There's no "right" way to approach money management. What works for you might not work for me, and vice versa. That's why it's called personal finance -- the point is to take good advice and apply it in ways that prove beneficial to you.

If at the end of the day you save more money and take control of your finances, it doesn't really matter how you got there, right? In this post, we explore seven different budgeting apps and why you might prefer one over another depending on your own personality type.

For the Control Freak: You Need a Budget

You Need a Budget (YNAB) quickly made a name for itself in 2014–15 and is now one of the industry-leading apps for personal finance and money management. It's an incredible bit of software that really delivers on its promises.

The downside is that that power comes with a lot of complexity. There's a learning curve here, and it can be difficult at times, especially if you've never touched a budgeting app before. But if you're looking for flexibility and are willing to tackle that curve, this is the app for you.

YNAB is all manual, so you keep full control over your money. You can import data from other sources, but that's about it as far as automation goes. I find the hands-on approach to be enlightening. You'll see where all of your money goes, and your eyes will be opened.

Download You Need a Budget (free trial, $50 per year)

For the Never-Saver: Digit

Do you tell yourself that you're going to stash away a chunk of every paycheck only to find that your bank account is empty by the end of the month? Does this happen every month? If so, Digit was made for you.

This app automates your savings, which means a hands-off approach that minimizes stress. After a while, you won't even notice it working in the background -- instead what you'll see is a steady building of savings that you wouldn't have had otherwise.

All you do is connect your bank account. Digit will then analyze your spending patterns to locate small chunks of money that you can save. Every few days, a little bit of money is automatically transferred into your Digit account. When you need the money, Digit will transfer it back to you within 1 business day.

Download Digit (free)

For the Goal-Oriented: Goodbudget

A goal-oriented approach to personal finance can be super effective, but only if you have a keen sense of what's important when setting goals. An abstract goal without concrete numbers won't help you.

"I will stash away $100 every month to a vacation fund" is a much better goal than "I want to be rich" because it's actionable. It's also easy to see when you're making progress.

That's why Goodbudget is an effective app. It's based on the envelope method of personal finance: you create different "envelopes" with various limits and every paycheck gets divided into those envelopes. In other words, every paycheck takes you one step closer to your goals!

Download Goodbudget (free, premium option for $45 per year) [No Longer Available]

For the Minimalist: Level Money

For many folks, finances are dreadful because they're so chaotic. Lack of organization can make money management feel like an overwhelming task, so instead of facing it head on, you end up procrastinating -- and if you procrastinate too long, you lose control of your finances.

The good news is, Level Money is as easy as it gets. It takes the aforementioned concept of envelopes and simplifies it, leaving you with only one category to worry about: "spendable." Any non-bill expenses you have can only come out of this spendable category.

You connect your bank account so everything is automated, and the result is that you only need to track a single number. It's so minimal that you won't feel overwhelmed or disorganized anymore, but you can always add more categories if you feel inclined.

Download Level Money (free)

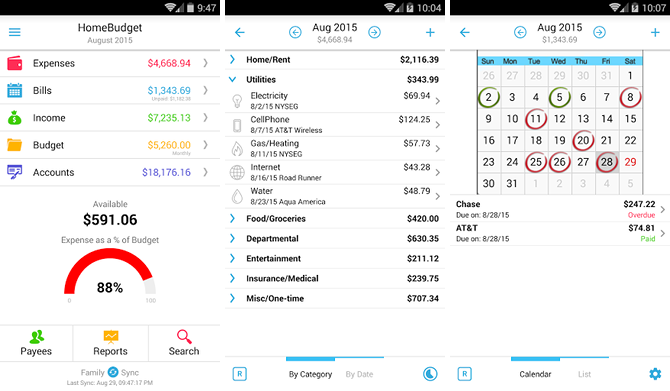

For the Family: HomeBudget

Like YNAB, HomeBudget is a manual budgeting tool. You have to input your income and expenses on a per-item basis, which is less convenient but comes with the benefit of making you highly aware of your financial situation.

It has two distinct features that make it worth using: automated sync across all of its supported platforms (Windows, Mac, Android, iOS, and Kindle) and family sharing (which lets multiple people coordinate shared bills and expenses). These features are great for managing an entire household's finances.

One other nifty feature is the ability to create charts and reports based on spending activity, which can be extremely useful for identifying and plugging money leaks.

Download HomeBudget (free trial, $5–$20 for paid versions)

For the Spendthrift: Mvelopes

Mvelopes is one of the best apps for developing better spending habits. Like Goodbudget, it's built on the principle of using envelopes to control your spending in various areas of your life.

What I like about Mvelopes is how simple it is to use. You can go from installing the app to setting up a financial plan in under 10 minutes. It can auto-pull information from your bank and credit card accounts, and the interface is simply great.

But the best thing about Mvelopes is that it's more than just a budgeting app. If you really can't rein in your spending, Mvelopes offers financial coaching.

Download Mvelopes (free, premium option for $95 per year)

For the Lazy or Busy: Mint

Mint is so popular and effective that we'd be remiss to leave it out of this article. This tool is designed specifically for beginners who hate dealing with money-related responsibilities. Is it the best app out there? Not necessarily. But it's a wonderful "gateway" app.

Most of Mint is automated, so you can be up and running within minutes. It's perfect for those who are too lazy or too busy to be hands-on with their money, and its learning curve is much easier than some other apps.

That being said, we don't recommend being "lazy" with your finances. Mint is a good stepping stone that will enlighten you to where all of your money goes, and you should become more and more involved as time goes on.

Download Mint (free)

Which Budgeting App Do You Like Best?

You don't have to use all of them. In fact, you'd do yourself a disservice by using more than one. It's better to find one app that suits your needs as much as possible, and then master that app.

As for me, I started off on Mint for several years before hopping between options like Mvelopes, Goodbudget, and Level Money. When your needs change, don't be afraid to change apps accordingly.

Which budgeting app are you using right now? What do you like most about it? Do any of the ones above interest you? Share your thoughts with us in a comment below!