Safe cryptocurrency storage is an extremely important consideration for traders and investors of all skill levels.

According to cryptocurrency firm Chainalysis, an estimated 20% of all Bitcoin in circulation has been lost forever. Stories of misplaced, lost, forgotten, and even stolen wallets are commonplace in the cryptocurrency community, with losses ranging from a few dollars to upwards of $200 million.

To that end, let’s delve into the topic of cryptocurrency storage as well as two of the most common terms in the storage ecosystem, hot and cold wallets.

What Is a Cryptocurrency “Wallet” Anyway?

If you’ve had any experience with cryptocurrencies in the past, you may have heard wallets described as a piece of software that holds your digital tokens. Somewhat unintuitively, however, this is far from the truth. Not only do cryptocurrency wallets not store your cryptocurrency on a local device, but they do not even have to be digital or software-based.

Cryptocurrencies such as Bitcoin and Ethereum are based on blockchain technology, which is just an elegant description for a ledger or book of accounts.

This means that the words ‘coins’ or ‘tokens’ are little more than abstractions used to make cryptocurrency seem more friendly to the end-user. At the most fundamental level, these networks simply maintain a log of transactions, which in turn allows everyone to know how many units of the currency are currently in their possession and spend-able.

Ledgers by themselves are nothing new, of course. They have been around for centuries as a means of accounting for trade between individuals.

However, Bitcoin was the first-ever digital ledger that introduced the concept of trustlessness. This property means that you no longer have to trust the ledger’s owner or maintainer to keep track of the amount of money you own. Instead, the network as a whole ensures that transactions are legitimate and accounted for at all times.

So what does this have to do with cryptocurrency wallets? Quite a bit. Instead of serving as a means of storing tokens, a wallet’s actual role is to authenticate your presence on the blockchain network.

Every wallet comes with a set of public and private keys. To receive cryptocurrency, you give the world your public key. Then, once the network has recorded a positive balance to your name, the wallet’s secret and private key can be used to initiate a new transaction.

Then it’s sufficient to say that your wallet’s private key is the only thing keeping a malicious actor from accessing or siphoning your crypto wealth. This is why various techniques for safe, private key storage exist. Generally, however, they can be broken down into one of two categories: hot wallets and cold wallets.

Hot Wallets vs. Cold Wallets: Convenience or Security?

The primary differentiating factor between these two types of wallets is simply that hot wallets reside on a perpetually connected device to the internet, while cold wallets live permanently offline.

