Unlike traditional lending institutions where a credit score determines if you can get a loan, Binance offers users crypto loans using collateral with reasonable interest rates. Borrowing and repaying loans from the crypto exchange is straightforward, especially since Binance offers users a wide range of crypto assets.

How Do Binance Crypto Loans Work?

Binance supports many loanable and collateral assets, including BTC, ETH, USDT, BUSD, BNB, and more. You can check the latest list of supported assets and interest rates on the Binance Loans page.

There are two types of Binance loans: flexible and stable. However, the interest rates and borrowing limits depend on the crypto asset you intend to borrow and whether you are a VIP or regular user. Interest is also calculated hourly or annually.

The two loan types have conditions that appeal to different users based on how much you intend to borrow and the interest rate.

Flexible Rate Loan

This isolated, overcollateralized, open-term loan product allows you to borrow cryptocurrencies without committing to a specific loan term using your crypto assets as collateral. There is interest on borrowed cryptocurrencies with this loan option, and the interest rate is determined by the type of cryptocurrency being borrowed and the current market conditions. Interest is accrued every minute and is added to the total outstanding loan balance. You can repay your loans at any time without penalty.

Opting for a flexible rate loan automatically subscribes you to the Simple Earn wallet, allowing you to earn daily rewards when you deposit your crypto for flexible or locked terms.

You can also use borrowed cryptocurrencies for various purposes, such as trading, margin trading, or staking.

Stable Rate Loan

This loan type allows you to borrow USDT or BUSD against your cryptocurrency holdings. The loan is collateralized, meaning you must provide Binance with an equivalent cryptocurrency. The interest rate for a stable loan is fixed and based on the loan-to-value (LTV) ratio–the percentage of the collateralized loan. For example, if the LTV ratio is 50%, you must provide Binance twice as much crypto as you are borrowing.

This loan type is a good option if you need access to cash quickly and have crypto holdings that you are willing to use as collateral. The fixed interest rate makes it easy to budget for repayments, and the LTV ratio ensures you stay within budget.

How Does Collateral Work On Binance Loans?

Binance allows you to borrow as much as ten times your assets and up to 65% of the value of your collateral. Although the amounts you can borrow or put as collateral varies according to the crypto asset.

The collateral is held as security for the crypto assets you borrow. However, if the current loan value-collateral value exceeds what was borrowed-pledged, Binance reserves the right to claim the collateral.

The current loan value-collateral value, or LTV, can exceed the liquidation LTV if the borrowed assets' worth rises or the collateral's value drops.

How to Get a Binance Crypto Loan

Before borrowing a crypto loan from Binance, you should be aware that the exchange requires collateral, and there is a minimum amount you can borrow, depending on the asset you need to process your loan. Here's how you can borrow a crypto loan on Binance:

- Create and verify your Binance account if you don't already have one

-

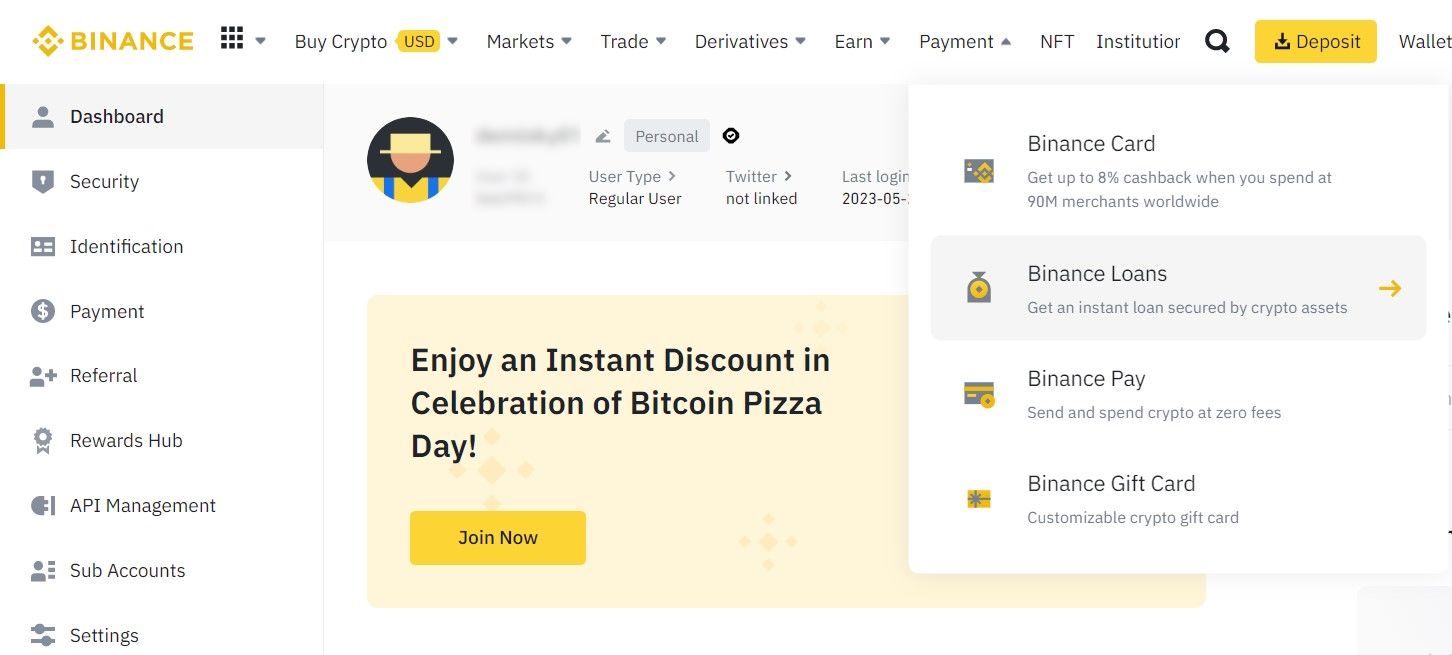

On the Binance homepage, hover over Payment and click on Binance Loans.

