don'ts (and the reasoning behind them) as well as providing a clear guide on the simple steps to take. It's magnificent. Read the whole thing yourself, but here's his TL;DR summary:

TL;DR -- Don't go into stock investing chasing ridiculous gains. Consider setting up a retirement account. Put money into indexed mutual funds, not single stocks. If you buy single stocks, consider that money written off. And, for the love of god, NO PENNY STOCKS.

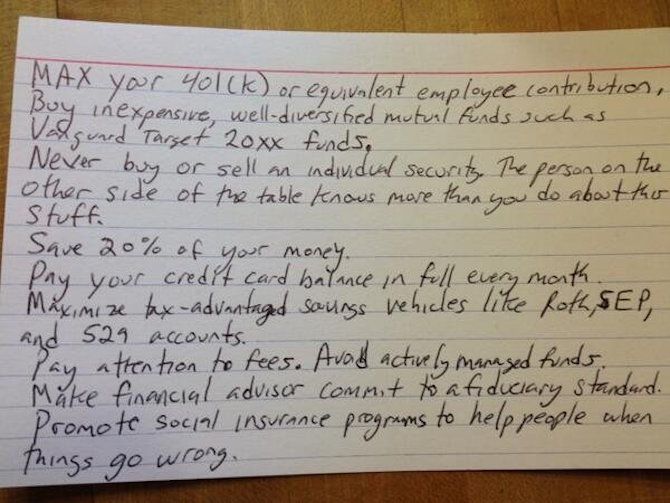

Everything You Need to Know on One Index Card

Professor Harold Pollack is an expert on public health and policies, but it was his personal finance advice that went viral. Pollack put everything you need to know about money management on a single index card. It's invaluable advice.

He listed nine basic points, covering debt, investments, security, savings, and hidden costs. It's everything you need to know about handling finances, which you can write on an index card to carry with you at all times. Struggling with a decision? Whip out that card and let it guide you.

Spend On What You Love, Rest Are "Things"

It's important to identify what you are passionate about and what you value. If fitness defines you, then spend more money on that. If you're an avid foodie, splurge on top-quality stuff. But identify that thing and save on others, says financial guru Ramit Sethi of I Will Teach You To Be Rich.

In one of the best Reddit AMAs, Sethi described several of his processes and his thinking. When asked about his own spending habits, Sethi said he spends a lot on health and fitness, but saves money on things that don't matter to him, like the brand of almond butter he eats. Money is all about priorities, so get yours in order.

A Guide to Excel for Finance

Microsoft Excel is arguably still the best tool to manage your personal or professional finances. It is unmatched in flexibility, formulae, and functionality, if you know how to use it right. We've shown you how to make a personal budget in Excel, but this guide adds a few more important tips.

Importantly, it teaches you key formulae and shortcuts that will help you tremendously in using Excel to chart your expenditures. Once you do that, budgeting gets easy. The post also offers a budget template to get you started, but you'll be better off with our collection of the best spreadsheet templates to manage your finances.

Using Reddit Is a Reminder of Financial Goals

A major reason you miss your financial goals is because of temptation. When you see something you can afford easily, you think, "Well, you only live once, go for it!" The best way to counter that is with a support group of people with the same goals as you.

Take this Redditor for example. Every time he is about to make a big impulse purchase, he reads the r/FinancialIndependence subreddit. Seeing others' targets is a reminder of his own plans, and he stops himself from giving in to temptation. If you take one thing away from this article, let it be this: if you want to stick to your money targets, become a part of a community with similar goals.

What's the Best Personal Advice You Got?

Everyone has some financial advice to give, especially gurus. But there's a certain charm to the advice you get personally from a loved one or an everyday person. That's where Reddit excels. You also must have got some pearls of wisdom from people you've met.

Tell us the best personal finance advice you've ever received. Have you been inspired by personal finance tips on Reddit? Share the best pieces of wisdom you found!