Money is something that we all want more of, but to get more of it requires us to do two things - bring more in or spend less. Preferably both. But how do you do that? Budgeting plays a huge role in helping to keep that money in your pocket, and thankfully there are a lot of online tools to help do this.

Now, should you use all of these? Probably not, as you might be more confused than you already are. The purpose of this article is to open you up to some websites and financial web tools that you might not have thought of or known about before. It’s also for helping you expand your thoughts about finance tools – there’s a lot at your disposal online and you should be taking advantage of them.

Let’s Get Mint.com Out Of The Way

Don’t let this heading scare you away from Mint – it’s great! It’s what I use, personally, and it’s owned by Intuit, a very reputable financial company known for products and services like Quicken, QuickBooks and TurboTax. We’ve covered Mint quite a bit on MakeUseOf and it has built up a solid reputation and become very well known. However, I couldn’t not mention it in this article.

http://youtu.be/rK6WLHNYjwM

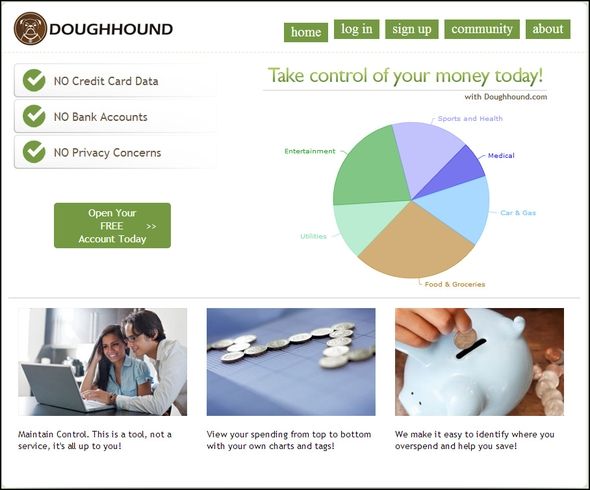

Doughhound [Broken URL Removed]

Doughhound is a nice, simple financial web tool that not only is easy to use, but has a unique little story behind it. Started by two college graduates Danny and Jillian, who are now married, Doughhound was inspired by the need for a financial tool better than your typical spreadsheets.

Below is a blurb from their “About us” page:

Now that we are living our dream we want to help other people to live theirs. Doughhound is a tool that anyone can use to really save money and reach your financial dreams. This isn't another site for tracking your bank account information or your credit card bills, this is for real people who have real goals. This is a tool for you to keep track yourself so that you can make the right decisions and think about your spending as you're spending, rather than looking at a worthless report a month later.

This is a tool for you.

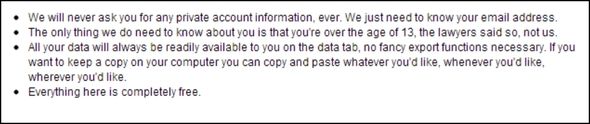

You might be asking "how is this site different from all of the others?" And they explain:

At the top of the page you have there are several tabs for the user - Account, Budget, Tags, Data and Community.

Above is the Budget page.

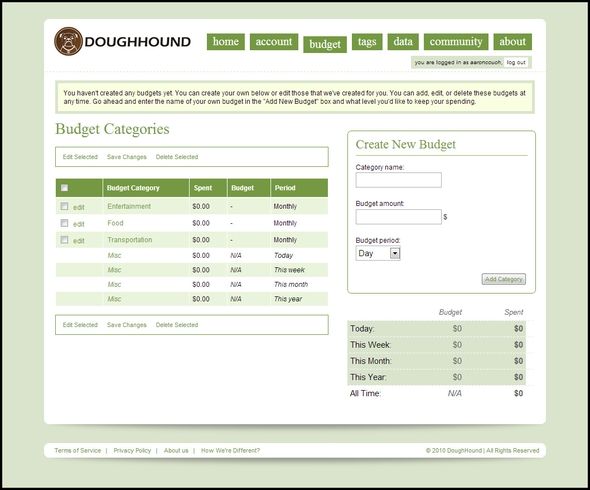

The Community (above) is a nice touch and really does help this site stand out amongst others. In many ways, it gives you that small town kind of feel. Perhaps it doesn't have the latest and greatest features – yes, it’s simple (and they acknowledge that), but it has two people behind it who are passionate about it and have built a community who is too.

