Imagine dining out at a restaurant. You get your check and everything looks fine, so you add your tip to the bill and have it all charged to your credit card. A few days later, you check your account online and see that the restaurant charged you an additional $10. Now what do you do?

While this may not be a common issue, it happens far more often than you'd think. Unfortunately, most people don't catch it, or they shrug it off because rectifying the faulty charge would be too much of a hassle. Well, you have a right to get your money back!

First, always contact the merchant that overcharged you and try to work out a civil solution (most likely it was an honest mistake). But if they refuse, that's when you turn to your last resort option: the chargeback. And yes, there are many other situations when a chargeback comes in handy, especially if you regularly shop online.

What Is a Chargeback?

When you pay for something with a credit card, the bank charges your account. If you're dissatisfied or need to make a return, you negotiate with the merchant to receive a refund. But if they won't issue a refund, you can go to the bank that holds your credit card account and request that your card gets charged back.

A refund and a chargeback are practically the same thing: both of them result in the charge on your credit card being reversed. The key difference is that a refund is issued by the merchant, whereas the chargeback is issued by the bank of your credit card.

If you're using PayPal, you can do something similar to a chargeback, but it's simply called a transaction dispute instead of a chargeback because PayPal is not credit. That is unless you have a PayPal credit card, which would require a chargeback. For all intents and purposes, though, the two serve the same purpose.

Most Common Reasons for Chargebacks

The chargeback exists to protect consumers. Banks don't want to waste their time playing referee between consumers and merchants, so they usually stay out of the way and prefer that you work out a solution directly with the merchant.

But when the merchant doesn't abide by certain rules set forth by the bank (which the merchant must agree to in order to accept credit card payments), the bank will step in and take matters into its own hands. That's the theory, at least, and when this happens, it's often in your favor.

Here are the most common and acceptable reasons for a chargeback:

- Services not provided. This is when you pay for a service that is misrepresented by the merchant, and you feel that you have been deceived.

- Merchandise not received. This is when you pay for an item that does not arrive within a reasonable anticipated time frame, whether due to fulfillment issues, shipping delays, or anything else.

- Merchandise defective. This is when you pay for an item, but it arrives in a damaged, not working, or otherwise deficient state.

- Merchandise not as described. This is when you pay for an item, but it arrives in a state that is not to your satisfaction. For example, buying an item marked "New" that is obviously used when it arrives.

- Refund not processed. This is when the merchant acknowledges a refund request but never actually processes the refund.

- Unauthorized usage. This is when an unauthorized user charges something to your card without your knowledge or consent. Also known as a fraudulent transaction. Often times related to digital identity theft.

You may also be able to initiate a chargeback for other reasons, but these are the ones banks will most likely accept.

The Reality of Chargeback Abuse

Everything sounds great so far, doesn't it? Now you can go out and pay for whatever you want, while resting in the knowledge that you can always request a chargeback if you're even the tiniest bit unhappy. Who cares about refund policies when you have chargebacks?

Well, it isn't that simple. Just because you request a chargeback doesn't mean you'll get it. The bank will investigate the request to see if it's legitimate.

Banks know that consumers can abuse chargebacks. They want to keep customers happy, but they also want to keep merchants happy. If merchants are slammed with too many frivolous chargebacks, they'll either shut down or simply stop accepting credit cards–a lose-lose-lose situation for everyone.

And unfortunately, abuse is not uncommon. Unethical users order items, get exactly what they intended to buy, yet still issue chargebacks for "free" money. This is called friendly fraud or chargeback fraud, and in 2022, nearly one in four consumers who filed a dispute admitted to it.

While chargeback fraud isn't exactly illegal, it has severe consequences. According to a 2016 study by LexisNexis, every dollar that gets charged back results in merchants losing approximately $2.40 in banking fines, penalties, product loss, and administrative costs. This is a huge deal that can seriously damage legitimate businesses.

As such, banks and merchants are cracking down on chargeback abuse and increasingly denying requests. There are several reasons why a bank may deny your chargeback:

- The merchant provides proof that you actually received what you bought.

- You don't have proof that you returned a defective item.

- You don't give the merchant a chance to resolve the issue.

- You're disputing something you bought overseas.

- You're disputing a service after you fully used it, like a hotel room.

