It can be difficult for new home buyers or renters to decide what's the better option. Several factors go into your choice, such as your current finances, the returns on your investment, the market outlook, etc. When making a big financial decision like this, you shouldn't rush into it, especially if you don't know exactly what's involved.

Thankfully, several online guides and resources focus on renting vs. buying to help you make a sound decision. They will teach you the pros and cons, offer market research and analysis, and even calculate the difference between what you'll spend in the long term.

1. Take a Free Online Course to Understand the Pros and Cons of Renting vs. Buying

Do you need to take a whole course for this? Well, it depends on how much you already know about the subject. If you're a complete beginner in the realty market, you need to know the pros and cons of buying vs. renting a home and a few related factors that will affect the decision. Some of the best apps for free online courses offer a guided path to understanding all of this.

Khan Academy's short module on renting vs. buying is part of a larger course on understanding housing markets, but it explains the topic briefly. As Apartment Therapy notes, this set of four videos totaling up to 45 minutes is well worth your time to get the basics through both simple calculations and detailed spreadsheet analysis. Yes, its numbers are a bit dated, but the principles are still sound.

OpenEdu's course is far more detailed and comes up with 8 hours of material. However, it also educates you about factors surrounding the decision, like whether house prices are over-inflated, how to make a household balance sheet and other financial aspects of home ownership. Plus, it can all be downloaded for offline studying.

2. Consumer Financial Protection Bureau's 3 Key Things to Remember

Do at least read this if you don't want to spend hours on the aforementioned online courses. The Consumer Financial Protection Bureau ensures the common man gets a fair shake from banks, lenders, and financial institutions. To that end, they've put together a relatively simple article about renting vs. buying that highlights the three main things you need to remember — even Consumer Reports says it's a must-read.

In simple layperson's terms, it explains:

- When owning a home will (and won't) help you build equity

- How having a mortgage will (or won't) affect your taxes

- When owning a home is a better value than renting, and when it's not

Within each section, you'll find appropriate links to further calculate your decision, like links to different state taxes, mortgage calculators, or rent-or-buy calculators. The article also includes a neat infographic showing how much of your payment goes to principal and interest, as well as costs.

If you land on the side of buying rather than renting a home, you might want to also sign up for their 2-week home buyer's email course to understand what you'll need and cover all your bases.

3. Check Research Reports and Charts for Comparison on Renting or Buying

There are quite a few realty-focused websites that want you to use their services, like the best sites to find a new home. A common tactic to entice potential buyers is to put out free research reports, analysis, and charts with easy-to-understand data and analysis. Of course, you don't need to use the website for anything beyond that, so as far as you are concerned, just read these reports to know more about the housing situation.

For example, LendingTree has compared the cost of buying and renting a house in the top 50 metropolitan areas in the USA. You'll see the difference between the average prices in these areas through simple tables and interactive maps. The research report also separates home ownership with and without a mortgage since those are crucial factors in metros. Be advised that the last report was updated in May 2021.

Similarly, property site Realtor.com puts out monthly reports on rental prices across the 50 largest metros. In these, you'll find larger analyses about year-over-year changes and other trends. For example, the large table shows averages for overall rent, rent for a studio, a 1-bedroom, and a 2-bedroom, as well as how it compares to the previous year. Latest reports come out around the middle of every month and can be found on the Realtor.com blog.

