If you're ever asked to name two cryptocurrencies, the chances are the first two assets that will come to mind are Bitcoin and Ethereum.

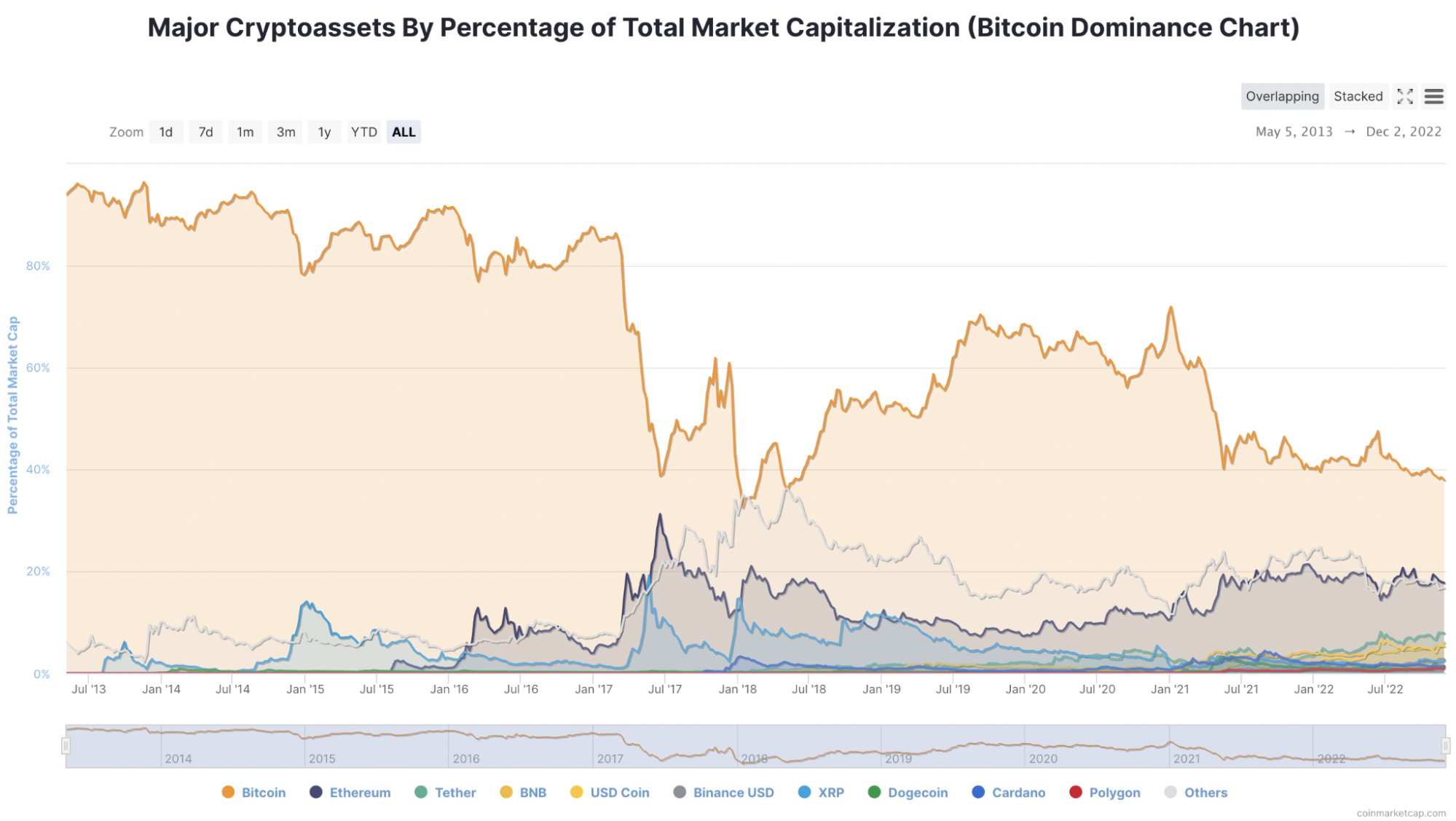

There's good reason for this, as both stand as the two largest cryptocurrencies in the world based on market capitalization. While Bitcoin has always been the most dominant form of digital currency, Ethereum has always been the world's most popular altcoin. However, Bitcoin's dominance may one day fall away, with some experts suggesting that a "flippening" could occur sooner rather than later.

Bridging the Gap: What Is the Flippening?

