Whether you created your own online business or you work in the finance department of another SME, you will be aware that cloud-based accounting has taken off in the last 18 months.

Whilst managing the finances of a small or medium enterprise (SME) used to be fraught with difficulties, the migration of businesses onto cloud-based applications has helped reduce tax mistakes, prevent audits and allowed for a greater collaboration between a business and its accountants and financial advisers.

In an industry that has traditionally been dominated by expensive and resource-hungry desktop programs there are now an ever increasing number of lightweight yet powerful cloud-based apps. If you have you have started your own online business, these accounting apps should be a part of your enterprise.

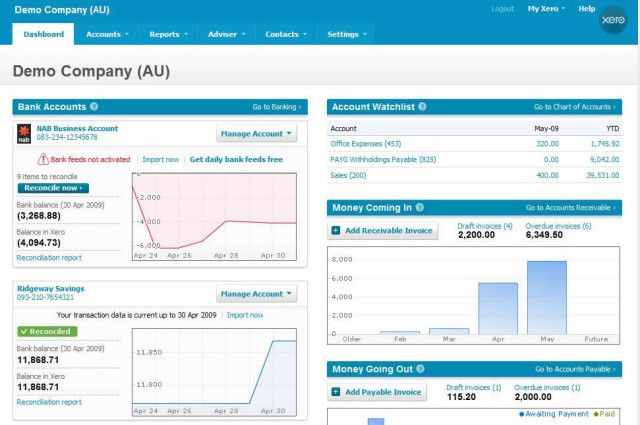

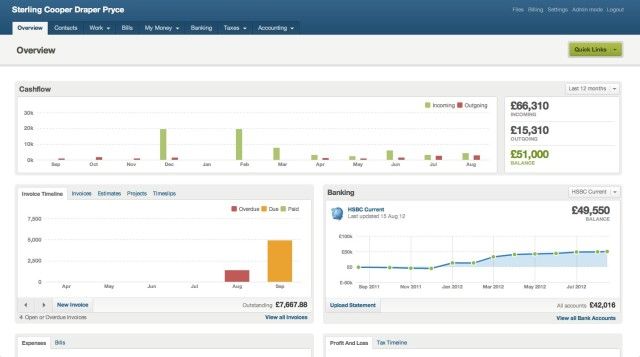

Xero

With 250,000 paying customers in 100 countries, and having recently won a 'Top Choice' award from PC World, Xero is rapidly become one of the new leaders of the accounting software industry. Accounting packages are available between $9 and $180 per month, although the most popular package in the US is the 'Premium 10' for $70 per month.

The software is multi-user, feature-rich and easy to use. The central dashboard gives real-time insight into bank balances, recent sales and upcoming bills, and from there users can manage inventory, create purchase orders, handle expense claims, conduct pay-runs, pay bills, create numerous financial reports and manage their contacts.

Xero also provide an excellent mobile app on both Android and iPhone, and offer 24/7 email support and a detailed online help centre.

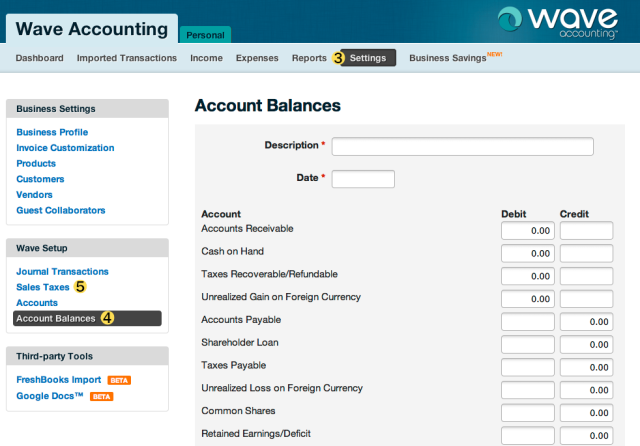

Wave

We recently reviewed Wave in detail. After launching as recently as 2009, the company now tracks 314,000 accounts and 44 million transactions -- with a total value of $134 billion. The app is free, but uses adverts from its beneficiaries in order to support itself.

Aimed at small businesses with nine employees or fewer, the award-winning software has now secured $20 million of investment and developed excellent support for invoicing, accounting, payroll and payments. Unusually for a free accounting app, Wave follows double-entry accounting protocol, meaning both the Chart of Accounts and the Journal entries can be modified.

