Let's face it: creating and managing a budget that actually works can be really hard, and that's why so many people don't have one. Thankfully, there's a very simple and easy way to manage your weekly and monthly budgets using Trello.

If you're unfamiliar with Trello, it's a web app that lets you manage anything using lists of "cards." Cards can contain any information that you want, and you can easily move cards around from one list to the next with a click and drag of the mouse.

So how can lists of cards help you build and manage a better budget? The secret comes from using this convenient "card shuffle" to manage your flow of money from income all the way down the line to your savings.

Starting Your Trello Budget

Most standard budgets include starting out with your income on the top line, listing all of your expenses and bills below it, subtracting them out, and assigning whatever you have left to savings or discretionary spending.

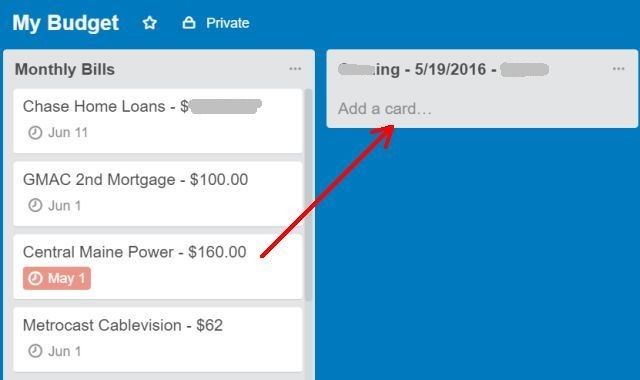

There are a lot of problems with this approach, the most important being that it's very difficult to manage when you receive bi-weekly paychecks and need to track where that income is going. Trello can help, but first you need to create an initial list that includes every single one of your fixed monthly bills -- things like mortgage payments and utilities.

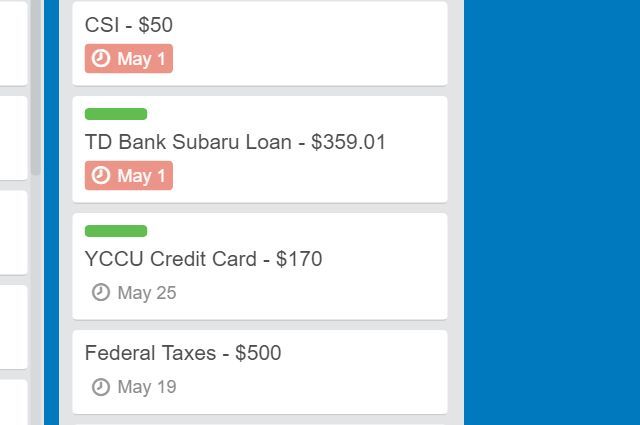

Make sure to include due dates for each of these bills so you can easily see which ones are due soon or in the distant future. Trello also features a nice bright red highlight on due dates that have gone by or are coming up soon.

Next, you'll create a list for each the paychecks you will be receiving. Title these lists with the source of the income (probably the name of your employer), the date you'll be receiving the check, and the amount.

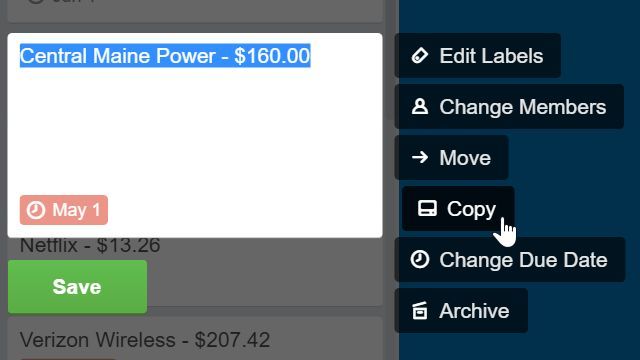

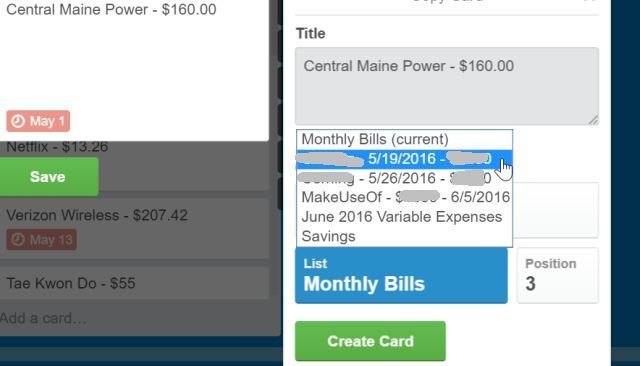

Then go through your expenses that are either past due, or due soon, and copy those.

