The cryptocurrency industry isn't just lucrative for traders and investors. Crypto miners can also make a healthy profit while contributing to the market, blockchain security, and network integrity, especially those that mine Bitcoin. But what exactly does the Bitcoin mining process consist of, and why is it so expensive to be a Bitcoin miner?

What Is Bitcoin Mining?

The key purpose of mining any cryptocurrency is to put new coins into circulation and increase the supply. Many cryptocurrencies can be mined, and the mining industry has grown exponentially in recent years, with individuals looking to make a buck from home.

As Bitcoin uses the proof of work (PoW) mechanism, the mining process is crucial in verifying transactions on its blockchain. So, how does it all work?

When a miner joins the Bitcoin network, they become what is known as a "node." These nodes are responsible for coin circulation and transaction verification. The Bitcoin network currently has tens of thousands of active nodes, with more added daily.

How Does Bitcoin Mining Work?

Bitcoin mining requires the solving of highly complex mathematical equations. These equations are cryptographic, with one alphanumeric string, known as the target hash, holding the key to solving each problem. A target hash starts with a string of zeros and is then followed by random letters and numbers, e.g., 00000000000000006FCAq...

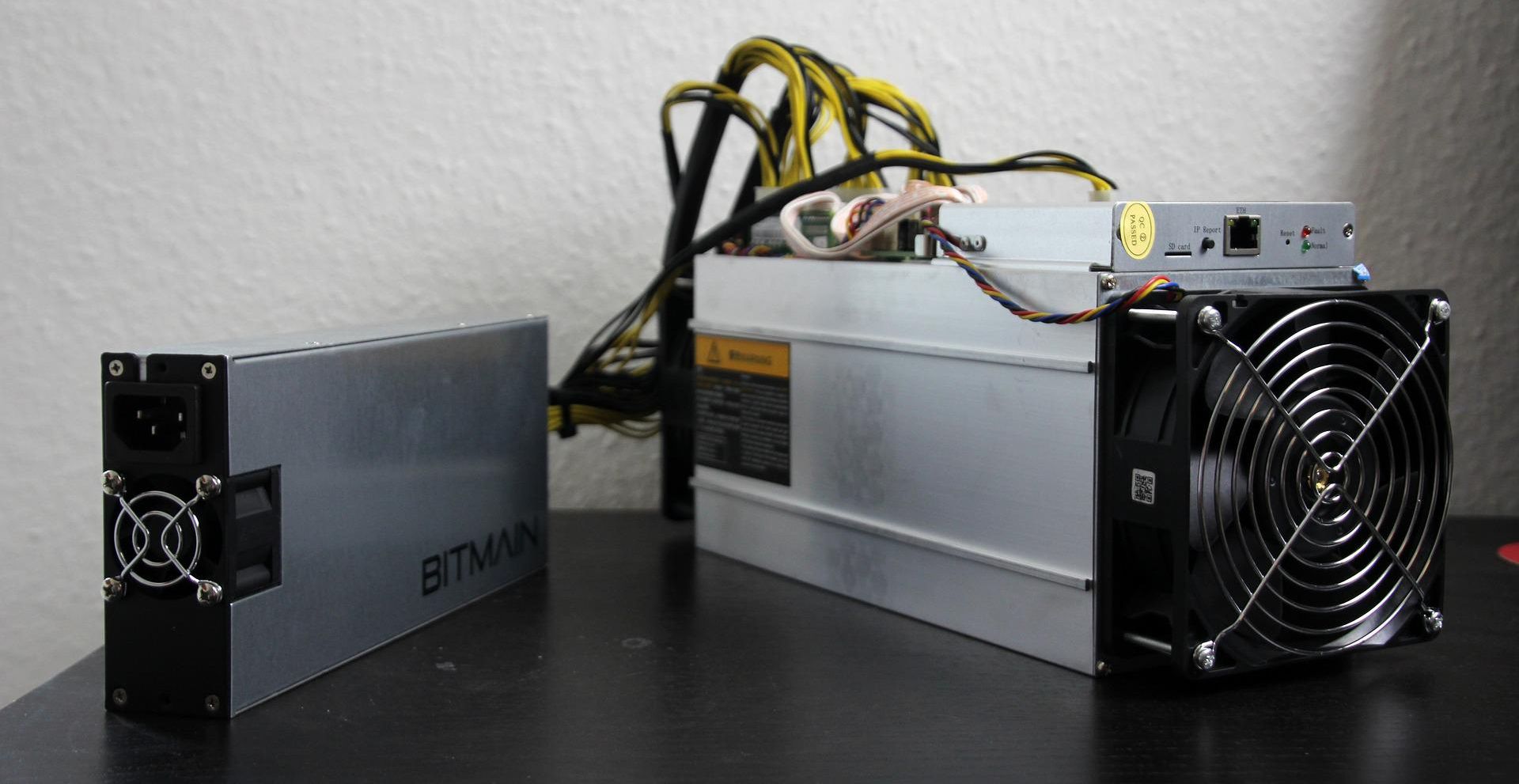

Miners must use certain kinds of hardware to solve these equations efficiently. A human cannot do it on their own. While Bitcoin mining could once be carried out with simpler, less costly hardware like the CPU in your computer or laptop, now miners must use ASIC miners to keep up with the rife competition. We'll discuss the cost of this kind of hardware a little later.