And anyone who is on the journey to improve their finances knows that sometimes having a little help and support can make all the difference.

http://youtu.be/zVuLHy-IDe0

For more information, check out their tutorial, Frequently Asked Questions, or Contact them through email or Twitter account.

Yodlee

Yodlee, which used to, but no longer powers Mint’s data aggregation tools, is a website with a broad vision aiming at both consumers and businesses. This section, however is only focused on the consumer aspect of the website. Yodlee presents itself in three not-so-uncommon, but-good aspects - Convenience, Control and Security. Again, these are pretty generic, but if followed through are without a doubt the three things we all want in an online personal finance tool.

Below are some features of Yodlee:

- View and manage all your accounts in one place.

- Accessible online or via the iPhone, BlackBerry and Android apps.

- Securely transfer funds anytime, anywhere.

- View your income and expenses in one place.

- Know where your money goes.

- Get the tools you need to control your budget and meet your goals.

- Track spending and analyze expenses.

There is a series of videos, accessible through the Media link, to help you learn how to use Yodlee and include the topics of linking accounts, viewing transactions, expense analysis, managing categories, monthly budgets, saving for a goal, net worth and more.

Below is the introductory video.

http://youtu.be/B8MKPtNaJnM

For more information check out the Yodlee blog, contact them or follow them on Facebook and Twitter.

BudgetPulse

BudgetPulse isn't a very well-known tool in this game, however it has been covered by a wide range of popular publications. There are many first impressions of this website that I tried not to let affect my opinion – I almost excluded it from this list. But something stopped me and it was the fact that it is pretty easy to use and despite it’s slightly aged interface, it isn't "sketchy" like some websites of this type.

BudgetPulse prides itself in being simple and not connecting to your bank account, if that is something you’re leery of.

Once you create an account you’ll be prompted to do four things:

- Set your preferences.

- Establish your accounts.

- Enter your transactions.

- Define your budget.

Once you do that, you will be able to get the full amount of help from BudgetPulse

I encourage you to take a look at BudgetPulse and see if it’s something that can help. It might be easy to be turned off by its inconsistent presence on Twitter and Facebook, or its mediocre how-to video, but not knowing how to use social media in a business doesn't necessarily equal a poor product or service. I think you’ll learn to appreciate it.

For more information check out the BudgetPulse blog.