When you copy the bill, you'll have the option to place the copy in a different list. Select the paycheck list that you've just created and choose Create Card.

Now you have a list for each of your paychecks for the coming month. Using the approach above, you can allocate which check will go toward which bill based on the due date of those bills.

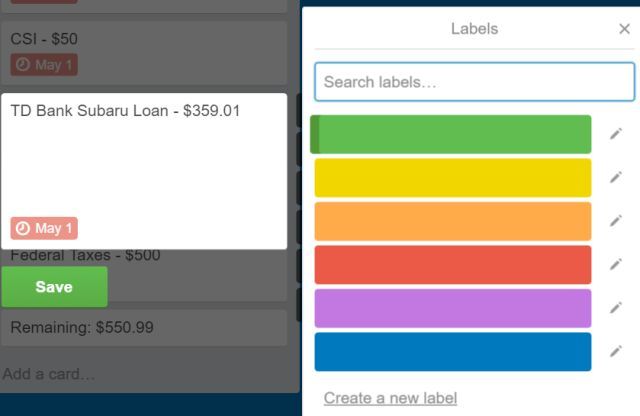

Track Paid Bills with Labels

One of the more useful features of Trello is the ability to label cards. In the area of budgeting, this is really helpful for tracking the bills that you've already paid this month. When you pay a bill, just click the card and select Labels.

In my case, I usually label the ones I've paid with green.

If you want to, you could flag the bills that you can't pay right away, and need to be late on, with something like yellow or red. This way, when you get your next paycheck, you'll know which ones to go after right away.

How Much Is Left After Bills?

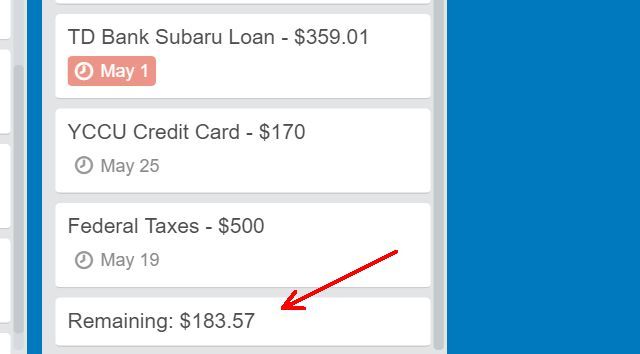

Once you've allocated those individual bills under the income lists, it's time to figure out how much of those paychecks you'll have left after you pay the fixed bills. Unfortunately, Trello doesn't have an automatic calculation feature, so you'll need to open up the calculator utility on your computer and subtract them out yourself. Create a card at the bottom of the list showing the amount remaining.

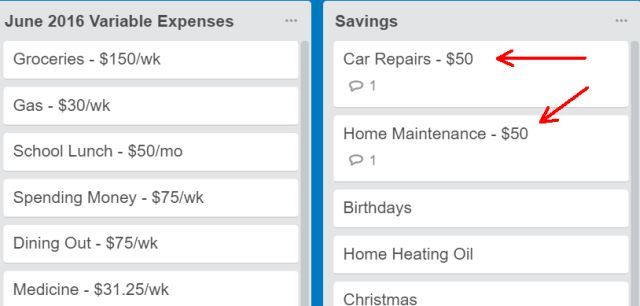

Now you know what you've got to play with for remaining variable bills like groceries, gas, dining out, and other expenses.

On the right side of your income lists, you'll want to create another list with all of your average variable monthly expenses. If you have a hard time estimating what these come to every month, you can easily figure it out by exporting your bank statement for the past 3 months to Excel, and spend some time sorting all of your expenses into categories.

Sort those by category, and add everything up by category for each month. Average what you typically spend in each category over the past three months, and use that number for budget items in the variable expenses list.

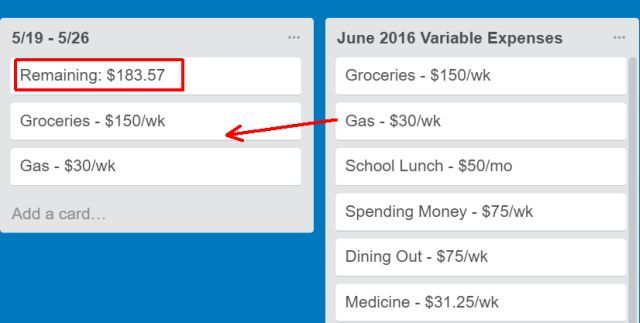

Now, in between your variable expenses list and your income lists, you'll want to create a list for each two-week period of the month that represents the time between each paycheck. The top of this list should be a copy of the "remaining amount" card you calculated just a moment ago. This is your starting point for making sure you have enough left after paying bills, to pay for things like groceries.