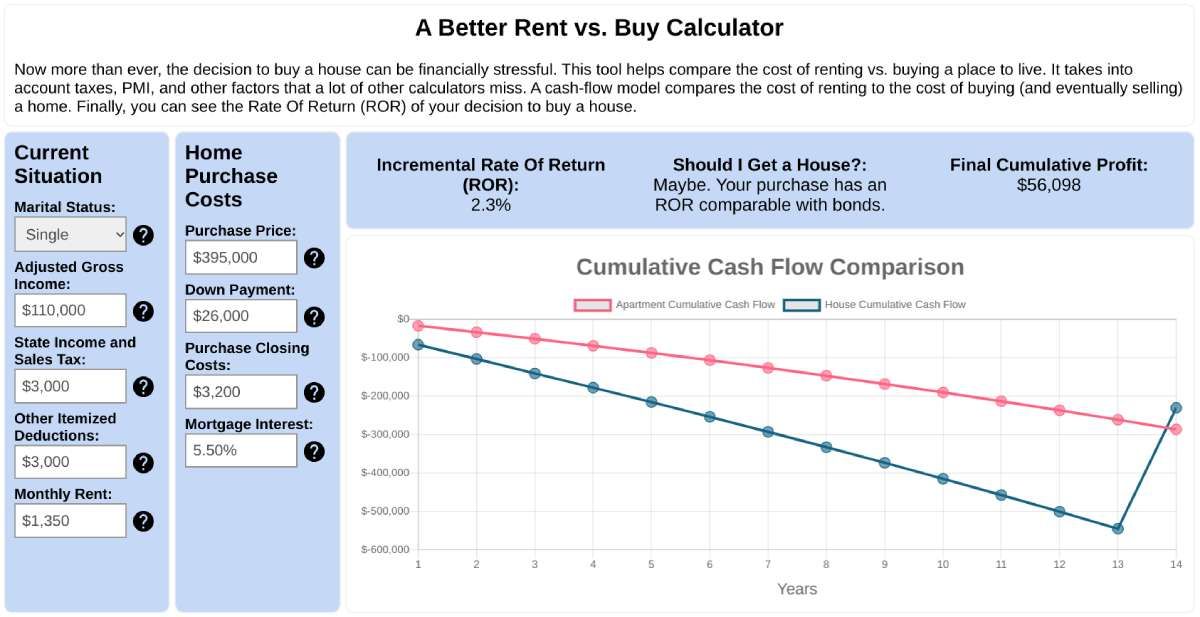

4. Use an Online Rent vs. Buy Calculator to See Projectors

One of the most popular advice you'll get is to try one of the free online rent vs. buy calculators. There are several of them, and they vary in small ways. Still, the general gist is to input financial data like property price or rent, interest rates, commissions, homeowner's or renter's insurance, down payment, taxes, etc. Then, based on these factors, you'll see a graph and analysis of what's better for you.

Each app has a few different factors it relies on, and the analysis can vary based on that. Here are some of the most recommended online rent vs. buy calculators:

- NYT Rent vs. Buy Calculator: The New York Times calculator is cited across the internet as the golden standard, but it's behind a subscription wall. If you can use it, most experts recommend it.

- Omnicalculator Rent vs. Buy: The simplest calculator to determine your costs over a certain period if you rent a house or buy a house and compare them side-by-side.

- Rentvs.Buy House: A simple calculator with only a few data inputs that focuses more on projections for buying a house, with a small comparison to your rental costs in the same period.

- Should I Get a House: A cash-flow model to compare renting costs to buying (and eventually selling) a house.

5. Stop Thinking Rent vs. Buy and Consider the "Rent to Own" Model

An alternative to the rent vs. buy debate is the "rent to own" model. Essentially, you'll be paying rent, and a part of it will be considered a downpayment if you decide to buy the property in the future. It sounds like the best of both worlds and is increasingly popular for first-time buyers, those without the downpayment, or those without excellent credit. But everything isn't as roses and sunshine as it seems.

Parents.com highlighted all the potential hidden costs and pitfalls in rent-to-own agreements that you should read to educate yourself. As the article points out, most agreements are between tenants and landlords, so they aren't standardized.

Homelight's guide offers a more detailed perspective on the pros and cons of the rent-to-home model. It's pretty long but well worth the read as it takes you through the motivations, mechanisms, standard operating protocols, contracts, potential issues, pros, and cons, etc.

Strike a Balance Between Fiscal and Emotional Needs

Owning your home is the American dream and gives you peace of mind. But if you haven't calculated your finances well, you'll soon be "house poor," i.e., spending too much on the house forces you to live a frugal life.

Renting a home lets you be more flexible with your financial overheads and allows for better long-term money planning. But it can lead to insecurity and a lack of control over your environment.

There is no one "correct" answer to this debate. The most salient advice is that it's up to you to balance satisfying your emotional needs and to manage your financial abilities.