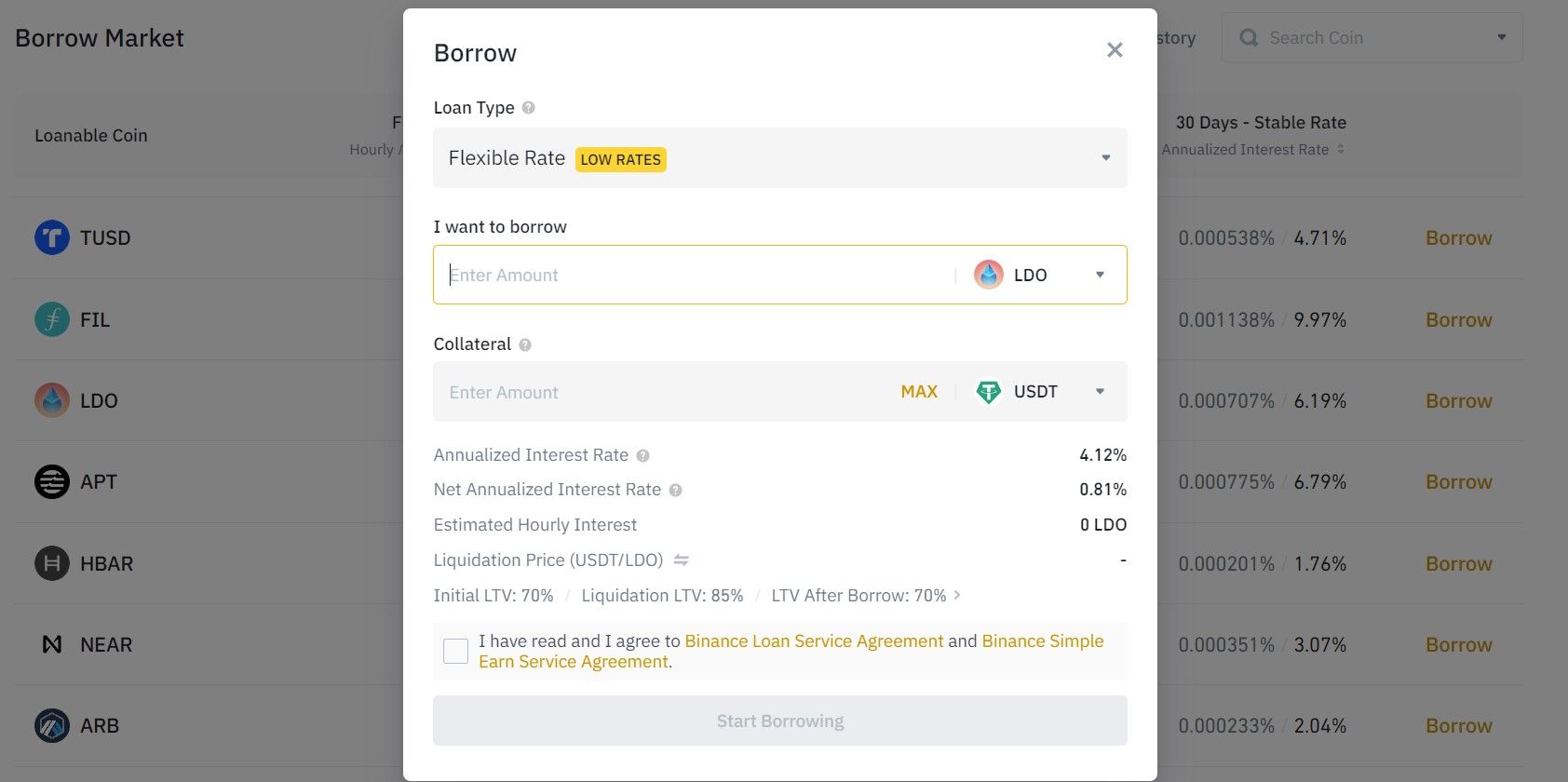

- Choose a loan type (stable or flexible) and enter the amount you wish to borrow. Then, choose a collateral asset. Based on the initial LTV, the system will instantly calculate the collateral amount. You will also see the annualized and net-annualized interest rates, estimated hourly interest, and liquidation price.

- Make sure you read and agree to Binance's Loan Service Agreement and Simple Earn Service Agreement before you check the box next to it and click Start Borrowing.

-

You will see a pop-up confirming the loan. Click Confirm to complete the process.

Here are some tips you should keep in mind before diving into a Binance crypto loan:

- Wisely choose your loanable coin and collateral: Binance supports a wide range of crypto assets as collateral and loanable coins, which you should carefully review. The collateral and loan amount is determined by the initial loan-to-value (LTV) ratio, which is the percentage of the loan amount divided by the collateral value. So, the higher the LTV, the higher the risk of liquidation.

- Monitor your LTV ratio: Your LTV ratio changes according to the market price of your collateral and loanable assets. If your LTV ratio reaches or exceeds 90%, your collateral will be liquidated automatically to repay your loan.

- Be aware of market volatility: Crypto markets are volatile and unpredictable. The price of your collateral and loanable assets can change rapidly in a short time. This can affect your LTV ratio and liquidation risk. Therefore, you should always do your research and only borrow what you can afford to lose.

How to Repay a Binance Crypto Loan

You can repay your Binance crypto loan by following these steps:

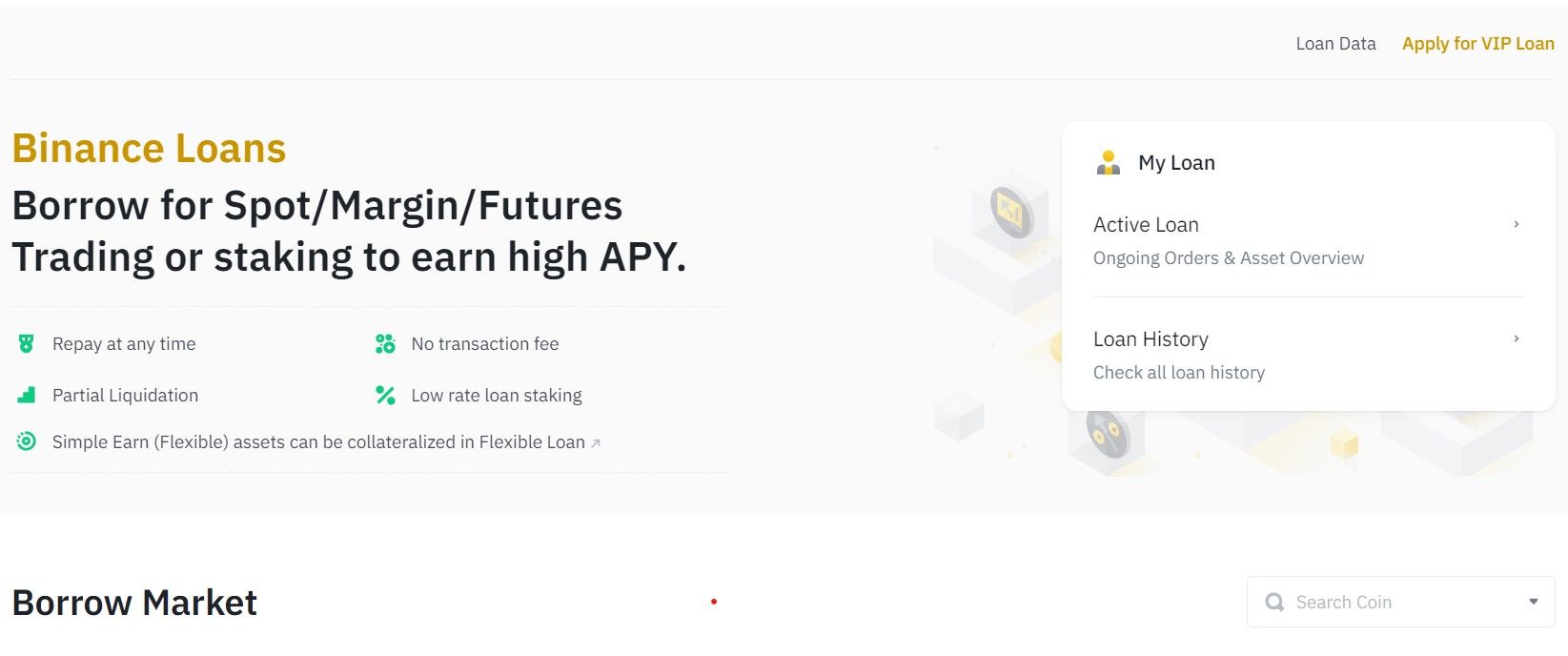

- Log in to your Binance account, hover over Payment, and click on Binance Loans.

-

Click on Active Loan.