- You waited too long to request the chargeback. Most banks require that you request chargebacks within 120 to 180 days of the purchase date.

How to Chargeback a Credit Card Payment

Assuming you have a valid reason for requesting a chargeback, here are the general steps involved for every major bank:

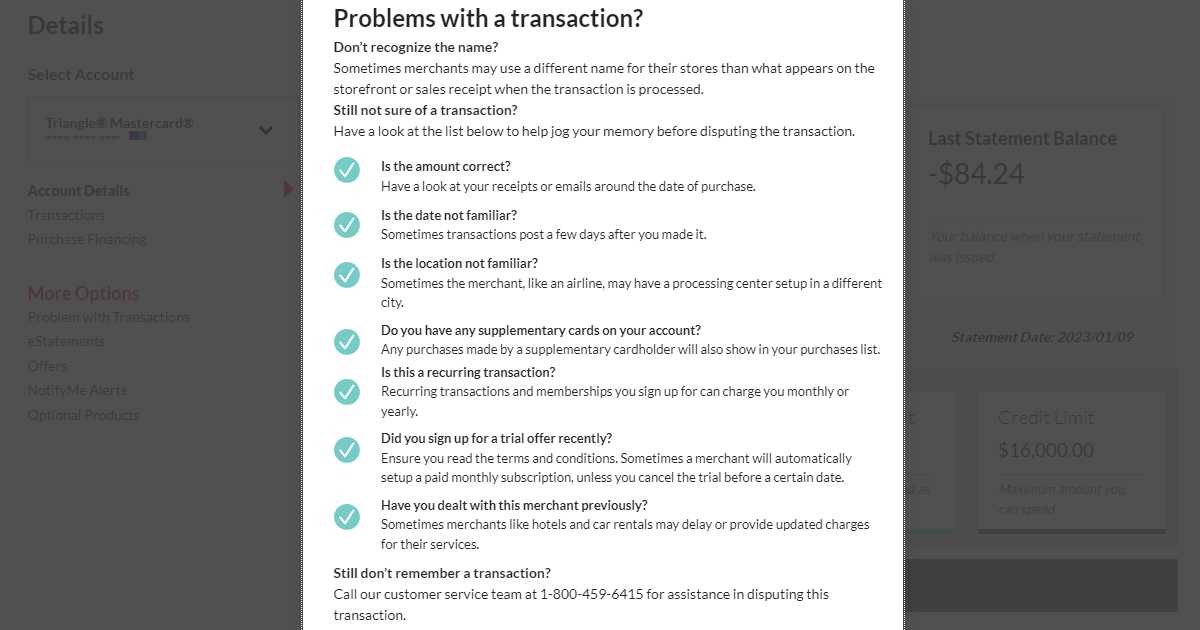

- You contact the bank and dispute a transaction.

- The bank investigates the validity of your claim. If they find the claim invalid, the process ends here and the bank will probably charge you a processing fee. If the claim is valid, you'll receive a provisional refund.

- The bank contacts the merchant's bank to get its money back.

- The merchant's bank investigates the validity of the claim. The merchant will have a chance to provide proof and documentation. If the claim is found valid, the bank grants the chargeback. On the other hand, if the claim is invalid, the provisional refund you received will be denied.

- If a resolution can't be reached, the case moves into arbitration, where you and the merchant both present your cases. Regardless of the outcome, you will likely have to pay a few hundred dollars in arbitration fees.

As far as you're concerned, the only action you need to take is step one, at which point the bank will take care of everything else behind the scenes. (Unless the case gets to step 5, at which point you are back involved.) Call your bank's customer support line to initiate the dispute.

How to Dispute a PayPal Payment

If you're using PayPal and you want to dispute a transaction, follow these steps:

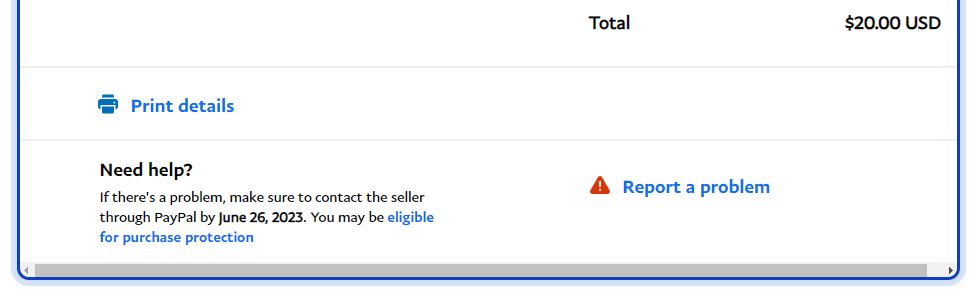

- Log into your PayPal account.

