You're likely familiar with PayPal, at least in name, due to its ubiquity for online payments. But PayPal also offers a lot of functions that you might not be aware of.

Let's take a look at the various PayPal account types and various other services that PayPal offers, along with important information like fees. This will give you a much clearer picture of what PayPal actually offers.

Types of PayPal Accounts

To use PayPal, you'll of course need an account. Currently, the company offers just two primary types of accounts. Prior account options, like Premier and Student, are no longer available as of this writing.

See how to get started with a PayPal account to begin once you know what account is right for you.

Personal PayPal Accounts

A personal PayPal account is for anyone who uses PayPal to make purchases and/or send money to friends. It allows you to send money to a friend to reimburse them for dinner, pay for purchases online, and similar. You can also use it for casual sales, like freelance art commissions.

PayPal Cash and PayPal Cash Plus

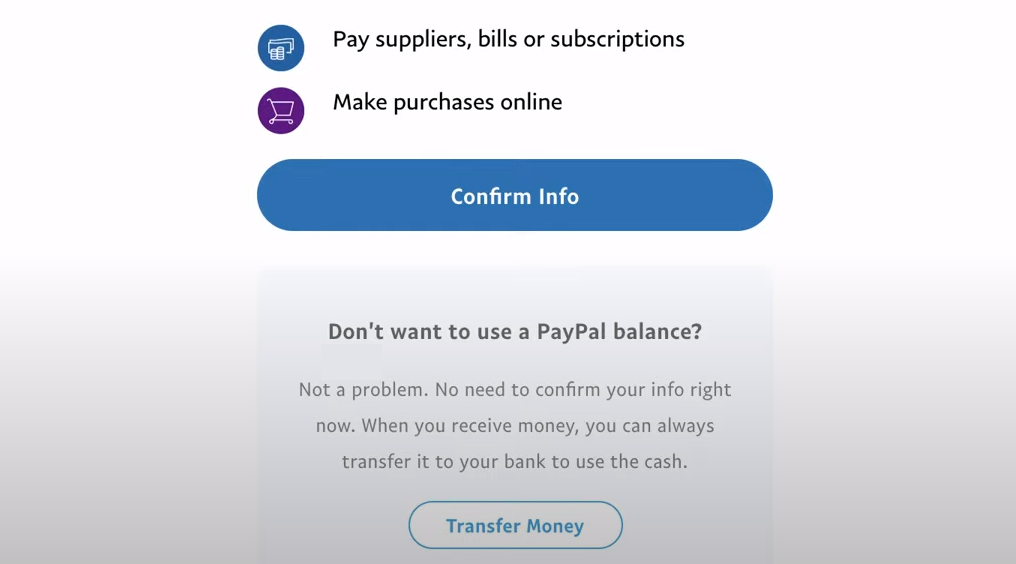

If you have a personal PayPal account in the US and also want to hold a balance, PayPal requires you to use what it calls a "balance account"—either PayPal Cash or PayPal Cash Plus. Without one of these, you can still send and receive money, make payments, and split bills.

However, to keep a balance in your PayPal account, you'll need one of the two balance account options. A balance account is tied to your existing PayPal account, so it's not really a distinct account option so much as an addition.

You can sign up for PayPal Cash when you receive money in PayPal. When you click Accept the Money on a transaction, you can choose Transfer it to your bank or Keep it in PayPal. If you choose the latter, you'll need to set up PayPal Cash.

In addition to holding a balance, PayPal Cash allows you to send money using that balance. You can also use it with Google Pay and Samsung Pay, as well as convert the currency of your balance.

As an alternative option, you can instead use a PayPal Cash Plus account. This enables you to do everything PayPal Cash does, plus use a PayPal debit card to make purchases in stores (see below), set up direct deposit into your account, and even deposit checks into your PayPal account.

You can sign up for a Cash Plus account by getting the PayPal Cash Mastercard, setting up direct deposit, or setting up goals in PayPal.

Business PayPal Accounts

If you're using PayPal as a company or other business group, you should create a business account for PayPal. This allows you to operate under your company's name, accept payments, give employees limited access to your account, and use business-oriented PayPal products.