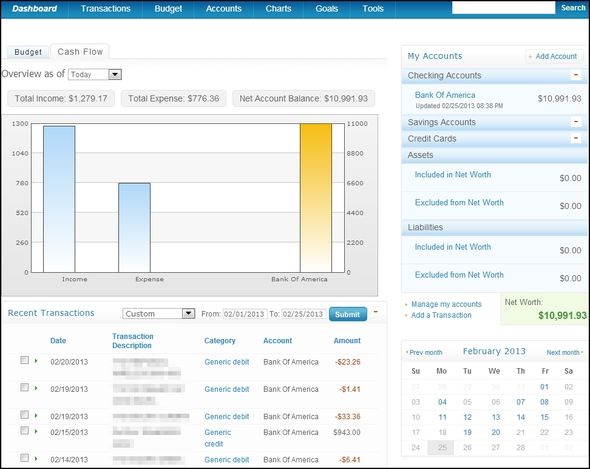

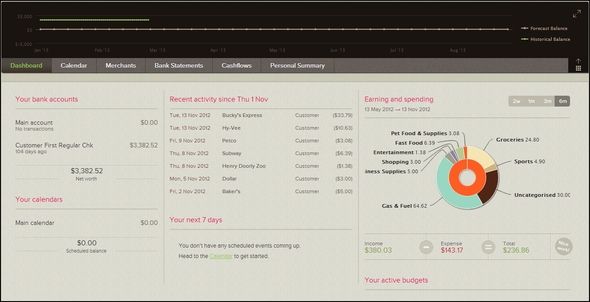

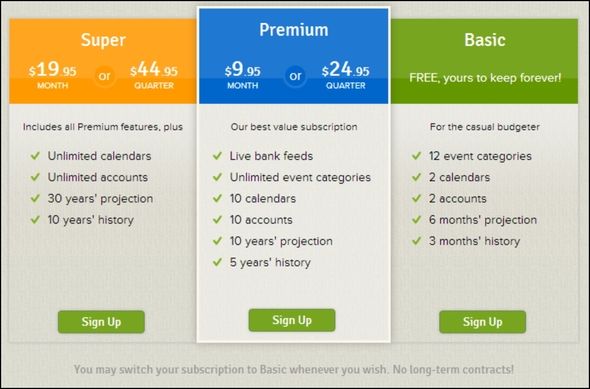

PocketSmith

If you’re looking for the perfect "Mint.com replacement", then PocketSmith might just be it. This New Zealand-based company has a modern website that is welcoming and intriguing. And not only are the looks great, but the features are too.

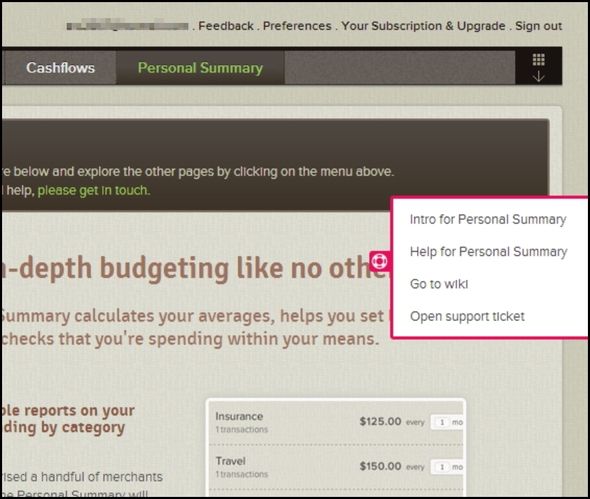

The setup was quick and seamless – time matters. I wasn't asked a bunch of meaningless questions, but instead I only had to enter the information that mattered. The ease of use isn't just in creating an account though, all throughout the website I found little things that make it not only easy, but enjoyable to use. Things like a little pink box on the side for different pages that offers helpful information if hovered over, but stays mostly concealed until "prompted".

Just simply follow the instructions for setting up an account and I think you’ll be very pleased with the outcome. PocketSmith, like all the others mentioned in this article, is free, but it does have a couple of upgrade options for a decent price.

After checking out the website, if you have any questions you can contact them through Twitter, Facebook or their contact form.

