If you’re willing to put in the work, becoming a freelancer is a great way to support a lifestyle outside of the traditional office job. For many, it’s also an opportunity to work with exciting companies in different countries.

However, international clients can also present difficulties. The majority of banking services charge a percentage, while other services offer poor exchange rates.

Here are a few tips you can use to receive payments from your clients abroad, plus some banking services you might want to take a look at.

Receiving International Payments: The Big Challenges

Before we discuss the solutions to accepting international payments as a freelancer, let's take a closer look at the major challenges. Here are three of the biggest ones.

1. Exchange Fees

One of the biggest challenges when it comes to receiving international freelance payments is dealing with exchange fees.

If you live in one of the big global markets—such as the US, UK, or Eurozone—your clients might be able to pay you in your native currency. But if you live somewhere like Sweden or India, you might need to exchange.

It’s essential to know where you can get the best exchange rate if you need to exchange the currency you’re paid in. Otherwise, you’ll needlessly limit your earnings.

2. Receiving Payments

When doing business abroad, the bank account you use for your everyday expenses might not be helpful when taking payments from elsewhere.

Different countries have different bank systems. If your clients are outside of your country, you will need to find a way to receive their money.

When invoicing for international payments, it’s also important to remember that you may need to provide extra details. For example, some banks will ask for the international bank account number (IBAN) from the person paying you.

3. Multiple Income Sources

Having various income sources is a nice problem, but keeping track of your payments can quickly become overwhelming. This is especially true if you’re getting paid in more than one foreign currency.

Besides keeping track of your invoices and what’s due, it’s also a good idea to have bank accounts in more than one currency. Some online banking options will allow you to do this with ease, as you’ll find out later in this article.

How to Choose a Payment Provider

So, now you know what to expect when it comes to international payment-related challenges. But when choosing a banking service provider, you should consider other more granular areas for each of them.

Credibility

Moving money around online can be risky, and you must take your security seriously. Before committing to any payment service, read user reviews and gather as much information as you can.

Currencies Accepted

Almost all international online banking methods will process payments in the biggest global currencies. But if you don’t work with companies in any of those countries and operate in markets closer to you, you’ll want to look for services that cater specifically to those currencies.

Payment Times

While worldwide payments have advanced massively in recent years, problems still exist. It's vital to consider waiting times when choosing a place to accept international payments as a freelancer.

If you have significant monthly expenses or monthly tax deadlines, this is particularly important.

International Payment Solutions for Freelancers

PayPal

While PayPal is often used for online purchases, you can also receive payments as a freelancer using the platform. As a freelancer, you can upgrade your account to PayPal for business, which gives you more privileges than a regular account.

Pros of Using PayPal

Getting paid with PayPal is easy. All you have to do is give your clients the email address associated with your account, and they can then send you the payment after each project.

When you use PayPal for Business, you can also send professional-looking invoices easily. As a result, you don’t need to search for online templates or invest in software for this particular purpose.

Transferring money to another account is also relatively easy with PayPal. You can link your bank account and transfer money within a few seconds of receiving it. You can also connect it to your accounting software to get your money quicker.

Cons of Using PayPal

The biggest gripe for many freelancers using PayPal for international payments is the exchange rate. Often, you’ll find that the rate you get with PayPal is lower than you what would have gotten elsewhere.

Another drawback to PayPal is paying large fees for each transaction. It could charge you 2.9% of its value for online transactions and another $0.30 on top of that. If you use the service regularly, this adds up quickly.

While PayPal is fast to process your payments, you might need to deal with delays—especially in the beginning. The service can hold funds for up to 21 days in some cases. While these are often easy to solve, they are frustrating and time-consuming.

Wise (Formerly TransferWise)