Verifying Your PayPal Account

You don't need a lot of information to sign up for a PayPal account—just your name, address, phone number, and email address are required. Of course, you'll need a payment method (bank account, credit card, or debit card) to send money, and need to connect your bank account if you want to withdraw your PayPal balance.

However, to show that you're a legitimate user, you should also verify your PayPal account. This shows that you are who you say you are, increasing confidence for anyone who does business with you.

To verify your PayPal account, you'll need to either add and confirm your bank account, or get approved for one of PayPal's credit products (see below). Confirming your bank account either involves logging in with your bank credentials, or verifying two small deposits that PayPal makes to your account.

After you've done this, as well as either providing your social security number or linking a credit/debit card, your monthly withdrawal limit from PayPal is lifted.

PayPal Fees

Opening a PayPal account doesn't incur any fees. Below are the situations where PayPal charges fees:

- When you receive money from a purchase, like selling something on eBay

- When you send or receive a payment outside your country

- When you pay friends or family using a credit or debit card

- When you move money from your PayPal account to your bank using your debit card

There are no fees if you transfer your PayPal balance to your bank account. PayPal also doesn't charge fees when you send a friend money using your bank account, or receive money sent from a friend's bank account.

In the US, the fee is 2.9 percent plus $0.30 for sending personal transactions using a card, or when you receive money for business transactions. There are additional fees for international transactions, including currency conversion fees.

See the PayPal fees page for a complete list of fees on various transaction types.

PayPal Cards

As PayPal is a financial service, it offers several cards that you might be eligible for as a user. We offer a summary of these below; check the PayPal Credit and Cards page for more info.

PayPal Cashback Mastercard

This card provides two percent cash back on every purchase you make, with no exceptions or rotating categories. You can redeem your cash back to your PayPal account at any time. There's no annual fee with this card, making it an attractive option if you want straightforward cash back with nothing to keep track of.

PayPal Extras Mastercard

Instead of cash back, this card works on a points system. You earn points as follows:

- 3 points per dollar spent on gasoline and restaurants

- 2 points per dollar spent on PayPal and eBay purchases

- 1 point per dollar on everything else

Once you rack up enough points, you can redeem them for gift cards, merchandise, cash back, or even travel vouchers. It also has no annual fee, so it's a good fit if you want more flexibility in rewards than just cash back.

PayPal Cash Mastercard

This is a debit card, not a credit card. It allows you to spend your PayPal account balance anywhere that Mastercard is accepted. The card is free of monthly fees or minimum balance restrictions, and doesn't require a credit check.

Signing up for the card will connect PayPal Cash Plus to your account, as discussed above.

PayPal Prepaid Mastercard

As a prepaid option, this isn't a debit or credit card. Instead, you add funds using direct deposit or by transferring your PayPal balance. There are also special offers, such as the option to sign up for a savings account.

Other PayPal Services

Finally, let's look at some of the various services that PayPal provides.

Pay in 4

Pay in 4 does what the name says: it allows you to split purchases made with PayPal into four payments. You'll pay once every two weeks with no interest or damage to your credit score. When checking out with PayPal, just choose Pay in 4 under Pay Later to use it.

PayPal Credit

Formerly known as Bill Me Later, PayPal Credit allows you to set up a reusable line of credit to pay for purchases over time. For purchases of $99 and over, there is no interest charge as long as you pay within six months.

You'll need to sign up for PayPal Credit separately, then link it to your PayPal account to manage everything in one place.

Money Pools

PayPal's Money Pools allow you to set up a page where people can chip in for a common goal. For example, you might collect funds for a friend's birthday party, or to help pay for someone's moving expenses. Anyone with a PayPal account can create a pool.

Understanding What PayPal Offers

We've looked at the fundamentals of PayPal accounts and services for consumers. Now you know more about what the company offers and can get the most out of your account.

PayPal also owns a number of services. Most notable is Venmo, a service focused on mobile payments to reimburse friends and similar.