Upgrades are expensive. It might be a time for celebration, for showing off your new hardware to your friends and family, but ultimately, there is a price to pay, and it's going to come straight out of your bank account.

But it doesn't have to be as devastating as you might think. Bank balances don't have to tumble beyond the overdraft; credit cards don't have to be maxed out.

How you upgrade, when you upgrade, and how you manage your money can all impact on whether you can get the latest tech without skipping meals. It's all a matter of changing your habits slightly.

Case Study: Me

I've been working as a technology writer for five years now, full-time. During that time, I've really struggled, especially in the early days, to get hold of the latest, must-have hardware without it denting my bank balance too much.

The secret to getting the tech I wanted – the stuff I knew I could profit from as a writer - wasn't really a secret at all. It was more of a realization of the situation, and how I could best find my way through it, simply by changing how I bought tech.

It really isn't difficult to make the right choices and not find yourself with red credit card bills every month. You don't have to buy that new iPhone and then wrap it in a jiffy bag because you couldn't afford the case.

Cultivate these 5 habits to make sure you save money and get the gadgets and hardware you've been lusting after.

Research Your Hardware

What do you want to buy? Is it the latest iPhone? Perhaps you have your sights set on a brand new Microsoft Surface Pro 4?

Before buying, make sure you do as much research into the device as possible. Read as much as possible; hardware reviews, specification lists, and find video reviews on YouTube that demonstrate the device in action.

Once you've done this, head – with no intention of buying – to your local consumer electronics store, and have a look at the device. Hopefully they will have a demonstration phone, tablet, PC or camera that you can handle, enabling you to determine whether or not it is suitable for you.

By now, you should know whether or not the device is suitable for your needs.

Ask Yourself: "Do I Really Need It?"

Regardless of whether the hardware you researched and tried out suited your requirements or not, it is now time to ask yourself a very wise question. This is a question you should ask yourself whatever you're buying, from a pizza delivery (pretty pointless if you're short of money yet have the ingredients to make a sandwich) to a car:

"Do I really need this?"

A good chunk of what we own is unused. Do you really want to spend $1,000 on a new tablet or phone that you don't really need? Does the model you're looking at really include a feature that your existing device doesn't, but you see yourself using regularly?

Once you've determined the answer, and decided that you really do need that new gadget, there is a follow-up question: "Can I afford it?"

Assess Your Finances First

Don't buy anything without first knowing how much money you have, and whether you can afford the purchase. Spending a grand on a new flagship smartphone is insane when you only have $500 in your account.

But people still do this. The most popular way, of course, is by signing up for a new contract, and spreading the payment over the subsequent 24 months. But getting yourself into debt does not equate to saving money. It is reckless, and exemplifies the narcissism of society's preoccupation with personal gadgets.

So, understand how much money you have. Save, if you have to, and pay the price for the handset. But don't throw your cash blindly at a mobile network to establish a new contract which will set you back another 50% of the price of the phone. You don't use most of the text messages you're paying for, and if you're smart, you're not using the mobile Internet, either.

Contracts: Understand the Terms

Upgrading while under contract is just as reckless.

On one hand, you might have the benefit of being in the "upgrade period". This means you can safely upgrade to a new device, and hopefully the one you want is available. If it is, see above – do you really want to be tied to financial servitude for another two years?

If the device you're after isn't available, you're lucky. See out your contract, save money for a few months, and buy the unlocked handset outright, choosing your preferred network provider for a SIM card.

Then there's the other hand. Here, the upgrade period is some months away, and you are desperate for a new iPhone. So what do you do? You break the contract, or worse, open a second contract with the same network or another.

No money is being saved here.

Breaking the contract will have severe penalties, which you should already be aware of, because you will have read the contract and understood the terms. And if you haven't, you should do so now.

Be Patient: Find the Best Price

Patience is most definitely a virtue, especially when it comes to buying expensive gadgets. There's no point in spending $1,000 on a phone when the same device (or one that is extremely similar) will be available in a few days' time – or from a different outlet – for $900.

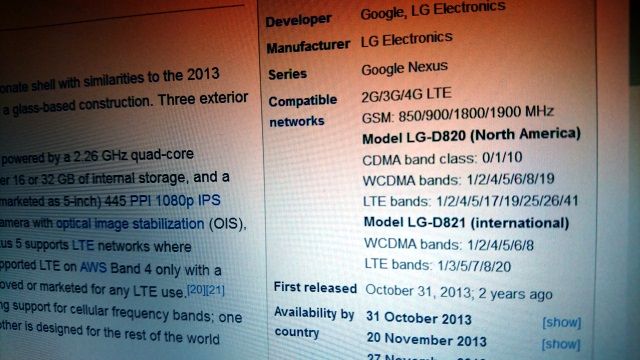

Example: so impressed was I upon reviewing the Sony Xperia Z5 for MakeUseOf, that I went out and bought my own handset. But this wasn't an impulse buy. I knew I needed an Android device superior to my 2013 LG Nexus 5 in the next few months, so a purchase was always likely to be imminent. As such, I had been researching phones for some weeks.

The first device I found was around $1,000. I managed to get mine for closer to $800, thanks to patient shopping around over the course of several weeks. Sure, I didn't queue for several hours to await a midnight opening, but then, who does that without looking like a total fool?

You need a new phone, tablet, or some other tech. But don't just click the first item you see that fits your description.

Look After Your Hardware, Maintain its Resell Value

Finally, treat your new hardware well. Apply cases, screen protectors; get insurance if you can afford it, but check whether the device is already covered with your current home and car insurance (if portable).

If you can cash in on the resell value within 12-18 months of the device being released (depending on the release cycle), you should find you have 66%-75% of the price of a replacement, ideal for selling online. As new habits to cultivate go, looking after your hardware as if you bought it only yesterday is up there at the top.

What do you do to save money for new tech? Tell us in the comments.

Image Credit: Gimas / Shutterstock.com, www.BillionPhotos.com via Shutterstock.com