-

Go to Activity, find the transaction in question, expand it, and select Report a problem.

- You can report "issues with your purchase", "issues with the seller", "billing errors or issues with subscriptions", and "unauthorized activity in your PayPal account". Select the appropriate issue and, in the following steps, provide as many details as you can, including a description, links, and the amount you expect to get refunded. Follow through according to the rest of the instructions to lodge your dispute with PayPal.

-

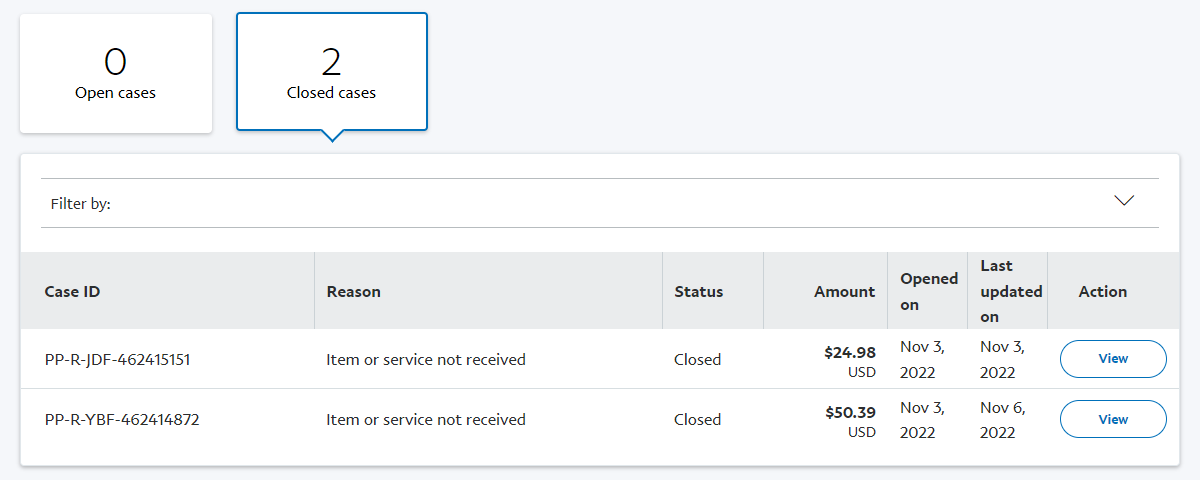

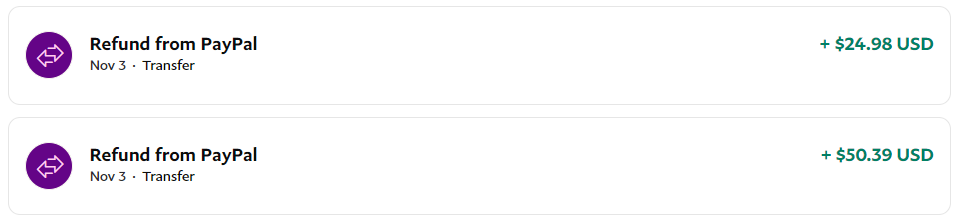

When all is done, your case will show up in PayPal's Resolution Center.

-

PayPal tends to side with buyers over sellers, so there's a good chance your dispute will be honored, and you'll receive a refund.

PayPal requires that you open the dispute within 180 days of the purchase date.

Watch Your Credit Card Statements and Get Your Money Back

Being able to dispute fraudulent purchases is just one of the many benefits to using credit over debit or cash, and that's why we recommend buying big purchases on a credit card when possible.

Whenever you can, choose PayPal, as it adds a layer of security to your credit card purchases and makes it easier to receive refunds when something does go wrong. And if you're using PayPal, you can take further steps to increase payment security.