If you conduct a Bitcoin transaction, chances are you'll have to pay a fee. But this fee does not stay at one figure. Bitcoin transaction fees vary all the time and are affected by several factors. At the time of writing in May 2023, the Bitcoin blockchain's fees are unusually high, causing frustration for users. But why are Bitcoin's fees so high right now, and can you do anything to tackle the issue?

Why Are Bitcoin's Fees So High?

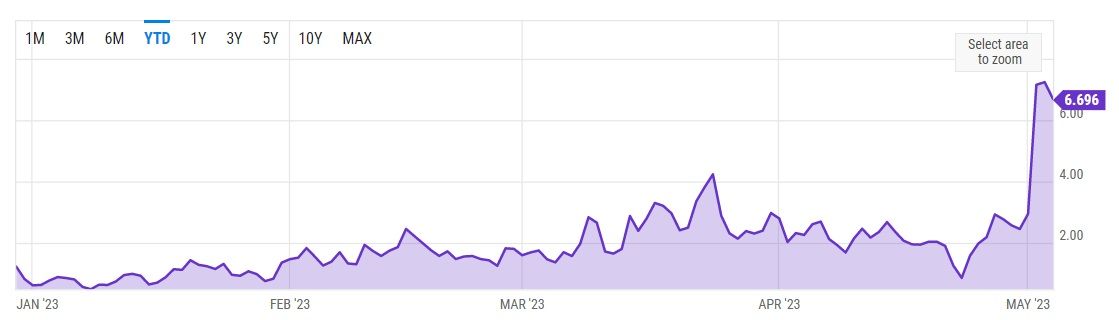

A look at YCharts shows that on May 1st, 2023, Bitcoin transaction fees began skyrocketing, reaching a peak of $7.24 on May 3rd. But what's caused this shocking fee surge?

Crypto transaction fees vary as different factors drift in and out of influence. However, at the time of writing, two key issues are pushing Bitcoin's transaction fees upward. Let's start with the emergence of BRC-20.

1. The Rise of BRC-20

BRC-20 is an experimental token standard launched in March 2023. Different token standards govern how and where crypto assets can be used.

BRC-20 is a token standard inspired by Ethereum's ERC-20 (the Ethereum standard that governs its standard, fungible tokens). The standard itself was created amid the growing popularity of Bitcoin's Ordinals protocol. In fact, the core purpose of BRC-20 tokens lies within Bitcoin Ordinals.

While Bitcoin Ordinals are considered non-fungible, BRC-20 tokens are entirely fungible, just like ERC-20 tokens. With BRC-20 tokens, users can trade fungible assets within the Ordinals protocol.

As is the case on the Ethereum blockchain, the BRC-20 standard has given way to the creation of many meme coins. Meme coins are assets named after popular internet memes, such as Doge and Pepe. In fact, these two memes already have cryptocurrencies attributed to them.

