Don't kid yourself: everyone needs a budget. And once you're living as a family, it becomes even more important to track where money is coming from and where it's going. You have responsibilities, after all! The good news is that it's never too late to start, and there are free, easy tools to begin budgeting.

In the past, we have looked at some useful Excel spreadsheet templates for family budgets. Naturally, the internet has many more to offer, and that's a good thing. The best budget is the one you're going to stick to, so browse these spreadsheets to find the one that you think suits your needs.

Remember, all these templates are completely free and will work in Microsoft Excel, Google Docs, OpenOffice, or other spreadsheet programs.

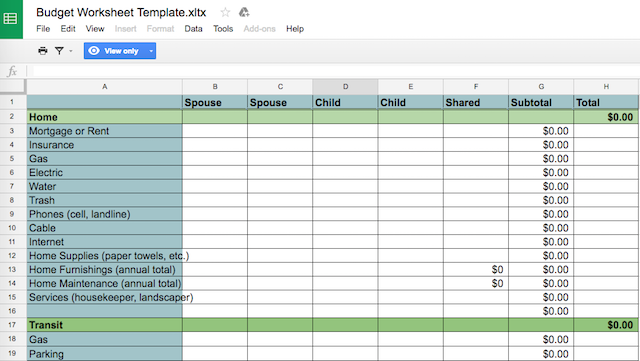

Family Budget Template from The Personal Finance Lawyer

Best for: someone making their first family budget.

If this is the first time you are making a budget for your family, then this is probably the best template to begin with. It's an easy but fantastic budget calculator. Read the guide to the spreadsheet before you start, so you know what kind of expenses should go where. It's a good starter sheet, since it prompts you with common expenses.

The sheet is broken into columns for spouse 1, spouse 2, child 1, child 2, and shared expenses. The rows track monthly costs for items like rent or mortgage, cell phone plans, car insurance, gas, and other common expenditures. There is also a separate category for annual expenses, like life insurance, travel, retirement savings, and so on.

Just fill up all the boxes where applicable, along with both spouses' incomes after taxes. The spreadsheet will quickly tell you the difference, so you know whether you need to cut down somewhere.

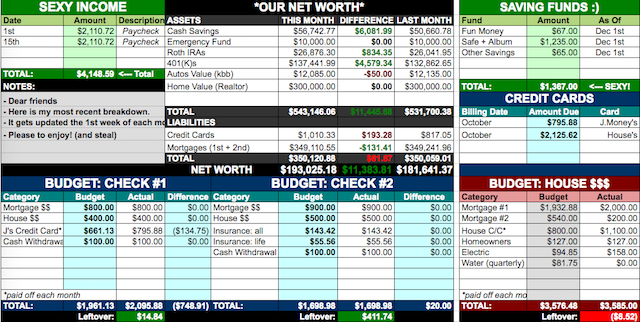

Financial Snapshot & Budget from Budgets Are Sexy

Best for: two partners with jobs, and no kids.

J. Money is one of the financial advisors you should follow on Twitter, and this little template makes it clear why. Although the spreadsheet isn't intended as a family budgeting tool, it can easily be modified to do just that for DINK (dual income, no kids) couples.

It's meant for one person and his/her household, but the spreadsheet has space for four income slots, so you can accommodate both people easily. There's enough space left in the budgeting slots to add entries for another person, too. Put it all together and the main screen acts as a wonderful snapshot of your entire financial situation for the month.

Scroll down and you'll see that J. Money has included simple explanations for what you should fill where. Read the full blog post for more details.

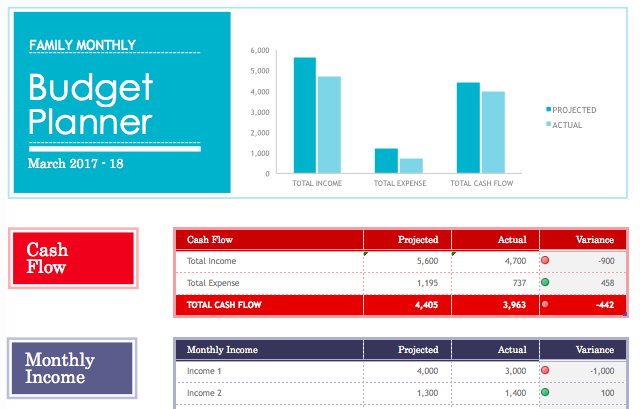

Family Monthly Budget Planner from BudgetTemplate.Net

Best for: learning how to budget with projected vs. actual costs.

Like the starter sheet from The Personal Finance Lawyer, this one is also ideal for beginners. But where the Family Monthly Budget Planner differs is that it has even more prompts, and two sections for each item: projected expense and actual expense.

Here's a quick rundown of all the categories you have to fill out: cash flow, monthly income, housing expenses, transportation, insurance, food, children, pets, personal care, entertainment, loans, taxes, savings and investments, gifts and donations, and legal expenses. Each category spells out the most common costs in that section, so you are unlikely to miss anything.

You are advised to put the projected costs first, and then fill the actual costs when you pay the bill. This way, you'll better understand what things actually cost. It's a recommended way to know if you're in financial trouble, since wrong estimates are the biggest flaws in handling money.

Once you fill up the sheet, the Family Monthly Budget Planner calculates your projected and actual finances, and plots them in a simple-to-understand bar graph. Do it monthly and you'll be surprised at the difference between your projected and actual bills.