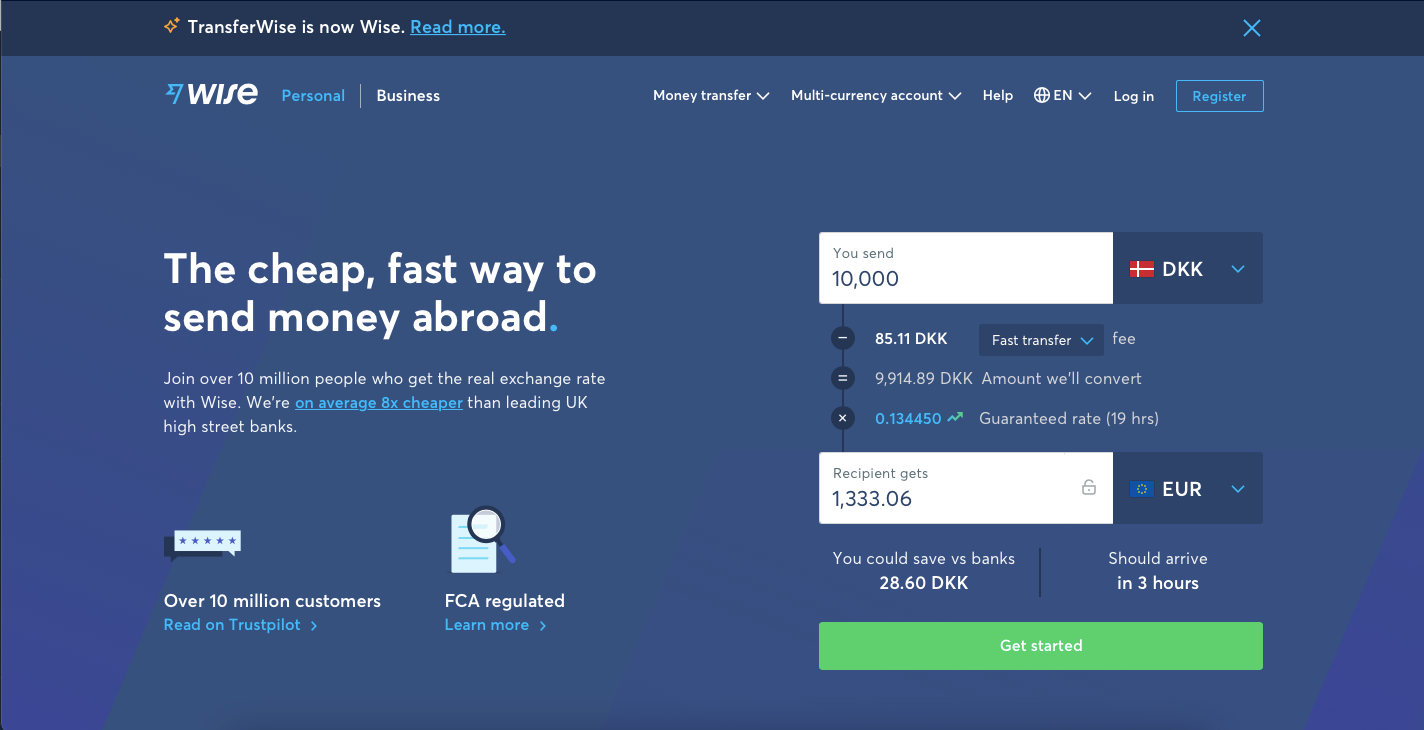

Wise is an international payments specialist that allows users to process payments in numerous currencies. Besides receiving online payments, you can also pay for a bank card to use your money directly.

Pros of Using Wise

Wise allows you to create bank accounts in multiple currencies. You can open separate accounts for US Dollars, Great British Pounds, and Euros. If you work with companies in Australia and New Zealand, they can also pay you in their native currencies.

Besides opening accounts in numerous currencies, you can also exchange and hold funds to your local one. This means you can transfer directly to your bank account afterward without being at the mercy of your bank’s exchange rate.

When using Wise, you’ll also receive a favorable exchange rate since the service uses a mid-market rate. As a result, you’ll get more than you would have with other payment methods.

Cons of Using Wise

While using Wise is convenient and offers complex solutions for international payments, there are some challenges.

Although you’ll get a better exchange rate, you will still need to pay some fees. These include when converting your money to other currencies when using the app. On the flip side, the company is transparent about its fees.

If you want to use the Wise credit card, you can only apply in some instances if you have a personal account. And for everyone, it costs $5/£7/€10 to obtain one.

Payoneer

Payoneer is a banking service designed for businesses. The company allows users to take payments from around the world. Various online commerce and freelance marketplaces also use it.

Pros of Using Payoneer

Like Wise, Payoneer lets you open business accounts in multiple currencies. Clients can pay you in USD, EUR, and GBP. You can also transfer your money directly to your local bank account.

When making international transactions to your bank account, you also won’t need to wait long for your payment to be processed. Moreover, the service supports over 150 currencies.

Payoneer is also easy to connect to freelance marketplaces. Upwork and PeoplePerHour are two of the various platforms that integrate the service.

Cons of Using Payoneer

When you first sign up for Payoneer, the verification process may take a while. In some cases, it may require you to provide further information.

Transferring funds to your local currency will not be a problem if you have a bank account in the same currency that you can receive payments through Payoneer. But if you use a smaller currency like the Danish Krone, then you will.

Get Paid Doing What You Love in an International Market

Freelancing is a great career choice for people who prefer to live where they want while doing something they enjoy. The endless opportunities for international expansion are also exciting.

But when working with clients in other countries, it is crucial to limit the fees you are charged. Fortunately, there are plenty of banking options for freelancers and small business owners operating internationally.

Once you've done your research, weigh your options and pick the one that works best for you.