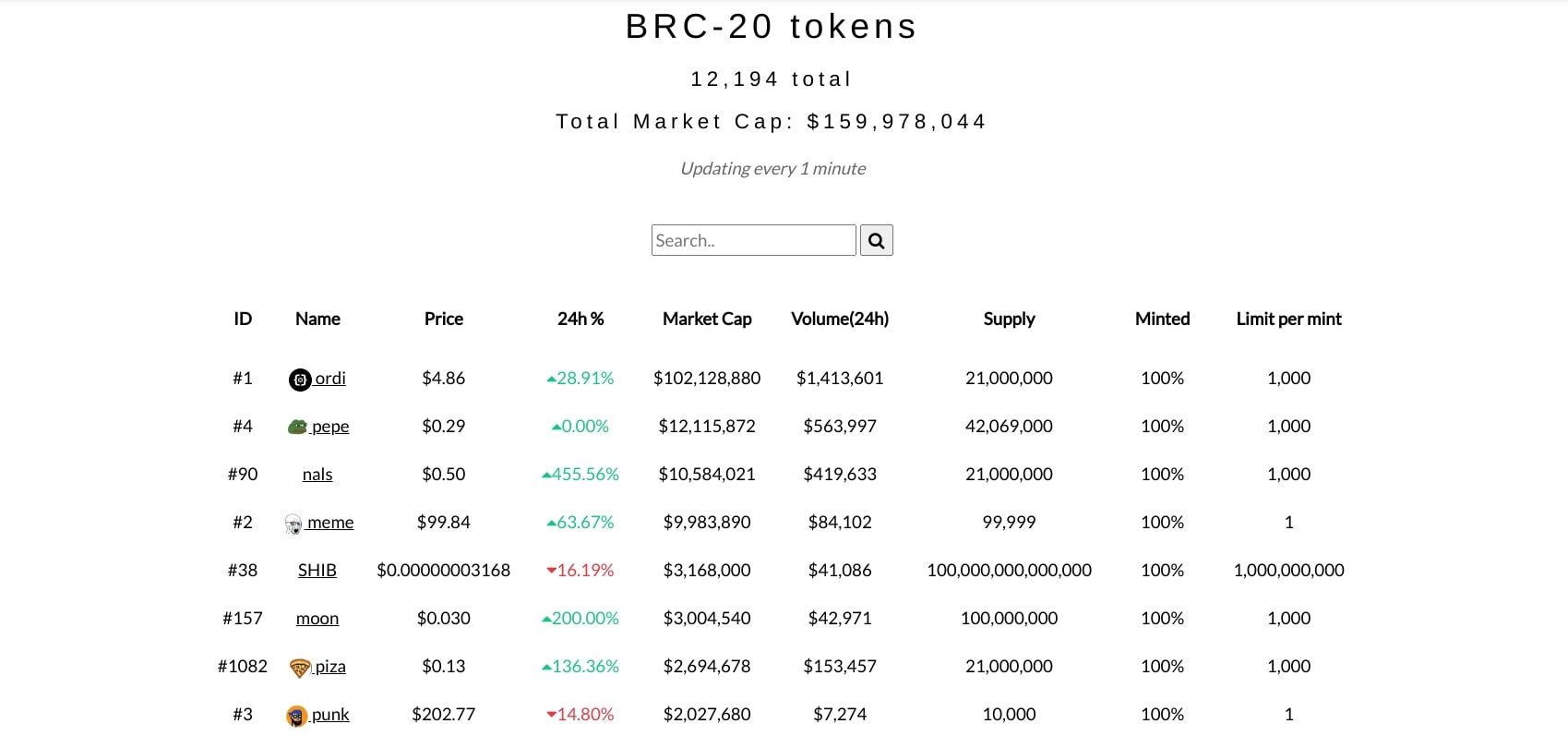

Some meme coins have done very well, like Dogecoin and Shiba Inu. So, it's no surprise they've cropped up in the Bitcoin space with the emergence of BRC-20. Some BRC-20 meme coins have amassed a lot of hype during the early months of 2023, growing their market cap significantly. Popular examples of BRC-20 tokens include ORDI, PEPE, DOMO, and PUNK.

Because these tokens are Bitcoin-based, their surging popularity puts extra stress on the network. A high network load usually gives way to higher transaction fees, which is exactly what has occurred on the Bitcoin blockchain via the growth of BRC-20 tokens.

2. The Popularity of Bitcoin Ordinals

The Bitcoin Ordinals protocol launched towards the end of 2022 and is still gaining popularity as more folks realize their potential. The Ordinals protocol allows for the creation of non-fungible, Bitcoin-based assets. This is done by inscribing data onto a satoshi, a tiny fraction of one BTC.

Using Ordinals, Bitcoin users can create their own NFTs, allowing it to further compete with the Ethereum blockchain, which has supported NFT creation and trade for years.

As people continue to mint and trade Ordinals on the Bitcoin blockchain (for which you'll need a Bitcoin Ordinal wallet), the network load remains higher than usual. Again, this often gives way to higher transaction fees for users.

It's also worth noting that the Bitcoin blockchain isn't very suited to high demand. Because most Bitcoin blocks are only 1MB-1.5MB, each block processes a limited number of transactions, leading to long waiting periods and, sometimes, higher fees.

How to Avoid High Bitcoin Transaction Fees

If Bitcoin's pricey transaction costs are a concern for you, there are a few things you can do to hedge against the issue.

Firstly, ensure you're not making Bitcoin transactions at peak times. There are times throughout the day when more people use the Bitcoin blockchain. According to FOREX, cryptocurrencies are most commonly traded between 8 a.m. and 4 p.m. So, to lower your Bitcoin transaction fees, consider trading earlier in the morning or later at night.

You could also batch your Bitcoin transactions. Batching transactions involves including multiple different transactions into one overall transaction. By batching your transactions, you can lower the amount of data you're adding to the network, lowering your fees.

Lastly, it may be wise to use a zero-free cryptocurrency exchange to trade Bitcoin. If you have to deal with high transaction fees, maker, taker, or spread fees, the various charges can add up quickly. Using a zero-fee or low-fee crypto exchange can cut down on the overall fee you're paying per Bitcoin transaction.

Bitcoin's Fees Are Always Changing

While it's great to take advantage of low-fee periods, it's also important to note that cryptocurrency transaction fees can shoot upwards in a matter of hours. Bitcoin is no exception to this rule. So, to avoid being hit by a sudden fee surge, consider the tips above.