Multiple guesses to an equation's target hash can be thrown out every second using an ASIC miner. These guess numbers, or hashes, must be equal to or less than the target hash for a miner to receive the next block of transactions. When a miner receives a block and verifies it, the rest of the network must confirm that they have done so correctly. Once this is done, the block can be added to the ledger.

This puzzle-solving process delivers new Bitcoins that are put into circulation while elevating the security and transparency levels of the Bitcoin blockchain. But this verification process has led to a great deal of latency on the Bitcoin network, as a backlog of transactions now exists that is giving way to longer transaction times.

What Are Bitcoin Mining Rewards?

It's important to note that miners don't do all of this from the goodness of their hearts. Bitcoin mining has a very tempting incentive. Each time a miner solves an equation and receives a block to verify, they receive a Bitcoin mining reward. The current reward for mining a block is 6.25 BTC, which currently equates to almost $200,000 (give or take a few thousand with coin price fluctuations). So it's safe to say that mining Bitcoin can be an incredibly lucrative venture.

Miners also receive some voting power when they become a node within the Bitcoin network, allowing them to have their say on the decisions and developments being made. Miners with more hash power have more influence in the voting process.

But Bitcoin mining is by no means easy and by no means cheap. Moreover, numerous costly elements involved with Bitcoin mining can make it inaccessible to some. So, let's discuss them.

Why Is Bitcoin Mining So Expensive?

As mentioned previously, the Bitcoin mining industry is now very competitive. People know how profitable it is, which has caused flocks of new miners to join the network in the hopes of grabbing that big block reward. Unfortunately, the more nodes there are, the harder it becomes for any one miner to guess the correct hash and receive the next block to verify.

Additionally, it's becoming harder to mine Bitcoin because there are fewer and fewer coins available to mine as the week, month, and years pass. Bitcoin has a supply limit of 21 million BTC, and around 90% of that has already been mined.

There are currently less than two million Bitcoin left to be mined, so miners have to work harder to solve cryptographic equations and get the next block. It can take years for a node to receive just one block to mine, so the entire venture is certainly a waiting game.

Because of the increasing competition and decreasing supply, more computing power has to be put into the mining process by each miner. Mining a single block or coin is very energy-intensive and, therefore, costly, as each miner must cover their electricity bills. But just how much energy is needed to mine?

It all depends on the ASIC miner you're using. A wide range of ASIC miners are available on the market today, with big names like Bitmain and WhatsMiner offering different models at different prices. But ASIC miners are by no means cheap. Prices can range from the high hundreds to tens of thousands, depending on the make, model, and condition of the ASIC in question. So, there's a hefty upfront cost that comes with mining Bitcoin.

How Much Does It Cost to Mine a Bitcoin?

In terms of energy usage, let's consider one kind of popular ASIC miner to get an idea of how much you'll be spending on computing power to mine Bitcoin. Take the Antminer S17 Pro. This ASIC miner has a pretty mid-range price of around $7,000, with a lifetime mining energy cost of around $14,700 to mine just one Bitcoin (at a rate of 5.5¢/kWh), meaning it'll cost you over $21,000 overall using this particular miner.

Measure this against the current reward of almost $200,000, and it's clear that you'll make a profit. But mining is a very long and sometimes frustrating process, so you'll likely fork out thousands of dollars on hardware and maintenance long before you manage to mine a single coin or block.

Many individuals choose to join mining pools to create a steadier income without using quite so much electricity. Mining pools require members to donate some of their computational power to the pool, contributing to the mining process. The more computational (or hash) power the pool has, the greater the chance of solving an equation and mining a block. When a block is mined, the reward is split between members (often proportional to the amount of power contributed).

There's one last issue here that miners must face, and that's reward halving. Bitcoin mining rewards are halved every four years to limit the number of coins put into circulation every year. The first halving occurred in November 2012, and the next is set to take place in 2024. This will take the available reward from 6.25 BTC to 3.125 BTC.

Depending on how Bitcoin's price changes, this could mean that miners end up receiving a lot less each time they successfully mine, so their profits may end up negative in relation to the cost.

Bitcoin Mining Is Crucial—But Expensive

Bitcoin mining is integral to Bitcoin's network, allowing for the circulation of new coins and the verification of transactions while rewarding nodes for their work. But becoming a successful Bitcoin miner is costly, time-consuming, and risky. And, with un-mined coins becoming rarer while rewards are periodically halved, there's no doubt that it's becoming increasingly difficult to make a healthy profit through Bitcoin mining.