There's little doubting Bitcoin's position as the world's most famous cryptocurrency. The wild bull run of 2021 saw BTC's market capitalization climb to $1.2 trillion before falling significantly in 2022's "crypto winter."

For Ethereum, a rally to a $500 billion market cap was similarly astonishing, but a retrace to less than $200 billion in 2022 shows that BTC still rules the roost in terms of size.

However, the talk of Ethereum growing to overtake Bitcoin is nothing new, and topics surrounding a flippening—the act of ETH "flipping" BTC's position at the top of the table of largest assets based on market capitalization—have been cropping up for many years now.

Virtually all commentaries agree that a flippening will be confirmed when Ethereum's market capitalization surpasses Bitcoin's.

Given BTC's age and reputation, this may be a tall order for any project, but history shows that the two assets have been remarkably close in the past and that current trends indicate waning dominance for Bitcoin and a slight increase for Ethereum.

Although there's still a gap of around 20% in terms of market dominance between BTC and ETH, the gulf is at its lowest point since early 2018, and the emergence of new projects is appearing to push investors away from Bitcoin while embracing Ethereum's blockchain ecosystem more.

However, there's still much work to be done. At the time of writing, Ethereum's market cap of $155 billion is less than half of Bitcoin's $327 billion. This means we would need to see Ethereum's current value more than double with Bitcoin's remaining static for a flippening.

Ethereum Is More Functional Than Bitcoin

To experience such exponential growth while Bitcoin stays stationary may seem unlikely, but recent developments for Ethereum's blockchain certainly improve the asset's functionality compared to its competitors.

While Bitcoin's primary function is as a store of wealth for investors, Ethereum boasts a programmable blockchain and has become an essential hub for crypto developers.

