No one likes paying taxes. But we have to do it. Nonetheless, there are a few easy ways you can minimize your tax burden. Nothing so complicated -- or morally questionable -- as the Double Irish or Apple's tax dodging. Just a few simple things you can do to save money.

These seven tips will help you get your taxes in, save money on them, and get your refund faster. So get started today! (And share your best tax-filing tips in the comments below.)

1. File Early

In 2017, taxes are due on April 18th, which means you have three extra days to file. But that doesn't mean you should take advantage of them. In fact, you should start preparing your taxes as soon as you can. The more time you have to look at the details of your tax return, the more likely you'll be to find deductions that you can take advantage of.

Just getting started on your taxes is often the hardest part. Make a point to begin the process sooner rather than later. You'll be less likely to make errors and more likely to save money.

2. Do Your Own Taxes

Unless your taxes are exceptionally complicated, preparing them yourself is the way to go. With all of the online and offline tax tools you can use, there's no reason to pay a few hundred bucks to have someone else prepare your documents. Many tools are free, and they all help you get your taxes prepared as quickly as possible.

I used FreeTaxUSA to file my own taxes this year, and I'll be using it to show examples of some of the things I mention below. Like many options, it offers free filing for federal returns and affordable fees (in this case, $13) for state filing. That's a big savings over having someone else do it.

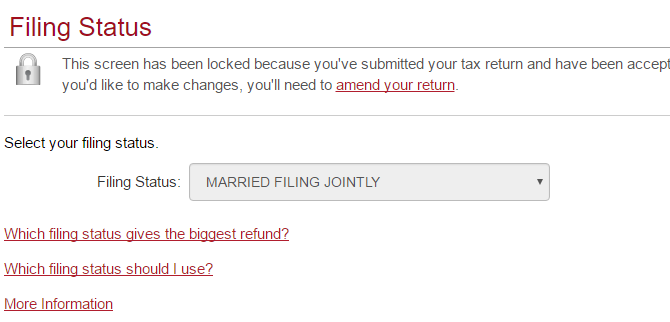

3. Consider Your Filing Status

If you're married, there's a good chance you file jointly with your spouse. And in many cases, that's a good idea. But depending on your circumstances, it may make more sense to file separately. For example, if both spouses earn about the same amount, filing together might put you in a higher tax bracket. Your deductions might make a difference in how you want to file, too.

If you have complicated taxes, you should look into optimizing your filing status. Some tax software will help you figure it out to see which is your best option. If your chosen software isn't much help in this area, you can always contact a tax professional or just fill out two different returns to see which results in a lower tax burden.

4. Report Accurately

With more and more people doing freelance and contract work, reporting income can be tricky. Take the time to make sure that you're reporting accurately. You might need to collect a lot of different forms or consolidate some tracking spreadsheets, but getting everything organized before you start will be a big help.

Even if you don't receive tax forms from your freelance clients, you still need to report your income. Interest, dividends, retirement account disbursements, small business income, rental income, online sales, even the money you earned from gambling needs to be reported. Reporting all of this accurately and completely is crucial in avoiding being audited.

FreeTaxUSA also points out that there are a number of types of income that you don't need to report. These includes things like life insurance proceeds, child support payments, and inheritances. Take a look at the list before you get started so you don't waste time reporting something you don't have to.

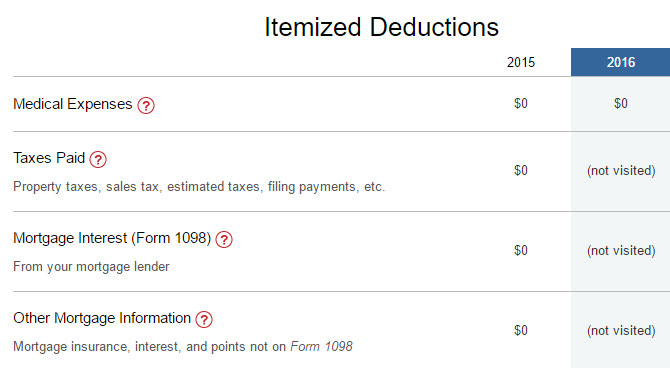

5. Itemize Deductions

The standard deduction can range from $6,300 to $12,600. And for many people, claiming the standard deduction is the best way reduce your tax burden. But if you itemize your deductions, and look at everything you can use to reduce your taxable income, you might find that you can pay a little less. Even if you don't, you won't risk the chance that you missed something.

FreeTaxUSA walks you through each step of the itemizing process, and gives you details on the various types of things you can deduct from your taxes.

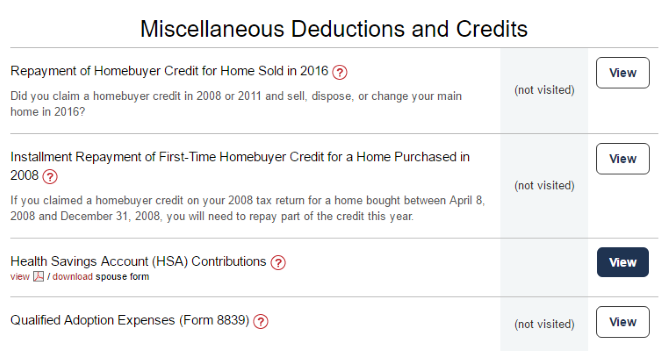

There's also the Common Deductions page that lets you deduct things like tuition, student loan interest, and the Home Energy Credit. Finally, you can select from a wide variety of other deductions on the Other Deductions/Credits screen.

6. Use Refund Recommendations

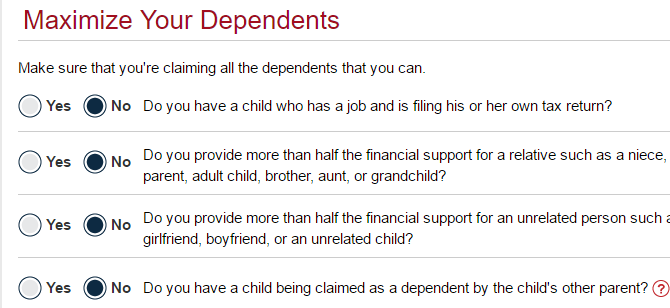

Many pieces of tax preparation software offer a set of recommendations for maximizing your refund (or minimizing your debt). While they won't apply to everyone, it's always a good idea to look them over.

When I went through the FreeTaxUSA Refund Maximizer, it asked me questions about dependents, retirement accounts, home ownership, tuition, and a few other things. While I had already identified all of the deductions I could take, there were a few that would be easy to miss, like needing to move for your job. Using a service like this could save you a few hundred bucks or more if you missed something the first time around.

7. File Online

According to efile.com, 91 percent of tax returns were filed online in 2016. That's a huge proportion, but it also means that millions of people are still mailing in their returns. If you're one of those people, it's time to switch to digital filing. Not only will it save you time, but it will also help you get your refund faster.

You might be nervous about online tax security, but you needn't be overly concerned. As long as you follow common-sense precautions, your financial information will be safe. And even moderately complicated taxes can be filed for free online, so you really don't have many excuses not to.

Don't Pay More in Taxes Than Necessary

If you don't follow the steps above, there's a good chance that you'll pay more in taxes than you need to. If you choose the best filing status, accurately report your income, maximize your deductions, and file online, though, you can be confident that you're saving as much as possible. Taxes can be complicated, but using the tools that are available can make the process much easier.

Which tools do you use to file your taxes? What advice do you have for people looking to minimize the taxes they pay? Share your tips and advice in the comments below!