In 2019, rumors were buzzing about a new credit card designed not by a bank but by Apple. Many people were excited by the idea of a tech company like Apple entering the world of banking.

And in the years since its launch, over 6.4 million people have become Apple Card users. J.D. Power even ranked Apple and Goldman Sachs as number one in customer satisfaction for midsize card issuers for two years straight.

The Apple Card has definitely been a huge success for Apple, but is it worth it for you?

Apple Card Overview

From the ground up, the Apple Card was designed to be simple. The Apple Card operates on the widely-accepted Mastercard network and doesn't have any upfront costs or hidden fees. That means the Apple Card has no annual charges, foreign transaction fees, over-the-limit, or even late fees.

The Apple Card is built as a cash back card. There are no points or miles programs to keep track of. Instead, with every purchase, you'll earn between 1–3% cash back in the form of Apple Cash, which you can easily transfer to your bank.

When it comes to the physical card's design, Apple knocked it out of the park. Although almost all credit cards are still plastic, some issuers have moved into metal construction for their premium products.

But while most metal credit cards are made of stainless steel, the Apple Card features an ultra-premium titanium design, the likes of which you'll only find on very hard-to-get credit cards like the American Express Centurion Card.

If you're considering applying for the Apple Card, you'll need at least a "good" FICO score of 670 or higher to have a fair shot at approval.

The Apple Card Requires an iPhone

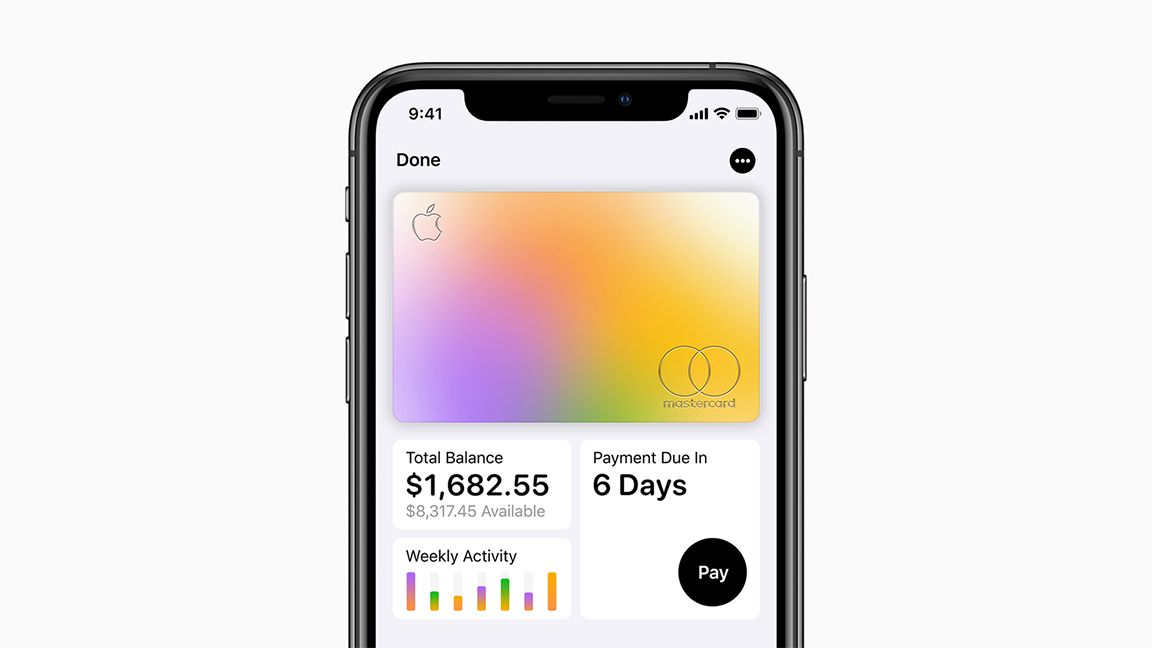

The Apple Card is designed for Apple users, and more specifically, iPhone users. In fact, the only way to see your Apple Card bill or make any payments is through the Wallet app on an iPhone. That means even if you're on an iPad or Mac, you won't be able to access your Apple Card.