-

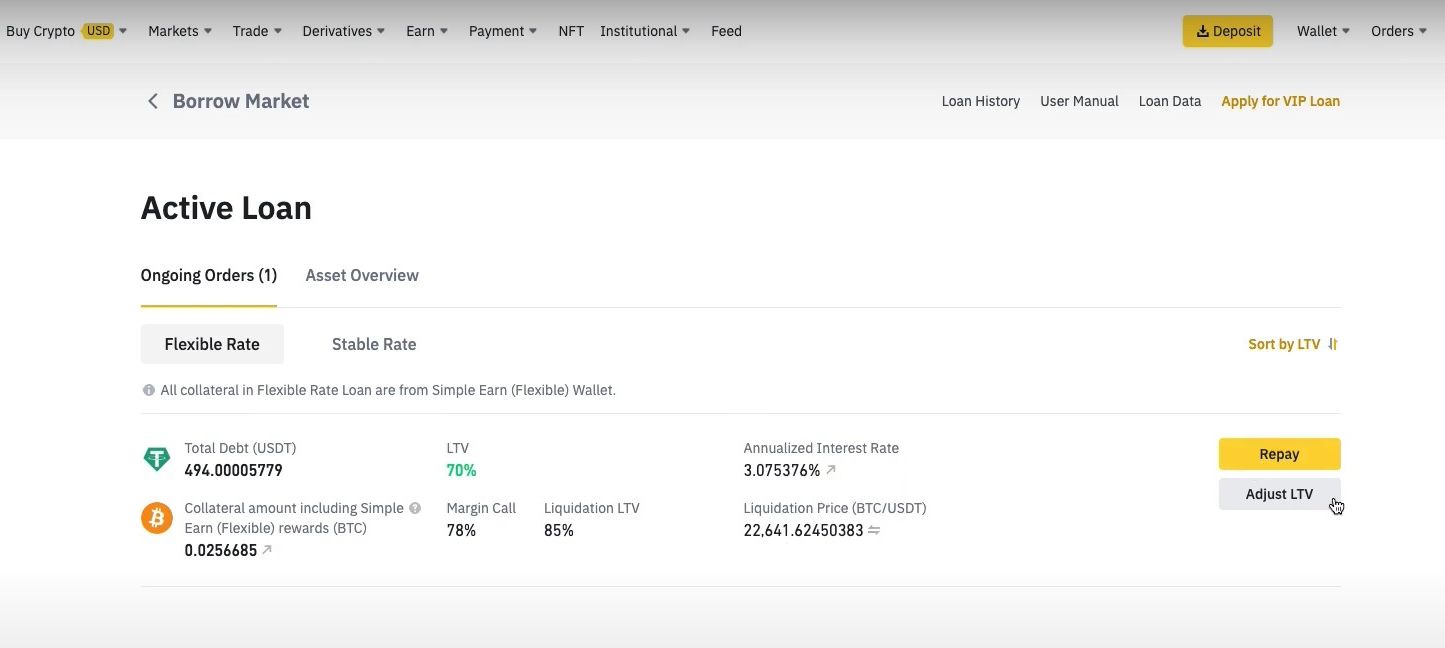

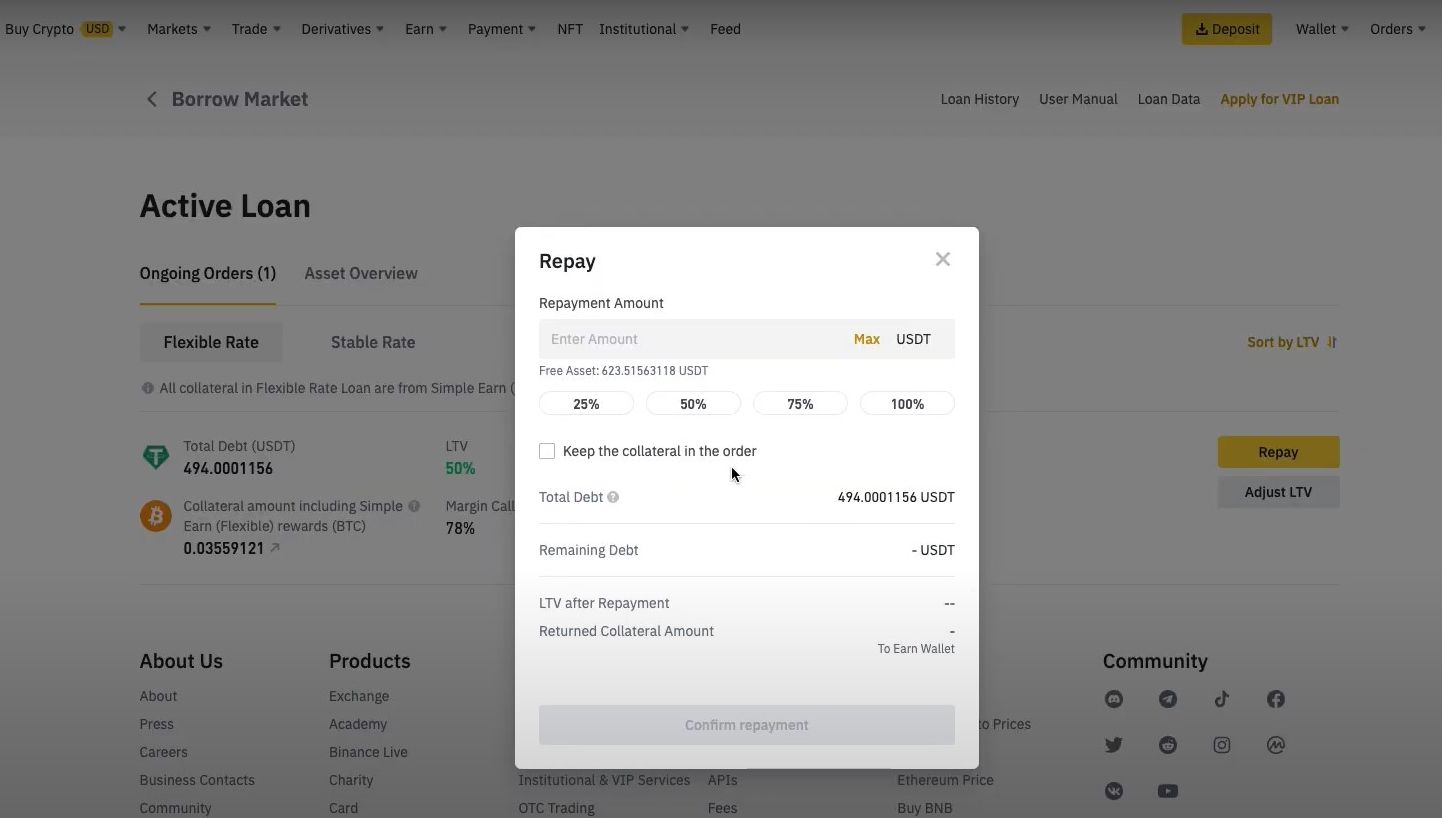

Under Ongoing Orders, Click Repay next to the order you wish to repay.

-

Enter the repayment amount (or click on MAX beside the coin), or select a repayment ratio if you want to pay in bits. If you want to keep the collateral in the order, check the box. Go over the details and then click Confirm Repayment.

- After the payment has been processed, you will get a confirmation message.

Advantages and Disadvantages of Binance Loans over Traditional Loans

Binance offers a convenient and flexible way to borrow crypto assets using other assets as collateral. But how does taking a loan from Binance compare to traditional loans?

- No credit check: Unlike traditional loans, a loan from Binance will not require a credit check or a verification of income or employment. You only need a verified Binance account and enough collateral to borrow funds.

- Fast and easy: Due to a simple and user-friendly interface, you can borrow funds in minutes on Binance. You can adjust your loan-to-value (LTV) ratio, repay loans with borrowed or collateral coins, and renew your loans anytime.

- Low-interest rates: Binance offers competitive interest rates that vary depending on the loan type, term, and coin. You can also enjoy lower interest rates by holding BNB tokens or using them as collateral.

- High security: Binance is a relatively secure and reliable platform that protects your funds and data.

- Market risk: Borrowing crypto assets are subject to market fluctuations and price volatility. You need to monitor your LTV ratio and collateral value to avoid liquidation, which may result in losing your collateral.

- Limited options: Binance only supports certain crypto assets for borrowing and lending, which may not meet some of your needs or preferences. You must also have enough collateral in the supported coins to borrow funds.

- Liquidation fee: Binance charges a 2% liquidation fee of the total loan amount when your LTV ratio reaches 90%. They deduct this fee from your collateral before returning the remaining balance.

Borrow and Pay Back Crypto Loans With Ease on Binance

Binance offers a convenient and flexible way to borrow crypto and use it for various purposes. Following the steps above, you can easily repay your crypto loan on Binance and avoid unnecessary fees and losses.

So you should conduct proper research before borrowing due to the risks and uncertainties attached, and we advise that you borrow assets only when necessary.