Hot Wallets Are Convenient

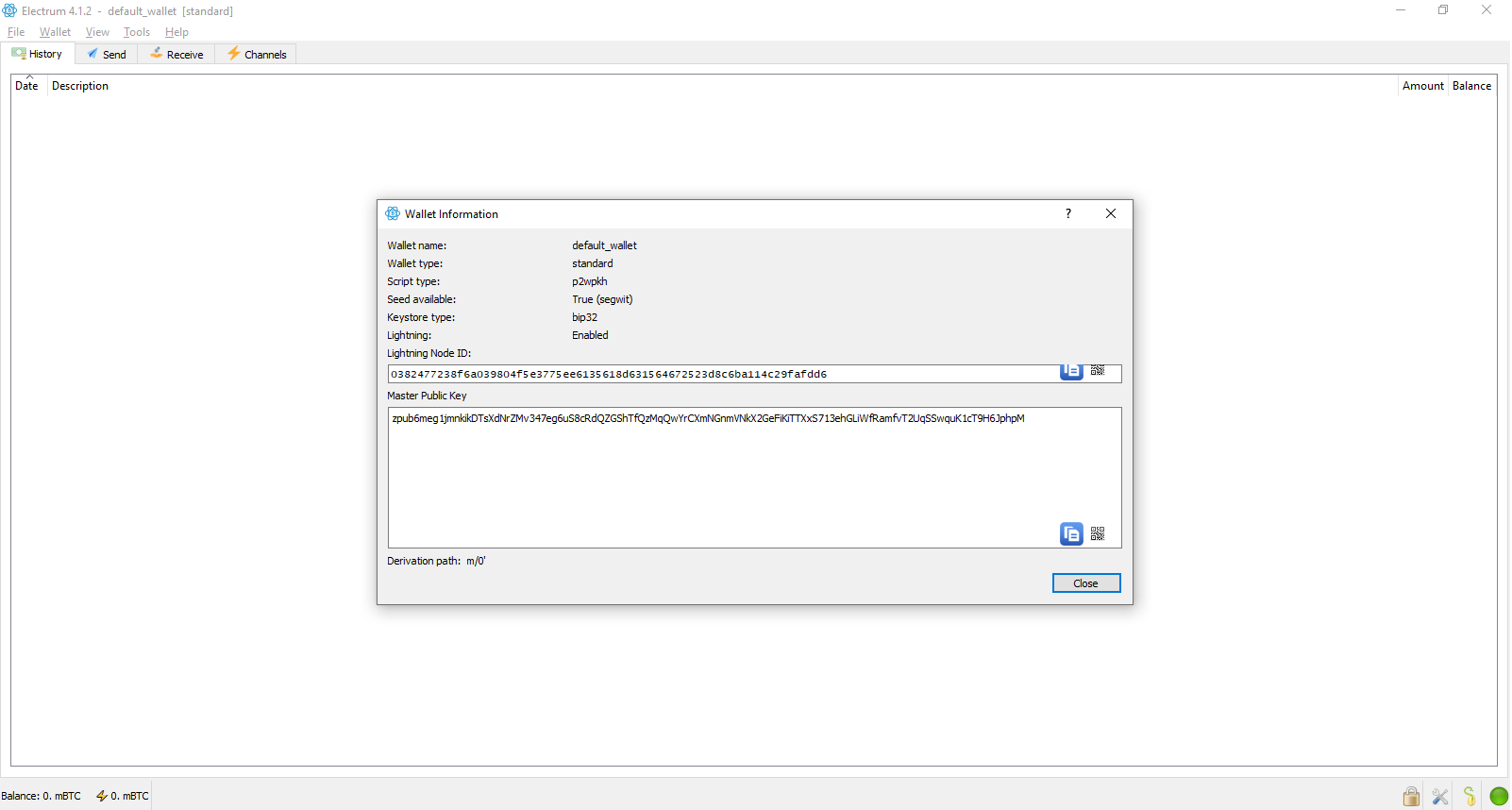

Take a typical desktop Bitcoin wallet such as Electrum, for example. When you download the software and run it for the first time, the program will automatically generate a set of private and public keys for you. The wallet file is then stored somewhere on your local hard drive, allowing you to access it in the future.

Leaving your wallet on your primary computer, however, is extremely risky. Imagine a scenario wherein you either accidentally download malware or lose physical access to your machine. In both cases, a prospective attacker only needs to copy a single file from your computer to access your entire cryptocurrency balance.

While most wallets these days, Electrum included, offer robust security mechanisms ranging from hardened encryption to multi-signature functionality, there is no hiding from the fact that a single exploit can compromise your crypto.

The same is true for mobile wallets, which are even more vulnerable to loss and theft. Having said that, though, both Android and iOS use sandboxes to safeguard app data. This means that the chances of malware reading your private key are lower on smartphones than on a desktop.

Cold Wallets Are Secure

If you’re looking for maximum security, cold wallets are specifically designed to be isolated from the outside world—both physically and electronically.

The simplest cold wallet involves writing down your private key on a piece of paper and deleting all electronic data related to it. Since keys are often long and complicated, Bitcoin implemented a system that converts your key into 12 or 24 English words, known as a seed. As long as you remember or write down the words in the correct order, your wallet can be restored and accessed.

From there, you can create multiple copies of your keys and store them in secure locations that only you can access. Naturally, your wallet can also be protected by an additional password, just in case.

Hardware Wallets: A Happy Middle-Ground

While hot wallets are vulnerable because of a persistent internet connection, cold wallets are inconvenient because they offer no mechanism to transfer your funds.

To remedy this dilemma, the cryptocurrency industry came up with hardware wallets—specialized electronic devices designed to store your private keys and ensure only you can initiate a transaction.

Most hardware wallets resemble a USB flash drive. To set one up, you typically use a companion program or app and create a new set of keys. These keys can only be accessed by connecting the hardware wallet to a laptop or smartphone. In other words, the private key is never logged, copied, or transferred to the computer—ensuring total isolation from the network.

These hardware devices function almost identically to a paper wallet in terms of security. The only way for someone to access your cryptocurrency is to steal the device and access its onboard storage. Still, all hardware wallets include a small, insignificant chance of being exploited via their software interface—despite how bulletproof the underlying engineering likely is. After all, nothing is unhackable.

The Practical Solution

The best course of action for any serious cryptocurrency user is to split their holdings between hot and cold wallets. If you tend to transact frequently, a hot wallet may be a better option for most of your wealth.

On the other hand, if you’re looking to hold your cryptocurrencies for a while, a cold storage solution may work out better. You can even make your own hardware wallet using a Raspberry Pi if you’re so inclined.

Whichever option you choose, remember to write down your private key or mnemonic phrase to ensure you aren’t locked out of your wallet several years later.

Image Credit: Max Saeling/Unsplash