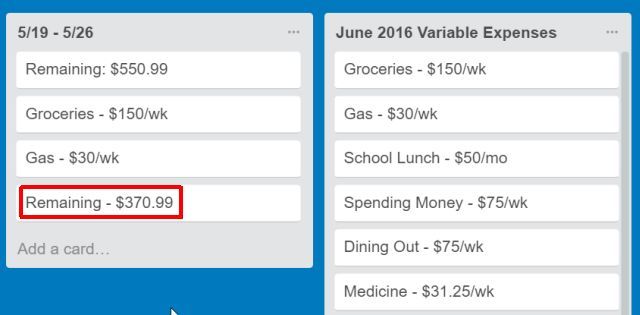

As you can see from the image above, it didn't take me long to figure out that I had allocated too much to pay fixed bills, and there wasn't enough left for the week's expenses. So I went back to the bill payment list, removed a couple of big bills (they'll just have to be paid late), recalculated the remaining amount, and put that new amount back into the bi-weekly list.

Now it's clear that I have enough for groceries and gas, with almost $400 remaining. If you know you're going to want to dine out during this two week period, copy the "Dining Out" card over to the week's list and subtract. If you know you're going to have to refill your prescription, copy the "Medicine" card over to the week's list and subtract.

Organizing Your Savings Plan

Once you've got all of your bills and variable expenses for the two weeks between this paycheck and your next paycheck out of the way, you know how much money you have left for your savings plans.

The "Savings" list will be the last list in your Trello budget. This will be a list of things that you hope to allocate remaining funds to. It can be a vacation, a new car, or an additional retirement savings plan (maybe a Roth IRA in addition to your existing 401k). Don't forget to save for those things that you need to be ready for, like car repairs or home heating oil.

At this point, you need to take the remaining amount once you've allocated the variable expenses for the next couple of weeks and distribute that amount across as many of the savings items in the Savings list as possible.

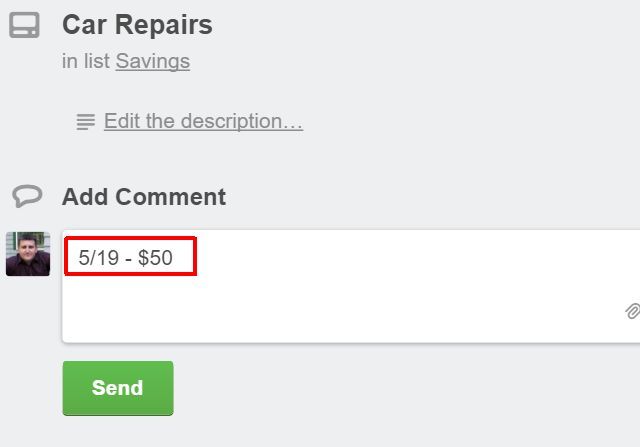

You "allocate" an amount by adding a comment to that card with the date and the amount that you've added. Then, modify the title of that card so it shows the total amount that you've saved so far.

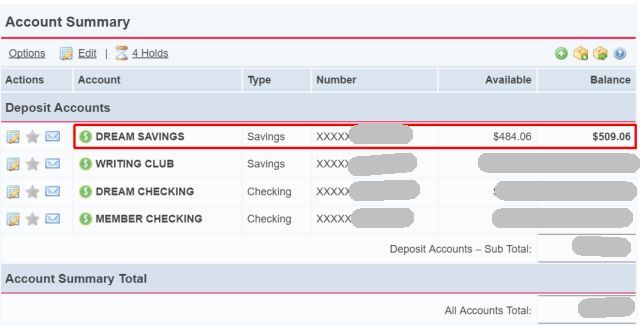

Every time you allocate a portion of your paycheck to the "Savings" list, you should actually go into your banking account and transfer that savings total to your savings account, so you won't "accidentally" spend that money on other things that aren't in your existing budget.

As you can see, the process of using Trello for budgeting is fairly simple. It's a flow of funds from left to right from one list to the next until what remains ends up in your savings account -- as it should be.

The nice thing about this system is that it is much more fluid and intuitive than a spreadsheet with a big wall of numbers. Trello lets you organize bills, income, variable spending, and saving in ways that let you see where all of your biggest spending is. This gives you an opportunity to see if you can shrink those cards that keep draining so much of your income every time you get paid. It also shows you where you could be saving more, because each of your savings goals has a clear balance that you can use to show progress toward those goals.

Have you ever used Trello, or a tool like it, to manage your budget? Share your experiences and your own pros and cons about using Trello for budgeting, in the comments section below.