When new technology is deployed, it often comes with problems. Some of them can be foreseen, and others can't. This is the case with Ethereum, the largest smart contract platform that reforms the banking sector in a decentralized, digital space. Unfortunately, as Ethereum became more popular, its blockchain network couldn't handle all the traffic without a drastic increase in transaction fees called ETH gas.

Loopring is one of the key solutions to thin out Ethereum's congestion and make the traffic flow at affordable fees once again, or at least until Ethereum completes its much-anticipated ETH 2.0 upgrade in the second half of 2022. Here is the breakdown of how Loopring accomplishes this.

Why Is Ethereum So Expensive to Use?

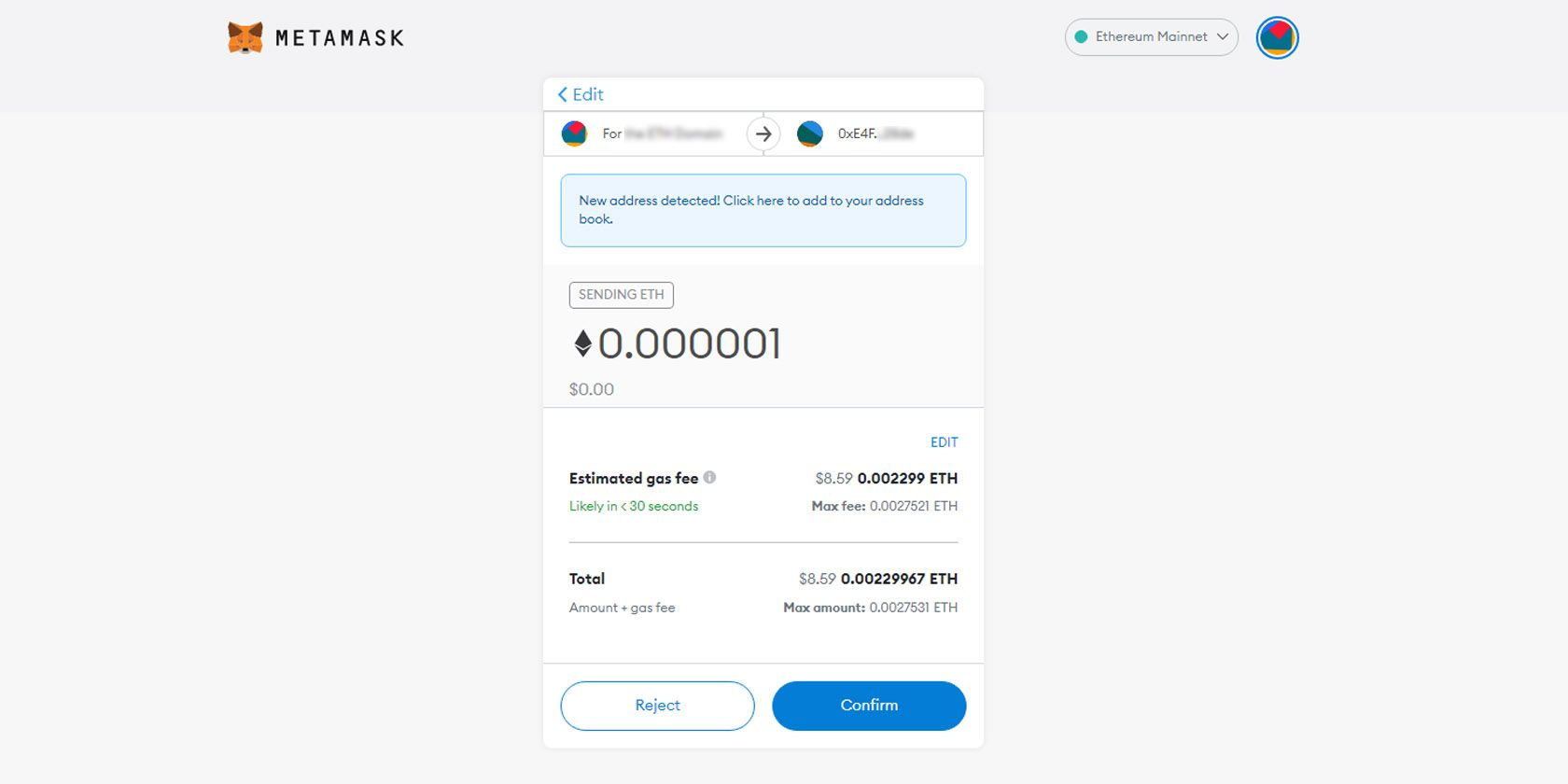

On a good day, a simple transaction where you would send ETH from one wallet to another would cost 16% of the total transaction, as demonstrated from the MetaMask wallet below on December 29, 2021.