That said, managing your Apple Card is extremely easy. The Wallet app lets you quickly check your bill, see your recent transactions, and view your cash back rewards. You can even see your spending organized by purchase category.

Making payments on the Apple Card is also very intuitive. Like most credit cards, you can make a minimum payment, pay your bill in full, or anything in between. But unlike most credit cards, Apple tells you exactly how much interest you'll end up paying. That's a great transparency feature that can save you money.

While most credit card issuers force you into dealing with a clunky and bloated website or app, the Apple Card makes it extremely easy and intuitive to manage your credit and track your spending.

The Apple Card's 2% Daily Cash Back Only Applies to Apple Pay

The Apple Card delivers a competitive 2% cash back when it comes to everyday purchases, but there's one big catch. You'll only be able to score the full 2% cash back when you use Apple Pay.

There are lots of reasons to start using Apple Pay, but although it's becoming more and more widely accepted, it's far from global adoption. Depending on where you live, many places, both in-store and online, just don't accept Apple Pay.

So, any time you make a purchase by pulling out and swiping your Apple Card or by using your card number online, you'll miss out on getting 2% cash back and get left with a much less attractive 1% back.

3% Cash Back at Select Stores

Although the Apple Card only delivers up to 2% cash back on most purchases, there are a few places where you can score a bit more. Apple has partnered with a handful of stores and brands to offer up to 3% cash back on the Apple Card. Included are apparel giant Nike, gas stations like Exon and Mobil, along with Uber and Uber Eats.

Even though there are a handful of stores where the Apple Card earns 3% back, your options are still tiny compared to what you'll get from bigger credit card issuers. And remember, you'll still need to use Apple Pay to get the full 3% back; skip that step, and you'll be left with just 1% cash back.

Best Feature: 3% Cash Back at Apple

As the name suggests, the Apple Card works best at Apple. All purchases directly from Apple will net you 3% cash back. That means spending $1,000 on a new iPhone will immediately pay you $30 back.

But the Apple Card isn't just for buying new devices. All purchases made on the App Store and iTunes Store are eligible for 3% cash back. That means earning some cash back from all of your monthly subscriptions from Apple, like Apple Music, your AppleCare+ warranty, and Apple Arcade.

Even better, everything else you buy through the App Store also falls under this category. That includes purchases and subscriptions to third-party apps like streaming services and VPNs.

For many people, the Apple Card delivers best-in-class rewards for a ton of physical and digital purchases from Apple—perfect for the company's fans.

There Are Better Cash Back Cards on the Market

Apple advertises the Apple Card as a competitive 2% cash back card, but remember, that's only when you use Apple Pay. However, many credit card issuers have products that offer similar or better rewards without any extra steps.

For instance, Citi's Double Cash Card has emerged as one of the most popular cash back cards on the market. It delivers 1% daily cash back and earns another 1% after you pay your bill. Similarly, the Wells Fargo Active Cash Card delivers a no-nonsense 2% cash back on all purchases, with no extra steps or strings attached.

Today, almost all card issuers make their cards more attractive by offering bonuses like interest-free periods, a cash sign-up bonus, or both. With the Apple Card, you won't get either. You'll start paying interest on purchases immediately, and you won't be able to get a cash bonus after hitting a minimum spend.

Although the Apple Card can deliver competitive rewards with Apple and a few select partners, there are much better options for cash back rewards overall.

Should You Apply for the Apple Card?

Whether the Apple Card is worth it depends on who you are. At the end of the day, the Apple Card is a credit card designed by Apple for its users. You should only consider applying for the Apple Card if you're somebody who owns an iPhone and isn't planning on switching anytime soon.

If you use Apple Pay every day and make a lot of purchases through Apple, the Apple Card might be worth picking up. However, if you're looking for the best daily cash back card available, there are better options on the market right now.