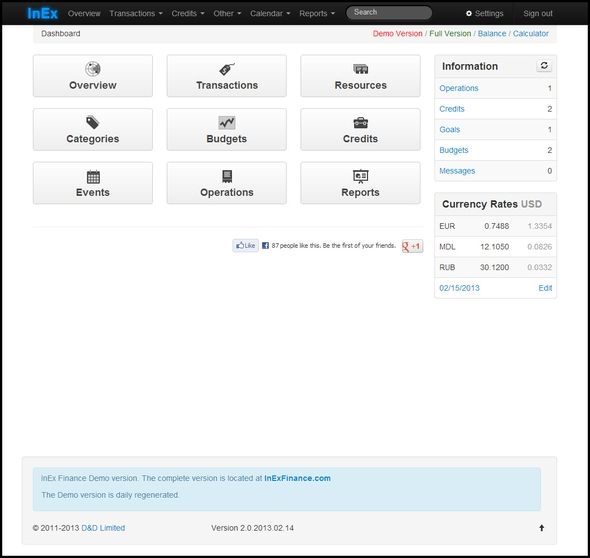

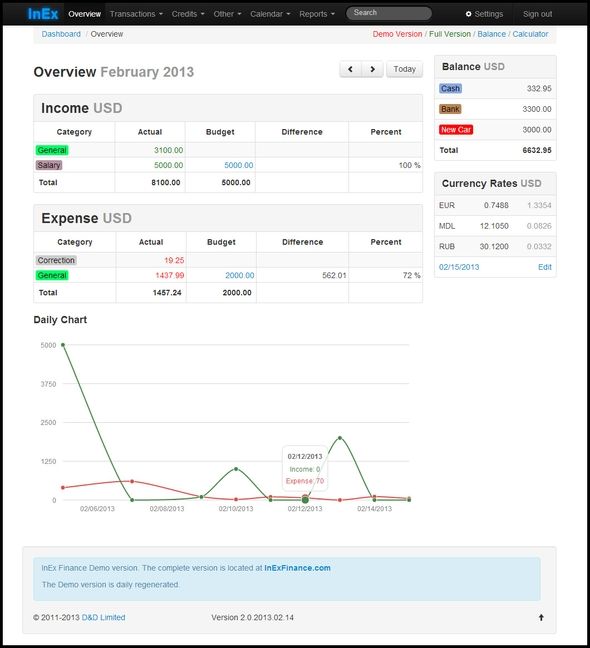

InEx Finance

InEx Finance is an excellent web tool that excels in several areas from global support to easy budget planning to comprehensive reports and a lot more. One great thing about InEx Finance is that you can truly and easily demo the product without creating an account first. This is something that I hadn't found yet in a service and perhaps it was overlooked, which is my point exactly – InEx makes it simple to find and use the demo. Why is this important? Because that means their product will be easy and simple to use as well – and it is.

Below are a couple screenshots of the demo, but I highly recommend you try it out yourself.

Dashboard

Overview

InEx Finance supports mobile use as well. If you have an Android-powered smartphone or tablet, you can use the app. Or if you have WebOS, BlackBerry, Windows Phone or iOS, you can use the mobile web version of the site, which also works for Android too.

For more information on InEx Finance, be sure to check out their How To section and blog. If you have any questions you can contact them through Facebook or email.

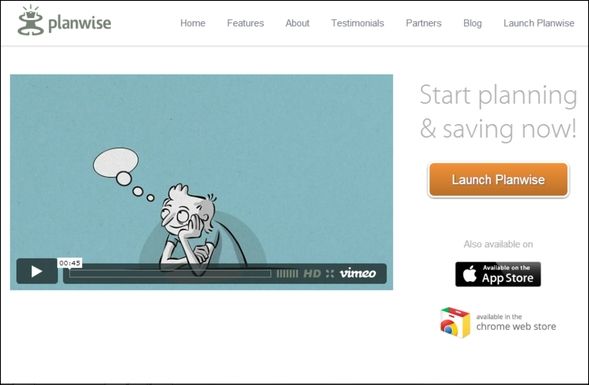

Planwise

Planwise knows not only how to create an excellent financial tool, but also how to create an intuitive, yet simple website. It is a breeze to look through and find out about how to use Planwise.

There are, without a doubt, some excellent features here with Planwise:

- Smart Alerts.

- Adding/Changing Plans.

- Cash Flow Graph.

- Embed the tool.

- No personal data required.

- Up to a 30 year projection.

Smart Alerts tell you what to do so you can make better financial decisions and save money.

Adding/Changing Plans allow you to compare different combinations and variations of plans to visualize the best option.

Cash Flow Graph allows you to see your bank balance and the end of each month based on the plans you have made.