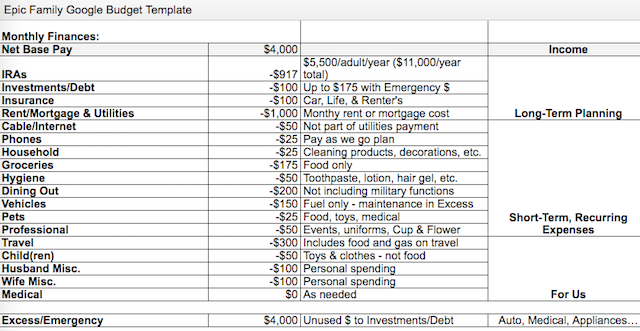

Epic Family Budget Template by The Penny Hoarder

Best for: big picture budgeting.

Melissa Gilliam Shaw says that this template helped her family save 60% of their income in one year. The Epic Family Budget Template may not give you such high savings, but if nothing else, you'll learn the art of budgeting.

Like with the above sheet, you'll have to put in projected and actual costs for each item. So track every payment and scan and save every receipt on your phone. It's important!

At the end of the month, tally everything and see how the numbers pan out. If you don't meet the target, don't panic! The trick to budgeting, as Shaw says, is that you need to look at the bigger picture at all times. If one category is going over budget, you can reduce the expense in another category. If the month of July was over budget, then adjust the difference in August and September. Overspending happens to everyone, but how you react will determine your budget's health.

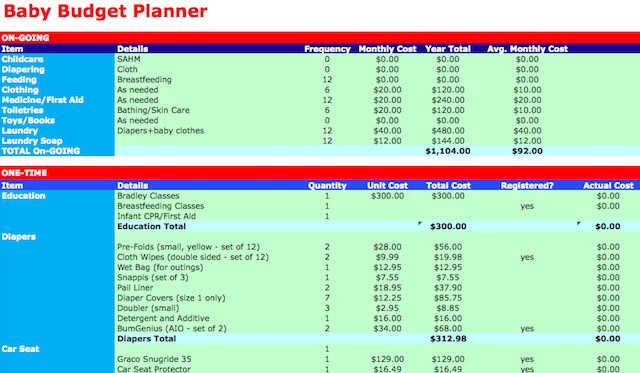

Baby Budget Format 2.0 by Budget Templates

Best for: if you have a baby.

A new baby puts a smile on your face and a frown on your wallet. Don't stress about the finances, it's all about planning a budget and executing it. Budget Templates has a spreadsheet to help new parents save money.

The template smartly breaks down your expenses into two main categories: one-time expenses and ongoing expenses. Again, you'll find sub-categories that prompt you to fill in items, like diapers, feeding, car seat, stroller, nursery, and so on. Just fill the quantity, the frequency (for ongoing items), and the base cost to get a full budget.

The Baby Budget Planner works on an annual basis and not monthly, which makes more sense since the costs for your child will change after each year.

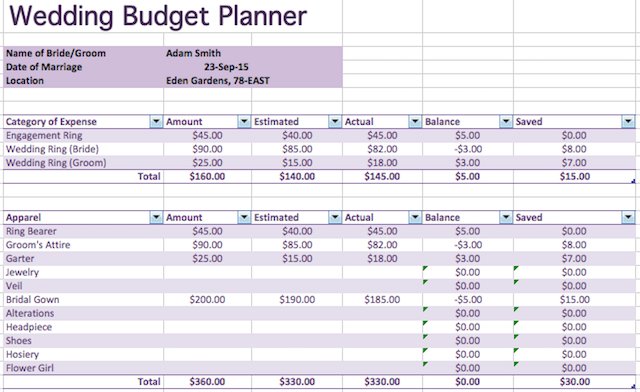

Wedding Budget Planner by Dot XLS

Best for: if you're getting married.

If you're about to start a family by getting married, you need a budget for your wedding. It's not going to be easy, so let Dot XLS's Wedding Budget Planner Template help you out.

Every wedding plan needs a long checklist of things to pay for, like the rings, clothes, decorations, gifts, beauty, ceremony and reception sites, photographer, stationary and printing, transportation, and much more. Almost everything you will think of is already included in this template, and you can just add more things if you need to.

Use the "Estimated" column to fill this template before you start. That way, you have a budget. And whenever you purchase an item, add the actual cost to know whether you're going over the budget or saving some money. Pair this with sites to save money on wedding costs, and you can adjust the balance as you go, without going broke.

Zero Balance Family Budget by Anne Greene

Best for: following money expert Dave Ramsey's plan.

Finance guru Dave Ramsey is known for his philosophy of not having any balance amount when you start your monthly budget, because he says it's wiser to put it away for the debt snowball effect.

YouTuber Anne Greene created a budget template based on this Zero Balance philosophy. It's a little difficult to succinctly explain how to use it, but thankfully, there's a full YouTube video for that. It's 20 minutes long, but it's worth it if you want to implement the Ramsey way into your life.

I'd recommend using this template if you are already budgeting regularly, and now want to start controlling and automating your money. By smartly dividing cash transactions, online payments, and automatic withdrawals, you'll be able to manage a better budget.

Apps vs. Spreadsheets

Spreadsheets are fantastic budgeting tools, but not as mobile-friendly as some of the best budget apps. But no matter which you prefer, there are some great options to help you keep making progress toward your financial goals. Everyone has their preferences, and we want to know yours!

Do you prefer to use smart apps to manage your budget or do you rely on a good old Excel sheet for your finances? Or is using both together the best option -- apps for daily tracking and spreadsheets for monthly? Tell us your thoughts in the comments below.

Image Credits:Family Budget by CafeCredit.com via Flickr