At other times, depending on the network's load, the gas fee for transferring money goes beyond 50%. This makes Ethereum completely fail its purpose of recreating traditional finance within the blockchain space. In fact, Western Union would blush in embarrassment for setting such fees. The reason for this can be tracked from Ethereum's legacy, starting as a Proof-of-Work blockchain that is energy-hungry and is less scalable.

Meaning, the network doesn't scale up sufficiently as more people begin to use it. Therefore, the cost of transactions rises to offset the imbalance. On the other hand, Proof-of-Stake blockchains do have better scalability, as demonstrated by Solana with its drastically lower gas fee of $0.00025 per transaction.

For the uninitiated, here are the main differences between Proof-of-Work (PoW) and Proof-of-Stake (PoS) blockchains. Suffice to say, Ethereum is in a transitory upgrade phase between the two types of consensus mechanisms to secure the network.

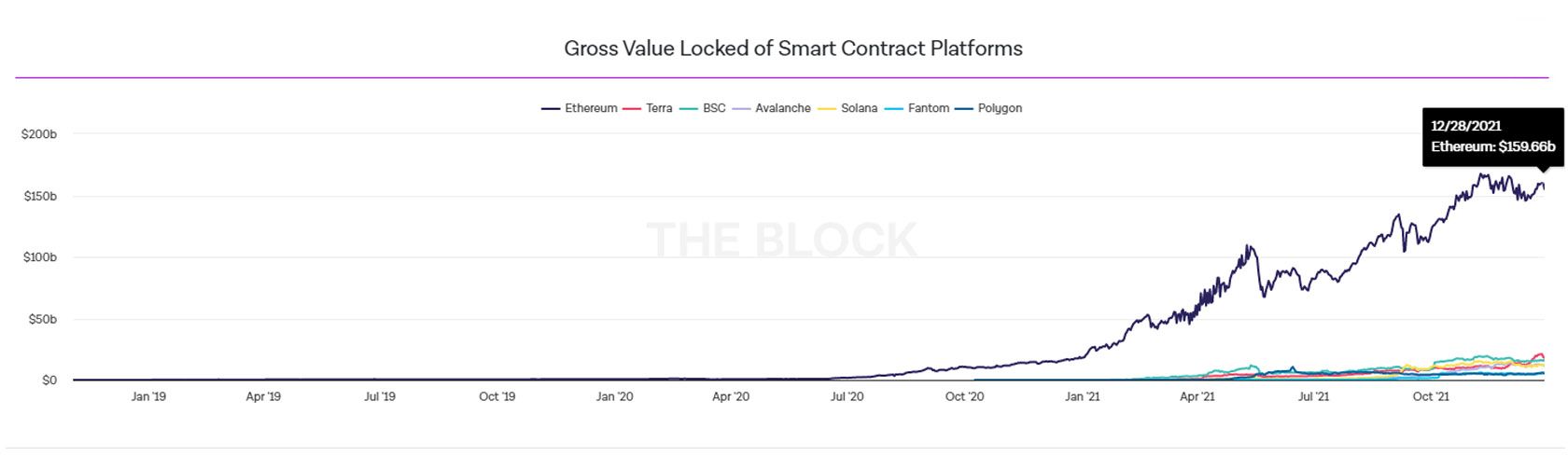

Although other smart contract platforms exist, Ethereum has a significant lead despite Solana providing a better blockchain experience. As you can see from the chart below, Ethereum has more combined crypto wealth inside smart contracts than all other competitors combined.

For this reason, Ethereum has to resort to scalability solutions like Loopring.

How Does Loopring Make Ethereum Better?

The main reason why any network is congested is data throughput. If you picture Ethereum as a Los Angeles highway with traffic congestion, then Loopring is the high-speed train that runs above it. In other words, Ethereum's blockchain is an L1 network, while Loopring is an L2 network, where the L stands for layer.

This is why Loopring, and other scalability solutions like Arbitrum, are called Layer 2 scalability solutions. Furthermore, Loopring is also a zero-knowledge rollup—zkRollup. This encryption algorithm involves reducing the amount of data involved flowing through the network.

Imagine not wanting to reveal your identity but still verifying it. This is what zkRollup is about, hence the name "zero-knowledge." Furthermore, as a Layer 2 scalability solution, Loopring boosts the speed of transactions going on Ethereum by bundling them into single batches. These are then fed back to Layer 1, the Ethereum main chain.