The final feature which sets Wave apart from its competitors is its ability to connect with your financial institutions and download recent transactions directly into its balance sheets. Even several paid apps won't let you do this, and its inclusion is a real time saver and an undoubted customer-winner.

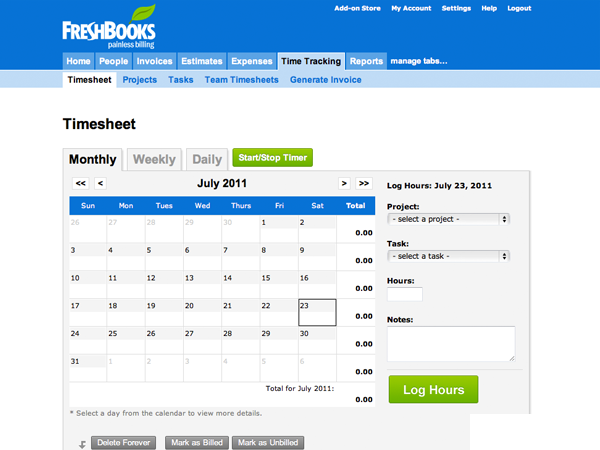

Freshbooks

If you're a financial professional you've probably heard of Freshbooks. The cloud-based software has been operational since 2003 and in that time has grown to serve 5 million users across 120 countries. With an online version as well as free Android and iPhone apps, the software allows you to monitor, edit and update your company finances from anywhere in the world.

Aimed at small and medium businesses, Freshbooks has the simple aim of helping companies get organised and get paid. With online payments, expense tracking, tax assistance, customised invoices, payment reminders and P&L reports, the app can be used as simplistically or as in-depth as the company requires.

The step-by-step wizard makes it easy for non-tech savvy people to quickly use and understand, and there is constant live support should you need to speak to a technician. You can take advantage of a 30-day free trial, where-after the basic business package will cost $19.95 per month.

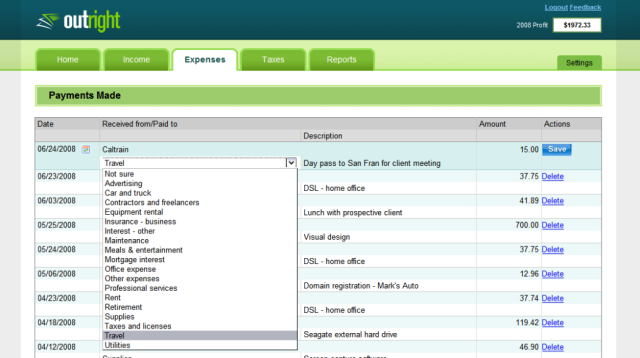

Outright [No Longer Available]

Founded by two former employees of desktop accounting behemoth InTuit, the small start-up was bought by GoDaddy in 2012. The app now boasts 200,000 small businesses using the software and provides bookkeeping for all GoDaddy's small business customers.

Outright should be of particular interest to US-based users thanks to its in-built ability to automatically sort sales and expenses into IRS tax categories.

In addition to typical features such as report production and account management, the software also offers nightly importing of your financial data from banks and credit cards, meaning every morning you will wake up to a complete, organised and up-to-date overview of your company's finances.

FreeAgent

Designed primarily with freelancers in mind, FreeAgent wants customers who lack accounting experience.

The benefit for freelancers and contractors comes in its organisation of expenses and incomes by project -- allowing users to establish a budget for each area and thus display their profitability. FreeAgent also utilises a time-tracking feature, making it perfect for remote workers to control and manage their timesheets within each project whilst the software maintains an overview of the project in its entirety.

The app offers a 30-day trial and thereafter is $20 per month.

Conclusion

As we said, the list of accounting apps is long. For more ideas try FreeDebks (we took a brief look), TAS (our review), and Talibro (our brief description).

Business owners talk about the benefits of web-based accounting tools in the video above. There is no "best" or "winner" in the world of cloud-based accounting. Every business will have their favourite and every accountant will have their choice. Ultimately, the one you pick comes down to how much time you are willing to spend working with the app, what information you need out of the app, and how many transactions you need to process. Some SMEs will discover that free app will do everything they require and others may feel the need to pay for a subscription to gain access to those extra must-have features.

The most sensible advice is to speak with a reputable accountant who already has a cloud-based offering, discuss your requirements and preferences, and see what they believe is the best route for you to take. If that's you, give us your recommendations.

Image Credits: 401(K) 2012 Via Flickr