Embedding allows anyone to put the Planwise on their website, free and quickly.

No personal data required means you can choose to register with your email address or any social networks in order to save your data. No name, address or banking information is inquired about.

30 year projection can be done through smart alerts and graphs which project 30 years forward for excellent planning.

To start using Planwise, simply click the Launch Planwise button in the top right corner. Planwise is also available in the Google Chrome Web Store and in the Apple App Store [No longer available]. You can find Planwise on Facebook, Twitter and YouTube and learn more about them and finances through their blog.

https://www.anrdoezrs.net/links/7251228/type/dlg/sid/UUmuoUeUpU60604/https://vimeo.com/54479385

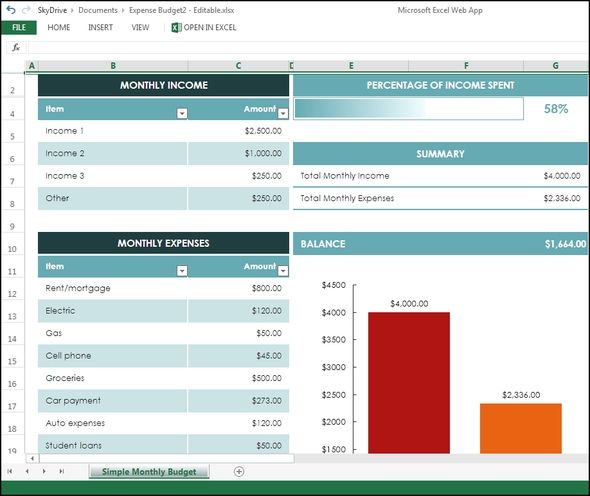

Online Spreadsheets

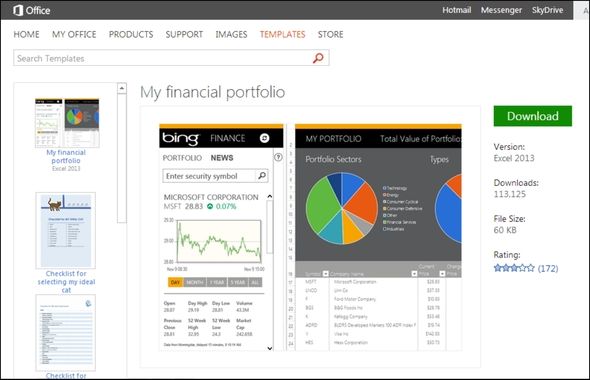

If you’re looking to manage your finances the manual way, one of the greatest resources we have at hand is the ability to create spreadsheets, online, for free. Two of the most popular Microsoft Web Apps and Google Docs have this capability. Sure there are others, but these are definitely the best and have the widest range of features and compatibility.

There are templates all over the web that you can import and use to manage and track your finances.

Your Local Bank’s Online Tools

Perhaps you don’t have a local bank and you just bank online only. If so, you probably already know about all of those features and tools at your disposal. But if you have a local bank and haven’t considered banking online or perhaps you do, but aren’t taking advantage of everything they have to offer, it might be time to.

There are some incredible financial web tools available to us, granted they do vary by bank. Such tools include electronic statements, instead of using paper and receiving them through the mail, or online budgeting software. My favorite though are the apps that allow you to take a photo of your check and deposit it. Not all banks have this feature, but it’ll become mainstream soon enough.

Conclusion

This is in no way a complete list, as there are many other financial web tools too, but as a writer I had to pick the ones I felt would benefit you the most while considering length. Also, these financial tools are only helpful if you use them consistently and honestly. They can be a great asset, but you must remain faithful to your financial goals and budget, otherwise an article like this is completely pointless.

Do you use any of these? If so, what experiences have you had with them? If you use another web tool and feel it should have made the list, we'd love for you to share about what it is and why you feel it deserves recognition.

Image Credit: Modern technology illustration with computers and business person via Shutterstock