Loopring developers have made a tutorial on how to use it and how much you can save in gas fee cost.

Of course, making Ethereum affordable is not the sole purpose of Loopring. After all, it is a network of its own, just like Polygon (MATIC) with its ecosystem of DApps—decentralized applications.

Taking Advantage of Loopring

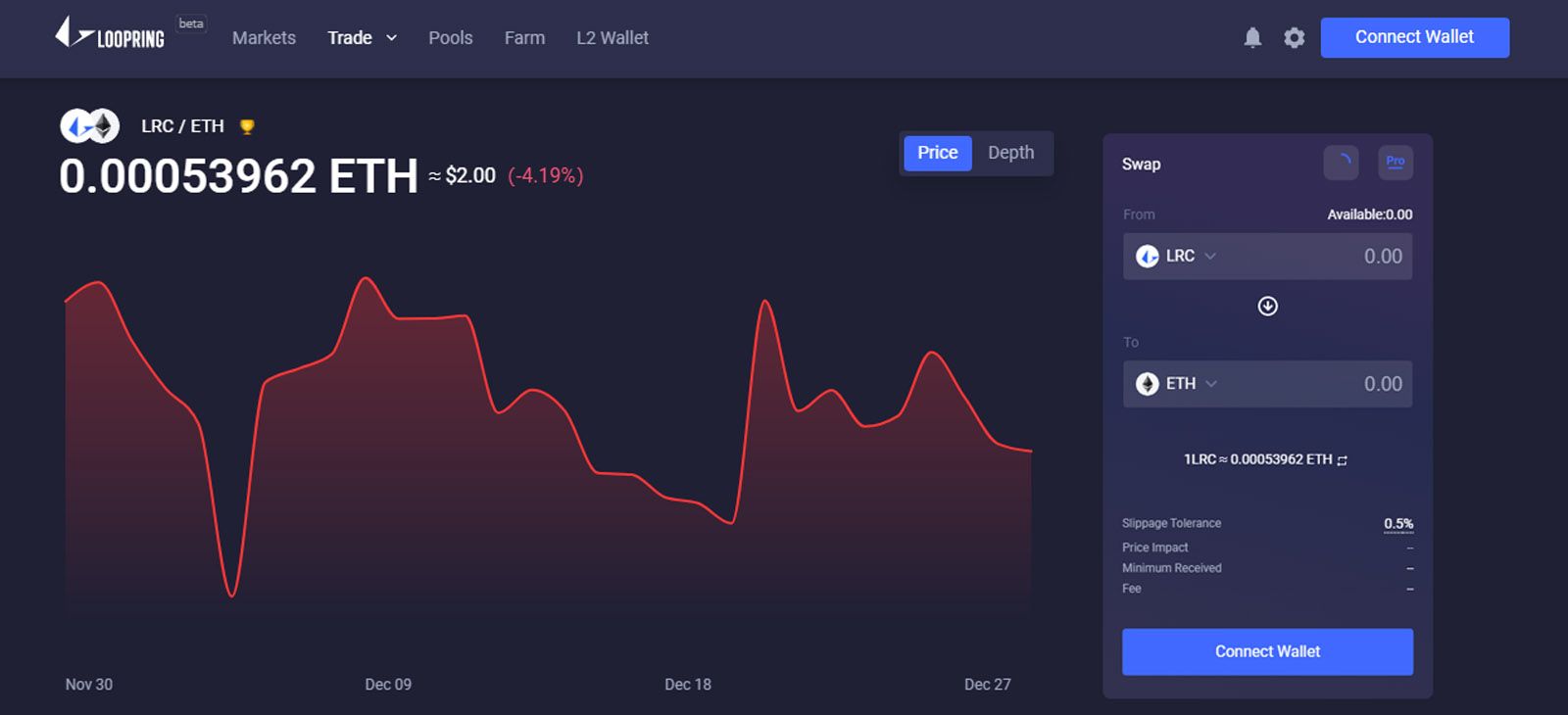

One of the most important Loopring DApps is its Loopring decentralized exchange (DEX) in order to swap cryptocurrencies affordably. The first order of business is to install the MetaMask wallet into your browser. Then, when you visit the Loopring protocol, simply connect it to the wallet. As you can see, you can swap pretty much any cryptocurrency/token you have ever heard of, including stablecoins like USDC.