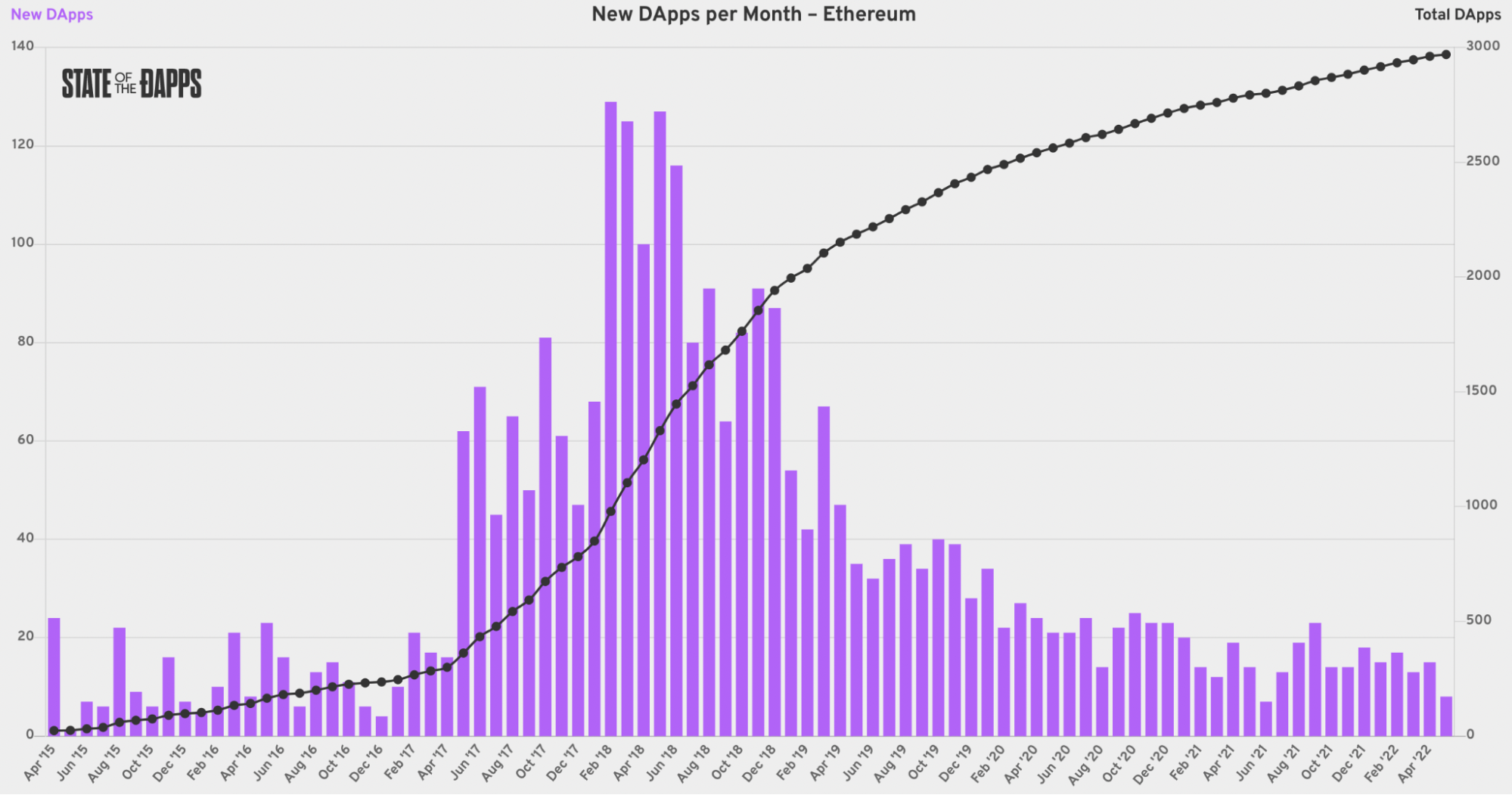

As the cryptocurrency ecosystem continues to welcome increasingly advanced decentralized applications (DApps), various other decentralized finance services, NFTs, and other digital tools, Ethereum has been placed front and center of a brand new vibrant landscape.

Around 3,000 different DApps have been built on Ethereum's network, and statistics show that this figure continues to increase.

Given that Ethereum is recognized as a highly functional place to host decentralized services, it's likely that the network will continue to grow in the age of Web3 and the metaverse. These landscapes thrive on blockchains that hold great utility, and in this regard, ETH offers something that BTC is too primitive to emulate.

The Rise of Digital Oil

Bitcoin's store of wealth has led to the asset being heralded as "digital gold," but if this is the case, Ethereum must be regarded as "digital oil," thanks to its supreme levels of utility today.

At the core of this utility is Ethereum's smart contract functionalities, which were added to the blockchain in 2015. Some 3,920 developers were onboarded in 2021 to the Web3 ecosystem, helping Ethereum to cement its place as the blockchain network with the greatest volume of active builders.

Furthermore, Ethereum is constantly expanding its functionality. For instance, in August 2021, Ethereum introduced a burning mechanism for its cryptocurrency, Ether, categorized under EIP-1559 and included in the London hard fork. This empowered the network to use flat rate fees instead of auction-based transaction fees on the network.

Backing these network improvements is the Ethereum Foundation, led by the asset's co-founder, Vitalik Buterin.

Crucially, Ethereum underwent "The Merge" in September 2022, a long-awaited shift to the proof-of-stake consensus model, which promises a 99.95% reduction in energy usage throughout the network.

This transition paves the way for greater scalability upgrades in making Ethereum 2.0 a reality, including sharding, which can help to increase the network's capacity and transaction throughput.

However, it's important to note that Ethereum isn't the only network that's intent on undergoing consistent upgrades and improvements. If ETH is digital oil in this analogy, it's reasonable to expect that it has rivals in the form of alternative energy sources. There have been many projects labeled as "Ethereum killers" in recent years, not least in the case of Solana. Other blockchains like Cardano and Binance's BNB chain can all be recognized as threats to Ethereum's long-term development.

Despite the emergence of rival networks, many key figures in the crypto industry believe that Ethereum has the potential to become the world's biggest cryptocurrency in the coming years. As explained by Vikram Subburaj, CEO of Giottus Crypto Platform, "There is a high probability of Ethereum (ETH) becoming the largest cryptocurrency in the medium term with the Merge being a key catalyst."

Could a Flippening be on the Cards for 2023?

In short, almost certainly not. The size of the gulf between both projects is far too great for it to be closed within 12 months, even in a space as volatile as crypto.

Taking a more long-term outlook shows that there's plenty of potential for Ethereum to become the crypto landscape's most dominant asset. The network's capacity for smart contracts, DeFi, and various other decentralized services points to a bright future for Ethereum. The fact that regular updates are being rolled out to improve the project also helps when it comes to forecasting a bright future.

Since Bitcoin's birth in 2009, no asset has come closer to toppling the world's most famous cryptocurrency than Ethereum. Now, as the crypto landscape shifts toward the demand for utility, we may finally be on the cusp of seeing the ecosystem's first-ever "flippening."