Loopring uses an automated market maker (AMM) to set the exchange rate between tokens. Although the platform's fees are not zero, they are very close. Compared to Ethereum's 16%, the current swap fee on Loopring is 0.3%. As you would expect, the fee funds the protocol: 0.2% goes to liquidity providers (LPs), and 0.1% goes to the Loopring developers.

Liquidity providers (LPs) make decentralized finance (DeFi) happen. Because DeFi, powered by smart contracts, doesn't rely on any institution, users themselves fulfill its role. In the case of market makers, LPs supplant them by staking tokens into liquidity pools. This way, whenever someone wants to swap a token, they tap into those pools, with LPs taking 0.2% of the cut for providing this service.

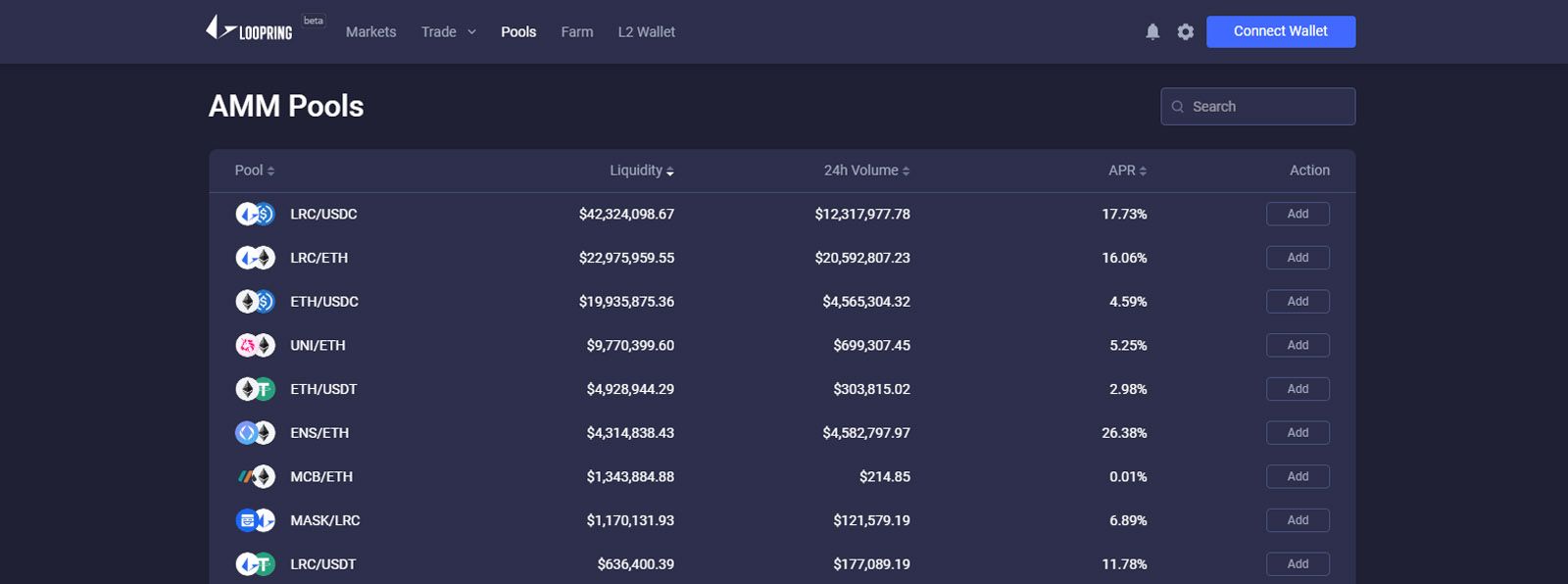

You can become a liquidity provider on Loopring via the pools tab. You would then have to pick a token pair for swapping and the number of tokens placed into the liquidity pool. Both tokens would have to be of equal value to make a trading pair. For example, to enter the LRC/USDC pool, you would have to place (stake) $50 worth of LRC and $50 worth of USDC.

The APR value, annual percentage yield, is your interest rate just as you would get one from depositing money in a traditional bank, however minuscule it would be. Presently, the highest-earning liquidity pool is MOVD/ETH token pair at 76% APR. Comparatively, this is 1,266 times higher than the average interest rate for savings accounts in the U.S. at 0.06%.

Loopring's LRC Token

Just like every other DeFi protocol, Loopring has its own token, called LRC. This token is how LPs and developers receive their cuts when people use the Loopring network. There is a maximum supply of 1.37 billion LRC tokens, of which 1.33 billion is in circulation.

Besides buying them directly via MetaMask wallet or on crypto exchanges like Coinbase or Binance, you can also earn LRC tokens by staking them. Staking just means that you provide liquidity to the protocol, just like with liquidity pools. Therefore, if someone wants to swap LRC tokens, they would tap into the staked ones.

In other words, all the liquidity pools with LRC as one part of the token pair would yield 70% of the protocol fees. This will go for all future DEXs built on top of the Loopring L2 network. As far as LRC price goes, it achieved an all-time-high (ATH) price on November 10, 2021, at $3.83 per LRC token.

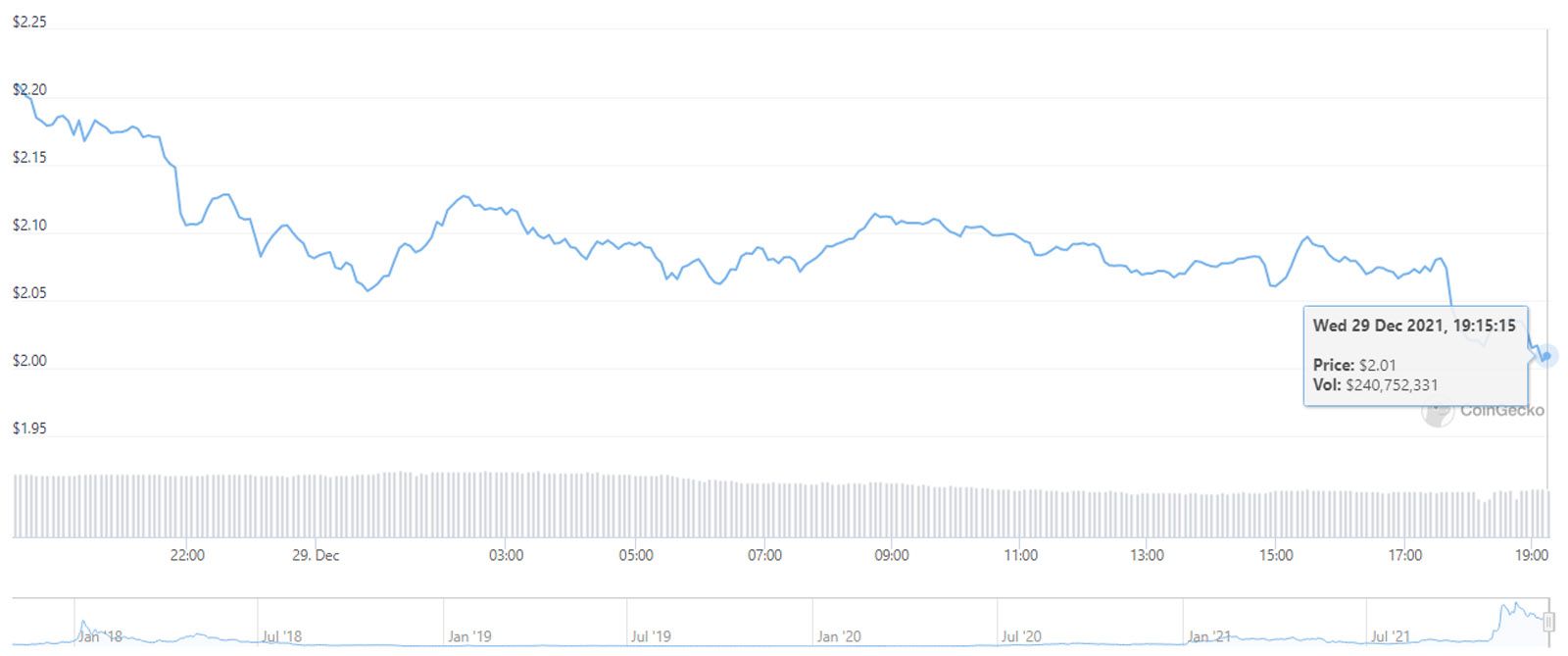

On December 29, 2021, the LRC price was at $2.01, with the further expectation of its rise as more DApps enter Loopring's ecosystem. Specifically, in anticipation of NFT marketplace launch from a partnership with GameStop, the world's largest retail video gaming chain. Of course, there is absolutely no guarantee that LRC's price will rise, and it's price could easily tumble despite what we've said. As with all investments, always research before parting with your money, and never invest more than you can afford to lose.

Will Loopring Continue to Make Ethereum Faster?

The best way to view the LRC token is as an infrastructural coin. Unlike meme coins, like DOGE or SHIB, such coins rely on long-term usability value. Ethereum certainly needs Loopring to scale up its operations and remain affordable. Therefore, the future of the largest smart contract platform is tied with this project.